Best SIP Plans for 1,000 Per Month in India 2026

00:00 / 00:00

Imagine a game where you take out two 500 Rupee currency notes from your wallet every month and put them away in a container. Do this every month for a couple of years and one day the container will be overflowing with currency notes. This is known as regular saving.

Now if you handed this amount to someone running a small-scale business that shows promising returns, the money will go towards buying machinery, building products, etc. After a few years, the small business would have grown into a larger company and your investment would have grown too. This is called systematic investing.

In this article, we will look at some of the best SIP plans for Rs 1,000 per month with impressive long-term growth potential.

Why Start an SIP with Rs.1,000 Per Month?

Systematic Investment Plans or SIPs have won favours among retail and large investors alike.

Indian Mutual Funds currently have about 9.61 crore SIP accounts a massive increase from 73 lakh accounts in March 2015. Investor faith in SIPs affirms the fact that it is not necessary to have a large surplus to invest in capital markets or mutual funds. Even a small amount of Rs 1,000 is sufficient to start investing, let’s see why:

Time in the Market: Many people wait to save enough to begin investing or are diffident and believe that their earnings are too little to just about manage expenses, let alone think about investing. Well, SIPs are the answer to this problem.

You can begin investing with as little as Rs 500 through systematic investment plans. The longer the time your money stays invested, the better the impact of compounding.

Small is Beautiful: Investing is all about the habit and discipline of getting started and staying the course. SIPs are an excellent way to build a habit of consistent savings and investing from an early age.

SIPs are automated investments with no expiry date. You can set up SIP for a small amount, say Rs 1000 a month, and increase the amount as your earnings grow.

Rupee Cost Averaging: Investing a small amount every month instead of waiting for money to accumulate is a good strategy to average out the cost of investment.

Markets are volatile, when you purchase SIP during an uptrend, you buy fewer units, and when markets are falling, you buy more units for the same money. In effect, you average out your purchase price and benefit from rupee cost averaging.

Easy to Save: Smaller amounts are easier to set aside from your expenses every month than plan a one-time lumpsum investment. The SIP amount is deducted on a particular date each month and gets invested automatically.

Keep Emotions at Bay: When it comes to markets, it is difficult even for seasoned investors to keep emotions at bay. SIPs eliminate impulsive decision-making when markets are volatile.

Convenient: SIPs are easy and convenient to set up and save time. You can visit online platforms and create SIPs on your own within minutes. There is no cumbersome paperwork or complicated analysis required. Apps like Rupeezy present advanced data analytics to help you choose the best funds from 1500+ schemes to suit your needs.

Flexible: SIPs are not rigid, there is no large initial investment, no lock-in or minimum investment period. You can stop your SIP anytime and withdraw your investment without any hassles.

You can also use the Step Up SIP feature to increase the SIP amount by a certain percentage periodically. For example, if you anticipate that you can invest more in future, you can create Step Up SIP with a 10-20% incremental contribution every year.

Top 10 Best SIP Plans for 1,000 per Month

Here’s a list of best-performing Rs.1,000 per month SIP for 5 years across equity, debt, hybrid, and equity index categories.

Scheme Name | 5-Year Return (CAGR) | Expense Ratio | AUM (Rs. Cr) |

23.39% | 0.68% | 32884 | |

22.65% | 0.87% | 64223 | |

31.12% | 0.72% | 75296 | |

34.27% | 0.7% | 1660 | |

29.81% | 0.53% | 4841 | |

27.84% | 0.74% | 38115 | |

25.07% | 0.99% | 40095 | |

13.82% | 0.48% | 2808 | |

7.99% | 0.45% | 1941 | |

18.93% | 0.18% | 19848 |

Best SIP Plans for 1,000 per Month

1. Nippon India Large Cap Fund

One of the top-performing large-cap funds, Nippon India Large Cap Fund has 90% corpus invested in large-cap companies that offer stable growth. This scheme is suitable for investors looking for capital appreciation from equity and steady growth from large stable businesses over the long term.

AUM: Rs.32,884 Cr

Category: Equity - Large Cap

Inception Date: 1 Jan 2013

CAGR Since Inception: 13.72%

CAGR (5-Year): 18.93%

Expense Ratio: 0.68%

2. ICICI Pru Bluechip Fund

This fund invests 91% of its corpus in large-cap stocks with allocation to diversified sectors such as Banks, Refineries, IT, Engineering, Auto, and Pharma. The fund is suitable for investors looking for long-term returns and comfortable with the risk associated with equity investments.

AUM: Rs.64,223 Cr

Category: Equity - Large Cap

Inception Date: 23 May 2008

CAGR Since Inception: 16.43%

CAGR (5-Year): 22.65%

Expense Ratio: 0.87%

3. HDFC Mid-Cap Opportunities Fund

This fund has 65% corpus allocated to mid & small-cap stocks and 35% exposure to large-cap stocks. It is suitable for investors who can bear high risk and looking for aggressive returns over a long period of time. The scheme has exposure to Pharma, Tyres, Banks, Healthcare, and Hotel sectors.

AUM: Rs.75,296 Cr

Category: Equity - Mid Cap

Inception Date: 25 June 2007

CAGR Since Inception: 20.91%

CAGR (5-Year): 31.12%

Expense Ratio: 0.72%

4. Invesco India Infrastructure Fund

The fund aims to generate capital appreciation by investing in a portfolio that is predominantly constituted of equity instruments of infrastructure companies. The scheme has 96% of its corpus allocated to equity with 54% allocation to large caps, 37% to mid caps and 10% to small caps. Sectoral funds carry slightly higher risk compared to diversified funds due to segment focus and are suitable for investors looking for aggressive returns and, a long-term view of the sector along with high risk appetite.

AUM: Rs.1,660 Cr

Category: Equity - Sectoral

Inception Date: 1 Jan 2013

CAGR Since Inception: 20.73%

CAGR (5-Year): 34.45%

Expense Ratio: 0.7%

5. ICICI Prudential Dividend Yield Equity Fund

The objective of this fund is to generate long-term gains by predominantly investing in a well diversified portfolio of dividend-yielding companies. It is suitable for investors looking for regular dividend returns along with capital growth. These funds can be less volatile due to stable dividend paying companies with healthy cash flows and profits.

AUM: Rs.4,841 Cr

Category: Equity - Dividend Yield

Inception Date: 16 May 2014

CAGR Since Inception: 17.68%

CAGR (5-Year): 29.81%

Expense Ratio: 0.53%

6. Nippon India Multi Cap Fund

This equity scheme invests across large-cap, mid-cap, and small-cap stocks. Multi-cap funds diversify the corpus without focusing on specific types of companies or sectors. This scheme is suitable for investors with high risk appetite and long investment horizon.

AUM: Rs.38,115 Cr

Category: Equity - Multi Cap

Inception Date: 28 Mar 2005

CAGR Since Inception: 17.52%

CAGR (5-Year): 27.84%

Expense Ratio: 0.74%

7. ICICI Prudential Equity & Debt Fund

Hybrid funds, also known as balanced funds, blend diverse asset classes like equities and debts within a single portfolio. They aim to generate long-term capital appreciation and income from a portfolio invested in equity as well as in fixed-income securities. This fund has 67% allocation to equity and the remaining to debt and fixed-income securities.

AUM: Rs.40,095 Cr

Category: Hybrid Fund - Aggressive

Inception Date: 3 Nov 1999

CAGR Since Inception: 17.76%

CAGR (5-Year): 25.07%

Expense Ratio: 0.99%

8. Kotak Debt Hybrid Fund

The investment objective of the scheme is to generate returns from a portfolio of debt instruments along with a moderate exposure to equity. This scheme has 70% exposure to debt instruments and 23% allocation to equity. It is suitable for conservative investors looking for low risk investments with a mix of equity for capital appreciation.

AUM: Rs.2,808 Cr

Category: Hybrid Fund - Conservative

Inception Date: 1 Jan 2013

CAGR Since Inception: 11.64%

CAGR (5-Year): 13.82%

Expense Ratio: 0.48%

9. Axis Strategic Bond Fund

The fund aims to generate optimal returns in the medium term while maintaining liquidity of the portfolio by investing in debt and money market instruments. It is suitable for risk averse investors looking to invest in fixed-income securities for a 3-5 year duration.

AUM: Rs.1,941 Cr

Category: Debt Fund

Inception Date: 28 Mar 2012

CAGR Since Inception: 8.75%

CAGR (5-Year): 7.99%

Expense Ratio: 0.45%

10. UTI Nifty 50 Index Fund

UTI Nifty 50 Index Fund is an open-ended scheme replicating the NIFTY 50 Index. The fund aims to generate returns in line with the underlying index. Index funds are suitable for investors looking for stable long-term returns from diversified large companies with top-line market capitalisation.

AUM: Rs.19,848 Cr

Category: Equity - Index Fund

Inception Date: 1 Jan 2013

CAGR Since Inception: 13.72%

CAGR (5-Year): 18.93%

Expense Ratio: 0.18%

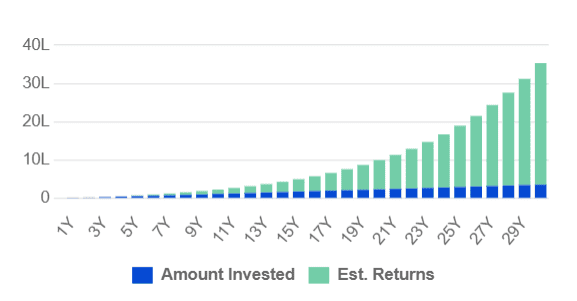

Long-Term Benefits of Investing Rs.1,000 per Month in SIP

Rs. 1000 may seem like a small amount that you may spend on movie tickets or a pizza but this amount invested every month over 20 or 30 years in SIP can create magic for your portfolio.

Here’s How:

Use our SIP calculator and Step Up SIP calculator to see how increasing your contributions over time can enhance your returns.

Rs 1000 invested every month for 30 years assuming a 12% CAGR (Compounded Annual Growth Rate) would grow to Rs 35 lakhs.

Amount Invested Rs. 3,60,000

Expected Return Rate 12 %

Total Corpus after 30 years: Rs. 35,29,913.77

This growth is at zero additional cost since SIPs are highly cost-efficient and save time. SIPs allow you to choose from different themes in the market e.g. large cap or mid-cap funds, thematic sectoral funds such as IT, banking, or infrastructure, or a different asset class e.g. debt funds, a mix of equity and debt, tax saving funds etc.

Therefore SIPs starting even with Rs. 1000 are highly beneficial for any investor to add to their portfolio.

How to Start a SIP with Rs.1,000 per Month

You can set up a SIP in a few simple steps:

Log on to the Rupeezy App.

Go to the ‘Explore’ Button on the lower navigation bar

Here, select a fund category from Equity, Debt, Hybrid/Sub Category Large Cap, Index, etc options.

Check top-performing funds and their risk-return metric on a visual graph.

Go to ‘List’ View and check fund details such as performance, AUM, risk, portfolio, etc.

Select a fund of your choice and click on the SIP option.

Enter the amount and proceed to payment using UPI or Net Banking.

Once the units are allotted, you can monitor your fund value from the portfolio tab.

Tips for Maximising SIP Returns

You can maximise your SIP returns and achieve your financial objectives by following simple rules:

Start Early: Early bird does get the prize when it comes to investment. Let the power of compounding work in your favour by starting early even with small amounts.

Stay Consistent: Invest regularly and make sure not to skip your contributions to fully benefit from rupee cost averaging and discipline of investing.

Step Up your SIP: As you move ahead in your career and life, your earnings and savings will grow. Use Step Up SIP and increase your SIP amount by a desired percentage periodically. For example, if your SIP is Rs 1000 today, you can opt for a 50% step up i.e. Rs 1500 SIP to be invested after 6 months or one year.

Choose Best Funds: Before you invest, conduct your own analysis of fund’s past performance, risk parameters, AMC track record, and investment style.

Diversify: Invest in a mix of equity, debt and hybrid funds keeping in mind your overall investment objectives. Also, keep your investment time horizon in mind before selecting a fund.

Stay Invested: Once you begin investing, do not get wavered by short-term volatility or events. Continue your SIPs across market cycles, and avoid the temptation to time the markets.

Use SIP Calculator: SIP Calculator is an excellent tool to estimate future returns for different amounts, time horizons, and rate of return. It helps you calculate the investment required to meet particular goals and set realistic targets.

Conclusion

SIPs are an excellent tool to invest in stock markets, build your investing muscle by making consistent contributions, and generate long-term wealth even with a very small amount of Rs 1000+. Benefit from the power of compounding and make best use of rupee cost averaging with SIPs. Conduct your own analysis and discover best-suited funds to invest in with Rupeezy app.

FAQs

Q. Can I invest Rs.1000 per month in SIPs?

Yes, you can set up a SIP even with small contributions of Rs 1000 per month and benefit from the growth potential od investing in stock markets.

Q. Is SIP risk free?

SIP is a mode of investment in different types of mutual funds. SIP in equity funds involves risk of volatility and Debt funds are more suited for risk-averse investors. There are hybrid funds that combine equity and debt investments.

Q. Can I withdraw SIP anytime?

There is no lock-in period for SIPs (other than ELSS schemes), you can withdraw the units anytime.

Q. Is SIP better than FD?

SIP is suitable for investors looking for long-term capital appreciation through capital market investments. There is risk involved along with an upside from the markets. FDs are suitable when you want fixed returns and zero risk but there is no upside and returns are low.

Check Out These Related Articles |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category