What is Impact Analysis Feature on Rupeezy? Latest Update

00:00 / 00:00

In cricket, the addition or replacement of a single player can significantly alter a team’s dynamics. A well-diversified portfolio just like a cricket team needs a good mix of investments suited for different market scenarios. This also means that the additions made to a portfolio can influence its overall performance. But how do we even understand and measure this impact? The Impact Analysis Feature on Rupeezy helps you do exactly that. Keep reading to find out more!

What is the Impact Analysis Feature on Rupeezy?

The Impact Analysis feature on Rupeezy is a powerful tool designed to assist investors evaluate the potential effects of adding a new investment to their existing portfolio. It provides insights into the effects that the new investment may have on the portfolio’s overall performance, risk, and other critical metrics. Let’s understand the feature better by taking a closer look at how it functions

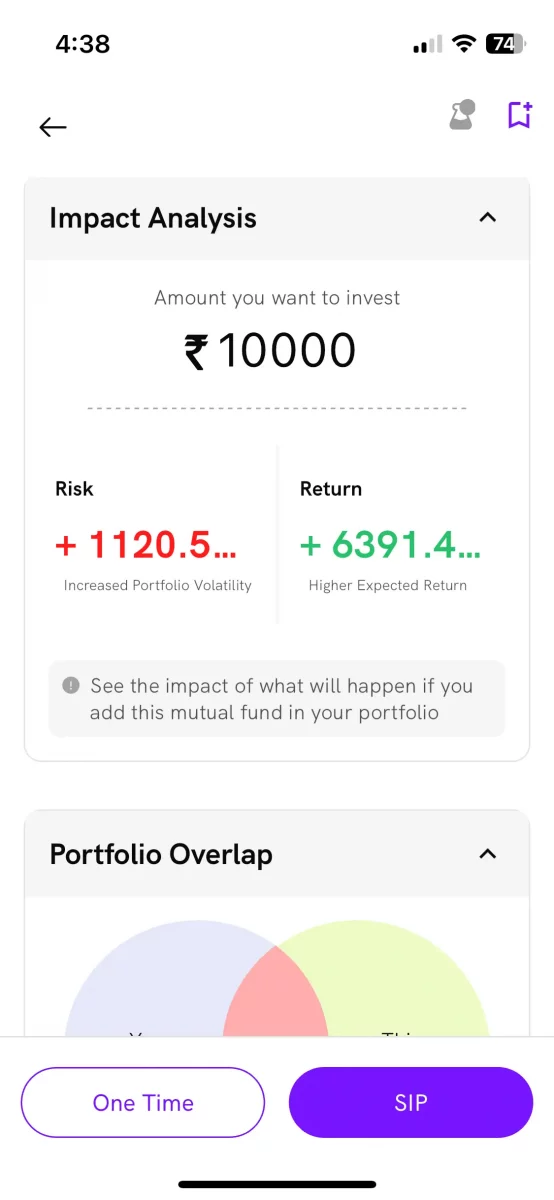

Impact Analysis screen

How does the Impact Analysis Feature Function?

Following are some of the important functions of the Impact Analysis feature that set it apart in the mutual fund industry:

1. Portfolio Evaluation

The first step would involve the investor entering his portfolio details. The feature would then evaluate the current portfolio by analysing factors such as asset allocation, historical returns, volatility, and correlation with the markets.

2. New Investment Simulation

Here all that an investor has to do is input how much he wants to invest into a new fund. The feature will then simulate the addition of the new investment to his existing portfolio.

3. Comprehensive Analysis

The Impact Analysis feature will then proceed to analyse the data and generate crucial metrics that indicate how the portfolio will be affected by the new investments. The results then generated are presented in an intuitive and easy-to-understand format. The metrics include but are not limited to:

Changes in Expected Return: This shows the investors the expected return of the portfolio after adding the new investment.

Overall Risk: Here investors can assess how the portfolio’s risk profile will change with the inclusion of the new asset.

Correlation with Market: This metric helps investors understand the correlation between the portfolio’s performance and the market following the addition of the new fund.

Max Drawdown(upcoming): The maximum drawdown of the portfolio, showing the potential changes that come with the addition of the new asset.

What are the Benefits of the Impact Analysis Feature on Rupeezy?

The Impact Analysis Feature offers several benefits to investors. They include:

1. Informed Decision-Making

By providing insights into the potential impact of a new investment, users can make informed decisions. This is because the impact analysis feature furthers their understanding of the impact of new investments on the portfolio’s risk and returns. This further helps users align their investment strategies with their financial goals.

2. Risk Management

The feature assists in evaluating the risk implications of a new investment. Users can identify potential risks associated with the new asset and decide whether it aligns with their risk tolerance.

For example, if the Impact Analysis feature shows you that adding a specific mutual fund is increasing the risk but at the same time also reduces the expected return, then you would probably want to stay away from this mutual fund, as it would cause more harm than good to your portfolio.

What are the Limitations of the Impact Analysis Feature on Rupeezy?

While the Impact Analysis feature is a valuable tool, it is essential to be aware of its limitations:

Assumptions: The accuracy of the analysis heavily relies on the accuracy of the assumptions and projections which may not always reflect real-world market conditions which may produce different results.

Past Performance is Not Indicative of Future Results: The analysis is based on historical data, which may not be indicative of future performance. Market conditions and economic factors can change, leading to different outcomes.

External Factors: The analysis may not account for external factors such as geopolitical events or sudden market shifts, which can influence portfolio performance.

In Closing

The Impact Analysis feature is a powerful tool that empowers investors to make informed decisions about new investments by providing valuable insights into the potential effects on portfolio performance, risk, and correlation with the market. This will further help investors align their investment strategies with their financial goals and enhance their portfolio management practices. However, users should always remember that the analysis is based on assumptions and historical data, and they should exercise discretion and professional judgment when interpreting the results for real-world investment decisions.

Invest smarter with the Rupeezy app, the best app for mutual fund investments, offering innovative tools and features to optimize your portfolio. Download now and take your investment analysis to the next level!

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category