Hanging Man Pattern - Meaning, Examples, How to Trade

00:00 / 00:00

These days traders have access to various tools that can help them identify trading opportunities in the stock market. One of the traditional and enduring methods is the use of candlestick patterns. Out of these various candlestick patterns, the Hanging Man Pattern is one of the simplest patterns among the traders. In this article, we will understand the meaning of the Hanging Man Pattern, its Interpretation, trading opportunities, and more.

What is a Hanging Man Pattern?

A Hanging Man Pattern is a bearish candlestick pattern that comprises a small body, little to no upper wick, and a large lower wick which is at least twice as large as the body of the pattern. This is a reversal pattern that appears at the end of an uptrend.

Types of Hanging Man Pattern

Based on the color of the Hanging man pattern, it can be broadly classified into the following:

1. Red Hanging Man Candlestick

In the red hanging man candlestick, the body of the pattern is red because the closing price is lower than the opening price during the session. This version of the hanging man shows a stronger bearish sentiment as it indicates that the sellers have gained control over the buyers during the session.

2. Green Hanging Man Candlestick

In green hanging man candlestick, the body of the pattern is green because the closing price is higher than the opening price during the session. This version of the hanging man pattern suggests that buyers are losing momentum giving the opportunity for the sellers to gain control..

Although the color of the pattern is not very relevant while trading using the hanging man candlestick pattern, it is important to note the red hanging man candlestick indicates a more potent reversal than the green hanging man candlestick due to its price closing lower than the opening price during the session.

Hanging Man Pattern - Formation and Interpretation

As a Hanging Man Pattern is considered a bearish reversal pattern, the prior trend before the formation of the pattern should be an uptrend. This suggests that the buyers are pushing the price of the security higher.

As the uptrend progresses, there will be one candle that is moving upwards and indicating that the buying pressure is still intact. However, during the session, the price is pushed lower by the sellers near its opening price. This suggests that the buyers may have lost control of the uptrend and a reversal may occur.

The formation of the next candle after the Hanging man pattern confirms the reversal in the security. That is, the next candle should preferably close below the low of the hanging man pattern.

How to Identify the Hanging Man Pattern?

The following are the key points to remember to identify the Hanging Man candlestick pattern:

Location: For a candlestick pattern to be called a Hanging Man pattern, it should only appear after an uptrend. If a similar candlestick pattern appears after a downtrend, then that pattern is considered to be a hammer pattern.

Shape: The Hanging Man candle should have a small body, a lower wick twice as large as its body, and little to no upper wick

Color: The body of the Hanging Man pattern can be red or green in color. However, a red Hanging Man Pattern indicates greater conviction for reversal as it indicates the price closed lower than the opening price during the session

How to Trade a Hanging Man Pattern?

As mentioned earlier, one should only trade using a Hanging Man Pattern if the prior trend before the pattern formation is an uptrend. Once this basic criterion is met, one can look to enter a short position in the stocks which is explained using a live example below:

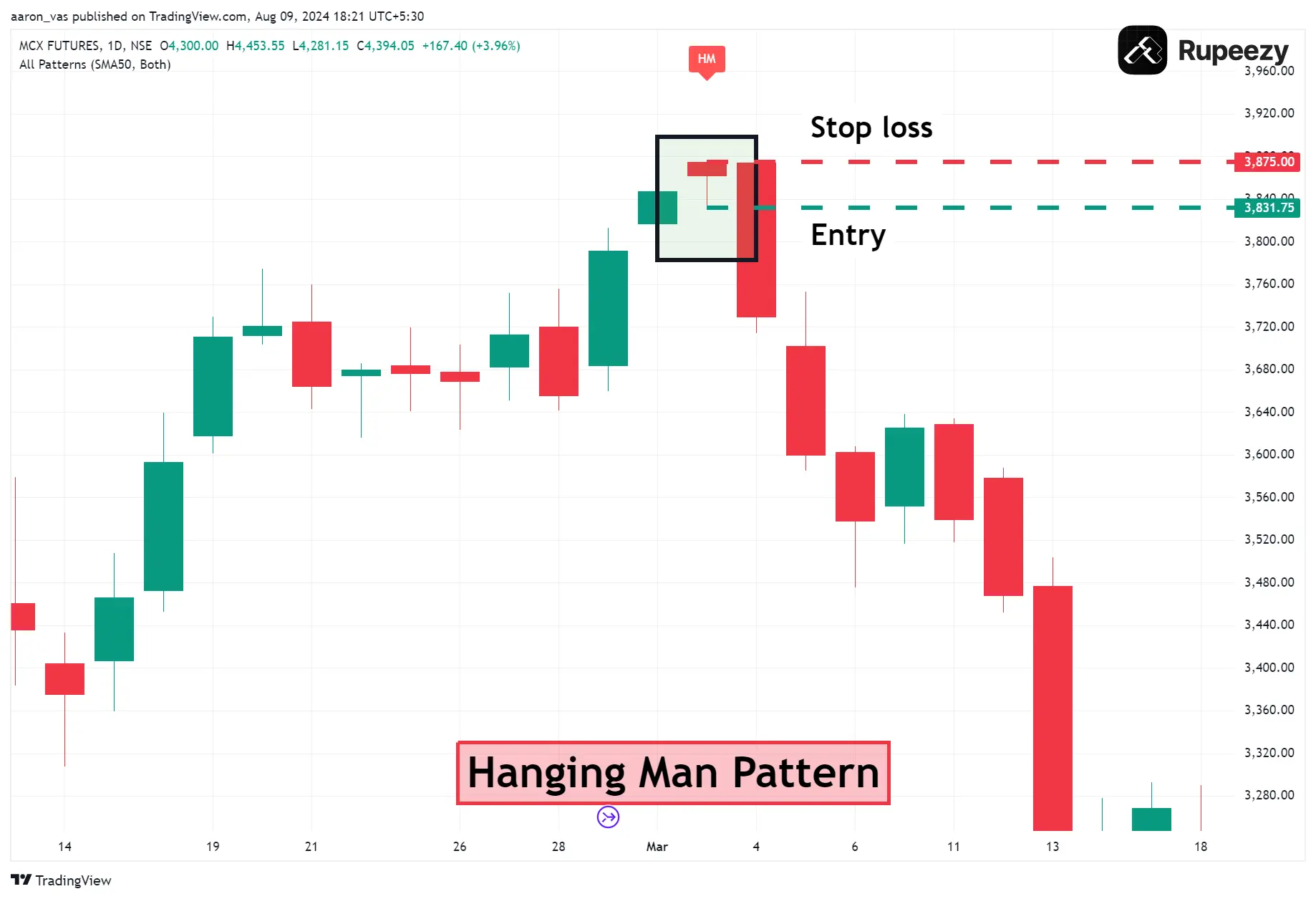

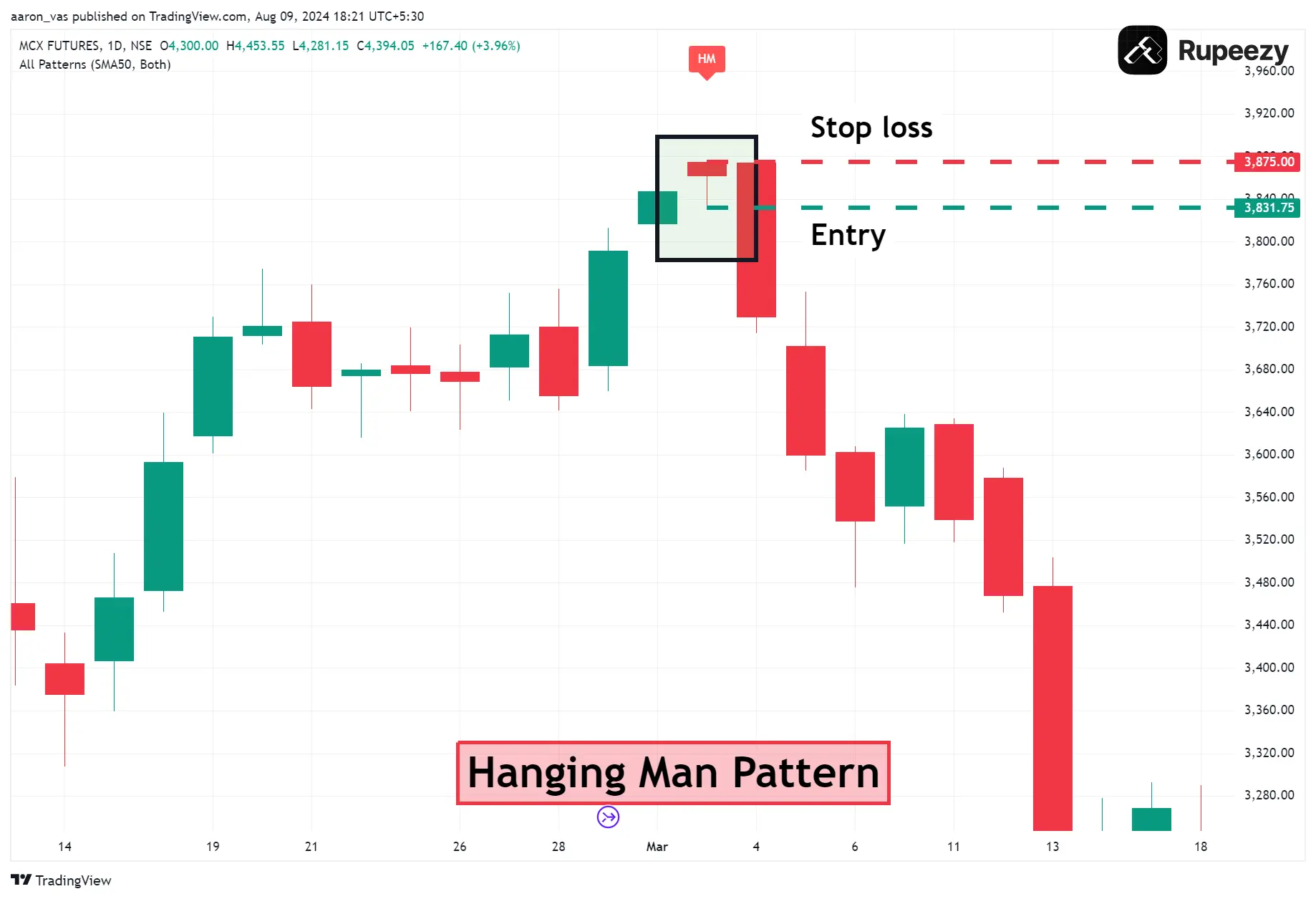

Hanging Man Pattern Example

Entry: There are two ways to trade using the hanging man candle. The first approach is you wait for the next candle after the hanging man candlestick to close below it. Following this, one can enter a short position in security.

The second approach is an aggressive approach where you do not wait for the next candle to close below the hanging man pattern. Here, you enter a short position as soon as the next candle starts trading below the hanging man.

Stop Loss: If the security starts moving above the high of the pattern, one can consider closing the short position in the trade.

But, if the size of the body of the hanging man is short, one can set a stop-loss using the risk-to-reward ratio of the prior resistance level (whichever comes first).

Profit Target: Because the hanging man trade is based on a single candlestick pattern, there is no standard way to calculate the profit target. Profits can be booked using the risk-reward ratio, the immediate level of resistance, or even the trailing stop-loss strategy.

The Best Scenario for a Hanging Man Pattern

As the Hanging Man Candle indicates a bearish reversal, its probability of success is likely to increase as it appears near a well-established level of resistance.

This is because resistance zones are levels where a significant price action has occurred in the past. Therefore, this zone is perceived as a strong supply zone where the security might reverse in the downward direction.

Thus, the formation of the hanging man pattern near a well-established support level creates confidence among the traders that the buyers are losing momentum near the supply zone and the price will likely reverse downwards.

Limitations of Hanging Man Patterns

While this is a well-recognized candlestick pattern used by traders, it does come with the following limitations:

Requires additional confirmation: As the hanging man pattern is a single candlestick pattern, validation from the next candle is required for any potential signals.

No Profit Targets: Because it is a single candlestick pattern, it does not provide levels where traders need to book profits in a trade.

Strength of the candle: The strength of the hanging man pattern is relatively lesser when compared to the shooting star pattern.

Hammer vs Hanging Man - Key Differences

The Hanging Man candlestick and Hammer candlestick pattern have a similar appearance. However, they have the following distinguishing features:

Features | Hammer Pattern | Hanging Man Pattern |

Prior Trend | Downtrend | Uptrend |

Indication | Indication of a bullish reversal | Indication of a bearish reversal |

Best Scenario | Preferable to appear near a support level | Preferable to appear near a resistance level |

Conclusion

We have reached the end of the article on the Hanging Man Candlestick Pattern. Before we wind up, it is important to note that the hanging man pattern does not guarantee a reversal, so it is important to use this pattern along with a combination of other technical tools and indicators and place proper risk management strategies to mitigate huge losses.

Make the most of technical indicators and features like trailing stop-loss with our Rupeezy trading app. Open Demat account with Rupeezy today and earn a 20% commission on every trade by referring friends and family.

Check Out These Related Articles |

4 Bullish Reversal Patterns That All the Traders Should Know |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category