How to Invest in Stocks in India 2026

00:00 / 00:00

If you're thinking of starting to invest in the stock market in 2026, believe me, you're making this decision at the perfect time. India's economy is growing rapidly, and millions of new investors have joined the stock market in recent years. In 2026, interest rates are within a manageable range, inflation is under control, and equities have historically delivered average returns of 12-14% over the long term. In my experience, the stock market isn't just for the wealthy; with the right understanding and a proper start, even ordinary people can gradually build significant wealth here. This blog will guide you through that simple and reliable path.

What Does It Really Mean to Invest in Stocks?

When you buy shares of a company, you're not just buying a number or a chart on a screen; you're becoming a small part-owner of that company. Simply put, if the company grows, makes profits, and its business strengthens, you benefit as well. That's the fundamental idea behind investing in stocks.

Now, it's important to understand a crucial distinction. Investing and trading are not the same thing. Investing involves choosing good companies and staying invested for the long term with patience, while trading attempts to make quick money from daily price fluctuations, which carries a much higher risk.

Imagine you buy a house, and its value increases after 10-15 years. Stocks work similarly if you invest in the right companies for the long term. This is why investing is considered a method for long-term wealth creation, rather than focusing on daily fluctuations.

How the Indian Stock Market Works?

If you are new to the stock market, the first thing you need to understand is how this system actually works.

What is the stock market?

The stock market is a digital platform where companies list their shares and investors can buy and sell them. In India, there are primarily two exchanges -

What exactly happens when you buy shares?

Step 1: Why do companies issue shares?

When a company needs money to expand its business, it issues shares. This means the company says, "Buy a small part of my business and grow with me." For these shares to be bought and sold, the company must be listed on the exchange.

Step 2: Why don't investors go directly to the exchange?

A typical investor cannot trade directly on the NSE or BSE. A brokering platform is required for this.

This platform acts as a bridge between you and the exchange.

Step 3: What happens when you "Buy" or "Sell"?

You placed an order to buy or sell shares.

The order reached the exchange (NSE/BSE).

The Order Matching System operates on the exchange.

A buyer and a seller are matched.

The price and quantity must match.

As soon as the price matches Trade Complete

Step 4: What happens after the trade is completed? (Settlement Process)

Settlement Cycle – T+1

T = The day you traded

T+1 = Settlement by the next business day

Meaning :

The shares are credited to your Demat account.

The money is transferred to the seller's account.

This system was previously T+2, but the shift to T+1 has made the market faster and more secure.

Step 5: The real role of Demat and Trading Accounts

Account | Work |

Trading Account | To place an order |

Demat Account | To hold shares |

Step 6: Who keeps the market safe?

Monitors the entire system, Securities and Exchange Board of India (SEBI)

SEBI ensures that:

Investors are not defrauded

Companies provide accurate information

Rules are applied equally to all

How to Start Investing in Stocks in India – Step-by-Step

First, let's make one thing clear: the stock market is not a place to make money overnight. It's a process-driven system where patience and discipline are paramount. If you're approaching it with a long-term mindset, you're on the right track.

Step 1: First, keep the necessary documents ready.

Opening an account is easy these days; you just need to have a few basic things ready:

PAN Card: This is mandatory for investing in the stock market.

Aadhaar Card: For your identity and address verification.

Bank Account: For depositing and withdrawing money.

Mobile Number & Email ID: For OTPs and important updates.

All these documents are required for KYC (Know Your Customer) verification.

Step 2: What is KYC and why is it necessary?

KYC stands for Know Your Customer, which means verifying your identity.

When you complete KYC :

Your account remains secure.

No one else can trade in your name.

Government and regulatory requirements are met.

Step 3: How to open a Demat & Trading Account online?

First, open a demat account

Sign up by entering your mobile number and email ID.

Verify the OTP and proceed.

Fill in your basic personal details.

Verify your identity using your PAN and Aadhaar.

Add your bank account details.

Complete the e-Sign process with your Aadhaar.

Complete the KYC process with a selfie or short video.

If all details are correct, your account will be activated on the same day.

Step 4: What to do after your account is activated

Many people make mistakes here. They invest without thinking as soon as the account is opened.

The correct approach is:

First, understand the app thoroughly

Observe market movements

Read about companies and sectors

Start with a small amount

Step 5: Remember this before your first investment

Your first investment doesn't have to be perfect, but it needs to be well-thought-out. Don't rely on tips or hype; take action with a basic understanding of the fundamentals.

How to Invest in Stocks in India Online

Now, let's assume your account is ready and the app is open.

The first step is to find the share you want to invest in. Before making any investment decision, it’s important to compare stocks based on fundamentals like revenue growth, profit margins, debt levels, valuation ratios (P/E), and sector performance rather than choosing a company only because its price is rising.

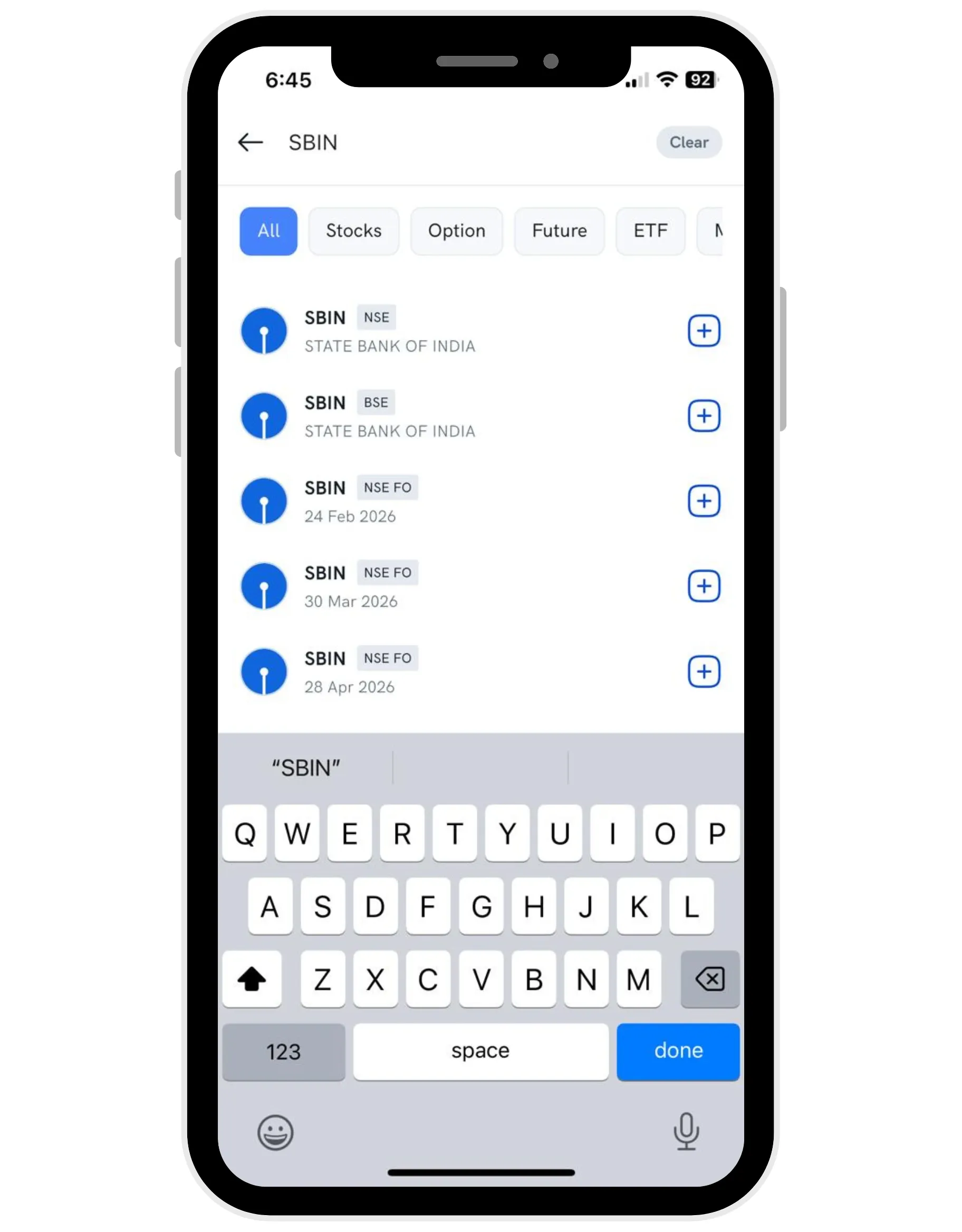

Step 1: Search for a Share and Add it to your Watchlist

At the top of the app, you'll see the Search & Add Stock option.

Here, you type the name of the company you want to track, for example, we're looking at SBI shares.

As soon as you click on the share, it gets added to your watchlist. The watchlist is useful so you can easily see price movements and updates.

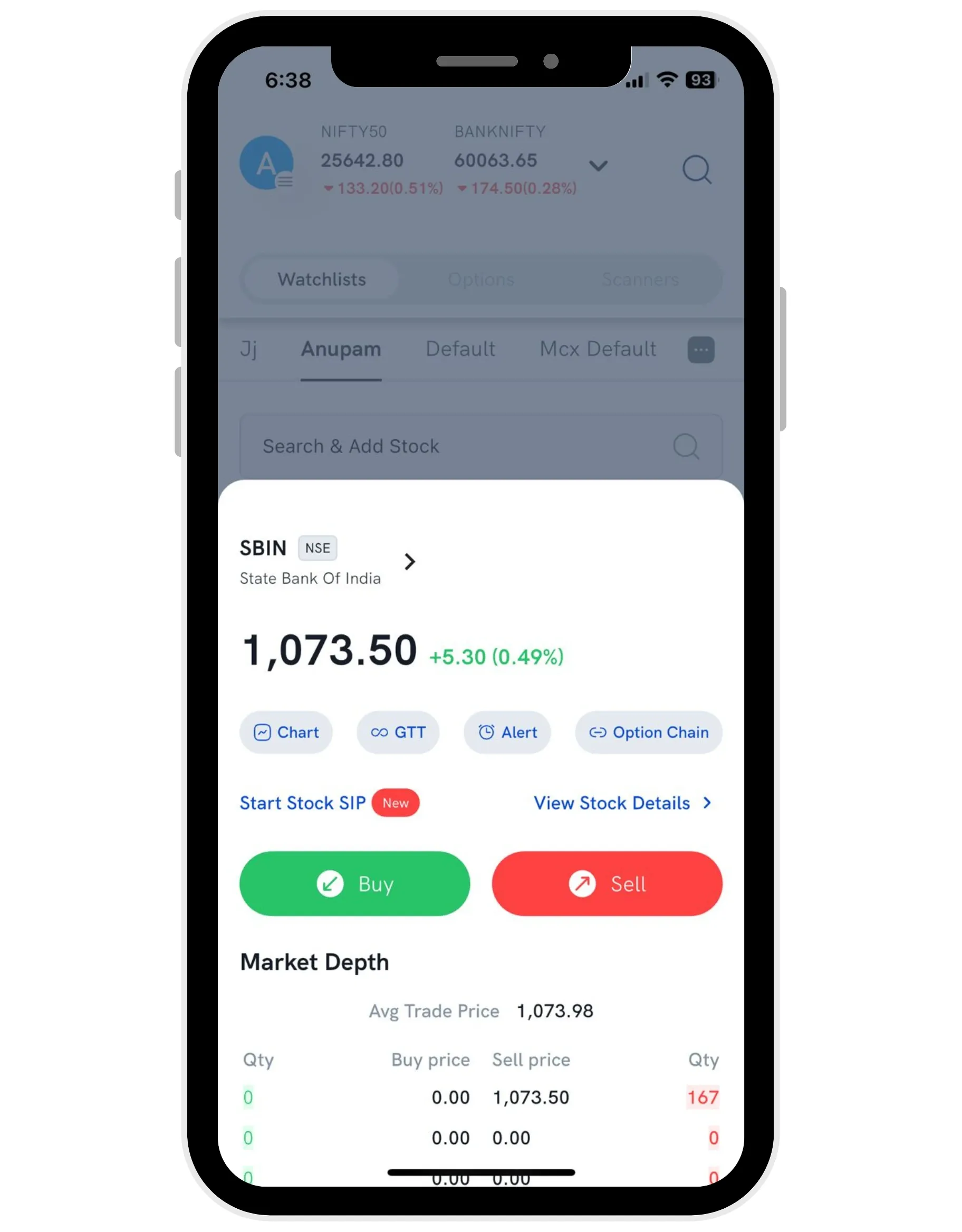

Step 2: What you see after clicking on the Share

Now you click on the share from your watchlist. On this screen, you'll clearly see these details:

Current market price

Price change (up or down)

Option to view the price chart

Basic company and market depth details

At the bottom, you'll find two clearly marked buttons:

Green color – Buy

Red color – Sell

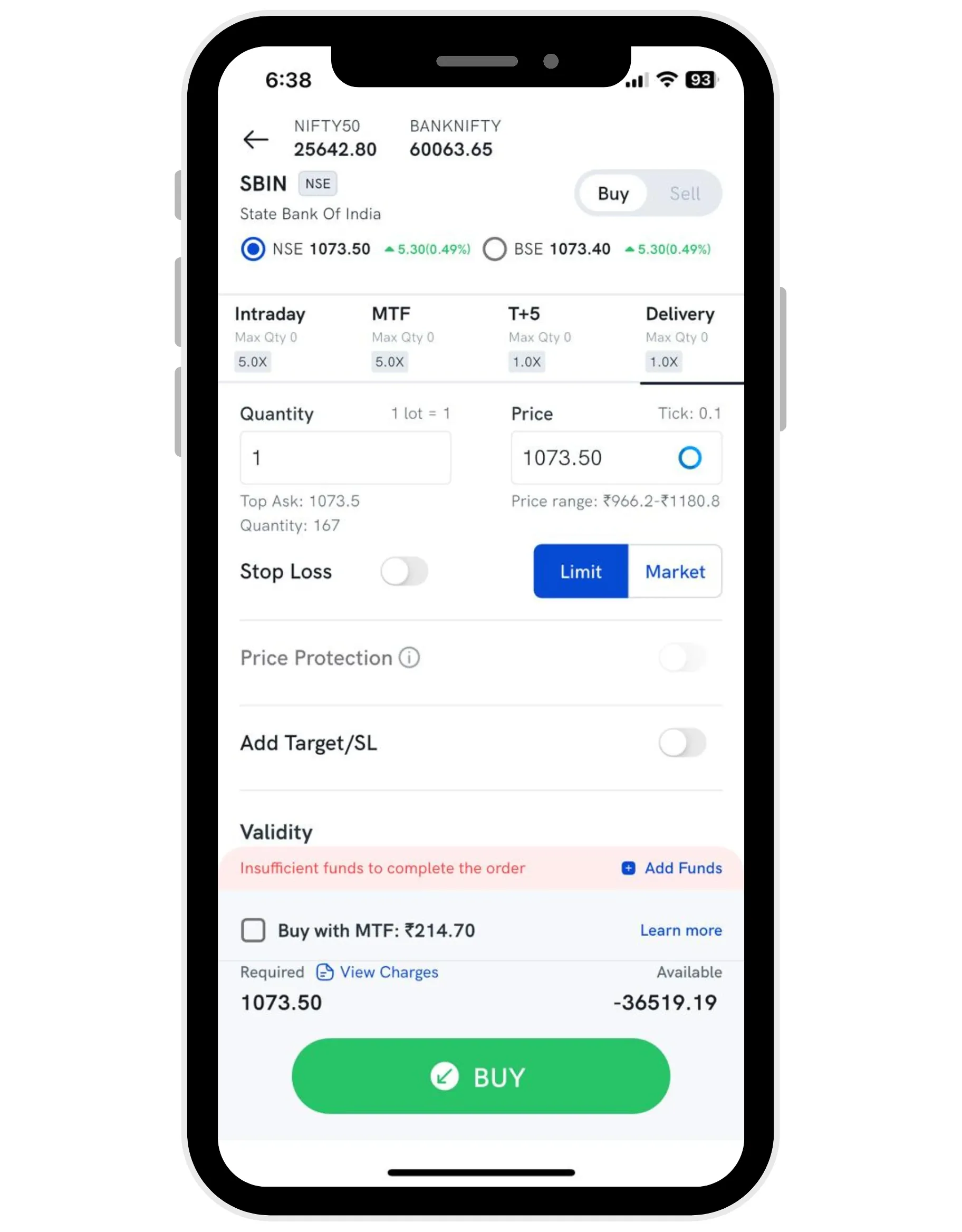

Step 3: Clicking the Buy Button opens the Buy Window

Now, when you click on Buy, the Buy Window opens.

This is where you have to decide:

Which product type to buy

How much quantity to buy

Which order type to use

Step 4: Selecting the Product Type

At the top of the Buy window, you'll see different product options:

Delivery

MTF

T+5

You choose one of these based on your investment goal.

The option you click on becomes active, and the margin and holding rules apply accordingly.

Step 5: Deciding on Quantity and Order Type

Now you enter the quantity and then select the order type:

Market order – Buy immediately at the current price

Limit order – Buy by entering your preferred price

Stop Loss / Target – To manage risk

After checking all the details, you click on the Green BUY button at the bottom.

How to Invest in the Stock Market for Beginners With Little Money

Now, a practical question arises: "I don't have much money, so can I still start investing?"

The straightforward answer is: Yes, absolutely. Starting in the stock market isn't about having a large sum of money, but about developing the right habits. You can even start with Rs. 500 or Rs. 1,000, as long as you do it the right way.

Investing gradually with Stock SIP

If you want to invest a small amount every month, the Stock SIP feature available on Rupeezy is very useful. Here, you can choose a good stock and invest a fixed amount every month – just like a mutual fund SIP.

The advantages are:

Investments are regular

The pressure of market fluctuations is reduced

Discipline is automatically built in

Use MTF only if you understand the risks.

If you think there's a short-term opportunity in a stock, you can use Rupeezy's MTF option.

But I'll be clear here: only use MTF if you understand the risks involved. It gives you large exposure with a small capital, but discipline and stop-loss are essential.

What is MTF (Margin Trading Facility)?

MTF, or Margin Trading Facility, is a facility that allows you to buy shares without paying the full amount upfront. You pay a portion of the money, and the broker provides the rest as margin.

In simple terms, MTF allows you to take a larger position with limited capital, but it also increases the risk. Therefore, MTF should not be seen as a shortcut, but rather as an advanced investing tool.

How to buy using MTF?

Now, let's say you see a short-term opportunity in a particular stock.

You search for the stock in the app.

You open the stock details and click on "Buy".

You select "MTF" as the product type.

You enter the quantity.

The app shows you the total position value and the margin you need to provide

You choose the order type (Market or Limit)

You confirm the purchase.

It's important to note that:

Some of the money is yours.

The rest of the money is provided as margin.

What happens after an MTF Buy?

As soon as your MTF order is executed:

The purchased shares are automatically pledged.

Pledging means that these shares are held as security

You are the owner of the shares, but the pledge remains active until you clear the full payment or sell the shares.

How is MTM (Mark-to-Market) calculated?

In MTF trading, your profit or loss is calculated in real-time; this is called MTM (Mark-to-Market).

Let's understand with a simple example:

You bought a share at 500.

The market price became 480.

So :

500 ? 480 = 20

20 × quantity = Your MTM loss

If the price goes up, you'll see an MTM profit; if it goes down, you'll see a loss.

In MTF trading, the position size is large, so the MTM changes quickly.

How does a margin shortfall occur?

Now, let's say the share price keeps falling. When the loss becomes so large that your available margin falls below the minimum required level, this is called a Margin Shortfall.

When and how does a margin call occur?

You receive a margin call as soon as a margin shortfall occurs:

App notification

SMS or email alert

This margin call instructs you to:

Either add extra funds

Or reduce your position/sell shares

If you don't take action in time, the broker may square off your position to manage the risk.

Conclusion

If you're thinking of starting to invest in the stock market, the most important thing is to proceed correctly, not hastily. Start with a small amount, understand the basics, and gradually build your experience. Delivery, Stock SIP, or MTF; each option has its own role, and you must use them according to your needs and risk tolerance. With the right mindset, discipline, and patience, the stock market can work for you in the long term.

FAQs

Q1. How much money do I need to start investing in stocks in India?

You can start investing with a small amount like Rs. 500–Rs. 1,000. The important thing is to invest regularly.

Q2. Is stock market investing safe for beginners?

If you invest with the right knowledge and a long-term perspective, the stock market can be safe even for beginners.

Q3. What is the best way to invest in stocks for beginners?

Delivery investment and stock SIP are the easiest and least risky methods for beginners.

Q4. Can I invest in stocks online without visiting any office?

Yes, today you can open a Demat and trading account completely online and invest from the comfort of your home.

Q5. What is Stock SIP, and how does it work?

In a Stock SIP, you invest a fixed amount in a stock every month, which helps maintain discipline.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category