Post Office MIS Interest Rate 2026

00:00 / 00:00

Looking for a safe investment with guaranteed monthly payouts? The Post Office MIS interest rate 2026 stands at 7.4% per annum, making it a great choice for those who prefer stable and risk-free returns.

With the Post Office Monthly Income Scheme (POMIS), you can park your savings in a secure option and enjoy a fixed monthly income ideal for conservative investors seeking financial stability.

So, let us explore the details of the MIS interest rate here in this guide.

What is a Post Office Monthly Income Scheme?

A Post Office Monthly Income Scheme (POMIS) is a safe and secure investment option in India. The POMIS scheme is backed by the government guarantee, which is the biggest safety point for all its investors.

It provides a steady monthly income through regular interest payouts, making it ideal for those seeking predictable returns. Post Office MIS interest rate is particularly attractive to conservative investors and retirees who value stability and reliability.

Its sovereign guarantee offers capital protection, ensuring that investors receive their principal amount along with interest, thus providing a stable financial foundation. This scheme is managed by the Indian postal service, offering a hassle-free investment experience.

Currently, under the Post Office Monthly Income Scheme latest interest rate is at 7.4% PA.

Key Features of POMIS

Fixed tenure of 5 years; principal can be withdrawn or reinvested.

7.4% per annum (2026) interest rate, payable monthly.

Minimum investment Rs.1,000, maximum Rs.9 lakh (single), Rs.15 lakh (joint).

Can be held by 1 to 3 individuals.

Full amount can be reinvested in a new POMIS account after maturity.

Nominee receives benefits in case of the account holder's demise.

Can be transferred between post offices across India.

Market-independent, offering fixed returns with no market fluctuations.

Interest earned is taxable as per income tax slab; no TDS deduction.

Available for resident Indians above 18 years; minors (10+) can open with parental consent.

Post Office MIS Interest Rate 2026 and Details

The interest rate for the Post Office monthly income scheme as of 2026 is 7.4% per annum, payable monthly. Below is a table summarizing the details:

Feature | Details |

Interest Rate | 7.4% per annum |

Payout | Monthly |

Minimum Investment | Rs.1,000 |

Maximum Investment (Single) | Rs. 9,00,000 |

Maximum Investment (Joint) | Rs. 15,00,000 |

Account Tenure | 5 Years |

POMIS Interest Rate History

The Post Office Monthly Income Sheme's latest interest rate is 7.4% PA. But do you know what the rates were in the previous years? Well, let us quickly check the interest rates for the previous years, starting from 2015:

Effective Period | MIS Interest Rate |

21-01-2015 to 31-03-2015 | 8.40% |

01-04-2015 to 31-03-2016 | 8.40% |

01-04-2016 to 30-09-2016 | 7.80% |

01-10-2016 to 31-03-2017 | 7.70% |

01-04-2017 to 30-06-2017 | 7.60% |

01-07-2017 to 31-12-2017 | 7.50% |

01-01-2018 to 30-09-2018 | 7.30% |

01-10-2018 to 31-12-2018 | 7.70% |

01-01-2019 to 31-03-2019 | 7.70% |

01-04-2019 to 30-06-2019 | 7.70% |

01-07-2019 to 30-09-2019 | 7.60% |

01-10-2019 to 31-12-2019 | 7.60% |

01-01-2020 to 31-03-2020 | 7.60% |

01-04-2020 to 30-09-2022 | 6.60% |

01-10-2022 to 31-12-2022 | 7.10% |

01-01-2023 to 31-03-2023 | 7.10% |

01-04-2023 to 31-03-2024 | 7.40% |

Post Office MIS Interest Rate for Senior Citizens

Most of the investment options offer better returns to senior citizens. However, in POMIS, senior citizens receive the same interest rate of 7.4% per annum.

However, if they want a secured option with higher interest, the Senior Citizens Savings Scheme (SCSS) is an option for them.

Post Office MIS Account Opening Details

To open the POMIS account, here are the details that you must know:

Residency: Only resident Indians can open a POMIS account.

Age: Adults above 18 years can open an account. Minors above 10 years can also open accounts with parental consent.

Guardianship: Minors or individuals with unsound mind can have an account managed by their guardian.

A few additional conditions that you must know are:

As the account holder reaches the age of 18, the account should be transferred from minor to major.

You can open a single or a joint account.

For a joint account, there can be a maximum of 3 people in one account.

The deposit limit for the account is mentioned in the table below:

Account Type | Minimum Deposit Amount (Rs.) | Maximum Deposit Limit (Rs.) |

Single | 1,000 | 9,00,000 |

Joint | 1,000 | 15,00,000 |

The documents that are required for the account are:

Document Type | Description |

Identity Proof | Aadhaar Card, Passport, Driving License, Voter ID |

Address Proof | Utility bills, Bank statements, Government-issued documents |

Age Proof | Birth Certificate, Passport, Government-issued documents |

Photographs | Two recent passport-sized photographs |

Nominee Details | Nominee's name, address, and relationship with the account holder |

POMIS Form | Submit the complete form with all the documents and signatures |

PAN and Aadhaar Specific Guidelines

In addition to the above, here are certain aspects that you must keep in mind in link to the PAN and Aadhar card:

As of recent regulations, the Ministry of Finance has made it mandatory to provide both Aadhaar and PAN details when opening a new POMIS account. Here are the key points regarding this requirement:

1. Aadhaar Requirement: If you don't have an Aadhaar number, you must provide proof of enrollment or an enrollment ID at the time of account opening. You must then submit your Aadhaar number within six months of opening the account.

2. Existing Account Holders: If you have an existing POMIS account and haven't submitted your Aadhaar number, you must do so within six months from April 1, 2023.

3. PAN Requirement: PAN is mandatory under certain conditions:

If the account balance exceeds Rs.50,000.

If the aggregate credits in the account exceed Rs.1 lakh in any financial year.

If the total withdrawals and transfers from the account exceed Rs.10,000 in a month.

In these cases, PAN must be submitted within two months of the event occurring.

This requirement aims to ensure compliance with financial regulations and prevent discrepancies in account details.

How to Open a Post Office Monthly Income Scheme?

MIS Post Office Interest Rate is quite great. But have you ever wondered how you can apply for this scheme most effectively and simply? Well, do not worry, let us take you through the steps here;

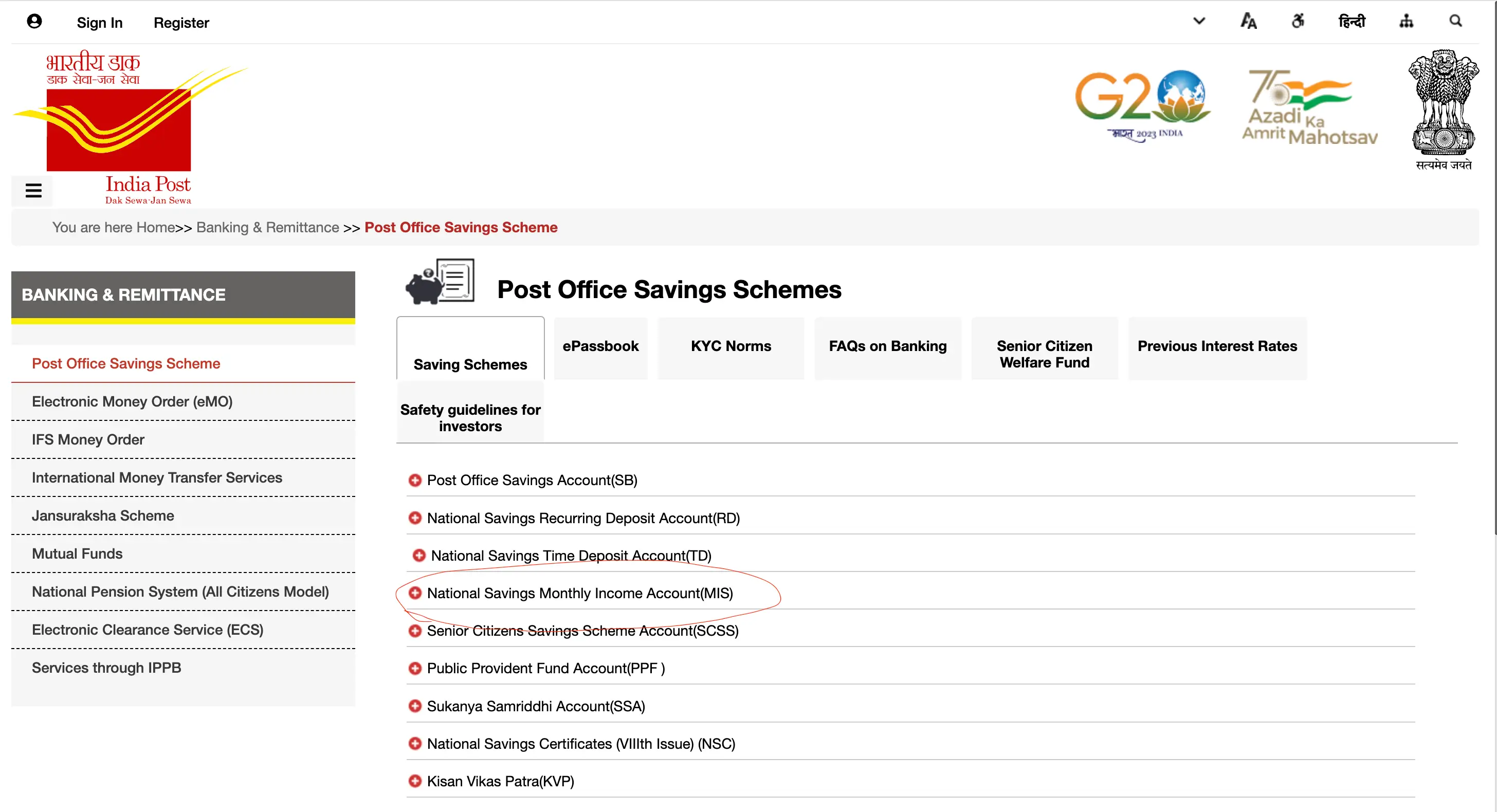

Visit your nearest post office and get a Post Office Monthly Income Scheme account opening form. You can also download it through the India Post website.

Fill in the necessary details in your POMIS account application form with accurate information.

Submit the duly filled application form along with the documents mandated.

Make an initial deposit through cash or cheque.

Collect the Passbook and now your account is open.

Now that you know how the POMIS account can be opened, you must be wondering how it actually works. So, let us check the same here with an example.

Example: Single Account

Meet Mr. Kumar, who is looking for a secure investment option to supplement his monthly income. He decides to invest Rs.2,000 in the Post Office Monthly Income Scheme (POMIS), which offers a fixed monthly payout based on the interest rate.

Investment Amount: Rs.2,000

Interest Rate: 7.4% per annum

Tenure: 5 years

Benefits:

Mr. Kumar receives Rs.12.33 every month for 5 years, providing him with a steady income stream.

At maturity, he gets back his principal amount of Rs.2,000.

Mr. Kumar can choose to withdraw his monthly interest directly from the post office or have it credited to his savings account via ECS. He can also accumulate the interest for a few months and withdraw the total amount at once, though this option doesn't earn additional interest.

POMIS Rules and Other Conditions

The Post Office MIS interest rate 2026 makes it a reliable investment, but understanding the rules on withdrawals, interest payments, and taxation is crucial before investing. Here’s what you need to know:

1. Withdrawal and Closure

After Maturity: The account can be closed after 5 years by submitting a withdrawal application and the passbook at the post office. The principal amount is then returned to the account holder.

Before Maturity: Premature withdrawal is allowed but comes with penalties:

If withdrawn after 1 year but before 3 years, a 2% deduction applies.

If withdrawn after 3 years but before 5 years, a 1% deduction applies.

Withdrawal is not allowed within the first year.

2. Interest Payment

Interest is paid monthly and can be withdrawn or transferred to a savings account. If interest is left unclaimed, no additional interest is earned on it.

3. Nomination Facility

A nominee can be added at the time of opening the account or later. In case of the account holder’s demise, the nominee will receive the entire investment and accrued interest.

4. Taxation on POMIS Income

No Tax Benefits: The scheme does not qualify for tax deductions under Section 80C.

No TDS Deduction: Interest earned is not subject to TDS.

Taxable Income: Interest is taxed based on the investor’s income tax slab. If the total income is below the taxable limit, no tax is levied.

Understanding these rules helps investors make informed decisions while ensuring smooth withdrawals and returns from the scheme.

Benefits of Post Office MIS

Now that you know the POMIS interest rate details, here is a quick view of the benefits that you will get:

Guaranteed Returns: Fixed monthly income at 7.4% per annum.

Zero Risk: Backed by the Government of India.

Multiple Accounts Allowed: Open in both single and joint names.

Nomination Facility: Can be transferred to legal heirs.

Premature Closure Option: Flexibility to withdraw with minimal penalty.

Quick Comparison: POMIS, MF, and FD

While you plan to make an investment, there must be hundreds of questions before you. Same is the case with POMIS investment too. Yes, the Post Office Monthly Income Scheme interest rate is great. But what makes it better than the rest? Well, here is a quick comparison for you to help you make the right decision:

Feature | POMIS | Mutual Funds (MF) | Fixed Deposits (FD) |

Investment Type | Fixed Income | Diversified Portfolio (Equity, Debt) | Fixed Deposit |

Risk Profile | Low | Moderate to High | Very Low |

Potential Returns | Fixed, Lower | Higher, Not Guaranteed | Fixed, Lower |

Liquidity | Limited, Penalty for Premature Withdrawal | Generally High | High, Penalty for Early Withdrawal |

Taxation | Taxable as per Income Tax Slab | Capital Gains and Dividends Taxed | Taxable, TDS Applicable |

Investment Management | Government-managed | Professionally Managed | Self-managed |

Investment Horizon | Fixed at 5 Years | Varies by Scheme | Fixed Tenure |

Diversification | Single Investment | Diversified Portfolio | Single Investment |

Interest Rate | 7.4% p.a. (Post Office MIS interest rate 2026) | Varies with Market Performance | Varies by Bank and Tenure |

From this comparison, it is quite clear that POMIS is comparatively safer and helps build wealth as well. So, if you are looking for portfolio expansion then this is the best.

Conclusion

The Post Office Monthly Income Scheme (MIS) 2026 continues to be a safe and reliable investment choice for individuals looking for stable monthly income. With an interest rate of 7.4% per annum, it is particularly beneficial for retirees, conservative investors, and those seeking risk-free returns. By understanding the eligibility, rules, and benefits, investors can make informed decisions and leverage this scheme for financial security.

FAQs

Q. What is the current Post Office MIS interest rate for 2026?

The Post Office Monthly Income Scheme (POMIS) interest rate for 2026 is 7.4% per annum, payable monthly.

Q. Is the POMIS interest rate fixed for 5 years?

Yes, the interest rate remains fixed for the 5-year tenure of the scheme. However, for reinvestment after maturity, the applicable interest rate at that time will apply.

Q. Is the interest earned from POMIS taxable?

Yes, the interest earned is taxable as per the investor’s income tax slab, but no TDS is deducted at the source.

Q. Can the POMIS interest be withdrawn monthly?

Yes, interest is paid every month and can be withdrawn manually or transferred to a savings account via ECS.

Q. Will the Post Office MIS interest rate change in the future?

The interest rate is reviewed quarterly by the government and may change based on economic conditions, but once an account is opened, the rate remains fixed for the entire tenure.

Check Out These Related Articles |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category