Open Demat Account for FREE

+91

+91  +91

+91

Our Pricing

Transparent pricing. No hidden charges*₹0

Account opening fee

Demat + Trading account charges₹0

AMC*

For lifetime₹0

AMC*

For lifetime10.99%

Interest p.a.

Margin Trading Facility (MTF)Rupeezy Features

Premium Trading Tools.

Free Account Opening

Advanced Option Chain and Charts

Free Strategy Store

Hedge with Far OTM Options

Instant Pledge, Same Day Payouts

Easy IPO Applications

How to Open a Demat Account?

You can open hassle-free demat account in just 5 minutes with Rupeezy.

Add personal & bank details

E-mail id , Mobile no., PAN, DoB and Account no.

Upload documents

Latest income proofs, selfie, signature and IDs

E-Sign forms

Aadhaar OTP verification

Margin Trading Facility

Take control of your investments with the best-in-class delivery margins provided by Rupeezy’s Margin Trading Facility.

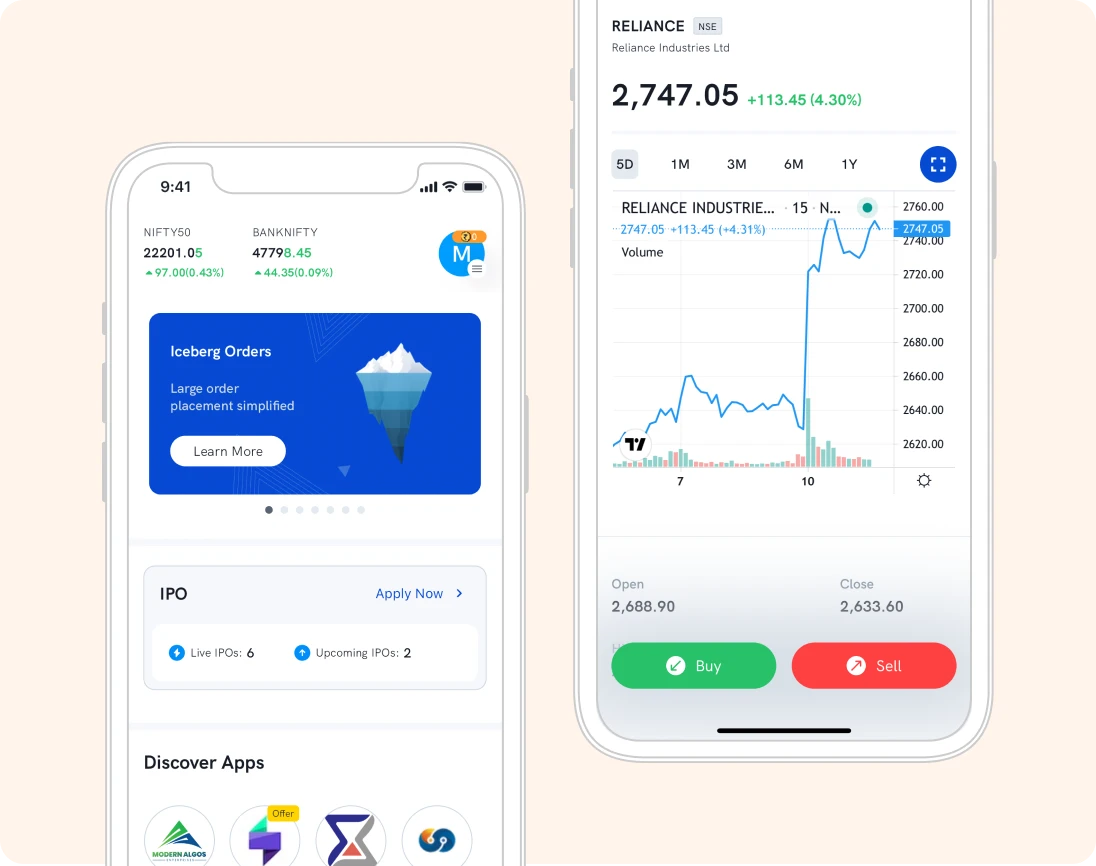

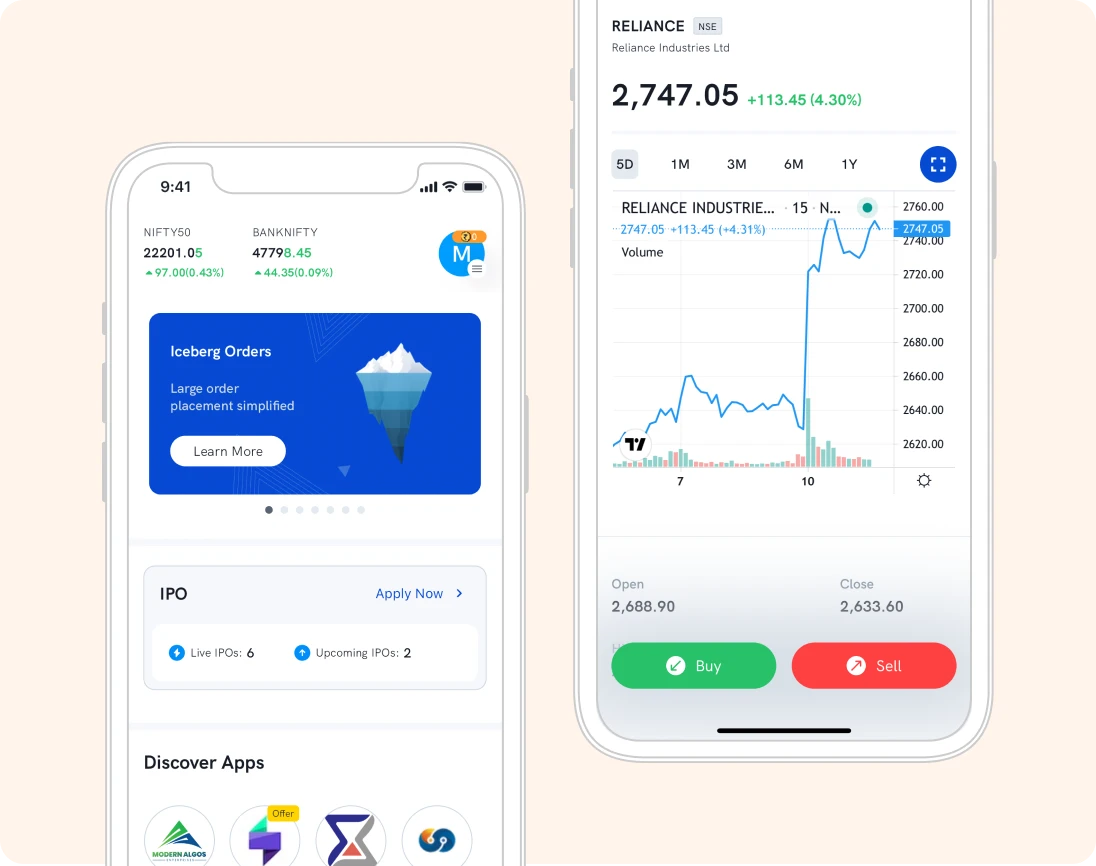

Shift to smarter trading with Rupeezy app

Free Strategy Builder/ Strategy Store

Get free option strategies in Strategy Store. Predict the market and get strategies in one click.

Automated Manual Trading (AMT) Orders

Options Greeks are a set of calculations that are used to measure various factors that may affect the price of an option contract.

GTT & OCO Order

Good-till-triggered & one-cancel-other.

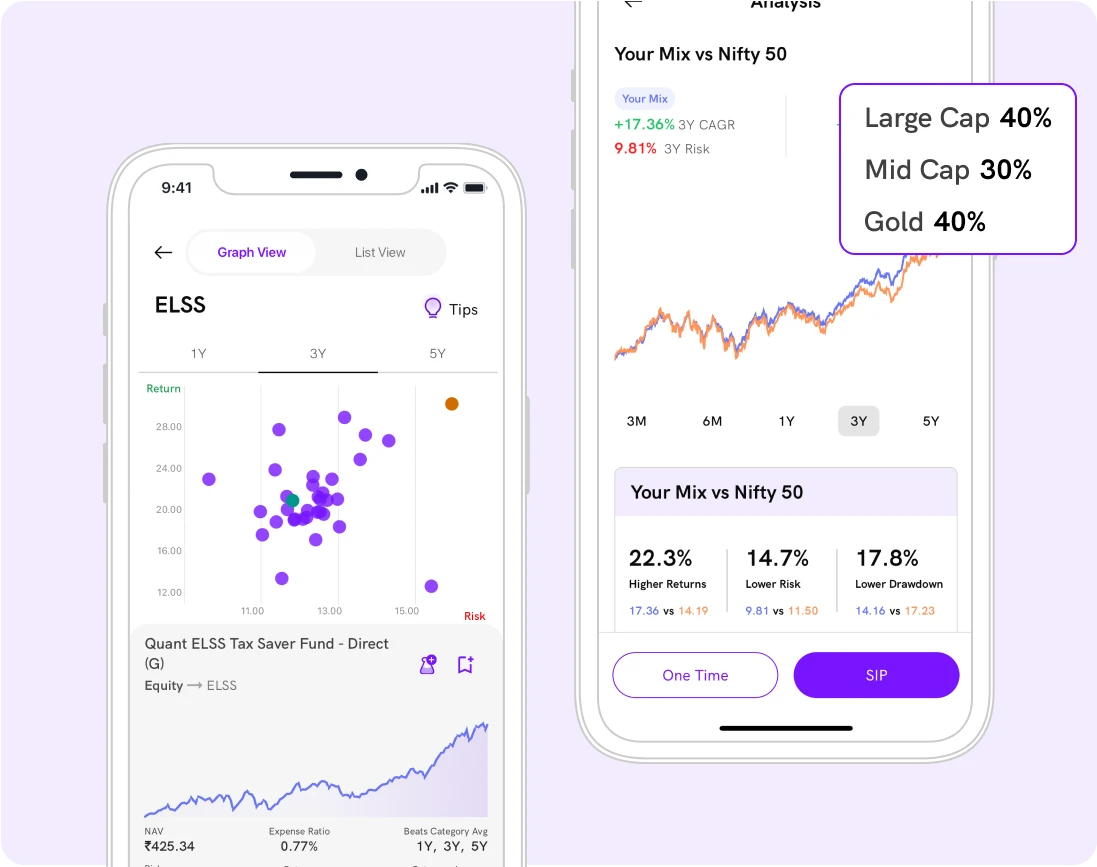

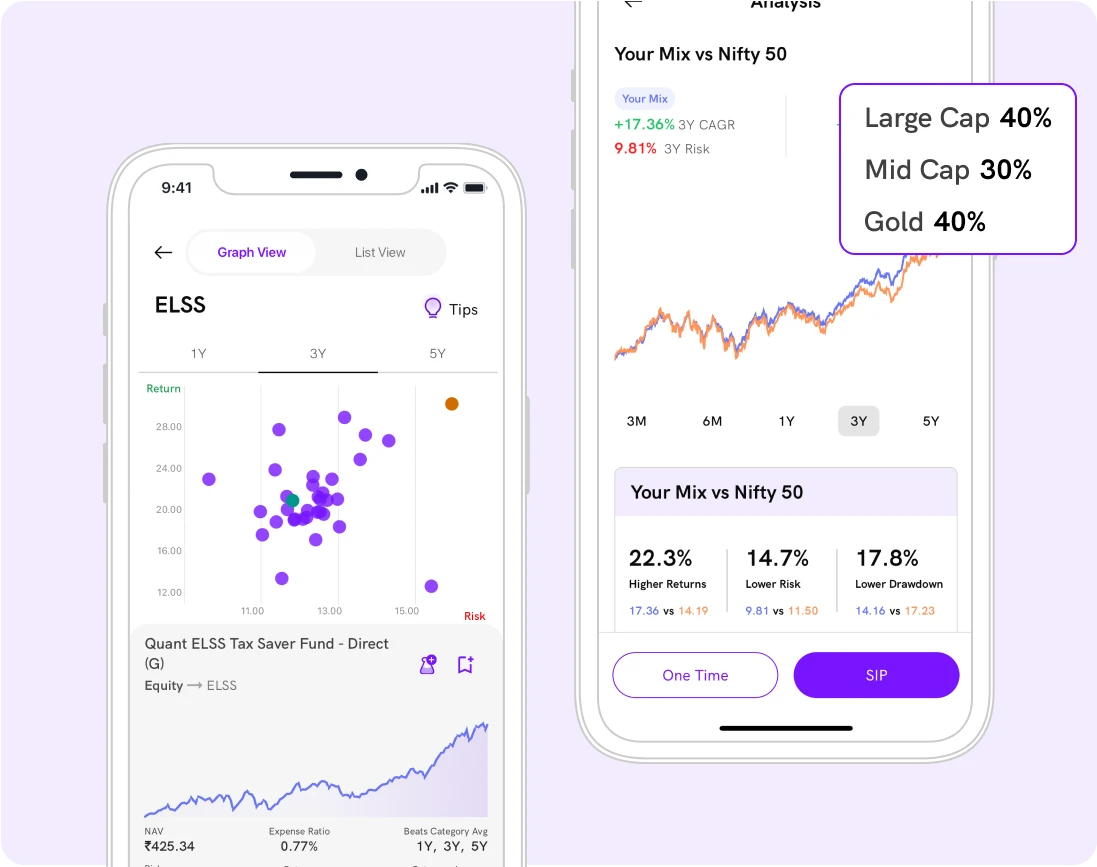

Mutual Funds Re-imagined on Rupeezy app

Smart Explore

Quickly compare risk & return of multiple mutual funds in one look.

Impact Analysis & Portfolio Overlap

Make your portfolio truly diversified by checking the overlap before buying a new mutual fund.

MF lab

Back test your mutual fund allocations before investing.

Trade directly through charts

Advance Tradingview Pro

Get advanced Tradingview charts with multiple indicators.

12 chart types

Including Renko, Kagi and Point & Figure - all customizable.

Upto 8 charts per tab

Plus, synchronize symbols, intervals and even drawings.

Option chain

Access option chain and trade directly through charts.

Custom time intervals

Any possible timeframe, including seconds and range bars.

One stop solution for Mutual Funds

SIP with Automated Payment

Set up SIPs with auto debit option

Flexible SIP Options

Choose weekly, monthly, or quarterly SIPs to fit your schedule

One Click Import

Import and track your existing mutual fund portfolio to Rupeezy

Step Up SIP

Add a little extra topping of SIP every year to beat inflation

Speedy Investment

Quick Pay with UPI or Net banking

Frequently Asked Questions

Q1. What is a demat account?

Ans. A demat account is an electronic account meant to hold shares and other securities in an electronic or dematerialised form, instead of physical paper. A demat account stores your investments digitally, making them safe from physical damage, loss, theft or forgery. It is easy to transact and transfer shares using a demat account. The transactions are executed and settled without delay instantaneously. You can monitor your holdings at a glance from the demat account.

Q2. Is a demat account a bank account?

Ans: Demat account is just like a bank account opened with a depository participant regulated by SEBI. A demat account holds your securities, bonds, ETFs, mutual funds etc in a digital form

Q3. What is the minimum balance for Demat account?

Ans: There is no minimum balance or no of shares required to be held in a demat account.

Q4. How long does it take to open a demat account?

Steps of Instant Account Opening:

- Visit our website www.rupeezy.in

- Click on Open Demat Account

- Fill in your personal detail (Mobile, Email, PAN and DoB).

- Validate your information pulled from KYC Database.

- Fill in your Bank Account detail. (Account Number and IFSC Code)

- Complete selfie and signature verification.

- Upload documents (latest Income Proof)

- E-Sign your forms using Aadhaar OTP verification.

Q5. What are the documents required for opening a demat account?

Proof Of Identity Documents (any one): PAN Card, Voter ID, Passport, Driving Licence, Aadhar Card