Best Intraday Trading Strategies and Tips for Beginners

00:00 / 00:00

If you are an intraday trader looking to elevate your game, then you have come to the right place. In this article, we will look into the best intraday trading strategies that will undoubtedly change the way you approach your trades. From scalping to momentum trading, we will explore all golden strategies for intraday trading and rules that have helped traders perform better in the markets.

Keep reading to learn more, and if you're unsure about the basics, check out our article on intraday trading meaning and concept to strengthen your understanding.

Best Intraday Trading Strategy for Beginners and Experienced Traders

Here are the most successful intraday trading strategies that a trader can use to maximize returns from trading:

1. Scalping Strategy

The scalping strategy is when you make many trades to accumulate small profits from each of them. You will have to focus on short time frames, typically ranging from a few seconds to fifteen minutes.

The strategy also requires you to have a keen eye for identifying and capitalizing on minor price fluctuations. Additionally, you must discipline yourself and learn how to control your emotions to prevent small losses from escalating. Following essential trading psychology principles, often highlighted in famous trading quotes by experienced traders, can help maintain discipline. The goal, as mentioned, is to consistently make modest gains, which can add up to significant profits over time.

2. Momentum Trading Strategy

Momentum trading strategy

Source: Trading Strategy Guides

In the momentum trading strategy, you will trade based on the strength of recent price movements. In other words, your aim is to capitalize on an asset’s existing momentum. Or selecting the right stock just before it makes significant changes in the market trends due to news or other factors.

News and events will always impact price movements in trading. It will create lucrative intraday trading opportunities. Major announcements, regulatory changes, and global economic developments will trigger substantial volatility, allowing savvy traders to capitalize on these market fluctuations.

You will either buy stocks in intraday trading when prices are rising, intending to sell at an even higher price, or sell when prices are falling, planning to buy back at a lower price.

In this strategy, you have to rely on the notion that prices often continue moving in a particular direction for a while. You also need to use some technical indicators to identify the strength and direction of the momentum.

3. Bull Flag Trading Strategy

In the bull flag trading strategy, you first need to identify a strong uptrend in price action, forming the flagpole. While this pattern appears in an ongoing trend, it can also develop after a bullish reversal pattern, signaling the start of a new upward move. Next, look for a brief consolidation or a slight pullback, creating a flag pattern. This pause allows the market to gather momentum before a potential breakout.

Your goal is to enter a long position when the price breaks above the upper boundary of the flag, confirming the continuation of the uptrend. This strategy relies on the assumption that the existing trend will resume after a short consolidation.

4. Reversal Trading Strategy

Reversal trading strategy

Source: Stock Pathshala

With the reversal trading strategy, you will need to look for signs that a current trend is about to reverse direction. Traders can also analyze reversal candlestick patterns, which can indicate a potential shift in momentum. These patterns help identify securities with a high probability of trend reversal. Once traders identify such stocks that will undergo this, they go ahead and place their trades. It is important to note that doing so involves a high level of difficulty, as it is hard to pinpoint when the stocks will pivot.

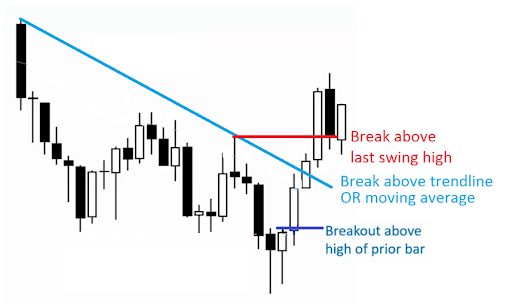

5. Breakout Trading Strategy

In the breakout trading strategy, you will need to identify the vital support and resistance levels on the price chart. These levels let you know the areas where the price has previously struggled to break through. So, when the price breaks through one of these levels, it could signal the start of a new trend.

Breakout trading strategy

Source: Dot Net Tutorials

You have to enter a trade once the price decisively breaks above resistance (buy) or below support (sell). Some people also place a stop-loss order below the breakout level to limit potential losses. In this strategy, you rely on the notion that prices will continue moving in that direction once a breakout occurs.

6. Gap and Go Trading Strategy

In the gap-and-go strategy, your focus should be on stocks with significant price gaps in the open market. If the gap is upward, you will look to buy the stocks with the expectation that the price will continue rising. Conversely, if the gap is downward, you’ll aim to sell short, anticipating further downside.

In this strategy, you assume that the momentum behind the gap will persist throughout the trading session. Moreover, you will have to place a stop-loss order to limit potential losses if the trade does not go your way.

7. Pair Trading Strategy

In this strategy, you first of all have to identify two stocks that are typically correlated and move together. When one stock starts to outperform the other, creating a divergence, you will then look to capitalize on this temporary imbalance.

Specifically, you have to use short selling on the outperforming stock while buying the underperforming stock, anticipating that their prices will eventually converge. You also have to continuously monitor the pair’s relationship and exit the trade once the divergence narrows or reverses. In this strategy, your aim is to look for profit from temporary mispricing between correlated assets.

Intraday Trading Tips for Beginners

While these intraday trading strategies are effective, they don’t work alone. You need to follow the intraday trading tips mentioned below to get the best results

1. Follow the Market Trend

One of the golden rules of intraday trading is to follow the market trend rather than trying to predict reversals. If the market is in an uptrend, focus on buying opportunities; if it’s in a downtrend, look for short-selling opportunities.

Example: If the Nifty 50 is showing consistently higher highs and higher lows, it’s better to enter long positions rather than shorting.

2. Use Stop-Loss for Every Trade

A stop-loss is your safety net in intraday trading. It prevents small losses from turning into major setbacks. Set a stop-loss at a logical level; the best zone is below a recent support level for long trades or above resistance for short trades.

Example: If you buy a stock at Rs 500 and identify strong support at Rs 490, place your stop-loss at Rs 490 to minimize risk.

3. Manage Your Risk with Position Sizing

Never risk more than 1-2% of your total trading capital on a single trade. This ensures that even if a trade goes wrong, your account won’t take a massive hit. Use a Risk-Reward Ratio (like 1:2 or 1:3) to ensure potential profits are higher than potential losses.

Example: If your stop-loss is Rs 5 per share, aim for at least Rs 10 profit per share to maintain a 1:2 risk-reward ratio.

4. Choose Highly Liquid Stocks

In intraday trading, liquidity matters. You need stocks that let you buy and sell quickly without big price swings. Look for ones with high trading volumes, tight bid-ask spreads, and strong market participation. You can look for large-cap and index-based stocks. These make it easier to enter and exit trades smoothly while avoiding sudden volatility.

5. Follow a Trading Plan & Stick to It

A structured approach to trading prevents impulsive decisions. Define your entry, exit, stop-loss, and target levels before placing a trade. Avoid chasing stocks based on emotions or sudden price movements.

Example: If your strategy is based on the moving average crossover, enter only when the signal appears don’t jump in just because the stock is moving fast.

6. Avoid Trading During the First 15 Minutes

The opening 15 minutes after the market opens (9:15 AM to 9:30 AM in India) are the most volatile. Prices fluctuate due to overnight news, global market influences, and large institutional orders. It’s better to wait for patterns to form before entering a trade.

7. Use Technical Indicators Wisely

Technical indicators help confirm trade signals but should not be used in isolation. Use a combination of indicators like Moving Averages (for trends), Relative Strength Index (RSI for momentum), and MACD (for reversals) to improve accuracy.

Example: If the RSI is above 70, the stock is overbought; if it’s below 30, the stock is oversold—this helps in timing entries and exits.

8. Monitor News & Market Events

Stock prices react sharply to news such as earnings reports, RBI announcements, and global market trends. Keep track of economic calendars and corporate news to avoid sudden market moves against your position.

Example: If a company is about to release its earnings report, avoid trading that stock intraday as it could see unpredictable price swings.

9. Avoid Overtrading

Overtrading is a common mistake where traders take excessive positions without proper analysis, often leading to losses. Stick to quality trades rather than quantity.

Example: If your strategy suggests 3-4 trades per day, don’t take 10 trades just because the market looks active—it increases risk unnecessarily.

10. Keep a Trading Journal

Maintaining a record of your trades helps you learn from past mistakes and improve future performance. Log details like entry price, exit price, stop-loss, reason for trade, and emotions at the time of trading.

Example: If you lost money on a reversal trade, reviewing your journal may reveal that you entered too early, helping you refine your strategy.

Conclusion

If you master these top golden intraday trading strategies, you will undoubtedly elevate how you trade. Whether you’re a seasoned trader or just starting out, implementing these techniques will give you a solid foundation for success.

To truly excel, you need a reliable trading platform. That’s why we recommend you open demat account with Rupeezy—an all-in-one platform for Stocks, F&O, IPOs, and Mutual Funds—trusted by over 2 lakh+ happy customers. Take the first step today and join the ranks of successful intraday traders!

FAQs:

Q1: Which intraday trading strategy is best for beginners?

For beginners, the Scalping Strategy and Momentum Intraday Trading Strategy are ideal starting points. Scalping helps build discipline through quick, small trades, while momentum trading teaches how to ride the wave of price trends

Q2: How can I earn profits in intraday trading?

You can earn profits in intraday trading by following a well-defined trading plan, using a proven strategy, maintaining a favorable risk-reward ratio, and staying disciplined.

Q3: How do I choose stocks for intraday trading?

To select stocks for intraday, look for highly liquid and volatile stocks with strong momentum and clear trends. Focus on those showing solid technical setups like breakouts near key support or resistance levels.

Q4: What is the 3-5-7 rule in intraday trading?

The 3-5-7 rule in intraday trading is a simple risk control method where you exit if a stock falls 3%, book a profit at 5%, and limit total daily loss to 7% of your capital. It helps you stay disciplined and avoid big losses.

Q5: Is intraday trading profitable?

A: Yes, intraday trading can be profitable if you use the right intraday strategy, stay disciplined, set proper stop-loss orders, and follow a well-defined risk-to-reward ratio plan.

Check Out These Related Articles: |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category