How to Transfer Shares from One Demat Account to Another

00:00 / 00:00

Transfer of shares is one of the most common practices adopted by investors. This is because, with a number of demat options, people usually look for the best demat account that offers better services at lower fees. Another reason can be the need to consolidate or transfer shares as a gift to a family member.

But most investors get stuck because they don’t know how to transfer shares from one demat account to another. Hence, understanding the transfer process, both manual and online, is crucial.

So if you're an investor planning to transfer your Demat account, this guide will provide all the details you need. It will help you understand the process and highlight common mistakes to avoid, ensuring a smoother and faster transition.

How to Transfer Shares from One Demat to Another

The investor can use both online and offline modes to transfer shares from one demat account to another. Let’s discuss the steps for both modes.

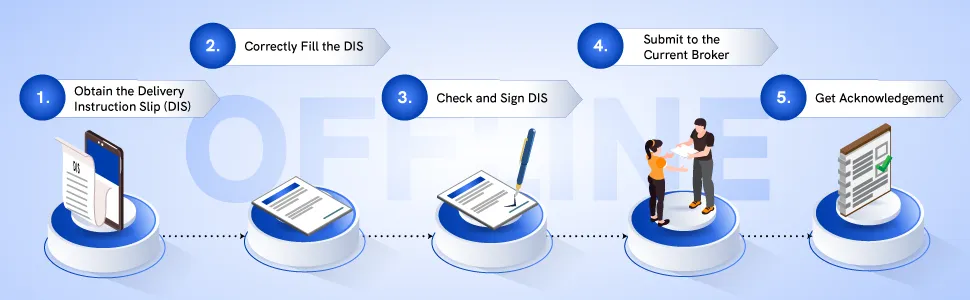

Offline Method

This is one of the oldest and most common ways to transfer stocks from one demat to another. In this method of share transfer, you would be required to follow the steps mentioned here:

Step 1: Obtain the Delivery Instruction Slip (DIS)

The first thing that you need to do is get the Delivery Instruction Slip (DIS). You will get this from the existing broker. It acts like a cheque for a share transfer. You will add all the details of the shares to be transferred in this slip.

Step 2: Correctly Fill the DIS

Start by filling out the slip. Ensure that you add the correct details for a smooth transfer of shares. The details that are required are:

International Securities Identification Number (ISIN): This is a unique 12-digit code assigned to each security, serving as its distinct identifier.

Quantity of Shares: Specify the number of shares you intend to transfer.

Target Client ID: You will get this as a 16-digit identification number. This is made of 2 different IDs. These are the Client ID and Depository Participant Identification (DP ID).

Name of the Target Broker: Include the name of the broker where the shares are being transferred.

Transfer Type: Indicate whether the transfer is "off-market" (between different brokers) or "inter-depository" (between accounts within the same depository).

Step 3: Check and Sign DIS

Once you have entered all the details, check them thoroughly. Ensure there are no mistakes that can lead to rejection or delay in the transfer process. Once done, sign the DIS in the space provided.

Step 4: Submit to the Current Broker

The filled slip needs to be submitted to the current broker. The broker will check the details and will charge a small fee to complete the share transfer process. The broker will proceed with the transfer process now.

Step 5: Get Acknowledgement

The process is now complete. You will get an acknowledgement slip from the broker. This slip will be needed in the future, so keep it safe.

A minimum of 3-5 business days will be needed to get this process completed. This is how you transfer stocks from one demat to another using an offline process.

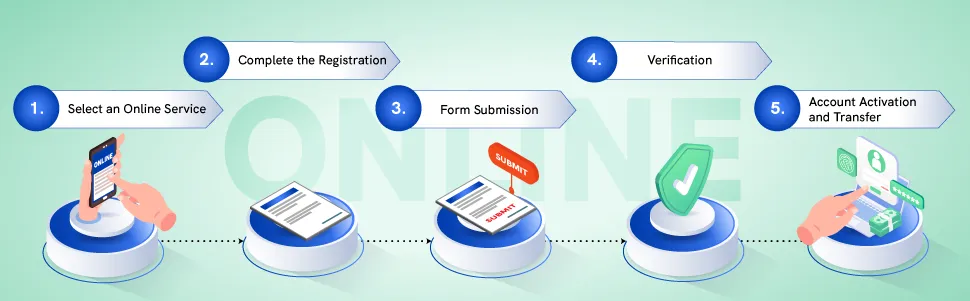

Online Method

If you are looking for a quick and simple method to transfer shares, then the online method will be best. The steps that you would need to follow for transfer of shares under this are:

Step 1: Select an Online Service

Start by selecting the online service. Here are the two online services that you can select from:

NSDL (National Securities Depository Limited): NSDL is the oldest electronic securities depository in India. It holds securities like stocks, bonds, and mutual funds in electronic form and facilitates seamless trading and settlements in the financial markets.

CDSL (Central Depository Services Limited): CDSL is a known Indian electronic depository. It is a critical link between investors, financial institutions, and companies, ensuring efficient securities transactions.

Step 2: Complete the Registration

Once selected, you can go ahead with the registration process. Now, if you go for NSDL, you would need to register for their service known as Speed-e while the name for CDSL service is Easiest. The steps to register for each of these are shared below.

For NSDL: Visit the NSDL website. Look for the New User Registration. Search for ‘Speed-e’ and click on Register.

For CDSL: Visit the CDSL website. Start the registration with the service called Easiest.

Enter the necessary Demat details, OTP, and account details (DP ID, Client ID, email ID, etc.) to complete the process.

Step 3: Form Submission

Upon registering, you will receive the forms. Take the printout of the filled form and submit it to your broker.

Step 4: Verification

The broker checks the details and submits the form for further processing to the central depository to verify your details. This step is crucial as it involves the authentication of your information by the central authority.

Step 5: Account Activation and Transfer

Once the central depository completes and approves the verification, your account will be activated. You will receive your login credentials. Use them to access your account and initiate the transfer of shares as needed.

In 3-5 business days, you will get the transfer done. With this, you know how to transfer shares from one demat to another online.

Participants in the Transfer of Shares

If you are considering a share transfer, then you must know the participants in the process who are:

Transferor: This is the existing holder or owner of the shares. He is the one who will start the process of transferring them.

Transferee: This is the one who will receive the shares once the transfer is done. He will be the new owner of the shares.

Depository Participants (DPs): Depository participants are the entities registered with the departments like NSDL and CDSL. These offer the demat account services that assist in the transfer process.

Depositories: These are the electronic depositories that hold and maintain the securities.

Reasons for Transferring Shares Between Demat Accounts

You might need to transfer shares from one demat to another for many reasons. The most common reasons why investors go for this are as follows:

1. Consolidation of Shares

Managing multiple demat accounts is tedious. Additionally, you would be required to pay the fees to each account, which is an added cost. Hence, many investors go for account consolidation. The idea is to bring all the shares from multiple accounts to one single account with better facilities and charges.

2. Better Services

Sometimes, investors move their shares to a different demat account to take advantage of better customer service. They might be looking for advanced trading tools or lower brokerage fees and DP charges. This can greatly enhance their trading experience and potentially improve investment returns.

3. Gifting Shares

If you gift a part of your shares to your family members as a gift, then you would need to go ahead with the transfer of shares. This can also be a part of estate planning, where you need to transfer a part of your shares to your heir.

Documents Required to Transfer Shares from One Demat to Another

You need the below-mentioned documents to smoothly transfer stocks from one demat to another:

1. Delivery Instruction Slip (DIS)

This document is crucial as it authorizes the transfer of shares from one demat account to another. The transferor needs to fill out this slip, which acts much like a cheque in the banking sector, detailing the shares to be transferred.

2. Client Master Report (CMR)

Both the transferor and transferee need to provide a CMR. This document contains all the relevant details of the demat account holder, such as the account number, holder's name, and other vital information, which helps in verifying the authenticity of the account during the transfer process.

3. Know Your Customer (KYC) Documents

These are necessary if the participants have not previously completed their KYC formalities with their respective DP. This may include identification documents like a PAN card, address proof, and other relevant ID proofs to ensure compliance with regulatory requirements.

Duration of the Share Transfer Process

The timeframe for transferring shares between demat accounts varies based on the transfer method (online or offline), the services provided by the Depository Participants (DPs), and the brokers involved.

Offline transfers may take several weeks to finalize, while online transfers are usually faster, with shares typically reflected in the new demat account within 3 to 5 days. In most cases, the entire process is completed within a week

In addition to this, here are some of the aspects that you must know:

For the same-day process, submit the request before 4 PM on a business day.

The request will be taken the next business day if you submit it after this time.

Requests added on holidays, Saturdays, and Sundays will get in the process the next business day.

Any mistake in the DIS will need rectification, which will add to your entire processing time.

Is There a Charge to Transfer Shares from One Demat to Another

Yes, there are charges for transferring the shares from one demat to another. Here are the things that you should know linked to charges.

Charges

Every DP sets its charges. So, ensure to confirm the charges before you start the process or even while you open a demat account.

If you are closing the demat account, then there is a chance that no fee might be applicable.

Tax Liability

When you transfer the shares to another person as a gift, there will be a tax liability in the form of capital gains.

If you transfer it to your account, no tax liability will arise.

Mistakes to Avoid During the Transfer of Shares from One Demat to Another

When you transfer shares from one account to another, there are certain checkpoints that you must consider. These points will ensure that your process is smooth and there are no delays in processing. The mistakes to avoid are:

1. Incorrect Details on the DIS

Many people make this mistake when filling out a form or slip. You must check all the information entered in DIS. This will avoid rejections and delays in the process.

2. Not Verifying the Transferee’s Demat Account Status

It's important to check the status of the account where you are transferring shares. See if it is active and in operation. If the account is not functional, then there can be delays, and the transfer can get stuck.

3. Ignoring the Expiry Date on the DIS

DIS slips often have an expiry date. You cannot use them once the date has passed. So, before you fill it, check the date mentioned. If it is expired, ask for a new DIS book and then start the process.

4. Overlooking Required Signatures

You would need to sign the form and slip. At times, there are chances that you might miss signing at some places or that your sign does not match. Cross-check in either of the situations to ensure correctness.

5. Failing to Notify Both DPs

Both the transferor's and transferee's Depository Participants should be informed about the transfer. This helps in smooth coordination and quicker resolution of any issues that may arise.

6. Neglecting to Account for Brokerage Fees or Taxes

When you process the transfer, some charges will be applicable. Your linked account must have sufficient funds to debit the charges. Insufficient funds will reject the transfer request and cause delays.

By avoiding these mistakes, you can help ensure that your share transfer process is efficient and error-free.

How to Track the Status of Your Share Transfer Request?

Once you have applied for the transfer of shares, you will need to keep track of the progress. This is to ensure that the process is going smoothly and that any queries are addressed on time. To track the progress of the request, you can follow these methods:

Check the status of the transfer on your online platform.

Connect with your DP to get an update on the status.

Conclusion

Transferring shares from one account to another is a critical process that requires attention to detail and understanding of the procedures involved. By following the proper steps and being aware of common pitfalls, investors can ensure a smooth and efficient transfer.

No matter what your reason is, the process remains fundamentally the same. Hence, by keeping these points in mind, you can complete share transfers with confidence and ease, ensuring your investments are managed according to your needs.

And if you are looking for a better and more efficient trading experience, visit Rupeezy!

Check Out These Related Articles |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category