How To Do Intraday Trading in India: A Beginner’s Guide

00:00 / 00:00

Intraday trading is when you buy and sell stocks, futures, or currencies within the same trading day. The goal is to make a profit from short-term price movements. To do this, you have to open and close positions before the market closes. Sounds exciting, right? However, it is also very risky. In this article, we will explore how to do intraday trading. Keep reading to find out more!

Getting Started with Intraday Trading

Intraday trading is about buying and selling assets like stocks or futures on the same day. To get started, you have to open a position by purchasing an asset and then close that position by selling it before the market closes – all within those trading hours.

To make it work for you, you will need very good analytical skills to quickly spot opportunities. However, the most important thing is to cultivate a disciplined mindset – stick to your strategy and manage risks diligently. As a beginner, it is advisable to start small with paper trading to practice first. Paper trading refers to the simulated buying and selling of stocks without the involvement of any real money. This allows you to get a better understanding of how trading works and also helps test your strategies. Gradually, you will build experience before risking real capital.

How is Intraday Trading is Different from Regular Trading?

Intraday trading is very different from regular trading. In regular trading, you have to hold positions overnight or even longer. However, in intraday trading, you open and close all trades on the same trading day. Here’s an overview of how they differ:

Aspect |

Intraday trading |

Regular trading |

Holding period |

Positions closed before the market closed. |

Positions can be held overnight or longer. |

Risk |

Limited to a single trading session. |

Overnight risk from gap openings. |

Capital required |

Lower because of no overnight exposure. |

Higher to accommodate potential losses. |

Trading style |

Quick, requires you to constantly monitor. |

Can be more passive and relaxed. |

Intraday Trading Strategies

There are many strategies to explore when it comes to intraday trading. Below are the top ones:

- Scalping: This is a short-term strategy in which you have to open and close multiple positions within minutes or even seconds. As a scalper, your aim is to extract small but frequent profits from minor price fluctuations throughout the trading day.

- Breakout trading: Here, your focus is trading on price movements that break out from established support or resistance levels. When the price breaks above resistance, you buy in anticipation of the uptrend continuing. Conversely, when it breaks below support, you sell short to ride the upcoming downtrend.

- Gap and go: In this strategy, you have to capitalize on price gaps between the previous day’s close and today’s open. If the market gaps up, you buy with the expectation that the uptrend will continue. If it gaps down, you sell short, betting on the downward momentum.

Each strategy has its own merits and suits different trading styles. Additionally, before you even start trading, you first have to define your entry/exit rules and risk limits. You can check here for more intraday trading tips.

Benefits and Risks of Intraday Trading

Below are the benefits and risks of involving in intraday trading:

Benefits of Intraday Trading

- Little risk: Since you square off all positions before market close, there are no overnight risks from gap openings or unexpected events.

- Leverage opportunity: You can leverage your capital to amplify potential profits from short-term price movements.

- Frequent opportunities: Since there are constant market fluctuations, you can capitalize on multiple trading signals within a single session.

Risks of Intraday Trading

- Very stressful: The quick nature means you must continuously monitor and make swift decisions.

- Overtrading temptation: Since there are frequent opportunities, you can erode your capital because of overtrading or impulsive behavior.

- Execution issues: Delays in order execution or slippage will impact your trade entry/exit strategy in a negative way.

Risk Management

You have to master risk management, as it is paramount in intraday trading. Without a good plan to control losses, there is a risk that you may blow up your account in a matter of hours. Make use of stop-loss orders religiously – they automatically exit losing positions at a predetermined price, which helps limit damages. It is also crucial to employ proper position sizing. Additionally, and most importantly, don’t ever risk more than you can afford to lose on a single trade.

To further mitigate losses, below are some tips on how to do intraday trading without loss:

- Stick to a well-defined strategy with entry/exit rules.

- Stay disciplined and avoid emotional decisions, especially those that drive fear or greed.

- Always reevaluate market conditions and be ready to adapt your approach if need be.

When you make risk management a priority above all else, you will safeguard your capital and boost your chances of long-term profit.

How to do Intraday Trading in Futures

With futures contracts, you can buy or sell an underlying asset at a predetermined price and date in the future. Intraday futures trading is when you open and close these positions within the same trading session. So, you may ask: how to do intraday trading in futures?

Well, there are some advantages that this approach offers to intraday traders. With leverage, you can control large contract values with a small margin requirement, and this will help amplify potential profits. Additionally, the highly liquid futures markets allow you to have quick entries and exits.

However, leverage is a double-edged sword – you could have losses mounting rapidly, too. Futures have defined expiration dates, and this is another risk entirely. To handle these risks and challenges, you have to deploy strict risk management strategies like stop-losses and prudent position sizing.

You can use technical analysis to profitably time entries and exits. Your focus should be on trading the most liquid contract months and trying not to hold positions overnight. Stay up to date on economic data releases and news that could spark volatility. You can lucratively engage in intraday futures trading with discipline and the right tactics.

Setting Up for Intraday Trading

To start intraday trading, all you need to do is open a trading account with a broker. The broker will demand that you submit your personal documents and proof of income. Once they approve it, the next step is to fund your account, and you will be ready to trade.

Next, try to familiarize yourself with different order types like market, limit, and stop-loss. Each of these order types serves a specific purpose. For instance, limit orders let you set your desired entry/exit price.

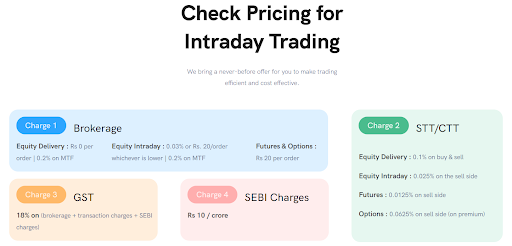

One important thing is you have to choose a trading platform that suits your needs. Aspiring traders should look for a user-friendly app, offers real-time data, offers charting tools and offers fast execution. Rupeezy is one such platform that has been created for traders. You can open a demat account by following the few simple steps.

Conclusion

Intraday trading is a high-intensity, potentially lucrative trading method. But you need to have the skill, discipline, and a robust risk management plan. You have to set up your trading environment, define your strategies technical analysis, and know how to handle some markets like futures.

But then, no knowledge can be compared with real-world experience. So, you need to start small with paper trading, gain confidence, and gradually increase your capital. However, the most important thing is to choose a reliable platform like Rupeezy that will give you all the tools and resources you need to become successful in intraday trading.

Remain patient, keep learning, and let your profits compound over time. With the right mindset and always trying to refine your approach, you will master how you can capitalize on short-term price movements. Stay focused, manage your risks well, and the rewards that come with intraday trading will be yours.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category