Is Vikran Engineering IPO Good or Bad – Detailed Review

00:00 / 00:00

Vikran Engineering Limited's IPO is set to open its initial public offering from August 26, 2025, to August 29, 2025. When considering applying for this IPO, potential investors might have questions about whether the Vikran Engineering IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Vikran Engineering IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Vikran Engineering IPO Review

Vikran Engineering Limited's IPO is a book-built issue of Rs 772.00 crore. The IPO comprises a fresh issue of approximately Rs 721 crore and an Offer for Sale (OFS) of Rs 51 crore by the promoter Rakesh Ashok Markhedkar. The issue is open for subscription from August 26 to August 29, 2025, with a price band of Rs 92 to Rs 97 per share and a lot size of 148 shares. The company plans to use the fresh issue proceeds primarily for funding working capital requirements and general corporate purposes.

Vikran Engineering, established in 2008, is a fast-growing Engineering, Procurement, and Construction (EPC) company. It offers end-to-end solutions on a turnkey basis across power transmission and distribution, water infrastructure, and railway infrastructure. The company operates on an asset-light business model, which helps reduce fixed costs and improve operational efficiency. As of June 30, 2025, Vikran Engineering had a robust order book of Rs 2,442.43 crore from 44 ongoing projects.

Financially, the company has shown strong growth in its top and bottom lines. Its revenue from operations grew from Rs 524.31 crore in FY23 to Rs 915.85 crore in FY25, a CAGR of 32.17%. Profit After Tax (PAT) also increased significantly from Rs 42.84 crore in FY23 to Rs 77.82 crore in FY25, with a CAGR of 34.78%. The company's profitability margins are notable, with an EBITDA margin of 17.50% and a PAT margin of 8.44% in FY25, which are among the highest in its peer group.

Key strengths of the company include its rapid growth, diversified project portfolio, an asset-light model that boosts capital efficiency, and an experienced management team with deep domain knowledge. However, potential investors should be aware of certain risks. These include a high dependence on government contracts, which accounted for a majority of its revenue in FY25, and a working capital-intensive business model that can lead to liquidity issues. The company is also facing a criminal proceeding and a ban order from the Railway Board, although the latter is currently stayed. The IPO provides the company with an opportunity to strengthen its balance sheet and support its future growth strategies.

Company Overview of Vikran Engineering IPO

Vikran Engineering is an Indian EPC company with a diversified portfolio spanning power, water, and railway infrastructure. The company's services include constructing high-voltage transmission lines up to 765 kV, substations up to 400 kV (Air Insulated Substations and Gas Insulated Substations), power distribution networks, water treatment plants, and railway electrification projects. It operates on an asset-light model, relying on leased equipment to reduce fixed costs and improve operational efficiency.

As of June 30, 2025, the company had completed 45 projects across 14 states with a total executed contract value of Rs 1,919.91 crore. It had 44 ongoing projects in 16 states with an aggregate order value of Rs 5,120.20 crore and an order book of Rs 2,442.43 crore. The company's clientele includes prominent government and public sector entities like NTPC Limited and Power Grid Corporation of India Limited.

The company's leadership includes Rakesh Ashok Markhedkar (Chairman and Managing Director), Avinash Ashok Markhedkar (Whole-time Director), and Nakul Markhedkar (Whole-time Director). Rakesh Ashok Markhedkar has 34 years of experience in the EPC sector.

Industry Overview of Vikran Engineering IPO

Vikran Engineering operates within the broader Indian infrastructure EPC industry. The power sector is experiencing growth driven by the need for a robust transmission system to integrate large-scale renewable energy capacities.

Investments in the transmission sector are projected to reach Rs 4.5 to 5.5 lakh crore between fiscals 2026 and 2030. The water sector is also seeing growth, with investments expected to rise from Rs 12.3 lakh crore (FY19-FY25) to Rs 13.5 to 14.0 lakh crore (FY26-FY30), supported by government schemes like the Jal Jeevan Mission.

The railway and metro sector is poised for growth with estimated infrastructure investments of Rs 15.0 to 16.0 lakh crore in railways and Rs 1.5 to 1.7 lakh crore in metro projects between fiscals 2025 and 2030.

Financial Overview of Vikran Engineering IPO

Particulars | March 31, 2025 (Rs crore) | March 31, 2024 (Rs crore) | March 31, 2023 (Rs crore) |

Revenue from Operations | 915.85 | 785.95 | 524.31 |

EBITDA | 160.24 | 133.3 | 79.71 |

EBITDA Margin (%) | 17.50% | 16.96% | 15.20% |

PAT | 77.82 | 74.83 | 42.84 |

PAT Margin (%) | 8.44% | 9.46% | 8.10% |

RoE (%) | 16.63% | 25.69% | 32.67% |

RoCE (%) | 23.34% | 30.43% | 28.04% |

The financial performance of Vikran Engineering over the three fiscal years ending March 31, 2023, 2024, and 2025, shows strong top-line growth and improving operational efficiency.

Revenue from operations has shown a significant upward trend, increasing from Rs 524.30 crore in Fiscal 2023 to Rs 785.94 crore in Fiscal 2024, and further to Rs 915.84 crore in Fiscal 2025. This growth is a result of consistent execution of orders from a healthy order book.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) has also seen a considerable increase. It rose from Rs 79.71 crore in Fiscal 2023 to Rs 133.29 crore in Fiscal 2024, and further to Rs 160.23 crore in Fiscal 2025. The EBITDA margin also improved, from 15.20% in Fiscal 2023 to 16.96% in Fiscal 2024, and then notably to 17.50% in Fiscal 2025.

Profit After Tax (PAT) has consistently grown, demonstrating the company's ability to translate revenue growth into bottom-line profitability. PAT increased from Rs 42.84 crore in Fiscal 2023 to Rs 74.83 crore in Fiscal 2024, and further to Rs 77.81 crore in Fiscal 2025. The PAT margin stood at 8.10% in Fiscal 2023, improved to 9.46% in Fiscal 2024, and was 8.44% in Fiscal 2025.

In terms of return metrics, the company has shown fluctuations. Return on Equity (RoE) was 32.67% in Fiscal 2023, increased to 25.69% in Fiscal 2024, and then decreased to 16.63% in Fiscal 2025. Return on Capital Employed (RoCE) was 28.04% in Fiscal 2023, increased to 30.43% in Fiscal 2024, and then moderated to 23.34% in Fiscal 2025.

Strengths and Risks of Vikran Engineering IPO

Let's delve into the strengths and weaknesses to assess if the Vikran Engineering IPO is good or bad for investors.

Strengths

Strong Execution Capabilities with Industry Experience: Vikran Engineering is recognized as one of the fastest-growing Indian EPC companies, with a revenue from operations CAGR of 32.17% from Fiscal 2023 to Fiscal 2025. The company has a proven track record of timely project execution and has successfully completed 45 projects across 14 states as of June 30, 2025.

Diversified Portfolio and Order Book: The company operates across multiple sectors, including power transmission and distribution, water infrastructure, and railway infrastructure. This diversification helps mitigate risks associated with a single sector and provides a steady flow of business opportunities. As of June 30, 2025, its consolidated order book stood at Rs 2,442.43 crore from 44 ongoing projects, ensuring a clear pipeline for future revenue generation and operational planning.

Asset-light business model: Vikran Engineering follows an asset-light model, relying on leased equipment from third parties to reduce fixed costs and improve operational efficiency. This approach allows the company to scale operations effectively and enhances capital utilization, as reflected in its fixed asset turnover ratio, which increased from 57.38 in FY23 to 101.27 in FY25.

Experienced management team: The company is led by a team of experienced promoters, including Rakesh Ashok Markhedkar (Chairman and Managing Director), who has 34 years of experience in the EPC sector. The leadership team's deep domain knowledge and strategic insights are key drivers of the company's growth.

In-house technical and engineering capabilities: The company has in-house design and engineering teams for each business vertical, ensuring timely project completion in line with quality standards. They also have a centralized project monitoring and control group to oversee projects and manage risks effectively.

Risks

High reliance on government projects: The company's business is heavily dependent on tenders from government authorities, which accounted for approximately 61.73% of its revenue in fiscal 2025. Any delays, lack of new tenders, or adverse changes in government policies could materially impact its operations and financial performance.

Working capital intensity and liquidity issues: The business is working capital intensive, with trade receivables and inventories forming a substantial part of its assets. If not effectively managed, these aspects could adversely affect profitability, cash flow, and liquidity. The company has experienced negative net cash flows from operating activities in Fiscals 2024 and 2025.

Litigation and regulatory challenges: The company is currently facing a criminal proceeding based on a charge sheet filed by the CBI, and the Railway Board has issued a ban order for two years, though the Delhi High Court has stayed its operation. An adverse outcome in these proceedings could harm the company's reputation and ability to secure future contracts, particularly with government bodies.

Competition and aggressive bidding: The EPC industry is highly competitive. The company faces pressure from existing competitors and new entrants, which may lead to aggressive pricing and reduced profitability in the future.

Dependence on Promoters: The company's success is highly dependent on its promoters, Rakesh Ashok Markhedkar, Nakul Markhedkar, and Avinash Ashok Markhedkar, who are also the Managing Director and Whole-time Directors. The loss of their services could materially and adversely affect the business.

Strategies of Vikran Engineering IPO

Strengthening core competencies: The company plans to continue focusing on growing its core business verticals in power transmission and distribution and water infrastructure. It intends to leverage its experience in executing projects under government initiatives like the Jal Jeevan Mission (JJM) and the Revamped Distribution Sector Scheme (RDSS).

Expanding business portfolio: Vikran Engineering aims to diversify its EPC portfolio by expanding into new sectors such as solar EPC and exploring opportunities in water irrigation projects. The company plans to undertake turnkey solar PV projects and balance of system (BoS) projects for solar power plants.

Capitalizing on government initiatives: The company is strategically positioning itself to benefit from national infrastructure initiatives and policies that promote development in its key sectors. This includes participating in government programs to secure more projects in the future.

Geographical expansion: The company plans to expand its presence into new geographies, including overseas markets, particularly in Africa and the Middle East, to reduce its reliance on specific domestic markets.

Leveraging Technology and Innovation: The company's strategy involves continuing to use in-house technical and engineering capabilities to deliver projects in a timely manner. It is an ISO certified organization for Quality Management System, Environmental Management, and Occupational Health and Safety.

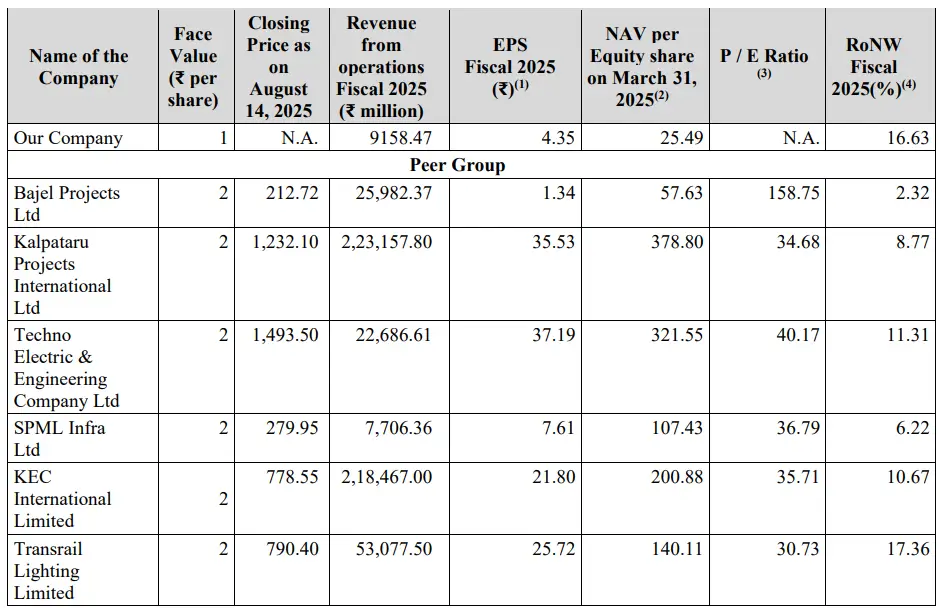

Vikran Engineering IPO vs. Peers

Source: RHP of the company

In Fiscal 2025, Vikran Engineering reported revenue from operations of Rs 915.84 crore, which is significantly lower than larger peers like Kalpataru Projects International Limited (Rs 22,315.78 crore) and KEC International Limited (Rs 21,846.7 crore). However, its revenue grew at a CAGR of 32.17% from FY23-FY25, which is higher than some peers, showing strong growth momentum.

Vikran Engineering's profitability metrics are strong compared to its peers. For Fiscal 2025, its EBITDA margin was 17.50%, which is the highest among the peer group. Its PAT margin of 8.44% was the second highest, only behind Techno Electric & Engineering Company Limited.

The company's return metrics for Fiscal 2025, RoE of 16.63% and RoCE of 23.34%, are better than those of several large peers, including Kalpataru Projects International (RoE - 8.77%, RoCE - 15.02%) and KEC International (RoE - 10.67%, RoCE - 15.73%). This indicates efficient use of capital despite its smaller scale. The company’s fixed asset turnover ratio of 101.27 in FY25 is significantly higher than most peers, reflecting its asset-light model.

Vikran Engineering's debt-to-equity ratio of 0.58 for Fiscal 2025 is considered moderate and is lower than that of KEC International (0.69) and Kalpataru Projects (0.65). It has also improved from 1.18 in Fiscal 2023. However, this ratio is higher compared to some peers like Techno Electric (0.01). The company's liquidity is deemed adequate, with a current ratio of 1.52, which is higher than several of its competitors. Overall, Vikran Engineering shows strong financial efficiency and profitability, positioning it as a competitive player in the EPC space despite its smaller size.

Objectives of Vikran Engineering IPO

The offer comprises a fresh issue and an offer for sale. The selling shareholders will receive proceeds from the offer for sale component. The net proceeds from the fresh issue of Rs 721 crore are proposed to be utilised for:

Prepayment and/or repayment of funding working capital requirement.

General corporate purposes.

Vikran Engineering IPO Details

IPO Dates

Vikran Engineering IPO will be open for subscription from August 26, 2025, to August 29, 2025. The allotment of shares to investors will take place on September 01, 2025, and the company is expected to be listed on the NSE and BSE on September 3, 2025.

IPO Issue Price

Vikran Engineering is offering its shares in the price band of Rs 92 to Rs 97 per share. This means you would require an investment of Rs. 14,356 per lot (148 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Vikran Engineering is issuing a total of 7,95,87,627 shares, which are worth Rs 772 crores. Out of which 7,43,29,896 shares of fresh issue are worth Rs 721 crore, and the remaining 52,57,731 shares are offer for sale by the selling shareholders and are worth Rs 51 crore.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on September 01, 2025, through the registrar's website, Bigshare Services Private Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Vikran Engineering will be listed on the NSE and BSE on September 03, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Vikran Engineering IPO

Important IPO Details | |

Bidding Date | August 26, 2025 to August 29, 2025 |

Allotment Date | September 01, 2025 |

Listing Date | September 03, 2025 |

Issue Price | Rs 92 to Rs 97 per share |

Lot Size | 148 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category