Best App for Mutual Funds in India 2025

00:00 / 00:00

In recent years, the Indian markets have witnessed a significant surge in the number of investors turning to mutual funds to invest. However, novice investors often find it hard to find the right mutual fund investment app or broker to invest in, making mistakes here can often prove to be costly in the long run. Through this article, we aim to provide a comprehensive list of the best mutual fund apps in 2025. These have been selected after taking into account various features and cost metrics. Keep reading to find out more about the best apps for mutual funds.

What are Mutual Funds?

Before we jump into mutual fund apps, let’s first understand what mutual funds are and how they work as this will help us understand what we should expect from an ideal mutual funds investment app and which app is best for mutual funds.

Mutual funds function by pooling money from multiple investors. This however is done with the common objective to invest in a diverse range of assets like stocks, bonds, and commodities to achieve a common goal. These mutual funds are managed by professional managers who decide which investments must be bought and sold to reach the fund’s objectives. These professional managers however must adhere to a certain mix of investments and goals which are detailed in the fund’s prospectus.

There are a variety of mutual funds available to investors, including equity, debt, hybrid, and Index funds which track the performance of Indices like Nifty 50 and the BSE Sensex. Mutual funds are also distinguished based on the means through which you invest in them as well. These are largely classified as regular and direct mutual funds. Now let’s look at the best app to invest in mutual funds in 2025.

Best Apps for Mutual Fund Investment in 2025

Platform and features | Rupeezy | Zerodha | Groww | IndMoney | Paytm | EtMoney | Scripbox | NJ Wealth | Asset Plus | Dhan | AngleOne |

Company Experience | 20 Years | 15 Years | 10 years | 3year | 7 years | 7-8 Years | 12 Years | 30 Years | 8 Years | 5 Years | 28 Years |

Mob App | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Smart Explore | Yes | No | No | No | No | No | No | No | No | No | No |

Virtual Portfolio Builder | Yes | No | No | No | No | No | No | No | No | No | No |

Impact Analysis | Yes | No | No | No | No | No | No | No | No | No | No |

One-time and SIP | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Step-Up SIP | Yes | Yes | Yes | Yes | Yes | Yes | No | No | No | No | No |

Import all mutual funds | Yes | No | Yes | Yes | No | Yes | No | No | No | No | Yes |

All Mutual available | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Overview of Best Apps for Mutual Fund in India

Here is the overview of best mutual fund apps in India:

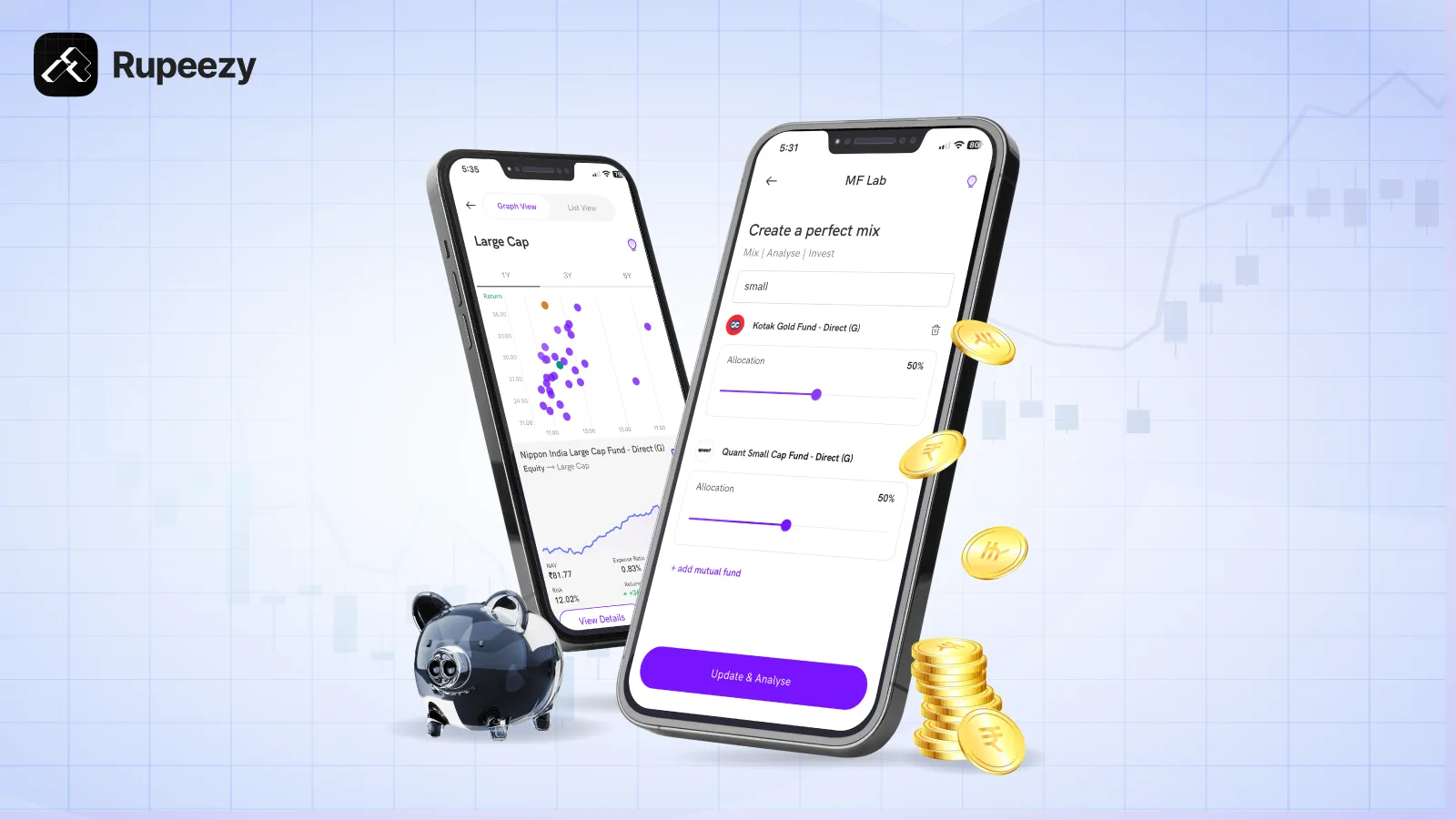

1. Rupeezy

Rupeezy is one of the best mutual fund apps in India because it has advanced analytics and some user-friendly tools. These tools cater to all types of investors. Rupeezy offers valuable data-driven insights and a comprehensive set of features to help optimize your decisions before, during, and after investment. The tool is ideal for building and analyzing portfolios.

Features:

Smart explore: See risk and return to make well-informed investment choices, not just based on returns.

MF lab: Create and test virtual portfolios to see historical performance before committing to an investing strategy.

Impact analysis: Assess how new mutual funds will affect your portfolio’s risk and returns.

2. Zerodha Coin

Zerodha Coin is a widely used app that allows you to invest in mutual funds without any commissions, keeping more of your money invested. It integrates with Zerodha's stock trading platform, making it an excellent choice for investors who trade both stocks and mutual funds.

Features:

Options: Invest in Equity, Debt, Hybrid, and Sovereign Gold Bonds.

Flexible SIP management: Start, modify, pause, or cancel your SIPs online anytime for complete control.

Investment options: Invest a one-time amount or set up a recurring SIP with ease.

Portfolio monitoring: Track your mutual fund portfolio online for better investment management.

3. Scripbox

Scripbox is a top-tier mutual fund app in India. It offers personalized portfolio recommendations based on your risk profile and financial goals. With its advanced algorithm and experienced research team, Scripbox ensures you invest in suitable mutual funds tailored to your needs.

Features:

Invest in 4000+ schemes: Access a wide range of mutual funds, including equity, debt, liquid, and tax-saving ELSS funds.

Family portfolios: Manage and plan investments for multiple family members in one place.

Comprehensive portfolio management: Get personalized recommendations and quarterly reviews to optimize your portfolio's performance.

4. AngleOne

Angel One is a trading and investment app trusted by over 2 crore customers in India. The platform offers various financial products, from stocks and mutual funds to IPOs and futures. Angel One's user-friendly interface and advanced features make it an ideal app for both beginners and seasoned investors.

Features:

Invest in 5000+ mutual funds schemes: Easily invest in various mutual funds, like debt, equity, and hybrid funds, with options for SIP and lumpsum investments.

One-click options trading: Simplify your futures and options trading with Instatrade.

Smart orders: Utilize advanced order types like Stop Loss and Cover Order to manage your investments efficiently.

5. Groww

Groww is a straightforward, user-friendly app designed to make investing in mutual funds accessible to everyone. Additionally, Groww has some educational resources, which makes it ideal for beginners who want to learn more about investing.

Features:

Detailed fund information: Access comprehensive data about each mutual fund option to make informed investment choices.

User-friendly interface: The app is designed for easy navigation and to provide a smooth investing experience for all users.

6. IndMoney

IndMoney is a versatile investment platform that allows you to manage and grow your wealth by investing in Indian and US stocks, mutual funds, and Fixed Deposits. It has features like goal setting and expense tracking to help users plan their finances effectively.

Features:

All-in-one investment tracker: Manage all your investments, including stocks, mutual funds, and fixed deposits, in one place.

Expense tracking: Keep a close eye on your expenses to build and grow your net worth.

7. Paytm Money

Paytm Money is a user-friendly platform for investing in mutual funds. It provides personalized investment recommendations to help you achieve your financial goals.

Features:

Zero maintenance fees: Enjoy zero annual maintenance charges.

Risk profile assessment: Take a free risk profile assessment to understand which investments suit you best.

SIP setup: Easily set up and manage SIPs for regular investments in mutual funds.

8. ETMoney

ETMoney is a reliable app for investing in mutual funds, NPS, and fixed deposits. It offers a seamless experience for managing your finances, with a focus on maximizing returns and making it easy for you to invest.

Features:

Personalized investment plan: ET Money Genius creates a customized investment plan based on quant models.

Portfolio health Tracking: Track and manage your mutual fund portfolio with health reports and risk-reducing suggestions.

9. NJ Wealth

NJ Wealth is a mobile app designed for financial transactions and portfolio management. It is also one of the best apps for mutual investments in India, as it caters to investors who need secure and convenient access to investment.

Features:

Portfolio management: Check your transaction history and portfolio reports directly from the app.

Secure access: Enjoy quick authentication using a username and password with two-way authentication for added security.

Data encryption: All sensitive information is encrypted using SSL to ensure your data is safe.

10. Asset Plus

AssetPlus is a top mutual fund app in India for investments. It provides comprehensive financial planning like goal-based planning, tax planning, and retirement planning.

Features:

Dedicated financial advisor: Personalized advice and portfolio management from a dedicated financial advisor.

Unified investment management: Track and manage both internal and external investments in a single app.

Investment tracking: Monitor and review all your mutual fund investments, even those from other platforms.

11. Dhan

Dhan is a comprehensive trading app offering extensive features for both stock and mutual fund investments. With Dhan, there are no commission fees on mutual fund investments and no platform fees for stock investing, IPOs, and ETFs.

Features:

Diverse investment options: Access to 1,000+ mutual fund schemes, 1,600+ stocks for intraday trading, ETFs, and commodity trading.

Advanced trading tools: Includes 100+ free indicators, 1-tap trading, flash trade options, and various advanced order types.

Integrated investment management: Track and manage mutual funds, stocks, and other investments in one app.

Calculate your fund performance and more with our SIP calculator, mutual fund calculator, and step up SIP calculator!

How do I Select the Best Mutual Funds App?

A good mutual fund app will provide you with the following:

The Platform allows you to track all your investments in one place.

The Platform makes it easier for you to find a fund that suits your needs and goals.

The Platform gives you access to all types of mutual funds.

The platform offers insights into your investments to help you become a better investor.

And finally, the platform comes from a well-established and trustworthy broker.

What Makes Rupeezy Stand Out?

Rupeezy stands out as one of the best best app for mutual fund and advanced mutual fund investing platform with an analytical nature that other platforms lack. Other than the execution of investments and redemptions this app provides crucial data which helps investors make better investment decisions. The following are some features that stand out:

Smart Explore: Rupeezy's smart explore feature offers a Risk Return view that allows users to visualize and understand the risks. This ensures that investors don’t just invest based on returns.

MF Lab: Rupeezy app offers a Virtual Portfolio Builder (MF Lab), to empower investors. Here investors can create a mix of mutual funds with their desired allocation and see how this portfolio would have performed over the years together. Once the investors are satisfied with the portfolio you have created, you can invest in that portfolio.

Impact Analysis: Rupeezy’s Impact analysis is a one-of-a-kind feature. Whenever you want to invest in a new mutual fund, Rupeezy’s Impact analysis will tell you the impact of this purchase on your current portfolio namely the impact on the portfolio’s Risk and Returns.

Conclusion

Choosing the best app for mutual funds and the right tools is essential for investors looking to optimize their risks and maximize their returns. By considering factors such as returns, risk and additional services offered, investors can identify brokers and applications offering the most competitive investing platform. Whether opting for a discount broker like Rupeezy or a full-service broker like HDFC Securities, investors should conduct thorough research and due diligence to make an informed decision that aligns with their investing objectives and risk tolerance. Happy Investing!

Check Out These Related Articles |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category