What is Pre-Open Market Session in Stock Market?

00:00 / 00:00

As we all know, the stock market is a buzzing place for all traders who engage in trading shares to reap profits. While trading starts at the official trading hours on weekdays, many people are not aware of a special period called the "pre-open market" session before the regular trading day begins. In this blog, we will explore the meaning of a pre-open market session, its timings, how it works, why it is important, and associated risks.

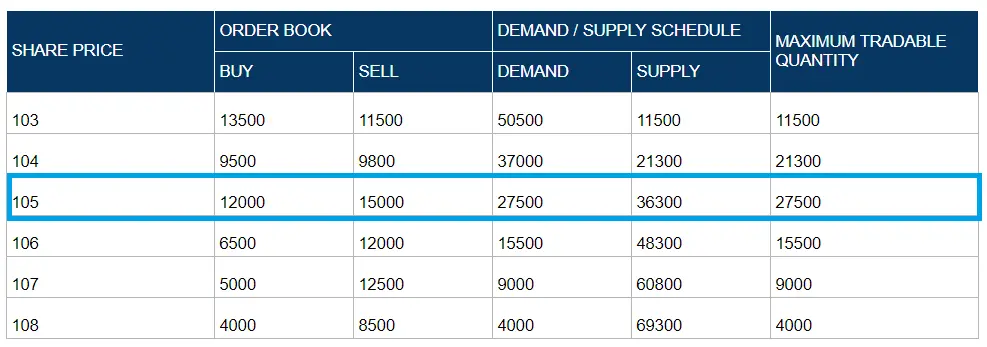

An important term of pre-open market trading is equilibrium price. The equilibrium price is the price at which the maximum number of stocks can be bought/sold which is based on a demand-supply mechanism.

What is Pre-Open Market Session?

The pre-open market session is a short interval before the regular stock market opening time. The primary purpose of the pre-opening session is to arrive at an equilibrium price of a stock which acts as the opening price of the stock. Traders have the chance to place buy and sell orders during this session, but these orders are not immediately executed. Instead, they are collected and matched to help determine the opening price of each stock for the regular trading session.

The orders that do not get matched or executed in the pre-open market session are carried over to the regular trading session and the opening price would be determined as such:

The limit orders that are not matched/traded at the pre-open market session are moved to regular trading sessions at the same price.

Market orders that are not matched/traded at the pre-open market session are moved to regular trading sessions at the opening price.

Pre-Open Market Time

Stock exchanges around the world have designated their own specific timings for pre-open market sessions. For instance, the pre-open market time for the two largest stock exchanges in India, namely the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) extends for 15 minutes from 9 am IST to 9:15 am IST.

Breakdown of the Pre-Open Market Time

The pre-opening session can be further subdivided into 3 phases.

Order entry session: This marks the beginning of the pre-open market session where the buy and sell orders are placed. The orders can also be modified or canceled if required. This period ends at the 7th to the 8th minute after which no more orders can be placed.

Order Matching session (9.08 am to 9.12 am): In this phase, the orders are matched and confirmed. At this time, the equilibrium price for each stock is also calculated, which later becomes the opening price of the stock. This period lasts for almost 4 minutes. There are 3 steps for order matching which are described in the first sub-session of the blog.

Buffer session: This is the last phase of the pre-open market session which acts as an intermediate between the pre-open market and actual live trading. It lasts for 3 minutes and ensures a smooth transition to regular trading.

Example of Pre-Open Market Session

Let’s understand this better with an example. During the pre-open market time, orders are placed in call action to arrive at an equilibrium price.

In the below example let's assume that NSE received orders for a particular stock at different prices between the pre-open market session timings. Depending on the demand and supply of shares, NSE will derive an equilibrium price at which the maximum number of shares can be bought and sold. In this case, the equilibrium (opening) price will be 105 at which the highest number of orders can be placed which is 12000.

Why is the Pre-Open Market Session Important?

The pre-open market session plays a crucial role in the stock market for several reasons:

Price Discovery: The orders placed in pre-open market sessions help in understanding the demand and supply of shares to establish the opening price of those shares. The opening price determined in the session sets the tone for the trading day ahead.

Early-Move Advantage: Participating in pre-open market sessions helps traders use the latest news and company announcements to their advantage to trade effectively.

Reduces Volatility - The pre-open market session helps in stabilizing the share prices by determining the equilibrium share price based on the demand and supply.

Limited Trading Time: The pre-open market session is ideal for traders with limited time and availability for trading who can place their order in the session and move forward with their busy day.

Pre-Open Market: Potential Risks and Considerations

While the pre-open market session offers many benefits, there are also some risks and considerations to keep in mind:

Price Uncertainty: The stock prices traded during the pre-market session might significantly deviate from the prices observed during regular trading hours. This can also result from the low volume of stocks traded during the pre-open market session compared to the regular trading session.

Limited Information: There might be a chance that only limited or tentative news is available publicly which is utilized by traders to place their orders in pre-open market sessions. Traders should be cautious and avoid making hasty decisions based on such incomplete information.

Market Order Placement Risk: Executing market orders during the pre-open market session can be risky because the price swing can be very high from the time the order is executed. Limit orders are often a safer option during this time.

Conclusion

The pre-open market session plays an important role in the stock market that helps in establishing and stabilizing the opening share prices to reduce volatility. It provides investors and traders a good opportunity to strategize their moves in the market and mitigate potential risks. At the same time, it also brings certain risks that require careful consideration. Understanding the nuances and benefits of pre-open market sessions can give traders and investors a better edge in navigating the stock market.

So, the next time you think about starting your trading journey, remember that the action starts even before the official opening bell rings, during the pre-open market session! And when you're ready to dive in, open a free Demat account with Rupeezy and make the most of every trading opportunity!

Check Out These Related Articles |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category