Is Anlon Healthcare IPO Good or Bad – Detailed Review

00:00 / 00:00

The IPO of Anlon Healthcare Limited will be open for investors from 26 August 2025 to 29 August 2025. The company is going to raise around Rs. 121.03 crore through this issue, in which a total of 1.33 crore new shares will be issued. This listing is proposed on BSE and NSE. In such a situation, it is natural for the question to arise in the minds of investors whether Anlon Healthcare IPO is good or bad, whether it will be beneficial to invest in it or not. This article gives a detailed review on the company's business, financial position and fundamental analysis.

Anlon Healthcare IPO Review

Anlon Healthcare Limited's IPO is worth Rs. 121.03 crore and is being brought as a completely fresh issue. Under this issue, the company will issue 1.33 crore new shares. The subscription dates are fixed from August 26 to August 29, 2025, while the listing of shares is proposed on BSE and NSE on September 3, 2025. The price band of this IPO has been fixed at Rs. 86 to Rs. 91 per share and the lot size is 164 shares. This means that the minimum investment for a retail investor will be around Rs. 14,104. At the same time, small HNI investors (sNII) will have to apply for a minimum of 14 lots i.e. 2,296 shares, while large HNIs (bNII) will have to apply for a minimum of 68 lots i.e. 11,152 shares. Anlon Healthcare Limited was founded in 2013 and specializes in the manufacture of pharmaceutical intermediates and active pharmaceutical ingredients (APIs). Its products are used in various sectors such as healthcare, nutraceuticals, personal care and animal health. The company's product portfolio is extremely diverse with 65 commercial products already present, while 28 products are at the pilot stage and 49 products are at the laboratory testing stage. This comprehensive portfolio gives the company a competitive edge in the market.

Apart from this, the company has done several Drug Master File (DMF) filings globally and has also received approval from international regulatory bodies such as ANVISA, NMPA and PMDA. This reflects the quality of the company's products and manufacturing capability in line with international standards.

Looking at the financial performance, the company has registered strong growth between FY2024 and FY2025. The company's revenue grew 81% to Rs during this period. 120.46 crores, while profit (PAT) grew by a whopping 112% to reach Rs. 20.52 crores. EBITDA also more than doubled to Rs. 32.38 crores. The company's Return on Equity (ROE) is 40.45% and Return on Capital Employed (ROCE) is 21.93%, which can be considered much better than the industry average. Also, PAT margin of 17.06% and EBITDA margin of 26.88% indicate the profitability of the company.

However, the company also faces some risks. Competition in the pharma industry is extremely fierce and obtaining regulatory approvals for new products is a time-consuming and challenging task. Also, the company is still not completely debt-free, although a part of the proceeds from the IPO will be used to repay the debt.

Overall, the Anlon Healthcare Limited IPO may be attractive to investors who believe in the long-term growth story of the pharma sector. The company's strong financial position, diversified product portfolio and international approvals are its major strengths. But investors should be cautious considering the regulatory risks and industry competition. This is why the answer to the question "Anlon Healthcare IPO Good or Bad" will depend on the investor's investment strategy and risk appetite.

Company Overview of Anlon Healthcare Ltd

Anlon Healthcare Limited was founded in the year 2013 and is engaged in the manufacturing of pharmaceutical intermediates and active pharmaceutical ingredients (APIs). The company produces high-quality pharma intermediates and APIs that are used in the manufacture of medicines, nutraceuticals, personal care and animal health products.

The company has a diverse product portfolio. It currently has 65 commercial products available, in addition to 28 products in the pilot stage and 49 products in the laboratory testing stage. This broad portfolio constantly exposes the company to new opportunities and gives it a competitive edge.

The company's business model is primarily based on the development of high-purity intermediates and APIs that are used by pharmaceutical companies in various formulations such as tablets, capsules, ointments and syrups. In addition, the company also does custom manufacturing, wherein complex chemicals are produced as per the specific requirements of customers.

Anlon Healthcare also has a strong presence internationally. The company has filed 21 Drug Master Files (DMFs) with global authorities so far. It has also received approvals from key regulatory bodies such as ANVISA (Brazil), NMPA (China) and PMDA (Japan). Notably, the company has received international approvals for Loxoprofen Sodium Dihydrate and Loxoprofen Acid APIs, while filings for Ketoprofen and Dexketoprofen Trometamol are ongoing. These approvals and filings reflect the company's quality standards, research capabilities and ability to meet global customer demand.

To ensure quality control, the company has four state-of-the-art labs and a 34-member team of scientists, including 24 graduate-level science professionals, all focused on ensuring product purity and maintaining industry standards.

In summary, Anlon Healthcare Limited has a strong business model and is growing rapidly due to a wide product portfolio, international approvals and a strong grip on quality. This is why the company has made its mark both domestically and globally.

Industry Overview of Anlon Healthcare Ltd

The Indian pharmaceutical and API (Active Pharmaceutical Ingredients) industry has strong growth prospects in the coming years. According to IBE F (India Brand Equity Foundation), the industry is expected to reach a size of US$ 130 billion by 2030 and companies are expected to witness revenue growth of 9–11% in FY2025-26.

Currently, the Indian pharma sector is the third largest producer by volume and the fourteenth largest market by value in the world. India also has the largest number of USFDA-compliant pharma plants (outside the US) and over 10,500 manufacturing units, providing medicines to 150+ countries.

The Indian pharma market recorded a growth of 8.4% in FY25, taking the total turnover to Rs. 2,25,000 crore (approx. US$ 26 billion). At the same time, the industry recorded a 7.9% YoY growth in July 2025 due to a combination of monthly volume growth and price increases, taking MAT above Rs. 2,30,000 crore (US$ 26 billion).

The API sector is also a strong identity for India. It produces about 8% of the world's APIs and has a 57% share in the WHO prequalified API list.

The policy support is also quite strong; the PLI (Production-Linked Incentive) scheme allocated Rs. 2,328 crore (US$ 270 million) to the pharma sector in FY25 alone, which is about 70% of the total PLI allocation.

India is also playing a leading role in terms of exports pharma exports in FY24 were US$ 27.82 billion and exports are growing steadily. Also, the government aims to reach Rs. 2,328 crore (US$ 270 million) by 2047. To reach exports of ?30,76,500 crore (US$350 billion), a tenfold increase from current levels.

Industry Importance and Opportunities for Anlon Healthcare:

Brisk domestic demand (growth rate of 8-9%) and rising exports are creating opportunities in the current market for pharma intermediates manufacturers like Anlon Healthcare.

Global competitiveness in APIs and India’s strong manufacturing capacity make such companies a part of the global supply chain.

Government subsidies and PLI schemes provide incentives for these companies to grow and invest.

The positive industry outlook indicates that Anlon Healthcare may see rapid opportunities in expansion, R&D, and global marketing after the upcoming IPO.

Financial Overview of Anlon Healthcare Ltd

Particulars | March 31, 2025 | March 31, 2024 | March 31, 2023 |

Assets | 181.30 | 128.00 | 111.55 |

Total Income | 120.46 | 66.69 | 113.12 |

Profit After Tax | 20.52 | 9.66 | 5.82 |

EBITDA | 32.38 | 15.57 | 12.66 |

Net Worth | 80.42 | 21.03 | 7.37 |

Reserves and Surplus | 40.57 | 5.03 | -4.63 |

Total Borrowing | 58.35 | 74.56 | 66.39 |

The Company's financial performance reflects a positive and strong growth during the three financial years ended March 31, 2025. During this period, the Company has not only improved its income and profitability but has also significantly strengthened its balance sheet position.

Total Income stood at Rs. 113.12 crore in 2023. Although it declined to Rs. 66.69 crore in 2024, the Company made a spectacular recovery in 2025, registering a growth of 80.61% and Total Income reached Rs. 120.46 crore.

EBITDA showed consistent strength. It grew from Rs. 12.66 crore in 2023 to Rs. 15.57 crore in 2024 and more than doubled to Rs. 32.38 crore in 2025. This improvement highlights the Company's operational efficiency and cost management capability.

Profit After Tax (PAT) also recorded a steady growth. The profit recorded in 2023 was Rs. 5.82 crore, which increased to Rs. 9.66 crore in 2024 and more than doubled to Rs. 20.52 crore in 2025. This increase in PAT margin reflects the improved profitability of the Company.

The Company has seen the most notable improvement in Net Worth and Reserves & Surplus. Net Worth was Rs. 7.37 crore in 2023, which increased to Rs. 21.03 crore in 2024 and more than quadrupled to Rs. 80.42 crore in 2025. Similarly, Reserves & Surplus was negative Rs. -4.63 crore in 2023, but improved to Rs. 5.03 crore in 2024 and jumped strongly to Rs. 20.52 crore in 2025. 40.57 crores.

Assets also recorded steady growth. Assets of Rs. 111.55 crores in 2023 increased to Rs. 128.00 crores in 2024 and Rs. 181.30 crores in 2025.

The total Borrowings trend was slightly fluctuating. Borrowings of Rs. 66.39 crores in 2023 increased to Rs. 74.56 crores in 2024, but the company reduced it to Rs. 58.35 crores in 2025. This reduction is a positive sign towards better financial discipline and reduced dependence on debt.

Overall, the company has significantly improved its financial position from 2023 to 2025 with strong earnings growth, better profitability, higher net worth and declining borrowings. This financial performance presents a positive sign for investors.

Strengths of Anlon Healthcare Ltd.

Strong and Diversified Product Portfolio : Anlon Healthcare has built a wide range of pharmaceutical products across multiple therapeutic segments. This diversification helps the company reduce dependency on a single product line and enables it to cater to varied healthcare needs, making its business model more resilient to market fluctuations.

Experienced Promoters and Management Team : The company is backed by promoters and senior management with extensive experience in the pharmaceutical and healthcare industry. Their deep domain knowledge, strategic vision, and execution capabilities provide Anlon Healthcare with a strong competitive edge in scaling operations and exploring global opportunities.

High Entry Barriers in the Pharma Industry : The pharmaceutical industry is characterized by strict regulatory requirements, high capital investment, and long research and approval timelines. These entry barriers protect established companies like Anlon Healthcare from excessive competition, enabling sustained growth and profitability.

Robust Quality Control with In-House Laboratories : Anlon Healthcare maintains stringent quality standards through its in-house research and testing laboratories. This ensures product reliability, adherence to international compliance, and builds trust among healthcare professionals and patients.

Regulatory Approvals and Global Compliance : The company has secured important regulatory approvals including Drug Master Files (DMFs) and follows international compliance frameworks. These approvals open up opportunities in highly regulated global markets such as the US, EU, and other regions, supporting Anlon’s vision of becoming a recognized international healthcare player.

Risks of Anlon Healthcare Ltd.

Dependency on Regulatory Approvals : The pharmaceutical sector is heavily regulated, and Anlon Healthcare’s business depends on timely approvals from both Indian and international authorities. Any delays, rejections, or stricter compliance requirements can impact the company’s product launches, exports, and overall growth.

Intense Competition in the API & Pharma Sector : The Active Pharmaceutical Ingredient (API) and healthcare segments are highly competitive, with both domestic and global players aggressively expanding. Increased competition could put pressure on Anlon Healthcare’s market share, pricing power, and margins.

Debt Levels and Financial Risks : Although the company has reduced its debt burden post IPO, it still carries financial obligations that could affect liquidity and profitability if not managed efficiently. Rising interest rates or adverse credit conditions may also increase financing costs.

Price Volatility Post Listing : As a newly listed company, Anlon Healthcare’s stock price is likely to experience volatility in the initial phase. Factors such as investor sentiment, sector outlook, and market conditions may cause sharp fluctuations, which can impact shareholder confidence.

Dependence on Limited High-Value Products : A significant portion of Anlon Healthcare’s revenue comes from a few high-value products. Over-reliance on limited offerings increases business risk any decline in demand, supply chain issues, or regulatory challenges with these products can adversely affect financial performance.

Strategies of Anlon Healthcare Ltd.

1. Expansion of manufacturing facilities : The company is focusing on increasing its production capacity. For this, investments are being made in new manufacturing units and state-of-the-art technology to meet the growing demand and gain an edge in the competition.

2. Increase in global DMF filings : Anlon Healthcare is continuously increasing Drug Master File (DMF) filings to strengthen its presence internationally. This will give the company more export opportunities in foreign markets and will also strengthen the trust of global customers.

Focus on quality and safety standards : The company follows the highest quality and safety standards. Its aim is that every product should be in line with international standards, so that long-term customer trust and reputation in the market remains intact.

Plan to reduce debt and strengthen working capital : After the IPO, the company has focused on reducing its debt and strengthening working capital. This will improve the financial position and adequate resources will be available for future growth plans.

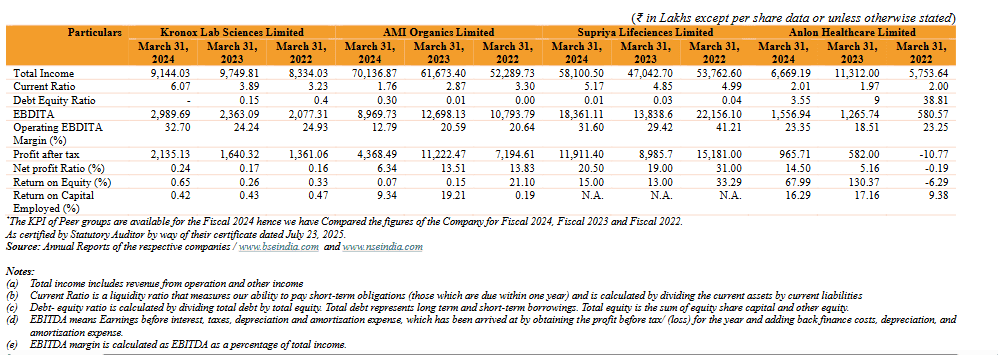

Anlon Healthcare IPO Peer Comparison

Comparing Anlon Healthcare Limited with leading companies in the pharma API sector such as Kronox Lab Sciences Limited, AMI Organics Limited and Supriya Lifescience Limited, it is clear that the company is registering stable growth financially, but there is still room for improvement in some areas.

Total Income: Anlon Healthcare reported revenue of ?6,669.19 lakh in FY 2024, down from ?11,312.00 lakh in 2023. In comparison, Kronox Lab Sciences reported revenue of ?9,144.03 lakh, AMI Organics reported revenue of ?22,589.73 lakh and Supriya Lifescience reported revenue of ?58,100.50 lakh. This shows that the scale of Anlon is still relatively small.

EBITDA & Margin: The company's EBITDA stood at Rs. 1,556.94 lakh in FY24, which is better than Rs. 1,265.40 lakh in FY23. Anlon's EBITDA margin stood at 23.33%, which is stronger than its competitors. Kronox's margin was 32.70%, AMI Organics' 17.60% and Supriya's 18.60%. That is, Anlon is in a relatively better position in terms of margin.

Profit After Tax (PAT) and Net Profit Ratio : Anlon recorded a PAT of ?965.71 lakh in FY24, while it was ?580.50 lakh in FY23. Net Profit Ratio stood at 14.50%, which is lower than Kronox (23.53%) and Supriya (20.50%) but better than AMI Organics (13.83%).

Return Ratios (RoE and RoCE) :The company's Return on Equity (RoE) stood at 33.29% in FY24, which is significantly higher than Kronox (0.65%), AMI (20.47%) and Supriya (19.00%). Similarly, Return on Capital Employed (RoCE) stood at 16.29%, which is at a better level than Kronox and AMI. This is an attractive sign for investors.

Debt-Equity and Current Ratio : Anlon's Debt-Equity Ratio stood at 1.97 in FY24, which is higher than Kronox (0.00), AMI (0.46) and Supriya (0.31), i.e. the company's borrowing level is higher than its competitors. At the same time, the Current Ratio was 2.00, which is lower than Kronox (6.07) and AMI (1.76), but at a sufficient level.

On the basis of peer comparison, Anlon Healthcare is in an attractive position due to its high RoE, strong EBITDA margin and better PAT growth. However, the company's income level and high Debt-Equity Ratio are its key risk factors. If the company accelerates income growth and reduces debt levels, it can become stronger than its competitors.

Objectives of Anlon Healthcare IPO

Anlon Healthcare Limited plans to use the proceeds from its IPO for four main purposes. Under this issue, the company will bring a fresh issue of 1,40,00,000 equity shares. The net proceeds from the issue will be used for the following purposes:

1. Capital expenditure for expansion of manufacturing facility (?3,071.95 lakhs) : The company will use this amount to increase its production capacity and expand the existing manufacturing facilities. This will help the company to scale its operations, adopt new technologies and meet future demands.

2. Partial or full repayment of borrowings (500.00 lakhs) : The company will partially or fully repay some of its secured term loan liabilities from this amount. This will reduce the interest cost of the company and strengthen the balance sheet.

3. Meeting Working Capital Requirements (4,315.00 lakhs) : The company will raise working capital to operate and expand its business. The proceeds will be used for procurement of raw materials, operational expenses and streamlining supply chain management.

4. General Corporate Purposes : A portion of the net proceeds will be used for general corporate purposes, including brand building, exploring new business opportunities and enhancing the overall performance of the company.

Additional Benefits : Another important objective of bringing an IPO is the listing of the company's shares on the stock exchange. This will increase the company's visibility, brand image and market presence. Also, a public market will be created in India for the company's shares, which will provide liquidity to investors.

Anlon Healthcare IPO Details

IPO Dates

Anlon Healthcare's IPO will be open for subscription from August 26, 2025 to August 29, 2025. Allotment of shares is expected to take place on September 1, 2025 and the company's shares will be listed on BSE and NSE on September 3, 2025.

IPO Issue Price

This IPO is being offered in a price band of Rs. 86 to Rs. 91 per share. Investors will get an opportunity to bid within this range.

IPO Size

The company plans to raise around Rs. 121.03 crore through this issue. This includes a fresh issue of 1.33 crore equity shares.

IPO Allotment Status

Investors who have applied for this IPO can check the allotment status from September 1, 2025 on the website of the company's registrar, BSE, NSE or their brokerage platform.

IPO Listing Date

Anlon Healthcare shares are expected to be listed on BSE and NSE on 3rd September 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Important IPO Details | |

Bidding Date | August 26, 2025 to August 29, 2025 |

Allotment Date | Sep 1, 2025 |

Listing Date | Sep 3, 2025 |

Issue Price | ?86 to ?91 per share |

Lot Size | 164 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category