IPO GMP - What is GMP, Risk, Key Takeaways

00:00 / 00:00

Before learning what is Grey Market Premium, it is important to know about grey market itself first. It is an unofficial market where the trading of a company’s shares happens before they are issued in the Initial Public Offering (IPO).

Grey market is a market where transactions are done privately, outside the recognized stock exchange. The Grey Market Premium (GMP) is one of the most crucial aspects of this market.

In simple terms, the grey market premium meaning is the price at which the shares are being traded in the grey market over and above the IPO price.

This premium is a strong indicator of the listing price and the demand for an IPO in the market.

Mechanics of Grey Market Premium (GMP) in IPO

GMP in IPO operates in an intriguing way. Here’s a snapshot:

Let’s say a company announces an IPO with a price band of INR 100-120.

The grey market perceives this IPO to be a great investment opportunity. Hence, the demand for this IPO increases in the grey market, and people are willing to pay an additional amount over the IPO price. This extra amount is the grey market premium.

If the GMP is INR 30, the grey market investors are willing to pay INR 130-150 (IPO price + GMP) for the shares.

It’s important to remember that these transactions are not official, and the enforcement of contracts is based on trust. The transactions are settled in cash and there are no intermediaries involved as in an IPO.

Significance of Grey Market Premium in IPO Investment

What is GMP in IPO? GMP in IPO plays a significant role in the investment decisions of individuals and institutions. Here are the key points:

It is a useful indicator of the listing gains an investor might make. If the GMP is high, it could mean that the share price may list at a higher price on the stock exchange.

A high GMP could indicate high demand for the IPO and vice versa.

However, the GMP is not always accurate, and it can be volatile. Therefore, it should not be the sole parameter for making an investment decision.

Deciphering the Grey Market Premium Trends

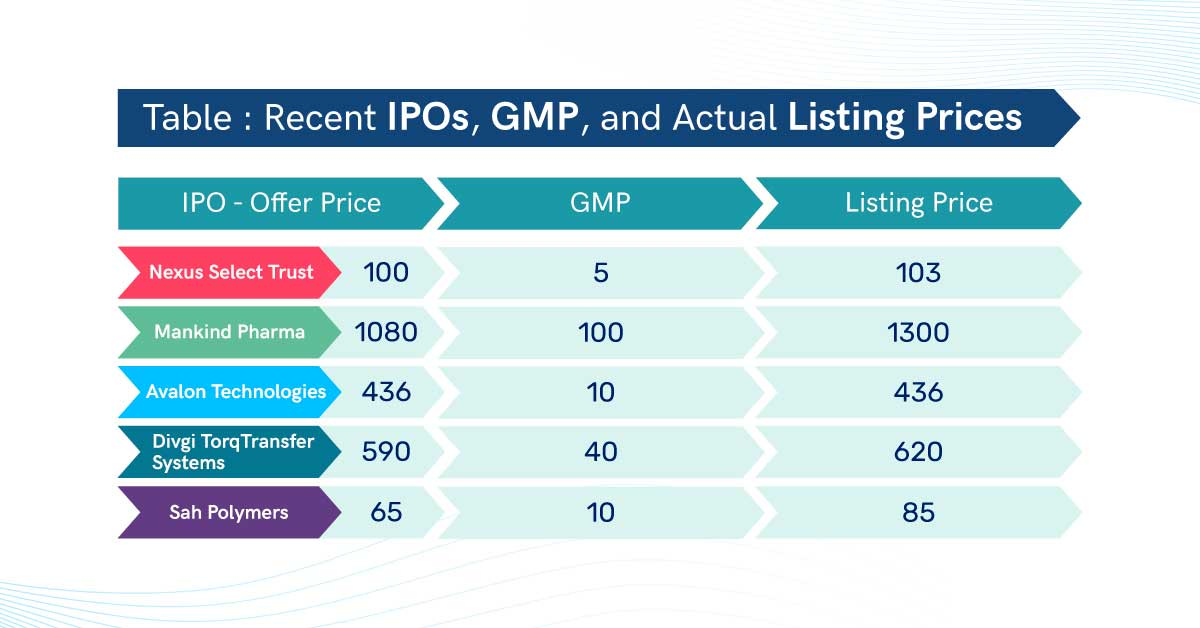

Historically, there have been instances where the grey market premium has correctly predicted the listing price of an IPO.

For example, in the case of the Burger King India IPO in 2020, the GMP was around INR 60-70, and the stock listed at a premium of 92% over the IPO price.

However, it’s essential to consider that the grey market premium can be speculative and can change rapidly.

It is influenced by various factors such as market sentiment, company fundamentals, and overall economic indicators.

Navigating the Risks of the Grey Market

Despite its benefits, the grey market premium comes with its share of risks:

It’s an unregulated market: The grey market is not regulated by any financial authorities like SEBI in India, which means contracts are not legally enforceable.

It’s susceptible to manipulation: Due to the lack of regulatory oversight, the grey market and its premium can be manipulated.

Information asymmetry: Accurate and reliable information about transactions in the grey market is hard to come by, making it difficult for investors to make informed decisions.

Indian Scenario: GMP and Its Influence

The Indian IPO market has been buzzing with activity over the past few years, with many companies choosing to go public. In such a scenario, understanding the concept of GMP becomes crucial for potential investors.

In India, the GMP has often correctly indicated the direction of the IPO listing price, though not always the exact price.

For example, the GMP for the Zomato IPO was quite high, indicating a strong listing, which indeed was the case.

However, it is essential to remember that while the GMP can provide a direction, it is not an exact science and should be used in conjunction with other research and analysis.

In Conclusion: GMP in IPO – A Tool, Not a Rule

While the grey market premium is a helpful tool for gauging market sentiment and potential listing price, it’s important for investors not to base their decisions solely on it.

It’s always recommended to carry out thorough research on the company’s fundamentals, financials, and market trends. The GMP can provide an indication but not a guarantee of the potential listing price or the future performance of the stock.

In a nutshell, the grey market premium is like a weather forecast. It can tell you if it’s likely to rain, but it cannot guarantee it, and it certainly can’t predict how much rain will fall. So, use it as a tool, but don’t forget to carry your umbrella of in-depth research and analysis!

Remember, successful investing is not just about following trends but understanding them, and the grey market premium is one such trend you would do well to understand. Open a demat account, invest in IPOs online, trade in equities, derivatives, currencies, commodities with Rupeezy.

Happy investing!

Key Takeaways

The Grey Market Premium (GMP) is the additional price over and above the IPO price that investors are willing to pay in the grey market.

GMP can be a useful tool for indicating potential listing gains and the demand for an IPO.

The GMP is not always accurate and can be quite volatile, reflecting changing market sentiments and speculations.

Despite its usefulness, GMP comes with inherent risks as the grey market is unregulated and susceptible to manipulation.

GMP should be used in conjunction with other research and analysis, not as the sole basis for investment decisions.

FAQs

Q1. How accurate is the grey market premium?

The grey market premium can give an indication of the potential listing price, but it is not always accurate. It should be used as one of many tools in making investment decisions.

Q2. Does the grey market affect IPO?

The grey market can affect the IPO in terms of sentiment. A high grey market premium could indicate strong demand for the IPO. However, it does not have any official impact on the IPO price.

Q3. How do I buy shares in the grey market premium?

Grey market transactions are typically conducted among large investors and are not open to the general public. However, if you are part of a private network or have a broker who can facilitate this, you may be able to participate.

Q4. How is the grey market price calculated?

The grey market price is essentially the sum of the IPO price and the grey market premium. If an IPO is priced at INR 100 and the GMP is INR 20, the grey market price would be INR 120.

Q5. What is the GMP rate gain IPO?

The GMP rate gain refers to the potential listing gains an investor could make based on the grey market premium. If the GMP is high, it could indicate a higher listing price for the IPO.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category