Commingled Funds: Meaning, Benefits, and How They Work?

00:00 / 00:00

When it comes to investing, people usually go for options that help them with stability and wealth creation. The most common choices that fall in this category of investment include mutual funds, fixed deposits, and tangible assets like gold or silver. While this is true, there is another fund that you must know of.

This fund gathers assets from various investors, like institutions or pension plans, and invests the same. This is what is known as commingled funds.

Now, the question is what is the exact meaning of the commingled hedge funds? Also, why are these funds used? Well, if you are eager to get the answers, then read this guide. Starting from the commingled funds, meaning to their benefits, get to know everything here.

What Is the Meaning of Commingled Funds?

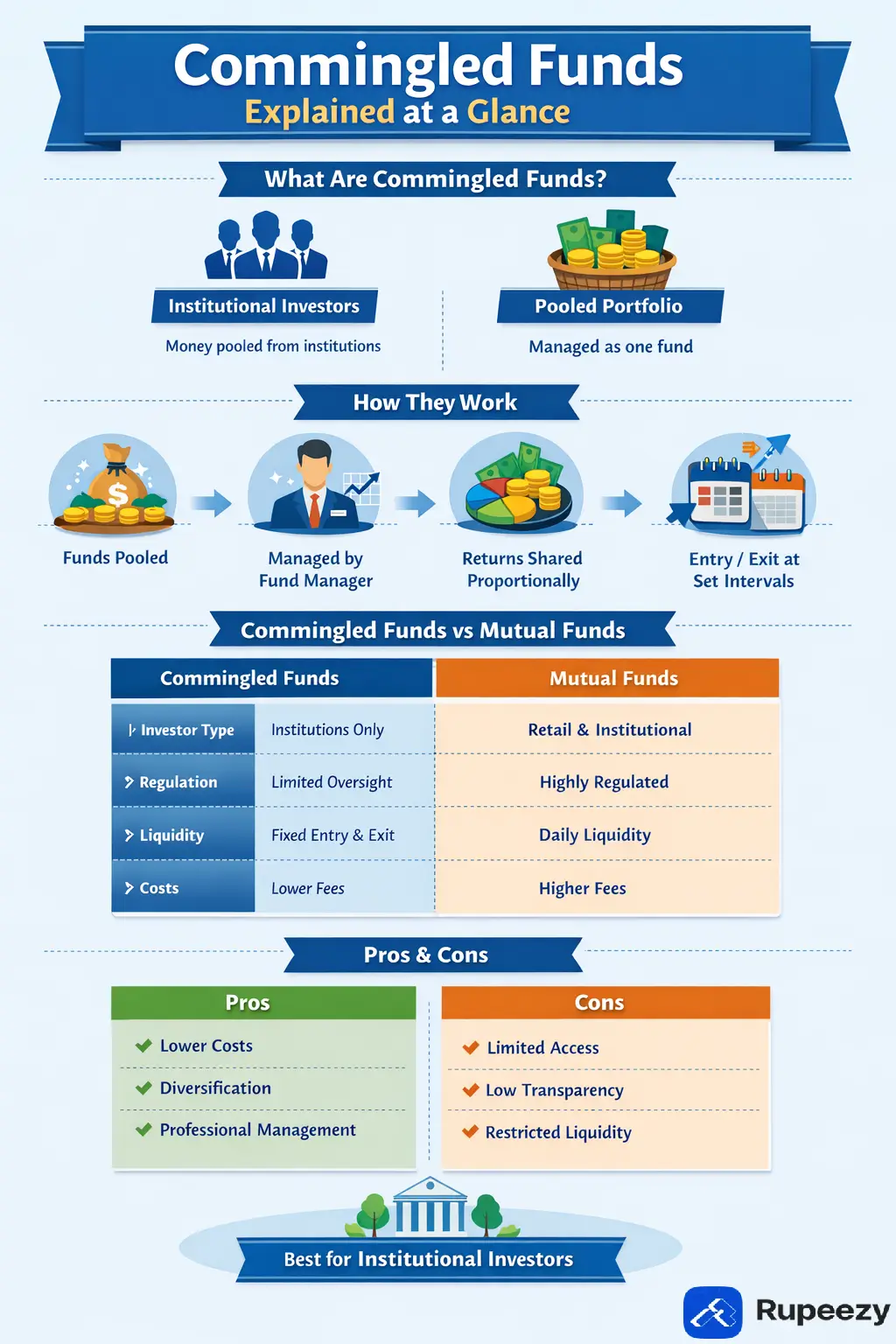

The meaning of commingled funds is quite simple. These funds combine money from multiple investors into one common investment pool. Instead of tracking individual ownership like mutual fund units, each investor owns a proportional share of the overall portfolio.

Commingled funds are mainly used by institutional investors such as pension funds, retirement plans, and insurance companies. These funds are privately managed. And this is one of the reasons why they are not registered with regulators like mutual funds. This means they are not traded publicly.

This allows lower operating costs or the expense ratio. At the same time, these are the options that offer more flexible investment strategies. This is the primary reason why institutions prefer them.

Key Features of Commingled Funds

Commingled funds are built around a pooled structure. These are the funds that mainly suit institutional investing. While this is true, it is equally important to understand the features of these funds that define their worth. So, here are the key features that you should know about.

Assets from multiple investors are pooled into one professionally managed portfolio.

Ownership is proportional to the total fund value, not based on individual securities.

The fund operates under a trust or contractual agreement.

Net asset value is calculated periodically rather than traded on an exchange.

All investors follow the same investment strategy and objectives.

Contributions and withdrawals are allowed only at set intervals.

How Do Commingled Funds Work?

Commingled funds operate through a clear step-by-step structure that allows multiple investors to participate in a single investment portfolio. This setup helps institutions manage large sums efficiently while following a common investment objective.

1. Pooling of Investor Capital

Multiple institutional investors contribute their money to one fund. Once invested, all contributions are combined. Now, this is treated as one single pool of capital that needs to be managed and taken care of.

2. Professional Fund Management

A dedicated fund manager is then appointed. He is the one who manages the amount that is invested in the pool. The management is based on a well-designed and predefined strategy. All investment decisions are taken centrally for the entire fund.

3. Proportional Ownership

Each investor owns a share of the fund in proportion to their investment amount. This means they will get their share of profit or loss based on their investment value. This ensures that they are able to gain benefits from their money.

4. Net Asset Value Calculation

The fund’s value is calculated at regular intervals using net asset value. This determines the current value of each investor’s share. Also, this ensures that if there is any need for changes in the strategy to avoid losses or such instances.

5. Controlled Entry and Exit

Investors are allowed to enter or withdraw only at specific times. This is because these funds are designed for stability. They are created with a long-term vision that ensures that the amount invested grows with the power of compounding.

6. Return Realization

Returns are reflected through changes in the fund’s net asset value. Based on the asset management, the fund’s profits are distributed. There can be dividends or direct distribution, as the plan suggests.

Pros and Cons of Commingled Funds

Commingled funds offer cost efficiency and professional management. This is why they are widely used by institutions. At the same time, their private structure can limit flexibility and visibility for investors. This is why there are pros and cons linked to them.

Pros

Lower management and operating costs due to pooled investments.

Professional fund management that comes with a clear strategy.

Helps with proper asset and portfolio diversification.

Ensures better and professional management of funds.

Best if you have long-term goals.

Cons

Limited transparency, which makes tracking hard.

Restricted liquidity with fixed entry and exit windows.

Not easily available to retail investors.

No individual control over portfolio decisions.

Lesser regulatory oversight than public investment funds.

Commingled Funds vs Mutual Funds

Both commingled funds and mutual funds are quite similar in nature. They pool money from investors to invest and manage. They are managed by expert fund managers. But they differ in structure, access, and regulation. Understanding these differences is quite important. It helps clarify why institutions prefer commingled funds while retail investors lean toward mutual funds.

Basis of Comparison | Commingled Funds | Mutual Funds |

Investor Type | Mainly institutional investors like pension funds and trusts. | Retail and institutional investors. |

Regulatory Status | Privately managed with limited regulatory oversight. | Fully regulated with strict compliance rules. |

Ownership Structure | Investors hold proportional interest in the fund. | Investors hold units of the fund. |

Transparency | Limited public disclosures. | Regular NAV and portfolio disclosures. |

Liquidity | Entry and exit are allowed at fixed intervals. | Daily purchase and redemption allowed. |

Cost Structure | Lower operating and management costs. | Higher costs due to regulation and marketing. |

Availability | Not easily accessible to individual investors. | Easily available to retail investors. |

Conclusion

Commingled funds play an important role in institutional investing. This is because they offer investors unmatched benefits like cost efficiency, professional management, and long-term portfolio stability.

But if you see these closely, these are not the funds that the retail investors are actually looking for. This is mainly because there is no tracking available for these. And if you are looking to invest right, then you need to have a proper analysis of the funds before starting.

This is where Rupeezy can help you a great deal. It offers you access to the tools and data that can help you not just plan the investment but also ensure that you are moving ahead in the right direction. So, start investing right today with the data and support you need.

FAQs

What is the meaning of commingled funds?

Commingled funds are investment pools where money from multiple investors is combined and managed together under a single strategy, mainly for institutional investors.

How are commingled funds different from mutual funds?

Commingled funds are privately managed with limited regulation, while mutual funds are publicly regulated and easily accessible to retail investors.

Are commingled funds safe to invest in?

Commingled funds are generally considered safe for institutions. But at the same time, these funds carry a high market risk. The transparency is low, so you need to be cautious.

Who can invest in commingled funds?

These funds are typically available only to institutional investors such as pension funds, insurance companies, and large trusts.

Do commingled hedge funds offer liquidity?

Liquidity in commingled hedge funds is limited, as investors can enter or exit only at predefined intervals set by the fund.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category