Forwards vs Futures: Contract Structure Comparison

00:00 / 00:00

You must have heard of futures and options. Well, these are the derivative contracts available in the market that are known for their performance and risk. While this is true, there is one more contract type that you should know of. These are the forward contracts.

For many investors, futures and forwards might look the same. Both contracts are indeed used to lock prices for a future date. However, they differ in terms of standardization, risk level, settlement method, and trading.

This is why it is important to understand the difference between these two contracts well. This will ensure that you understand how forwards and futures contracts work in real market conditions. Also, let us explore the difference between forwards and futures. So, let us understand all the details here.

What Are Forward Contracts?

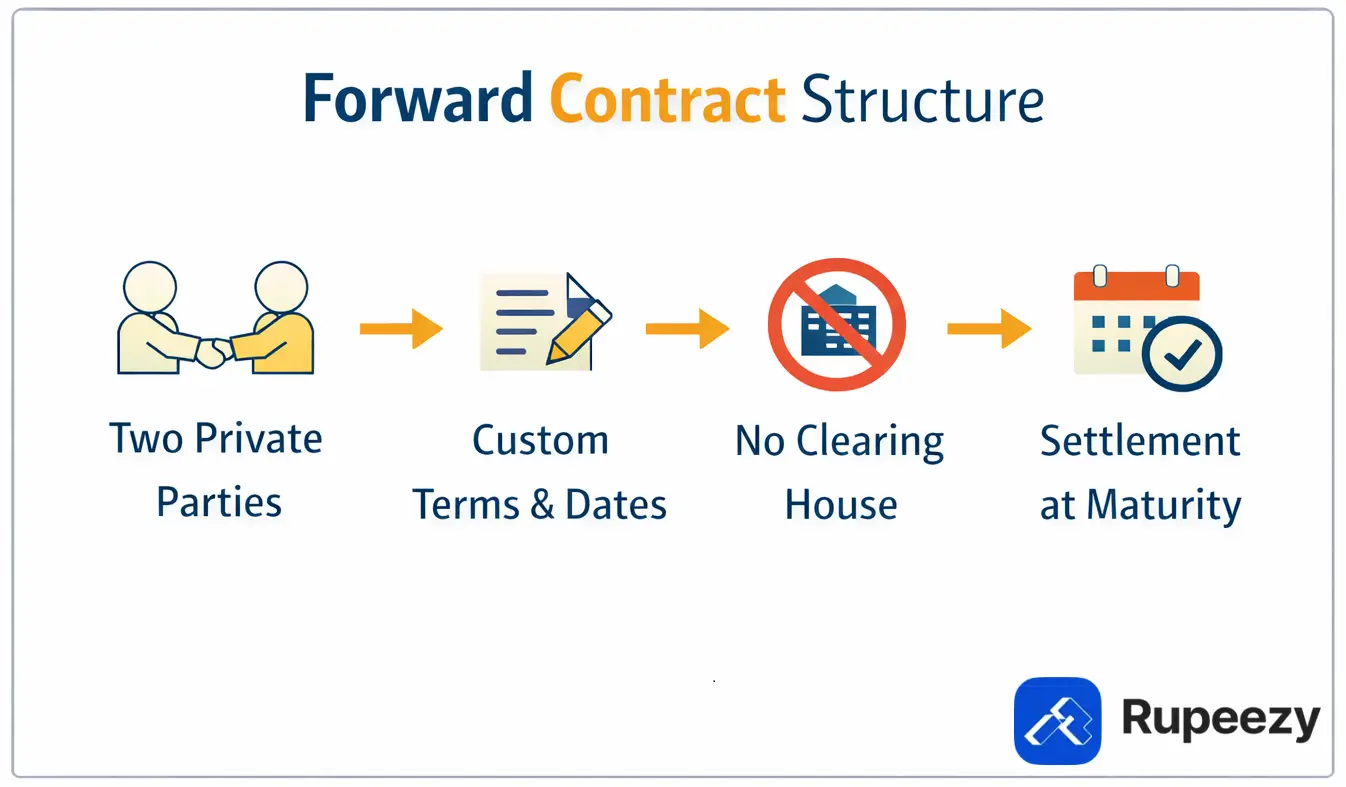

A forward contract is a private agreement between two parties to buy or sell an asset at a fixed price on a future date. These contracts are customized. This is mainly based on the needs of the parties involved. Now, you must know that the forwards are not traded on exchanges. This means all the details like price, quantity, and settlement date are flexible and decided mutually.

This flexibility makes forward contracts useful for hedging. Now, these are used for some of the specific risks, especially in commodities, currencies, and corporate transactions. However, this same flexibility also brings certain risks. This means that the investors should understand clearly.

Key Features of Forward Contracts

These contracts are traded over the counter and not on exchanges.

Contract terms are fully customized between the buyer and seller.

No daily settlement or margin requirement is involved.

Settlement usually happens only on the contract maturity date.

There is high counterparty risk as there is no clearing house.

Pros of Forward Contracts

There is a high amount of flexibility when it comes to contract size and settlement terms.

Useful for precise hedging to help businesses and individuals.

Most cases come with no need for upfront margin money.

Cons of Forward Contracts

High counterparty risk if one party defaults.

Low liquidity as contracts cannot be easily exited.

Lack of transparency due to private trading arrangements.

What Are Futures Contracts?

A futures contract is a standardized agreement to buy or sell an asset at a predetermined price on a specified future date. These contracts are traded on recognized stock exchanges. This is one of the reasons why these contracts are safe and offer transparency as well. There is also a fixed term on these contracts, which makes them great.

Futures contracts are commonly used by traders, investors, and institutions for hedging and speculation. The presence of an exchange and clearing house reduces default risk and improves liquidity, making futures more accessible for a wider range of participants.

Key Features of Futures Contracts

These contracts are traded on regulated exchanges.

Contract size, expiry, and terms are standardized.

Daily mark-to-market settlement is mandatory.

Margin money is required to enter and maintain positions.

A clearing house acts as the counterparty to all trades.

Pros of Futures Contracts

Lower counterparty risk due to clearing house support.

High liquidity and easy entry and exit.

Transparent pricing for better trades.

Works in a properly regulated environment.

Cons of Futures Contracts

Flexibility is quite limited.

Margin needs are high.

Frequent cash flow is needed.

Price volatility can increase short-term trading risk.

Difference Between Forwards and Futures

After understanding forwards and futures separately, the real clarity comes from comparing them directly. Although these two derivative contracts might look the same, there are a lot of differences between the two.

The main differences lie in some of the major points. These include the contract structure as the main one. Then there is the trading platform, risk exposure, and settlement process. The table below explains futures vs forwards here.

Aspect | Forward Contracts | Futures Contracts |

Contract Nature | A forward contract is a private agreement created between two parties based on mutual terms. | A futures contract is a standardized agreement traded on a regulated exchange. |

Trading Method | Forward contracts are traded over the counter without any exchange involvement. | Futures contracts are traded on stock or commodity exchanges. |

Contract Terms | The price, quantity, and settlement date can be customized by both parties. | The exchange decides the contract size, expiry date, and other terms in futures. |

Counterparty Risk | Forward contracts carry higher default risk because there is no clearing house. | Futures contracts have lower risk since the clearing house guarantees settlement. |

Settlement Process | Settlement in forwards usually happens only on the contract maturity date. | Futures are settled daily through the mark-to-market process. |

Margin Requirement | Forward contracts generally do not require margin payments. | Futures contracts require initial and maintenance margin. |

Liquidity | Forward contracts have low liquidity, and so exiting them can be a bit difficult. | Futures contracts are highly liquid and can be easily bought or sold. |

Price Transparency | Prices in forward contracts are not publicly available. | Futures prices are transparent and visible on the exchange. |

Conclusion

Both forward and futures contracts are important tools in the derivatives market. But it is important to note that both of these serve quite different purposes. Forward contracts are more suitable for businesses and institutions. These are the ones that need customized hedging solutions.

On the other hand, futures contracts offer higher liquidity, transparency, and lower risk. This is mainly due to exchange regulation. This is why you must consider all the points before selecting one. This will ensure that you are investing in the right tool.

And for investing, you would need insights and support. This is where Rupeezy can help you. Understand all the complex financial topics here with ease and ensure that you trade well. Make sure that you invest right with the proper information at your disposal.

FAQs

What is the main difference between forwards and futures contracts?

The main difference is that forwards are private and customizable contracts. On the other hand, futures are standardized and traded on exchanges. This is their structure mainly.

Are forward contracts riskier than futures contracts?

Yes, forward contracts carry higher counterparty risk because there is no clearing house involved.

Why do futures contracts require margin money?

Margin money ensures daily settlement and reduces default risk in futures trading.

Who should use forward contracts?

Forward contracts are mainly used by businesses and institutions for specific hedging needs.

Which contract is better for retail investors?

Futures contracts are generally better for retail investors due to liquidity, transparency, and lower risk.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category