Is Wakefit Innovations IPO Good or Bad – Detailed Review

00:00 / 00:00

Wakefit Innovations Limited’s IPO is set to open its initial public offering from December 08, 2025, to December 10, 2025. When considering applying for this IPO, potential investors might have questions about whether the Wakefit Innovations IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Wakefit Innovations IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Wakefit Innovations IPO Review

Wakefit Innovations Limited's IPO is open for subscription from December 08, 2025, to December 10, 2025, with listing expected on December 15, 2025, on NSE and BSE.

The company is the largest D2C home and furnishings solutions company in India by revenue in FY24, offering a comprehensive product range including mattresses (60.65% of H1FY26 revenue), furniture, and furnishings. Its core strength lies in its full-stack vertical integration, controlling R&D, manufacturing (with five facilities), and distribution, which ensures quality, cost control, and enables rapid product iteration based on direct consumer feedback.

Wakefit operates an extensive omnichannel network, leveraging its proprietary website and a fast-growing retail presence of 125 Company-Owned, Company-Operated (COCO) Regular Stores as of September 30, 2025. This direct model contributes significantly to higher margins and customer retention, evidenced by a 35.45% repeat purchase rate in H1FY26. The promoters, Ankit Garg and Chaitanya Ramalingegowda, hold an aggregate of 43.01% of the pre-Offer paid-up equity share capital.

The company operates within the rapidly transforming Indian Home and Furnishings market, which was valued at approximately Rs 2.8 to Rs 3.0 lakh crore in CY2024 and is projected to grow at a robust CAGR of 11% to 13% to reach Rs 5.2 to Rs 5.9 lakh crore by CY2030, driven by the shift from unorganized trade to organized, D2C, and omnichannel retail.

Wakefit Innovations’s financial performance from FY23 to FY25 reflects robust and accelerating top-line growth coupled with a strong path toward profitability. Revenue from operations grew from Rs 812.62 crore in FY23 to Rs 1,273.69 crore in FY25 (a CAGR of 25.12%).

The company has demonstrated a significant operational turnaround, with EBITDA Margin recovering from -10.55% in FY23 to 7.13% in FY25. Critically, after recording Net Losses in FY23 (Rs 145.68 crore), FY24 (Rs 15.05 crore), and FY25 (Rs 35.00 crore), the company achieved a net profit of Rs 35.57 crore in H1FY26. The company also demonstrates extremely high working capital efficiency, with Net Working Capital Days contracting sharply to 3.84 in FY25.

Strengths include being the Largest and Fastest Growing D2C Home and Furnishings Destination, a Full-Stack Vertically Integrated Operations model, a Robust Omnichannel Sales Presence driving higher margins (64.91% from own channels in H1FY26), a Comprehensive Multi-Category Product Portfolio, and High Customer Retention.

Risks include Significant Revenue Concentration in the Mattress Segment (60.65% of H1FY26 revenue), a History of Losses and Negative Cash Flow from Operating Activities (in FY23), Raw Material Price and Supply Chain Volatility due to a lack of long-term agreements, Scalability Risk from Aggressive Store Expansion (piloting Jumbo Stores), and Outstanding Indebtedness and Contingent Liabilities.

The IPO consists of a total issue of 6,60,96,866 shares valued at Rs 1,288.89 crores, comprising an Offer for Sale (OFS) of 4,67,54,405 shares (Rs 911.71 crores) and a Fresh Issue of 1,93,42,461 shares (Rs 377.18 crores). The fresh issue proceeds will be primarily used for Expenditure for lease/rent for existing COCO Stores (Rs 161.47 crores), Marketing and advertisement expenses (Rs 108.40 crores), and Capital expenditure to set up 117 new COCO Regular Stores (Rs 30.84 crores).

The shares are priced in the band of Rs 185 to Rs 195 per share, with a lot size of 76 shares.

Company Overview of Wakefit Innovations IPO

Wakefit Innovations is the largest D2C home and furnishings solutions company in India in terms of revenue in FY24, offering a wide range of products including mattresses, furniture, and furnishings through an extensive omnichannel network. The core focus is on advanced, vertically integrated design, manufacturing, and distribution, allowing complete control over product quality, cost, and the end-to-end customer experience.

The company's competitive strength is rooted in full-stack operations that integrate R&D, manufacturing including specialized processes like roll-packing for mattresses and flat-packing for engineered wood furniture, warehousing, and a direct sales approach. This vertical depth enables rapid product iteration based on direct consumer feedback and ensures quality and consistency, positioning Wakefit as a prominent player in the organized Indian home solutions market.

Wakefit Innovations operates a robust manufacturing and logistics footprint across India, with five modern manufacturing facilities located in Bengaluru (2), Hosur (2), and Sonipat (1). The sales network is strategically omnichannel, leveraging its proprietary website and a fast-growing network of 125 COCO (Company-Owned, Company-Operated) Regular Stores as of September 30, 2025.

Its core business strength is built around an integrated suite of capabilities that drives cross-selling and customer retention, as demonstrated by the strong repeat purchase rate (35.45% of total revenue from operations for the six months ended September 30, 2025). This robust product portfolio supports customers across its main business segments, including:

Mattress Segment: Specializing in foam, latex, and hybrid mattresses, along with innovative smart sleep solutions like Regul8 (temperature-regulating) and Track8 (contactless under mattress sleep tracker).

Furniture Segment: Offering beds, sofas, wardrobes, and tables crafted from engineered wood and natural wood.

Furnishings Segment: Including pillows, cushions, home essentials, and decor.

The geographic split of the revenue from operations for the six months ended September 30, 2025:

India - 99.81%

Outside India (UAE, USA, Japan, Nepal) - 0.19%

In the business-wise segment, they have 3 categories based on revenue from operations for the six months ended September 30, 2025:

Mattress Segment - 60.65%

Furniture Segment - 29.26%

Furnishings Segment - 10.09%

The Company’s Promoters are Ankit Garg and Chaitanya Ramalingegowda. Ankit Garg serves as the Chairperson, Chief Executive Officer, and Executive Director, and Chaitanya Ramalingegowda is an Executive Director. Navesh Gupta is the Chief Financial Officer with resignation effective December 31, 2025. The promoters hold an aggregate of 43.01% of the pre-Offer paid-up equity share capital on a fully diluted basis.

Industry Overview of Wakefit Innovations IPO

Wakefit Innovations Limited operates within the rapidly growing and transforming Indian Home and Furnishings market, offering a comprehensive range of solutions across the Mattresses, Furniture, and Furnishings and Decor categories. The sector is undergoing a significant shift from unorganized, local trade to organized, D2C, and omnichannel retail, driven by rising consumer awareness and demand for quality and convenience.

The Indian Home and Furnishings Market, the primary Total Addressable Market (TAM) for Wakefit, was valued at approximately Rs 2.8 to Rs 3.0 lakh crore in Calendar Year (CY) 2024 and is projected to reach Rs 5.2 to Rs 5.9 lakh crore by CY2030. This reflects a robust CAGR of 11% to 13% from CY2024 to CY2030.

The market structure in CY2024 is predominantly fragmented, with around 71% share held by the unorganized sector. However, the organized sector is accelerating its consolidation, driven by technology and brand trust. The market segments break down as follows by value as of CY2024:

Furniture Segment: Represents around 66% of the market.

Furnishings & Décor Segment: Represents around 29% of the market.

Mattress Segment: Represents around 5% of the market, with strong growth fuelled by wellness awareness.

Financial Overview of Wakefit Innovations IPO

Particulars | March 31, 2025 (Rs Crores) | March 31, 2024 (Rs Crores) | March 31, 2023 (Rs Crores) |

Revenue from Operations | 1,273.69 | 986.35 | 812.62 |

EBITDA Margin | 7.13% | 6.68% | -10.55% |

Profit after tax (PAT) | -35 | -15.05 | -145.68 |

PAT Margin | -2.75% | -1.53% | -17.93% |

Return on Equity (RoE) | -6.72% | -2.77% | -28.84% |

Return on Capital Employed (RoCE) | -0.68% | 0.27% | -20.50% |

Net working capital days | 3.84 | 6.89 | 20.44 |

Revenue from Operations has demonstrated robust and accelerating growth across the period. Revenue increased significantly from Rs 812.62 crore in FY23 to Rs 986.35 crore in FY24, a 21.38% growth YoY, before accelerating further to Rs 1,273.69 crore in FY25 translating to a 29.13% growth. This positive trend is driven by the successful execution of its multi-category and omnichannel strategy.

EBITDA Margin reflects a significant operational turnaround and improving scale efficiency. The margin recovered sharply from a deep loss of -10.55% in FY23 to 6.68% in FY24 and stabilized at 7.13% in FY25. It reached a high of 14.25% in H1FY26, demonstrating superior operational leverage gained from its full-stack vertical integration and maturing scale.

Profit After Tax (PAT) demonstrates a strong path to profitability. Net Loss reduced drastically from Rs 145.68 crore in FY23 to Rs 15.05 crore in FY24, showing a near-breakeven. The loss widened slightly to Rs 35.00 crore in FY25, primarily due to significantly higher non-cash depreciation and finance costs associated with its expanded retail and manufacturing footprint. Critically, the company reported a net profit of Rs 35.57 crore in H1FY26.

PAT Margin clearly reflects the net financial stress during the investment phase. The margin recovered dramatically from -17.93% in FY23 to -1.53% in FY24, before slightly deteriorating to -2.75% in FY25. In H1FY26, the margin reached a positive 4.91%, underscoring the success of the recent efficiency drives.

Return on Equity (RoE) demonstrates a strong recovery in capital utilization. RoE improved substantially from -28.84% in FY23 to -2.77% in FY24. Although it fell back to -6.72% in FY25.

Return on Capital Employed (RoCE) reflects the significant capital required for physical expansion. RoCE recovered from a deeply negative -20.50% in FY23 to a marginal positive 0.27% in FY24. It slightly retreated to -0.68% in FY25.

Net Working Capital Days reflects extremely high efficiency in managing operating cash flows. The cycle consistently contracted, moving sharply from 20.44 days in FY23 to 6.89 days in FY24 and further to 3.84 days in FY25. This demonstrates effective control over inventory and strong D2C collection mechanisms.

Strengths and Risks of Wakefit Innovations IPO

Let's examine the strengths and weaknesses to determine if the Wakefit Innovations IPO is a good or bad investment for investors.

Strengths

Largest and Fastest Growing D2C Home and Furnishings Destination: Wakefit is positioned as India's largest D2C home and furnishings company by revenue in Fiscal 2024. It is recognized as the fastest homegrown player among organized peers to achieve total income of over Rs 1,000 crore (Rs 986.35 crore revenue from operations) in Fiscal 2024.

Full-Stack Vertically Integrated Operations with Differentiated Processes: The company operates a full-stack integrated model controlling the entire value chain from product conceptualization, design, manufacturing with five owned facilities in Bengaluru, Hosur, and Sonipat, distribution, and sales. This model incorporates key process innovations like roll-packing technology for mattresses and flat-pack designs for furniture, optimizing logistics and reducing costs compared to traditional models.

Robust Omnichannel Sales Presence Driving Higher Margins: A significant portion of revenue is generated through the company's own channels, like website and COCO - Regular Stores, accounting for 64.91% of revenue from operations for the six months ended September 30, 2025. This direct model enables higher profit retention, enhances brand loyalty, and provides direct customer feedback, supporting the expansion to 125 COCO stores as of September 30, 2025.

Comprehensive Multi-Category Product Portfolio: Wakefit is the only D2C home and furnishings company in India to have generated over Rs 100 crore in revenue in Fiscal 2024 across all three core categories which are Mattresses, Furniture, and Furnishings and Decor. This multi-category approach maximizes customer lifetime value (CLV) through cross-selling and upselling.

High Customer Retention and Data-Driven Brand Strategy: The company demonstrates strong customer retention, with repeat customers contributing 35.45% of revenue from operations for the six months ended September 30, 2025. This is supported by a multi-faceted brand strategy, celebrated campaigns such as Sleep Internship, and continuous integration of data analytics to inform product development and personalize marketing.

Risks

Significant Revenue Concentration and Profitability Risk: The business is heavily dependent on the Mattress Segment, which constituted 60.65% of revenue from operations for the six months ended September 30, 2025. Any shift in consumer preferences or heightened competition in this single category would adversely affect the business.

History of Losses and Negative Cash Flow: The company recorded Net Losses for Fiscal 2023 (Rs 145.68 crore), Fiscal 2024 (Rs 15.05 crore), and Fiscal 2025 (Rs 35.00 crore). Additionally, the company experienced negative cash flows from operating activities in Fiscal 2023 of Rs -20.46 crore, presenting a risk to liquidity and future growth funding.

Raw Material Price and Supply Chain Volatility: The company does not have long-term agreements with suppliers for key raw materials such as chemicals, wood, and fabrics. Its dependence on both domestic and imported materials exposes it to price volatility and supply disruptions, which could strain profit margins if cost increases cannot be fully passed on to consumers.

Scalability Risk from Aggressive Store Expansion: The company's strategy involves significant capital expenditure for setting up 117 new COCO – Regular Stores and developing its first large-format COCO – Jumbo Stores. This aggressive expansion is subject to execution risks, lease liabilities, unforeseen cost overruns, and the challenge of successfully operating large-format stores without prior experience in that format.

Outstanding Indebtedness and Contingent Liabilities: The company has outstanding borrowings totalling Rs 73.76 crore as of October 31, 2025. Additionally, significant contingent liabilities amounting to Rs 8.08 crore existed as of September 30, 2025 which are primarily related to claims not acknowledged as debt, including tax matters, which, if they materialize, could negatively impact the financial condition.

Strategies of Wakefit Innovations IPO

Strategic Expansion of Retail Footprint (COCO Stores): The core strategy is to expand the retail network by setting up 117 new COCO – Regular Stores across various cities (funded by Rs 308.42 million from Net Proceeds) and piloting COCO – Jumbo Stores that are 50,000 to 200,000 square feet to offer a comprehensive, one-stop shopping experience.

Synergistic, Data-Driven Product Category Expansion: The company aims to scale its furniture business by investing in advanced machinery and launching new premium products such as the 'Plus' range) and innovative sleep tech like Regul8 or Track8, supporting its evolution into a complete home solutions brand and increasing average order value.

Enhance Brand Salience and Market Visibility: The company plans to utilize a substantial portion of the fresh issue proceeds of Rs 108.40 crore for marketing and advertising campaigns through community engagement, celebrity collaborations, and digital channels to maintain brand trust, attract new customers, and drive growth.

Leverage Technology for Customer Experience and Operational Efficiency: The strategy involves continuously enhancing the proprietary website experience, such as live video demos, personalized search, leveraging analytics for precise forecasting, and integrating technologies like RFID for real-time inventory and supply chain tracking to maintain a competitive edge.

Increase Customer Lifetime Value (CLV): The goal is to maximize the value derived from existing customers by fostering strong loyalty through high-quality after-sales support, expanding cross-selling opportunities across categories, and undertaking strategic acquisitions to broaden the service and product portfolio.

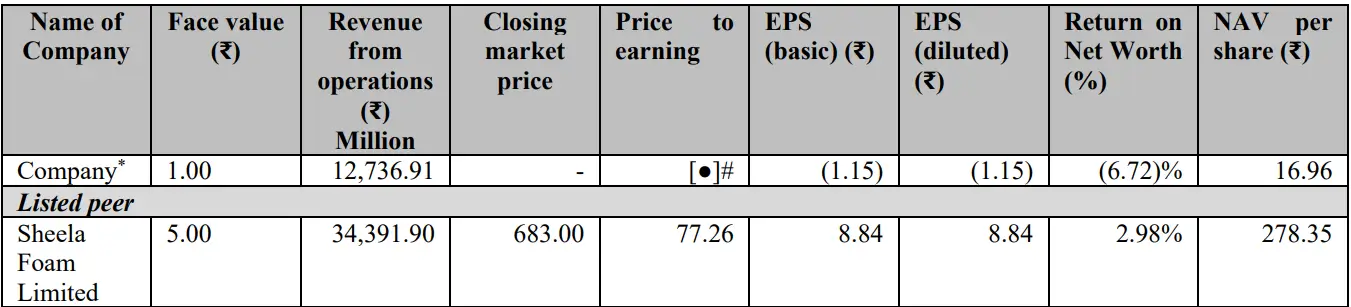

Wakefit Innovations IPO vs. Peers

In terms of core operational profitability, Wakefit Innovations' performance is mixed compared to its peers. Wakefit recorded an EBITDA Margin of 7.13% in Fiscal 2025, which is slightly below that of Sheela Foam Limited at 8.32%. This difference reflects Wakefit's intensive investment in marketing (7.56% of Revenue in FY25) and its rapid physical expansion of COCO stores, which currently carries higher overheads relative to revenue compared to an established peer.

The Company’s net financial performance is currently in a loss-making phase. Wakefit Innovations reported a PAT Margin of -2.75% in Fiscal 2025, which trails Sheela Foam Limited’s positive net margin of 2.62%. This difference is largely attributable to Wakefit's strategic business expansion phase, marked by high growth-related operating expenditures, primarily in logistics and retail infrastructure.

The impact of this high-growth, investment-heavy phase is clearly reflected in Wakefit’s capital returns profile for Fiscal 2025. The company reported a negative Return on Equity (RoE) of -6.72% and a corresponding negative Return on Capital Employed (RoCE) of (0.68%).

This profile contrasts with its listed peer, Sheela Foam Limited, which achieved a positive RoE of 2.98% and a RoCE of 5.01% in Fiscal 2025. Wakefit Innovations’ unique position as a full-stack D2C company prioritizing aggressive market capture and vertical integration investment, while managing its operational scale, accounts for this difference in financial maturity compared to its established, profitable peer.

Objectives of Wakefit Innovations IPO

The offering consists of a total of 6,60,96,866 shares worth Rs 1,288.89 crores, out of which the offer for sale of 4,67,54,405 shares is valued at Rs 911.71 crores, and the fresh issue of 1,93,42,461 shares is valued at Rs 377.18 crores. The selling shareholders in this IPO are:

Ankit Garg, Chaitanya Ramalingegowda, Nitika Goel, Peak XV Partners Investments VI, Redwood Trust, Verlinvest S.A., SAI Global India Fund I, LLP and Paramark KB Fund I will receive the offer for sale proceeds.

However, the fresh issue proceeds will be used for the following objectives:

Capital expenditure to set up 117 new COCO Regular Stores (Rs 30.84 crores)

Expenditure for lease, sub-lease rent and license fee payments for existing COCO Regular Stores (Rs 161.47 crores)

Capital expenditure for the purchase of new equipment and machinery (Rs 15.41 crores)

Marketing and advertisement expenses (Rs 108.40 crores)

Funding Inorganic growth, Acquisitions and Strategic Initiatives and General Corporate Purposes totalling Rs 61.05 crores.

Wakefit Innovations IPO Details

IPO Dates

Wakefit Innovations IPO will be open for subscription from December 08, 2025, to December 10, 2025. The allotment of shares to investors will take place on December 11, 2025, and the company is expected to be listed on the NSE and BSE on December 15, 2025.

IPO Issue Price

Wakefit Innovations is offering its shares in the price band of Rs 185 to Rs 195 per share. This means you would require an investment of Rs. 14,820 per lot (76 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Wakefit Innovations is issuing a total number of 6,60,96,866 shares valued at Rs 1,288.89 crores, out of which the fresh issue comprises 1,93,42,461 shares worth Rs 377.18 crores and the remaining 4,67,54,405 shares worth Rs 911.71 crores will be received by the selling shareholders in this IPO.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on December 11, 2025, through the registrar's website, MUFG Intime India Private Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Wakefit Innovations are expected to be listed on the NSE and BSE on December 15, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Wakefit Innovations IPO

Important IPO Details | |

Bidding Date | December 08, 2025 to December 10, 2025 |

Allotment Date | December 11, 2025 |

Listing Date | December 15, 2025 |

Issue Price | Rs 185 to Rs 195 per share |

Lot Size | 76 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category