Know Your PAN Number Online

00:00 / 00:00

PAN or Permanent Account Number has become an integral part of our lives. From opening a bank account to availing loans or even investing in securities you need to provide your PAN number and for that, you need to know your PAN number. However, there may be situations where one may not know where to find this number or may lose access to his PAN card. This article will help you understand the different ways you can know your PAN number using your name, DOB, Aadhaar number, etc. among other methods. Keep reading to find out!

Where can you find your PAN number?

The easiest way to know your PAN number is from the PAN card that you have received after applying for the same. On the physical card, you can find an alphanumeric number, which is 10 characters. This is usually printed at the bottom left corner of the card. The PAN number will have five letters out of which the fifth letter will be the initial of your name, and then followed by four numbers and another letter. For instance, if your name starts with S, then your PAN number can be ABCDS1234E.

Now if you do not have a physical PAN card or you may have lost it and still want to find out your PAN number, then the following are the methods you can opt for.

How to find your PAN number from an Income Tax website?

The first legitimate method is to check the PAN number from the Income Tax Website. To do so, you have to follow these steps –

Step 1: Open the Income Tax website

Step 2: If you are a new user, you need to first register yourself; otherwise, you can proceed to the next step.

- Choose the ‘type of user’ and click on the Continue button.

- Enter the details required for registration purposes.

- The mobile number and the email address that you enter will receive an OTP on the same.

- Enter the OTP and complete the registration.

Step 3: Now you can log in to your account and visit the e-filing website.

Step 4: Go to the profile settings tab and choose ‘My Account’

Step 5: Here you can find all the details which will include the PAN number as well.

How to know your PAN number using your Aadhaar number

Using this website, you can know your PAN number by Aadhaar card number as well. All you need to do is to:

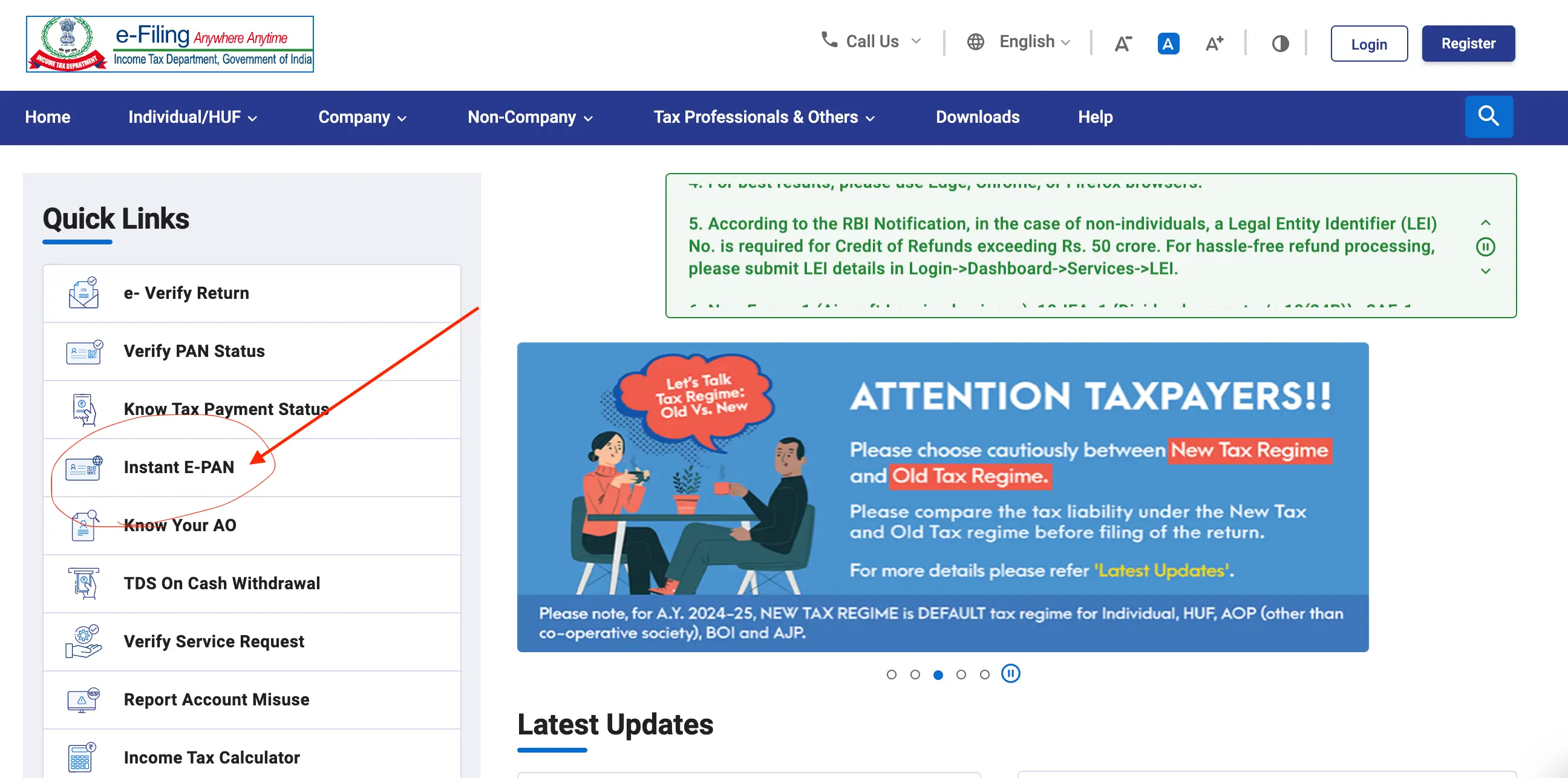

Step 1: Click on the website's ‘Quick Links’ button

Step 2: Then click on the tab called ‘Instant e-PAN’ to visit the page

Step 3: Now tap the ‘Check Status/Download PAN’ option below the page

Step 4: Then you will be asked to enter your Aadhaar number and do the captcha verification

Step 5: An OTP will come to the registered mobile number that you have with your Aadhaar

Step 6: Once you enter the OTP on the screen, you can know your PAN number by Aadhaar card

How to check your PAN number by Mobile App?

Another easy way to find your PAN number is by using the Indian Pan Card mobile app. The steps are as follows:

Step 1: You need to download the app on your smartphone.

Step 2: Once the application is installed, open it and click on ‘Know your PAN details’. You can find the option at the bottom of the home page.

Step 3: Enter the mobile number you provided for PAN card registration.

Step 4: An OTP will pop up on that number, enter the OTP on the application and submit.

Step 5: Your PAN number along with other details of the account will appear on the smartphone screen.

How to know your PAN number from NSDL?

Yes, you can know your PAN number by name and dob through NSDL as well. You can choose any of these two ways mentioned below:

You can call NSDL on the toll-free number – 1800222990 and ask them to assist you find your PAN number.

Alternatively, you can email them at tininfo@nsdl.co.in or to gsd@utiitsl.com.

How to find your PAN number after application?

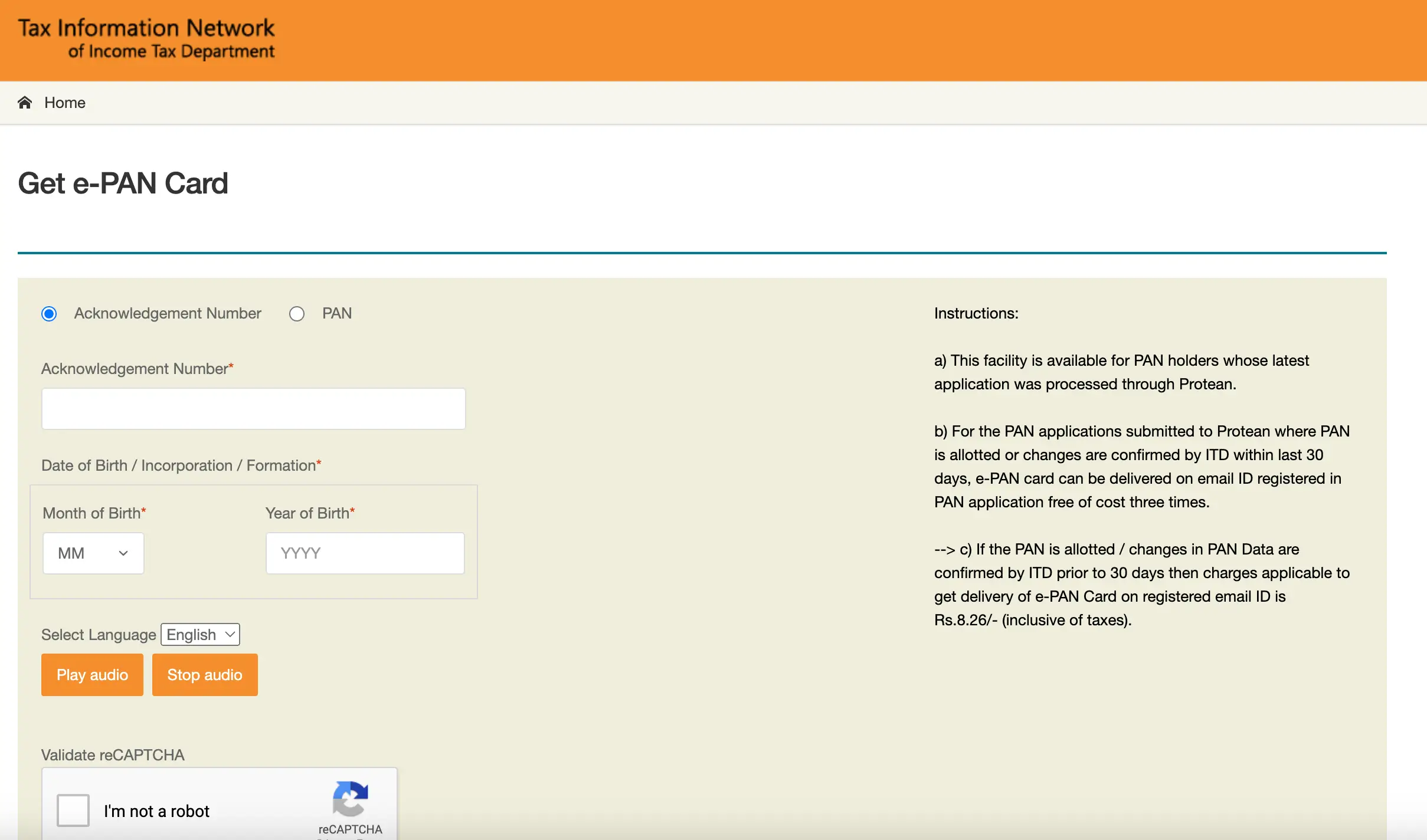

Once you have applied for PAN, you receive a 15-digit acknowledgment number, provided you have applied for it through Protean e-Gov Technologies Limited. If you have applied through UTIITSL, then you will receive a 9-digit acknowledgment number.

Now you can know your PAN number with acknowledgment number and can also check the status of your PAN card application. All you have to do is to:

Step 1: You have to visit the NSDL website and enter the acknowledgment number.

Step 2: Then enter the date of birth and enter the captcha.

Step 3: OTP will be sent to your registered mobile number, which you need to enter to validate your authenticity.

Step 4: Now you check the status of your PAN card application and if it is completed, then you can download the same in PDF format.

Also Read: How to Check PAN Aadhaar Link Status

Wrapping up

So, if you were looking for your PAN number, now you know how to obtain the same. By following any of the methods mentioned above, you can easily know your PAN number. The digital era has made retrieving your PAN number hassle-free. So, whether you’re a taxpayer, investor, or simply someone in need of their PAN number, rest assured that there are reliable ways to retrieve it. So you no longer have to worry about misplacing your card and can now confidently navigate your financial endeavors with ease.

You may find these articles interesting | |

1 | |

2 | |

3 | |

4 | |

5 | |

6 | |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category