Is Regaal Resources IPO Good or Bad – Detailed Review

00:00 / 00:00

Regaal Resources Limited’s IPO is kicking off its initial public offering, which will be open from August 12, 2025, to August 14, 2025. While considering applying for this IPO, certain questions may arise in your mind, including whether the Regaal Resources IPO is good or bad, whether it is worth investing in this IPO, and so on.

This article offers a comprehensive Regaal Resources IPO review, covering its business operations and fundamental analysis to help you make an informed investment choice.

Regaal Resources IPO Review

Regaal Resources Limited's IPO is coming up with a total issue size of Rs 306 crore, comprising a fresh issue of Rs 210 crore and an Offer for Sale (OFS) of Rs 96 crore by its promoters and promoter group. The IPO is open for subscription from August 12 to August 14, 2025, with a price band of Rs 96 to Rs 102 per share and a lot size of 144 shares. The company plans to use the fresh issue proceeds primarily for the repayment or prepayment of certain outstanding borrowings and for general corporate purposes.

Regaal Resources Limited is a manufacturer of maize-based specialty products, including native starch, modified starch, and various value-added products. The company's manufacturing facility is strategically located in Kishanganj, Bihar, a major maize cultivation hub. As of May 31, 2025, the company had an installed crushing capacity of 750 tonnes per day and operates a Zero Liquid Discharge (ZLD) plant, a key sustainability feature. Its customer base is diversified, serving industries such as food and beverage, paper, textiles, and animal feed.

Financially, Regaal Resources has shown a strong growth trend. Revenue from operations increased by 52.52% in fiscal 2025 to Rs 915.16 crore, following a significant increase of 22.97% in fiscal 2024. The company has consistently grown its Profit After Tax (PAT), which increased from Rs 16.76 crore in fiscal 2023 to Rs 47.67 crore in fiscal 2025, representing a robust CAGR of approximately 68.6%. The company's debt-to-equity ratio has decreased from 2.65 in fiscal 2024 to 2.08 in fiscal 2025. Its Return on Equity (RoE) has also consistently improved, reaching 20.25% in fiscal 2025. However, it has experienced negative cash flows from operations in the past.

Key strengths of the company include its strategic manufacturing location, a sustainable and efficient plant, a diversified product portfolio, and an experienced management team. The company's RoE and RoCE are higher than its key listed peers, although its debt-to-equity ratio is also higher. However, potential investors should be aware of certain risks, such as a reliance on a limited number of suppliers and customers, a geographical concentration of sales in a few regions, and the ongoing promoter litigation. The IPO presents an opportunity for the company to deleverage its balance sheet and continue its growth trajectory in India's expanding maize-based products market.

Company Overview of Regaal Resources Limited

Regaal Resources Limited is a manufacturer of maize-based specialty products, including native starch, modified starch, value-added products like maize flour, icing sugar, baking powder, and custard powder, and co-products such as maize germ and gluten. The company's manufacturing facility is located in Kishanganj, Bihar, a major maize cultivation hub. This strategic location provides a significant advantage by ensuring a consistent supply of raw materials. The company operates a Zero Liquid Discharge (ZLD) plant, a sustainable feature that sets it apart from many competitors.

The company's customer base is diversified, serving industries such as food and beverage, paper, textiles, and animal feed. They have a structured business model based on 3 broad segments such manufacturers of end products, manufacturers of intermediate products, and distributors or wholesale traders. It maintains a widespread sales network across India and exports its products to countries like Bangladesh, Nepal, and Malaysia. Over the years, Regaal Resources has consistently expanded its installed crushing capacity, reaching 750 tonnes per day (TPD) as of May 31, 2025.

Regal incurs 45.46% of the revenue from the top 10 customers, 27.26% from the top 5 customers, and 16.80% from the top 3 customers for the fiscal year 2025. Native maize starch accounts for 59.29% of the sales (before discounts), 21.78% from co-products, 16.84% from others (includes traded maize), 1.59% from value-added products, and 0.50% from modified starch.

Industry Overview of Regaal Resources Limited

The Indian maize-based specialty products and ingredient solutions market can witness high growth due to rising population, accelerating urbanisation, increasing disposable incomes, and a significant shift in consumer preferences towards packaged and convenience foods.

India's maize production grew at a CAGR of 7.3% between fiscal year 2020 and fiscal year 2025, rising from 28.8 million tonnes to 42.3 million tonnes. The country ranks as the sixth-largest maize producer globally. The Indian native maize starch market size, in terms of volume, grew from 4.36 million tonnes in 2019 to 5.18 million tonnes in 2024. It is projected to grow at a CAGR of 4.40% to reach 6.43 million tonnes by 2029. The modified starch market is also expected to grow at a healthy CAGR of 5.87% between 2024 and 2029.

The demand for maize-derived products is particularly robust across various end-user industries:

Food and Beverage: This is a key driver, with the consumption of maize flour, starches, and other derivatives rising due to the growth of the bakery industry and ready-to-eat food products.

Animal Feed: The rapidly expanding poultry and animal nutrition sectors are major consumers of maize and its co-products, such as gluten and fiber.

Paper and Textiles: Maize-based starches are widely used as binders and sizing agents to improve the quality and strength of paper and fabrics.

Biofuel: The push by the Indian government to increase the ethanol content in gasoline is driving up the demand for maize-based ethanol.

Overall, the industry outlook is positive, with several players investing in capacity expansion and product diversification to cater to this growing demand.

Financial Overview of Regaal Resources Limited

Particulars | March 31, 2025 | March 31, 2024 | March 31, 2023 |

Revenue from Operations (Rs in Crores) | 915.16 | 600.02 | 487.96 |

EBITDA (Rs in Crores) | 112.79 | 56.37 | 40.67 |

EBITDA Margin (%) | 12.32% | 9.39% | 8.34% |

PAT (Rs in Crores) | 47.67 | 22.14 | 16.76 |

PAT Margin (%) | 5.19% | 3.68% | 3.43% |

RoE (%) | 20.25% | 17.49% | 16.05% |

RoCE (%) | 14.17% | 10.07% | 10.99% |

Debt to Equity Ratio | 2.08 | 2.65 | 1.68 |

The financial performance of Reegal Financials over the three fiscal years ending March 31, 2025, shows a strong trend of growth in both revenue and profitability.

Revenue from operations increased by 52.52% from Rs 600.02 crore in fiscal 2024 to Rs 915.16 crore in fiscal 2025. This followed a significant increase of 22.97% from Rs 487.96 crore in fiscal 2023 to Rs 600.02 crore in fiscal 2024, indicating consistent top-line growth.

Profit after Tax (PAT) has shown consistent and accelerated growth, increasing from Rs 16.76 crore in fiscal 2023 to Rs 22.14 crore in fiscal 2024 and further to Rs 47.67 crore in fiscal 2025. This represents a robust Compound Annual Growth Rate (CAGR) of approximately 68.6% from fiscal 2023 to fiscal 2025. The PAT margin also improved steadily over the period, rising from 3.43% in fiscal 2023 to 5.19% in fiscal 2025.

The company's debt-to-equity ratio stood at 2.08 in fiscal 2025, compared to 2.65 in fiscal 2024 and 1.68 in fiscal 2023, showing a reduction in leverage from the previous year. The Return on Equity (RoE) has consistently improved, standing at 20.25% in Fiscal 2025, compared to 17.49% in Fiscal 2024 and 16.05% in Fiscal 2023. The RoCE improved in fiscal 2025 with debt reduction.

Overall, Reegal Financials has demonstrated a clear ability to grow its profitability and improve its return on equity, supported by strong revenue growth over the past three fiscal years.

Strengths of Regaal Resources Limited

Strategic Location: The manufacturing facility is strategically located in a major maize-growing area of Bihar (Kishanganj), reducing procurement costs and logistics expenses. They can reach Nepal and Bangladesh by road. This is an exclusive advantage, as it is the only maize milling plant in the state of Bihar.

Strong Procurement Strategy: Regaal Resources has a multifaceted raw material sourcing strategy, procuring maize directly from farmers, as well as from traders and agri-distribution companies. This approach helps mitigate supply chain risks and enables the company to secure high-quality raw materials at competitive prices.

Sustainable Manufacturing Facility: The company operates a Zero Liquid Discharge (ZLD) maize milling plant, one of the few in India, which aligns with modern environmental standards. This commitment to sustainability is further evidenced by its use of a dual-feed captive power plant that can run on renewable energy sources like husk.

Diversified Product Portfolio: The company manufactures a wide range of products, including native starch, modified starches, co-products, and value-added products, catering to diverse industries such as food, paper, animal feed, and adhesives. This diversification reduces reliance on a single product or market segment.

Experienced Management: The company is led by a team of experienced promoters and professionals with extensive industry knowledge, who have successfully driven rapid growth and expansion.

Risks of Regaal Resources Limited

Promoter Litigation: A chargesheet was filed by the Economic Offences Wing, Mumbai, against one of its promoters, Anil Kishorepuria, for alleged violations of the Indian Penal Code and the Prevention of Corruption Act. An adverse order in this proceeding could have a material impact on the company's reputation and business operations.

Reliance on a Limited Number of Suppliers: The company has a significant concentration of purchases from its top 10 vendors, which constituted more than 83% of its total cost of maize in each of the last three fiscal years, and the loss of such customers could have a material adverse effect on its business.

Negative Cash Flows from Operations: The company has experienced negative net cash flows from operating activities in the past, including in Fiscal 2024 (-22.51 crore) and Fiscal 2025 (-11.20 crore). Sustained negative cash flow could adversely impact the company's ability to fund its working capital and expansion plans.

Seasonality of Raw Material: The primary raw material, maize, is seasonal, and the company does not typically enter into long-term contracts with its vendors. Any fluctuations in prices or interruptions in supply could adversely affect the company's profitability and business operations.

Geographical Concentration of Sales: A large portion of the company's sales is concentrated in specific geographic regions, with the East and North zones accounting for the majority of its domestic revenue. Any adverse economic, political, or social developments in these regions could negatively impact its business.

Strategies of Regaal Resources Limited IPO

Increase Manufacturing Capacity: The company's strategy includes a brownfield expansion to increase its installed crushing capacity from 750 TPD to 1,650 TPD in Kishanganj. This expansion is intended to capitalise on the anticipated growth in its end-user industries.

Deleveraging the Balance Sheet: The company plans to use the net proceeds from the fresh issue to repay or prepay certain outstanding borrowings, thereby reducing its debt and improving its debt-to-equity ratio. Currently, the ratio stands at 2.08 for the fiscal year 2025.

Diversify Product Portfolio: Regaal Resources aims to expand its product offerings by commencing the manufacturing of derivative products like maltodextrin powder, liquid glucose, and dextrose, as well as new modified starches.

Expand Domestic and International Footprint: The company plans to increase its market penetration in South India, which currently stands at 1.07%, and expand its presence in international markets to mitigate geographical concentration risk.

Development of White labelled business: They undertook some of the manufacturing of certain products like maize flour, baking powder, custard powder, and icing sugar as per customer specifications. The company plans to focus on this segment and looks forward to improving this business on an increasing scale.

Regaal Resources Limited IPO Peer Comparison

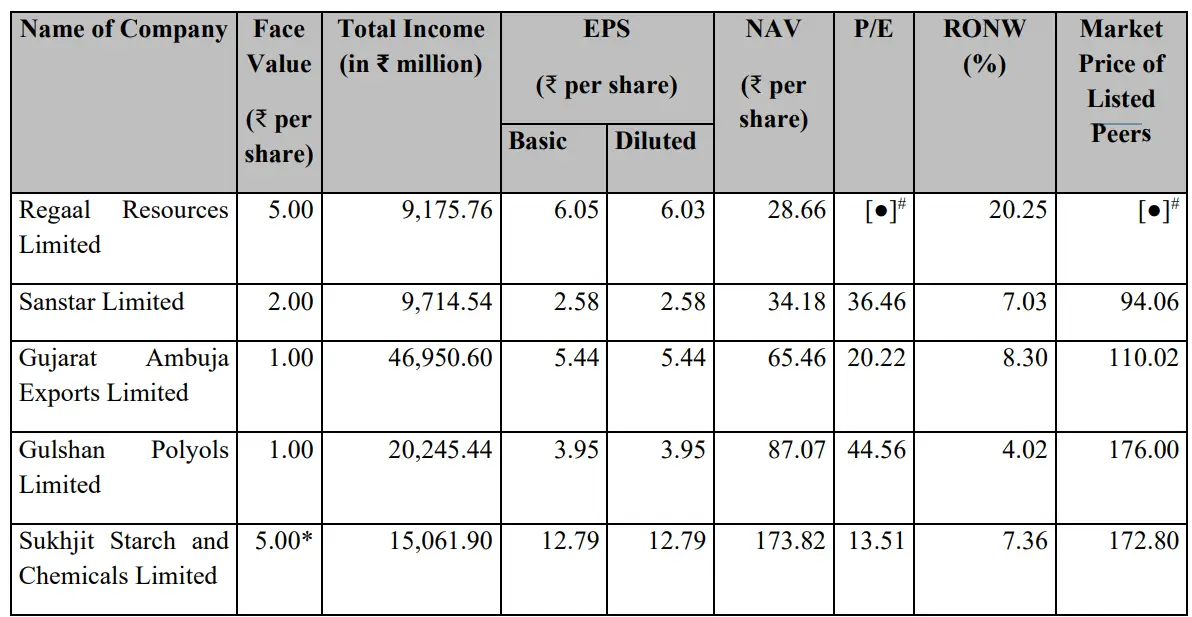

In fiscal 2025, Regaal Resources reported revenue from operations of Rs 915.16 crore, which is lower than its assessed peers, such as Gujarat Ambuja Exports Limited’s Rs 4,612.58 crore, Gulshan Polyols Limited’s Rs 2,019.67 crore, and Sukhjit Starch and Chemicals Limited’s Rs 1,497.95 crore. The company's PAT margin for fiscal 2025 was 5.19%, which is higher than most of its peers, including Gulshan Polyols Limited (1.22%) and Sukhjit Starch and Chemicals Limited (2.65%), but slightly lower than Gujarat Ambuja Exports Limited (5.31%).

Regaal Resources's Return on Equity (RoE) and Return on Capital Employed (RoCE) for Fiscal 2025 were 20.25% and 14.17%, respectively. The RoE is higher than all its listed peers, including Sanstar Limited (7.03%), Gujarat Ambuja Exports Limited (8.30%), Gulshan Polyols Limited (4.02%), and Sukhjit Starch and Chemicals Limited (7.36%). The RoCE is also higher than all of its peers, with Sanstar Limited at 9.44%, Gujarat Ambuja Exports Limited at 8.58%, Gulshan Polyols Limited at 5.79%, and Sukhjit Starch and Chemicals Limited at 9.34%.

The company's Debt to Equity ratio of 2.08 in fiscal 2025 is higher than its peers, which range from 0.04 for Sanstar Limited to 0.64 for Gulshan Polyols Limited. However, the company aims to address this by using IPO proceeds to deleverage its balance sheet. Regaal Resources stands out for its diverse product mix, which includes native and modified starches, as well as value-added products, distinguishing it from companies that may focus on fewer product categories. The company also reported a fast-growing revenue at a CAGR of 36.95% between fiscal 2023 and fiscal 2025, positioning it as a rapidly expanding player in the maize-based specialty products market.

Objectives of Regaal Resources IPO

The total issue size stands at Rs 306 crore, out of which Rs 210 crore is a fresh issue and the remaining Rs 96 crore is an offer for sale. The selling shareholders in the offer for sale are the promoter and its group, which include Anil Kishorepuria, Shruti Kishorepuria, BFL Private Limited, and SRM Private Limited.

The funds raised through the fresh issue are being utilised for,

Rs 159 crore towards repayment or prepayment of certain outstanding borrowings taken by the company.

General Corporate Purposes.

Regaal Resources IPO Details

IPO Dates

Regaal Resources IPO will be open for subscription from August 12, 2025, to August 14, 2025. The allotment of shares to investors is expected to take place on August 18, 2025, and the company is expected to be listed on the NSE and BSE on August 20, 2025.

IPO Issue Price

Regaal Resources is offering its shares in the price band of Rs 96 to Rs 102 per share. This means it requires an investment of Rs. 14,688 per lot (144 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Regaal Resources is issuing a total issue of Rs 306 crore, out of which Rs 210 crore is a fresh issue and the remaining Rs 96 crore is through an offer for sale.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on August 18, 2025, through the registrar's website, MUFG Intime India Private Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Regaal Resources will be listed on the NSE and BSE on August 20, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Regaal Resources IPO

Important IPO Details | |

Bidding Date | August 12, 2025 to August 14, 2025 |

Allotment Date | August 18, 2025 |

Listing Date | August 20, 2025 |

Issue Price | Rs 96 to Rs 102 per share |

Lot Size | 144 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category