Dark Cloud Cover Pattern - Meaning, Examples, Trading Tips

00:00 / 00:00

Today, traders use multiple tools to identify trading opportunities in the stock market. Among these various tools, candlestick patterns are one of the oldest approaches that are still relevant to this day. Out of these various candlestick patterns, the Dark Cloud Cover Pattern is one such simple pattern used among traders. In this article, we will understand the dark cloud cover meaning, its interpretation, trading opportunities, and more with proper examples. So let’s get started!

What is a Dark Cloud Cover Pattern?

A dark cloud cover pattern is a two-candlestick pattern that is mainly used after its appearance in an uptrend. It is a reversal pattern that indicates that the buyers are unable to maintain control of the security and the sellers may overtake them soon.

The dark cloud cover candlestick pattern comprises a large green candle which is followed by a gap up and a red candle that closes below the midpoint of the previous red candle.

Dark Cloud Cover Candlestick - Formation and Key Features

Now that we understand the meaning of the dark cloud cover, let’s explore its formation criteria and unique features to effectively use this candlestick pattern for identifying bearish reversal

Prior Trend: As the Dark Cloud Cover Pattern is used for bearish reversals, the appearance of this pattern after an uptrend provides an ideal scenario for trading it.

First candle: The first candle in the dark cloud cover candlestick is a Bullish (green) candle which indicates the buying pressure on the security.

Gap Up: The second candle in the pattern should appear above the prior green candle with a gap up

Second Candle: The candle in the dark cloud cover pattern should be a red candle that closes below the midway of the prior green candle.

Confirmation of dark cloud cover: When the next candle after the dark cloud cover closes below the pattern, the likelihood of bearish reversal increases.

Psychology of the Dark Cloud Cover Pattern

Let us now understand the psychology of the Dark Cloud Cover Pattern in the context of its appearance after an uptrend.

The first candle in the candlestick pattern indicates that the buyers have a dominant position in security and are pushing the price higher. Furthermore, the second candlestick of the dark cloud cover pattern opens the gap up, suggesting that the buyers are continuing to exert pressure in the market as shown in the image as well.

But, during this particular trading session, the price starts trading lower and by the end of the session, the price closes below the midpoint of the previous green candle. This indicates that the buyers have lost their momentum and the sellers are starting to gain control of the security which can be followed by bearish reversal.

Additionally, the conviction of the bearish reversal increases if the next candle is also bearish and closes below the opening price of the green candle in the dark cloud cover pattern.

How to Trade a Dark Cloud Cover Pattern?

When a Dark Cloud Cover pattern appears after an uptrend, one can look to enter a short position in the stocks which is explained using a live example below:

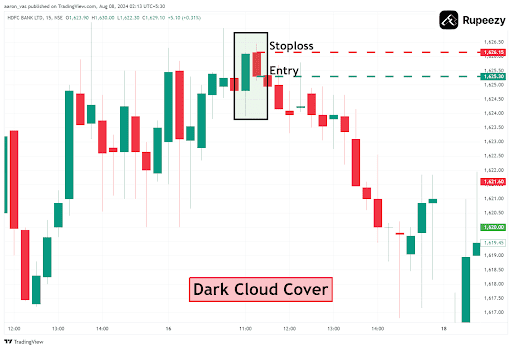

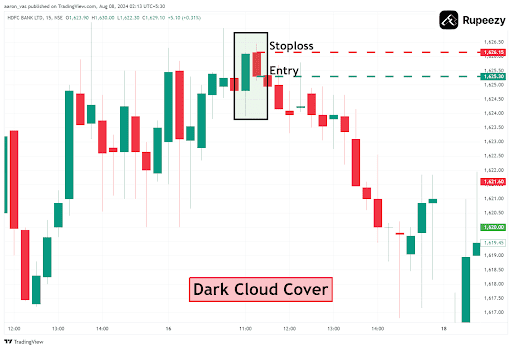

Dark Cloud Cover Pattern Example

Entry: When the price of the security starts trading below the closing price of the dark cloud cover, one can look to enter a short position in the security.

If you are risk risk-averse trader, you can wait for the price to start trading below the opening price of the green candle before entering a short position.

Stop Loss: If the price of the security starts trading above the opening price of the dark cloud cover, it suggests that the seller might have regained control of the security. Thus one can place a stop loss at the opening price of the red candle, as shown in the example with the red marked line.

Profit Target: The profits for a dark cloud cover candlestick pattern can be booked based on the trailing stop-loss method, the immediate support level or the risk-to-reward ratio.

Mistakes to Avoid When Identifying Dark Cloud Cover Pattern

There are two common mistakes traders should avoid when identifying Dark Cloud Cover candlesticks:

Ignoring the Gap: The gap opening between the first and the second candle is the crucial part of the dark cloud cover candlestick. This gap indicates that the initial bullish momentum is being overcome by the sellers in the market. Thus, it is important to notice if there is a gap between the green candle and the red candle.

Ignoring the Midway between green and red candle: The red candle closing below the midway of the green candle in the dark cloud cover implies that the sellers have overcome the bears in the market. If the red candle does not close below the midway, it implies that the bearish pressure is not strong enough to signal a reversal.

Piercing Pattern and Dark Cloud Cover - Key Differences

Particulars | Piercing Pattern | Dark Cloud Cover |

Composition | The green candle closed above the midway of the prior red candle after a gap down opening | The red candle closed below the midway of the prior green candle after a gap-up opening |

Formation | Forms at the end of a downtrend | Forms at the end of an uptrend |

Significance | Signals a potential bullish reversal | Signals a potential bearish reversal |

Limitations of the Dark Cloud Cover

Need for Confirmation: As the red candle in the dark cloud cover only closes below the midway of the prior green candle, it does not necessarily suggest a complete change in the market sentiment. Thus, one will also be required to use other technical tools while trading using the dark cloud cover pattern.

Dependency on Overall Trend: The reliability of the dark cloud cover pattern can vary a lot depending on the market condition. For instance, in a choppy/range-bound market, the pattern wouldn't be as reliable.

Conclusion

We have reached the end of the article on the dark cloud cover pattern. Before winding up, it is important to note that the dark cloud cover does not always guarantee a reversal which is why it is important to use this pattern along with a combination of other technical tools and indicators and also place proper risk management strategies to mitigate huge losses.

With our Rupeezy trading app, you can access a variety of technical indicators and take advantage of features like trailing stop loss. Open Demat account with Rupeezy now, and also earn a 20% commission on all trades made by friends and family you refer.

Check Out These Related Articles |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category