Smart Order Routing (SOR) Explained for Algo Traders

00:00 / 00:00

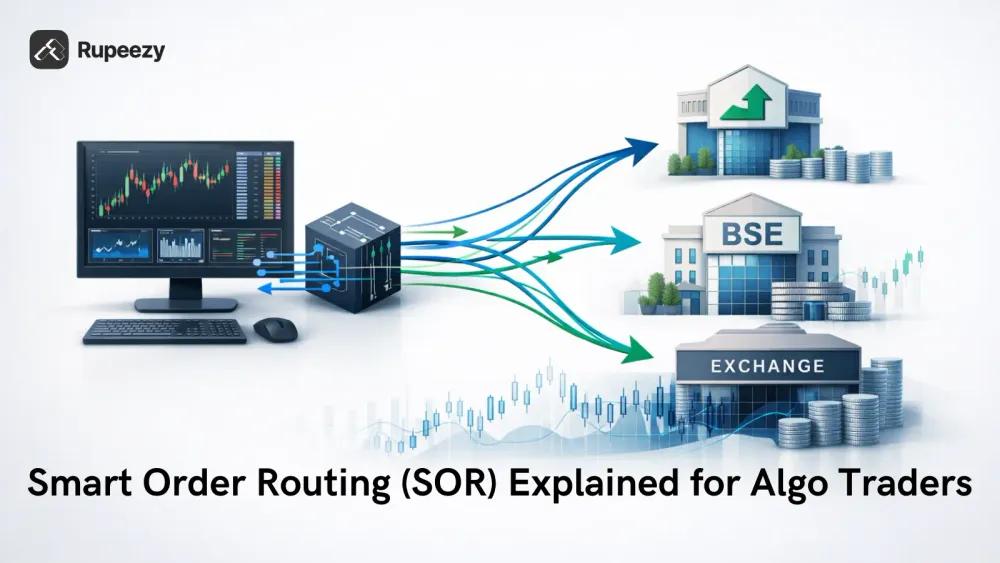

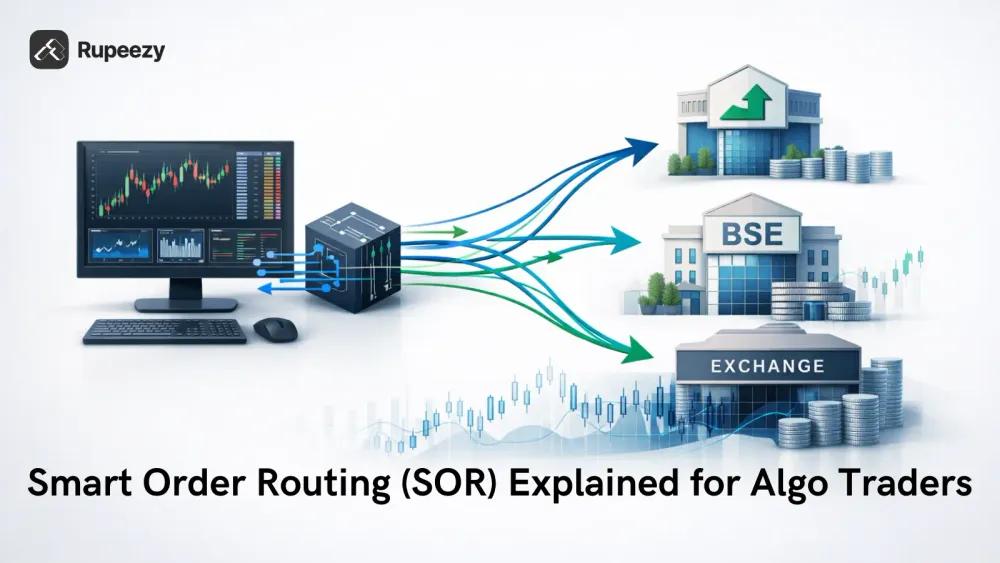

In today's fast-moving markets, simply placing the right trade isn't enough; executing it at the right price is equally crucial. Often, even when liquidity is available, orders don't get filled at the desired price, a problem stemming from fragmented exchanges. Smart Order Routing (SOR) is a technology that routes orders to the best available exchange in real time, ensuring faster execution, reduced slippage, and lower overall trading costs. For algo traders, SOR is no longer an optional feature but a vital tool for improving execution quality.

What Is Smart Order Routing?

Smart Order Routing (SOR) is an advanced execution system that automatically and intelligently routes a single order across multiple exchanges. In simple terms, SOR doesn't just look for the best price; it also considers factors like liquidity, execution speed, and the risk of slippage.

SOR is considered a decision engine, not just a simple routing rule. When an algorithm receives data from multiple trading venues (such as NSE and BSE) simultaneously, SOR compares the price, available quantity, market depth, and execution speed in real time.

For example, let's say you want to buy 50,000 shares. The best price might be available on one exchange, but only 5,000 shares are available there. In this case, SOR intelligently splits the order and routes the remaining quantity to another exchange to ensure better overall execution.

In manual order placement, this decision rests with the trader, while SOR performs this task quickly and in a data-driven manner. Therefore, the true objective of SOR is not just to find the best price, but to achieve superior execution quality.

Why Market Fragmentation Created the Need for SOR

Initially, equity market trading mostly took place on a single exchange, resulting in centralized liquidity. However, with increased competition and technological advancements, multiple exchanges emerged, and trading volume became distributed across different venues. This shift gave rise to market fragmentation.

The Practical Reality of Fragmentation in the Indian Market :

In India, equity trading is primarily concentrated on the NSE, where spreads are generally tighter, and depth is greater. Liquidity on the BSE is comparatively lower, but meaningful execution opportunities can still be found there for certain stocks, auctions, or specific situations. Liquidity remains stable for index stocks, while exchange-wise depth fluctuates for individual stocks.

Fragmentation is Even More Complex in Global Markets :

International markets have multiple lit exchanges along with dark pools, meaning the visible order book doesn't reflect the entire liquidity. This makes execution decisions even more challenging.

For Algo Traders :

Liquidity is distributed, dynamic, and often misleading. Therefore, the "best price" displayed on the screen doesn't always guarantee the "best execution." This is where the need for Smart Order Routing arises.

How Smart Order Routing Actually Works

Market Data Intake :

Smart Order Routing (SOR) first collects real-time market data from multiple exchanges. This includes bid-ask prices, available quantities, order book depth, spreads, and queue positions. In Indian markets, this data primarily comes from the NSE and BSE, with the NSE being the primary source of liquidity. The goal of SOR is not just to see the best price, but to understand whether actual execution is possible at that price.

Venue Evaluation :

Next, SOR evaluates each exchange. This involves considering not only the price but also the available quantity, the speed of order execution (latency), and past fill behavior. Sometimes, the exchange with the best price may have low liquidity or a long queue, which can slow down execution. SOR takes these practical factors into account when making decisions.

Order Splitting & Sequencing :

When the order size is large, SOR splits it into smaller child orders. Some orders are sent to multiple exchanges in parallel, while others are executed sequentially. The purpose of this is to control market impact and slippage.

Real-Time Feedback Loop :

SOR continuously receives feedback during execution. If a partial fill occurs, the remaining quantity is rerouted. Cancel-replace decisions are also made when necessary. This is why SOR acts not as a fixed rule-based system, but as a real-time optimizer that constantly adjusts itself to changing market conditions.

Types of Smart Order Routing Strategies Used in Algo Trading

Price-Based Smart Order Routing :

Price-based SOR is the most basic approach, where the order is routed to the exchange offering the best visible price. This method seems simple and fast, but the risk is that the quantity available at the best price might be limited, or the queue might be long, leading to increased slippage. This is the most commonly used model in retail trading algorithms.

Liquidity-Seeking Smart Order Routing :

Liquidity-seeking SOR focuses more on fill probability than price. It prioritizes exchanges with greater depth and a higher likelihood of quick order execution. This approach is considered more effective for large orders or institutional-level execution, where a complete fill is more important.

Time-Based Smart Order Routing :

Time-based SOR attempts to execute orders within a fixed time window. This approach is typically used in VWAP and TWAP strategies, where the objective is to execute at or near the market's average price, rather than at the instant best price.

Cost-Aware Smart Order Routing :

Cost-aware SOR considers not only the price but also transaction costs, exchange fees, and market impact. Its goal is to minimize the overall execution cost, which is considered critical in professional algorithmic trading.

Smart Order Routing vs Normal Order Routing

Point | Normal Order Routing | Smart Order Routing (SOR) |

Routing Logic | The order is sent at a fixed exchange rate. | The order is intelligently routed in real-time across multiple exchanges. |

Nature | Static and rule-based | Dynamic and adaptive |

Price Selection | It depends only on the best visible price. | Besides price, I also look at liquidity, depth, and execution speed. |

Slippage Risk | Especially in fast-paced markets. | Comparatively less, because the routing keeps adjusting. |

Queue Priority | Despite having the best price, the queue might be long. | It considers the queue position and fill probability. |

Partial Fills | There is often a partial fill or a delay. | The system tries to get better fills by splitting the order. |

Impact for Algo Traders | Execution quality remains unpredictable. | The execution is more stable and controlled. |

Hidden Risks and Limitations of Smart Order Routing (SOR)

Risks of Latency Arbitrage :

SOR relies on real-time data, but in fast markets, even a slight delay between data and execution can cause the price to change. High-frequency traders can exploit this latency gap, degrading the expected execution quality.

Missed Fills Due to Over-Optimization :

Sometimes, SOR over-optimizes in its attempt to find the best possible price or venue. The downside is that the order is repeatedly rerouted and may ultimately fail to fill, especially in low-liquidity or volatile conditions.

Heavy Dependence on Market Data Quality :

SOR's decisions are entirely dependent on market data. If the data is incomplete, delayed, or noisy, the routing decision can be flawed. This risk is amplified for retail traders who have access to limited data feeds.

Exchange-Specific Microstructure Issues :

Each exchange has different order matching logic, queue priority, and execution behavior. If SOR does not properly account for these microstructure differences, the execution may not meet expectations.

The Biggest Misconception Among Retail Traders :

Many retail traders assume that SOR guarantees the best execution. The reality is that while SOR can improve execution, it does not guarantee it.

Hidden Risks and Limitations of Smart Order Routing (SOR)

Risks of Latency Arbitrage :

SOR relies on real-time data, but in fast markets, even a slight delay between data and execution can cause the price to change. High-frequency traders can exploit this latency gap, degrading the expected execution quality.

Missed Fills Due to Over-Optimization :

Sometimes, SOR over-optimizes in its attempt to find the best possible price or venue. The downside is that the order is repeatedly rerouted and may ultimately fail to fill, especially in low-liquidity or volatile conditions.

Heavy Dependence on Market Data Quality :

SOR's decisions are entirely dependent on market data. If the data is incomplete, delayed, or noisy, the routing decision can be flawed. This risk is amplified for retail traders who have access to limited data feeds.

Exchange-Specific Microstructure Issues :

Each exchange has different order matching logic, queue priority, and execution behavior. If SOR does not properly account for these microstructure differences, the execution may not meet expectations.

The Biggest Misconception Among Retail Traders :

Many retail traders assume that SOR guarantees the best execution. The reality is that while SOR can improve execution, it does not guarantee it.

Conclusion

Smart Order Routing (SOR) is a powerful tool for improving execution quality in algo trading, but it's not a shortcut. Even with a sound strategy, poor execution can negatively impact P&L, and this is where SOR demonstrates its true value. It's crucial for algo traders to focus not only on signals but also on the order execution process itself. SOR works best when it is properly understood, monitored, and adapted to the specific strategy, market conditions, and liquidity behavior.

FAQs

Q1. What is Smart Order Routing?

Smart Order Routing is a system that improves execution by sending orders to the correct exchange in real-time.

Q2. Is SOR really useful for retail algo traders?

Yes, especially when orders are large, or trades are frequent.

Q3. Does SOR always give the best price?

No, SOR focuses more on smooth and reliable execution than on always getting the best price.

Q4. Which exchange plays the biggest role in SOR in India?

In India, most of the liquidity is on the NSE, so the NSE is primary in SOR decisions.

Q5. Can SOR completely eliminate slippage?

No, but under the right conditions, SOR can significantly reduce slippage.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category