What is TPIN Number - Meaning, Full Form & How to Generate

00:00 / 00:00

In the rapidly evolving world of digital finance, investor security has become a top priority. Among the many measures introduced to safeguard retail investors, the TPIN system stands out as a significant step towards enhancing security in demat account transactions.

In this article, you will understand what TPIN means, its role in facilitating secure transactions, how to generate TPIN, its verification process, and much more. So let’s dive in!

What is TPIN in a Demat Account?

The full form of TPIN is “Transaction Personal Identification Number”, which is a 6-digit numeric password that is used to authorize the sale of shares from a CDSL (Central Depository Services Ltd) demat account. This authorization is valid for only one day and allows investors to approve transactions without giving brokers a Power of Attorney (POA).

Why is TPIN Required?

Earlier, brokers had full access to sell shares on behalf of investors, requiring only a signed Power of Attorney (POA) document. However, the brokers were seen misusing POA for their own benefit, like withdrawing or moving shares and securities without the knowledge of the demat account holders.

The introduction of the TPIN system on June 1, 2020, removes the need for brokers to have this Power of Attorney, and grants complete authority to investors to approve all the demat transactions themselves. This ensures better security, direct control, and reduced risk of fraudulent activities.

How Does TPIN Work?

Now that we have understood the TPIN meaning, here is a step-by-step breakdown of how TPIN works when you initiate a sell transaction:

Step 1: Initiate Transactions

Begin by logging into your trading platform and placing a sell order for the stocks you wish to sell from your CDSL Demat account.

Step 2: Authorization Request

Once the sell order is placed, CDSL sends you an authorization link via SMS or email, directing you to the CDSL verification portal.

Step 3: Enter TPIN and OTP

By accessing the link, you can enter your Demat account number along with your 6-digit TPIN, and validate it by entering the OTP received on your registered mobile number.

Step 4: Transaction approval

After successful authentication, CDSL approves your transaction, allowing you to execute the sell order on the platform. Once the order is confirmed, the corresponding shares are debited from your Demat account.

Step 5: Settlement

Upon the completion of the sale, the proceeds are credited as a cash margin to your trading account. Now you can either retain them for further trading or transfer to your linked bank account if needed.

Here, one important thing to keep in mind is that the TPIN authorization is required only once per day, meaning you can place multiple sell orders throughout the same trading day without re-authenticating the TPIN every time.

TPIN Example in the Share Market

Suppose you hold 200 shares of Tata Motors and decide to sell 100. When you place a sell order through your broker’s platform, you are redirected to the CDSL portal for authentication. There, you must enter your TPIN and the OTP sent to your registered mobile number to approve the transaction. After successful verification, you're redirected to your broker’s platform to place the order on your preferred exchange, NSE or BSE.

Once the trade is executed, CDSL debits the 100 Tata Motors shares from your demat account and transfers them to the buyer. The cash proceeds are reflected in your trading account and can be used to invest again or withdrawn to your linked bank account.

What is the BO ID for TPIN

The BO ID, short for Beneficiary Owner Identification Number, is a unique 16-digit number assigned to every Demat account holder registered with CDSL (Central Depository Services Limited). It serves as a distinctive identifier that links an investor’s Demat account to their holdings in electronic format.

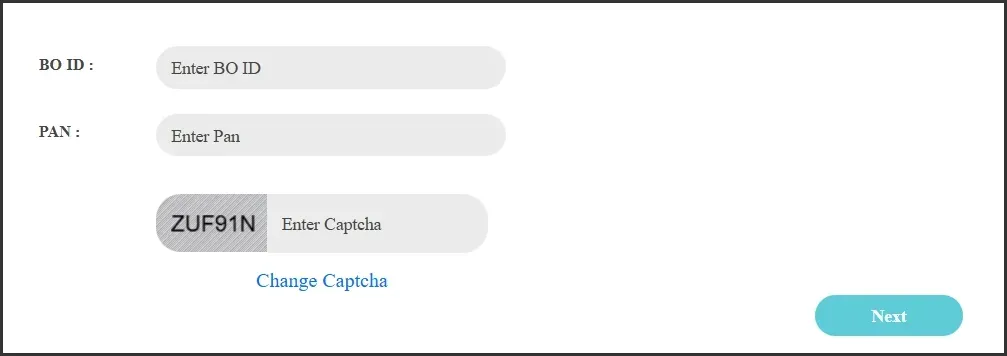

The BO ID, required for TPIN generation or authentication, includes the DP ID (Depository Participant ID) in the first 8 digits and the Client ID in the last 8 digits.

Where to Find Your BO ID?

You can easily locate your BO ID through multiple reliable sources. One of the most convenient ways is by logging into your stockbroker’s trading platform or mobile app. Once logged in, navigate to sections such as Profile, Account Settings, or Demat Details, where you'll typically find your BO ID listed. It may be labeled as “BO ID” or “Demat Account Number” and will be a 16-digit identifier.

Alternatively, you can retrieve your BO ID directly from the CDSL (Central Depository Services Limited) portal by visiting the official CDSL India website. Under the “Quick Links” section, select the ‘Know Your Demat’ service. To access your BO ID through this method, you’ll need to enter your PAN and verify it with an OTP sent to your registered mobile number.

How to Generate TPIN for CDSL Online

CDSL TPIN generation can be done anytime using the official CDSL platform. Below is a step-by-step guide you can follow to generate your CDSL TPIN online.

Step 1: Visit the official CDSL website

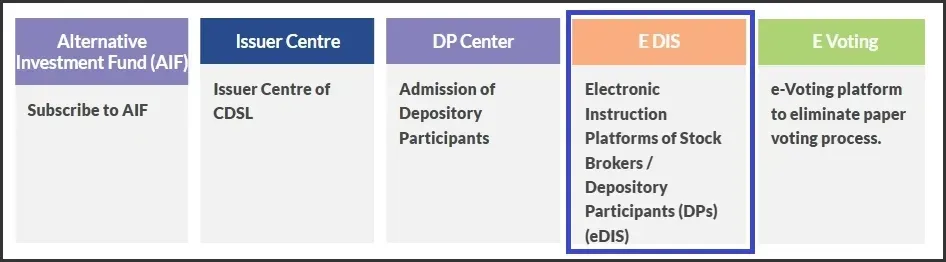

Step 2: Click on the eDIS (Electronic Delivery Instruction Slip) section from the homepage.

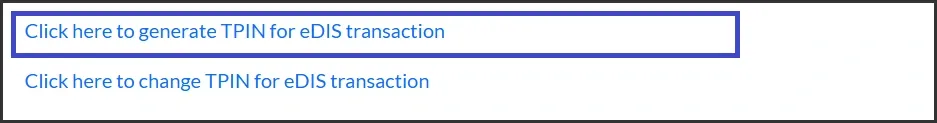

Step 3: At the bottom of this page, you will find a link called ‘Click here to generate TPIN for eDIS transaction’, click on it.

Step 4: Now, enter your BO ID, PAN, and the correct captcha to receive an OTP to your registered mobile device.

Step 5: Enter your OTP, and you will then receive your TPIN through email or SMS.

How to Change TPIN Number

If you've forgotten your TPIN or want to update it for security reasons, the process is identical to the steps used for generating a new one, as outlined above.

Simply visit the CDSL website, go to the eDIS section, and select ‘Click here to change TPIN for eDIS transaction’ at the bottom of the page. From there, enter your BO ID, PAN, and captcha, verify via the OTP sent to your registered mobile number, and you’ll receive your new TPIN by SMS or email.

Difference Between MPIN and TPIN

While both TPIN and MPIN serve as security pins, they are used in entirely different financial contexts. Now that we already know what TPIN is, let us look at the major difference between MPIN and TPIN.

Aspect | MPIN | TPIN |

Full form | Mobile Banking Personal Identification Number | Transaction Personal Identification Number |

Purpose | MPIN authenticates login and transactions on Mobile Apps. | TPIN will authorise all the sell transactions in Demat Accounts. |

Issued by | Your bank or mobile payment app provider. | Central Depository Services Ltd (CDSL) |

Usage | Used for mobile banking or UPI transactions. | Used during stock sell orders from the Demat account. |

Generation mode | It is set manually by the user within the banking application. | It is sent via SMS or email by CDSL. |

Reset method | It can be reset through the bank application settings only. | It can be reset via the CDSL portal only. |

Conclusion

TPIN is a simple yet powerful tool that helps you to securely authorise the sale orders of shares from your demat account. It has added an essential layer of security and convenience for investors without relying on the broker’s Power of Attorney.

At the end of the day, TPIN makes your trading safer and puts you in charge of your own demat account. Now that you know what TPIN means, how it works, and how to reset it when needed, you are better prepared to handle your stock market transactions smoothly and securely.

FAQs

Q1. What is TPIN in a bank, and is it the same as a Demat TPIN?

TPIN in a bank means Telebanking Personal Identification Number, which is a unique numeric code that is used to access and transact over the phone with your bank. Whereas, a TPIN in Demat stands for Transaction Personal Identification Number, which is used to authorise selling shares from your Demat account.

Q2. What is CDSL TPIN?

A CDSL TPIN (Transaction Personal Identification Number) is a 6-digit password that is issued by Central Depository Service Limited (CDSL) to authorise the sale of shares in a Demat account.

Q3. How long is a TPIN valid after verification?

The CDSL TPIN authorisation is valid for one single day. This means that you can place multiple sell orders throughout the same trading day without re-authenticating the TPIN every time.

Q4. What should I do if I forgot my TPIN?

In case you forget your TPIN, you can always reset your password by visiting the CDSL India website.

Q5. Can I set my own custom TPIN?

No, CDSL does not allow you to have your own custom TPIN.

Check Out These Related Articles |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category