Understanding SEBI: Understand the Indian Securities and Exchange Board

00:00 / 00:00

Introduction

In India SEBI (Securities and Exchange Board of India) is a Market Regulator.

Essentially SEBI (Securities and Exchange Board of India)primary objective is to protect the interests of people in the stock market and provide a wholesome environment for market participants.

- Checks whether exchanges like NSE & BSE Conduct its business impartially .

- Small retail investors or individual investors are protected .

- Protects illegitimate activities or unfair practices from participants .

- Brokers and sub-brokers do their business fairly .

- Avoiding unhealthy practices done from any corporate clients or disproportionately taking any benefits from market (e.g Satyam computers scandal 2009) .

- Big investors with huge cash should not in anyway manipulate market .

- In General Market Regulators helps in developments & progress of Market .

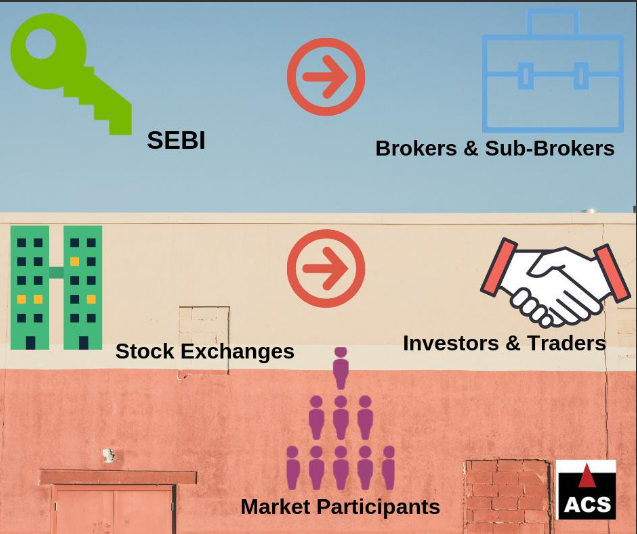

Organizations Or Entity Under SEBI Eyes

- Brokers & Sub-brokers

- National Securities Depository Limited(NSDL) & Central Depository Services Limited(CDSL)

- Depository Participants (DP)

- Credit Rating Agency

- Foregin Institutional investors (FII)

- Asset Management Company (AMC)

- Portfolio management system (PMS) or Portfolio Managers

- Merchant Bankers

- Debenture trustees

Under the ‘Legal Framework’ section of SEBI site ,You can check the rules applicable to a specific entity or organisations.

There is no need to know all this entity listed and working , As an investor or trader we should be knowing the most important of those .

Stock markets exists electronically and it can be accessed through a stock broker or sub-broker like Rupeezy .

So first will try to understand how you can start trading and investing ? what are the requirements for you to start trading in the market .

What kind of investors and traders are there in the market ? Let us discuss this one by one .

So first of all Anyone who does any stock market transactions is referred to as ‘Market Participant’.

Market Participants Of Various Categories

Domestic Retail Participant

These are individuals like you & me . So any single ,independent doing investment , trading or transaction in the market .

NRI and OCI

People who are based out of india but born in india . Indian origin based out of india .

Domestic Institutions (DII’s)

Huge corporate organisation based in india . Most of them are big insurance companies , mutual fund companies .

Domestic Asset Management Companies (AMC)

An asset management company (AMC) is a firm that invests pooled funds from clients, They put there money to work in different investments including stocks, bonds, etc .

Some Typical examples ICICI Prudential Mutual Fund. HDFC AMC , SBI MUTUAL FUND etc .

Foreign Institutional Investors (FII’s)

These are non- indian corporate organisations or entities , Foreign Asset management companies , hedge funds etc.

Regardless of which kind of market participant is there ,All here in market wants to grow there money .

People like Warren Buffett, Peter Lynch have shown the world how stock market returns can be highly profitable.

In India value Ace investors like Rakesh Jhunjhunwala, Vijay Kedia, Porinju Veliyath and Dolly Khanna has emerged .

If you too want to be one of them than the primary thing is to understand the basic terminology about markets .

Go step by step , do not try to learn everything in a day or month .Give yourself some time and focus on basics .

Example & Illustration

So as you can see, this is how the market operates internally .

This is just an overview of market history , financial fundamental instruments and the numerous entities working together under SEBI .

Now as you have a basic understanding about the market in the next chapter we will learn in detail about how you can start trading , tips on various strategy adopted in the market .

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category