Smallcase vs Mutual Funds: Key Differences Explained

00:00 / 00:00

When it comes to trading and investing, you have two options. The first is to invest and manage the funds on your own. This is possible only when you know the market and understand how it works. The second is to invest in assets managed by professionals. This is more when you are looking for a professional management that can offer better returns.

This is where you have one of the two options that you can go for. These are the smallcase and mutual funds. While the basic idea behind these is the same, they do differ a lot in their functionality and working.

So, let us explore the smallcase vs mutual funds here in this guide. Find all the details you need to ensure that you invest in the right choice and make a better call.

What Is Smallcase?

Smallcase is an investment option. It is one where you invest in a basket of stocks or ETFs. This is based on a specific theme or strategy. These baskets are created by SEBI-registered professionals. And when it comes to investment, these are available through the Smallcase platform.

When you invest in a smallcase, the individual stocks are directly credited to your demat account. This means you own each stock yourself and not units of a fund. Smallcase is suitable for investors who want transparency and active control over their portfolio.

Key Features of Smallcase

Smallcase offers flexibility and visibility that many traditional investment options do not. The key features include:

Direct ownership of stocks in your demat account.

Theme-based portfolios such as dividend, value, or sector-focused ideas.

Ability to rebalance, add, or remove stocks anytime.

One-time or subscription-based fee, depending on the smallcase.

Real-time tracking of individual stock performance.

Pros of Smallcase

Smallcase appeals to investors who are willing to participate in management and want to have clarity. But there are other benefits as well, which are:

Full transparency of underlying stocks.

Higher control compared to mutual funds.

Flexibility to exit or customize the portfolio.

Best for those who know the equity market.

Cons of Smallcase

While there are various pros of using the smallcase in a portfolio, there are certain drawbacks as well. These are as follows:

High risk as equity is highly involved.

Requires active monitoring and decision-making.

Tax impact can increase due to frequent rebalancing.

Not ideal for completely passive investors.

What Are Mutual Funds?

Mutual funds are investment vehicles. These are the ones that pool money from multiple investors. The amount that is collected is then invested in various assets, which include stocks, bonds, or other assets. These investments are managed by professional fund managers. These are the experts who make all buy and sell decisions on behalf of investors.

When you invest in a mutual fund, you own units of the fund and not the individual securities. One of the most important things to note here is that, based on your risk appetite, you can invest in debt, equity, or hybrid funds. This is why these structured investment options are preferred by beginners and experts alike.

Key Features of Mutual Funds

Mutual funds are designed to make investing simple and accessible for all types of investors. This is one of the reasons why people prefer them. But there are some other reasons as well, like:

Managed by experts.

Managed risk due to proper diversification and management.

Option to invest through a lump sum or SIP.

SEBI defines the rules, and the fund follows the same.

A wide range of funds, like equity, debt, hybrid, and index funds.

Pros of Mutual Funds

Mutual funds are popular because they help investors gain better outcomes. While this is one of the primary benefits, there are others, too.

Suitable for beginners and passive investors.

Lower risk due to diversification.

No need for active market monitoring.

The SIP option helps in regular and disciplined investing.

Cons of Mutual Funds

No doubt investing in a mutual fund ensures you have professional support. This makes them a good choice for all. But there are certain risks as well:

Limited control over stock selection.

The expense ratio reduces overall returns.

Portfolio transparency is limited compared to Smallcase.

Exit may take time due to NAV-based settlement.

Smallcase vs Mutual Funds Comparison

Both smallcase and mutual funds aim to help investors grow wealth. But both of these function in quite a different manner. This is where you need to understand the mutual funds vs smallcase properly. So, the table below shares all the details you need.

Basis of Difference | Smallcase | Mutual Funds |

Meaning | A curated basket of stocks or ETFs based on a theme or strategy. | A pooled investment vehicle managed by a professional fund manager. |

Ownership | Investors directly own individual stocks in their demat account. | Investors own units of the mutual fund scheme. |

Control | Investors can rebalance, add, or remove stocks themselves. | All investment decisions are taken by the fund manager. |

Transparency | Complete visibility of all underlying stocks at any time. | Portfolio disclosure is periodic and limited. |

Minimum Investment | Usually starts from Rs. 5,000 or more, depending on the smallcase. | Starts as low as Rs. 500 through SIP. |

Cost Structure | One-time or subscription-based fee may apply. | The expense ratio is charged annually. |

Risk Exposure | Higher risk due to concentrated equity exposure. | Risk varies depending on equity, debt, or hybrid funds. |

Liquidity | Stocks can be sold during market hours. | Units are redeemed at the end of the day NAV. |

Investor Suitability | Suitable for active and informed investors. | Suitable for beginners and long-term passive investors. |

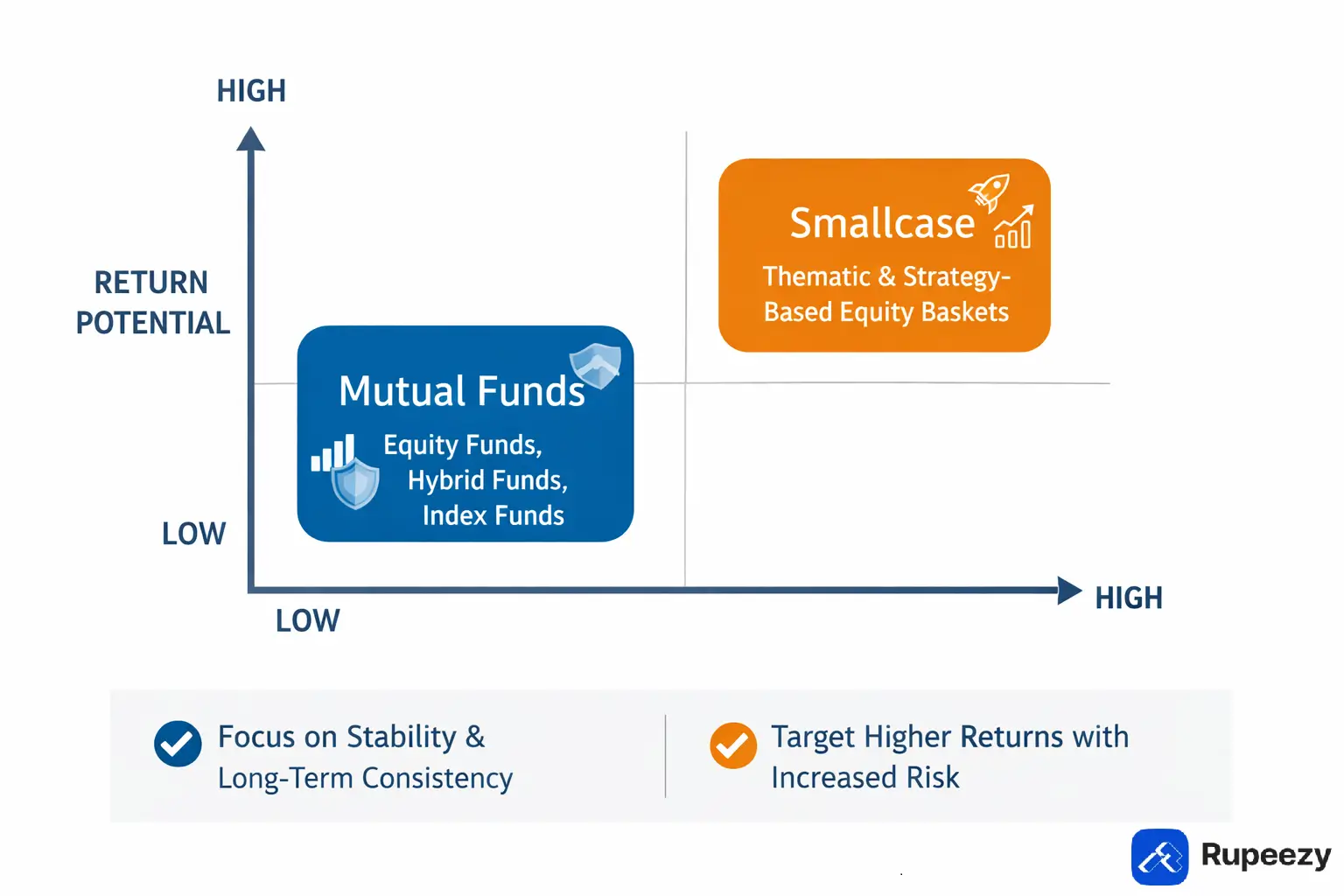

Who Should Invest in What Based on Risk and Return?

Both smallcase and mutual funds are great choices. But both suit a different set of investors.

Smallcase is for:

Investors with a high risk appetite and equity market understanding.

Those who are looking for higher returns from the market.

Investors who know the market and track the same regularly.

People who are comfortable with short-term fluctuations.

Mutual Funds are for:

Investors with low to moderate risk appetite.

Beginners who want professional management and diversification.

Long-term investors are looking for steady wealth creation.

Individuals who prefer SIP-based, disciplined investing.

Conclusion

Smallcase and mutual funds are built for different types of investors. Smallcase is for those who want high returns and are comfortable with high risk. But on the other hand, mutual funds are designed to serve a range of investors. These can be those who want high risk and high returns, or those who are looking for low risk and moderate returns.

Hence, mutual funds offer a broader range of choices for investors. This is where you need the guidance of the experts.

At Rupeezy, we believe the right choice depends on your risk appetite, return expectations, and involvement level. Also, you can combine both to build a better and more diverse portfolio.

FAQs

Is smallcase better than mutual funds for long-term investing?

Yes. Smallcase can offer higher returns in the long term. But at the same time risk is high.

Are mutual funds safer than smallcase?

Yes, mutual funds are generally safer. This is because of the diversification and the professional management.

Can beginners invest in smallcase?

Yes. Beginners can invest in smallcase. But it is advised that you only invest when you have a good understanding of the equity market.

Which option offers better returns, smallcase or mutual funds?

Returns depend on market performance. This is why smallcase tends to deliver higher returns over time.

Can I invest in both smallcase and mutual funds?

Yes, you can. If you do so, you gain the benefit of market and diversification.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category