Bullish Engulfing Pattern - Meaning, Examples, Trading Tips

00:00 / 00:00

Today, traders are using multiple tools to spot trading opportunities in the market. Among these various tools, candlestick patterns are one of the oldest and most classic approaches that are still relevant to this day. Out of these various candlestick patterns, the bullish engulfing pattern is the simplest and most widely used pattern among traders. In this article, we will understand the bullish engulfing meaning, its Interpretation, trading opportunities, and more. So let’s get started!

What is Bullish Engulfing Pattern?

Bullish Engulfing candlestick pattern is a two-candlestick pattern that is primarily used after its appearance in a downtrend. It is a reversal pattern that indicates a shift from bearish to bullish sentiment in a stock.

This candlestick pattern comprises a red candle followed by a green candle that completely engulfs the prior candle. You can better understand this in the Bullish Engulfing Pattern example under our 'How to Trade' header.

How to Identify a Bullish Engulfing Candle

One should look for the following criteria to use a bullish engulfing pattern for a bullish reversal:

Prior Trend: As the Bullish Engulfing pattern is used for bullish reversal, the appearance of this pattern after a downtrend provides an ideal scenario for trading it.

First candle: The first candle in the bullish engulfing candlestick pattern is a bearish (red) candle which indicates the selling pressure in the security.

Second Candle: The second candle in the pattern is a bullish (green) candle that opens lower than the close of the first candle and closes higher than its opening price as shown in the image as well.

Wicks: The wicks of the candlesticks are not a crucial part of the bullish engulfing pattern. It is only sufficient if the body of the green candle covers the body of the red candle.

Confirmation of bullish engulfing candle: The likelihood of reversal increases if the next candle after the bullish engulfing pattern closes above it.

Bullish Engulfing Pattern Example

Psychology of the Bullish Engulfing Pattern

Let us now understand the psychology of the bullish engulfing pattern in the context of its appearance after a downtrend.

The first candle in the candlestick pattern indicates that the sellers have a dominant position in the security and are pushing the price lower. But, the formation of the next green candle changes the tide in the market. When the green candle closes above the prior red candle, it suggests that the buyers are gaining control and suggests a potential bullish momentum in the security.

Furthermore, the conviction of the bullish reversal increases based on the size of the green candle’s body. That is, the larger the body of the green candle compared to the prior red candle, the stronger the interest of the buyers in pushing the price up.

Additionally, if the volume of the green candle is higher than the volume of the red candle, it indicates a stronger conviction of the buyer to push the price higher. Check out the image under the 'How to Trade' header for reference.

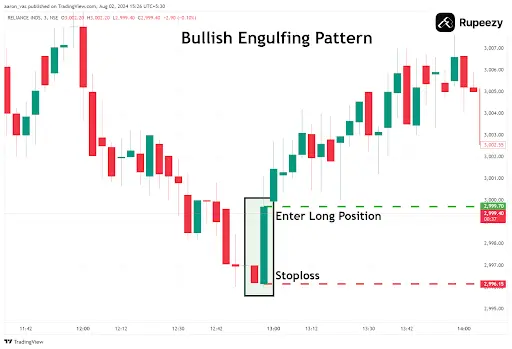

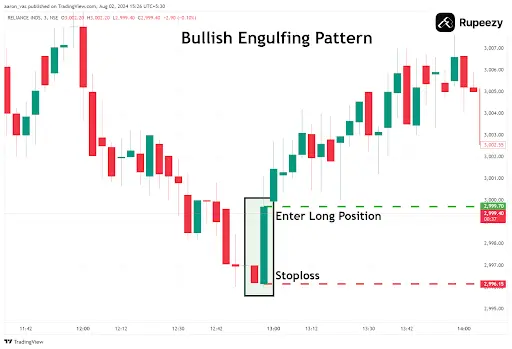

How to Trade a Bullish Engulfing Pattern?

When a Bullish Engulfing Pattern appears after a downtrend, one can look to enter a long position in the stocks which is explained using a live example below:

Bullish engulfing entry: When the price of the security starts trading above the closing price of the bullish engulfing candlestick, one can look to enter a long position in the security.

Stop Loss: If the price of the security starts trading below the opening price of the bullish engulfing candle, it suggests that the buyers have been overtaken by the sellers. Thus one can place a stop loss at the opening price of the green candle, as shown in the example with the red marked line.

Profit Target: If the body of the green candle in the bullish engulfing pattern is large, one can book profits matching the size of the green candle's body. One can also book profits based on the risk-to-reward ratio, trailing stop loss method, or the immediate resistance level.

The Best Scenario for a Bullish Engulfing Pattern

The following are the factors that increase the probability of reversal for a bullish engulfing pattern:

Appearance near a support zone: When the bullish engulfing candle is formed near a support zone, it suggests that the buyers have higher interest near the demand zone. Thus, it will likely increase the chances of reversal.

High Volumes: If the green candle in the engulfing pattern has higher volumes than its prior red candle. It shows the strong conviction of the buyers to push the price higher which in turn increases the likelihood of reversal.

Bullish Engulfing as a Continuation Pattern

The bullish engulfing pattern is normally used for bullish reversals, it can at times form within a larger uptrend, thereby reinforcing the buying pressure that is already playing out. However, this pattern is most effective after a significant downtrend since it denotes a strong bullish shift in the market sentiment.

Bearish and Bullish Engulfing Pattern - Key Differences

Particulars | Bullish Engulfing Pattern | Bearish Engulfing Pattern |

Composition | A green candle which engulfs the prior red candle | A red candle which engulfs the prior green candle |

Formation | Forms at the end of a downtrend | Forms at the end of an uptrend |

Significance | Signals a potential bullish reversal | Signals a potential bearish reversal |

Bullish Harami and Bullish Engulfing - Key Differences

Particulars | Bullish Engulfing Pattern | Bullish Harami Pattern |

Composition | A green candle which engulfs the prior red candle | A green candle formed within the body of a red candle |

Significance | Signals a potential bullish reversal | The bullish reversal signal is not as strong as the Bullish engulfing pattern. |

Limitations of the Bullish Engulfing Pattern

Short-Term Focus: The Bullish Engulfing pattern generally signals a short-term reversal in security. Thus, this pattern may not be suitable for long-term trades.

Dependency on Overall Trend: The reliability of the pattern can vary a lot depending on the market condition. For instance, in a strong downtrend, the pattern wouldn't be as reliable. Thus it should be used with a combination of other technical tools.

Conclusion

We have reached the end of the article on the bullish engulfing pattern. Before winding up, it is important to note that the bullish engulfing pattern does not guarantee a reversal which is why it is important to use this pattern along with a combination of other technical tools and indicators and also place proper risk management strategies to mitigate huge losses.

You can utilize a range of technical indicators and take advantage of features such as trailing stop loss on our Rupeezy trading app. Open Demat account with Rupeezy today and earn a 20% commission on every trade made by referring your friends and family.

Check Out These Related Articles |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category