How to Check IPO Allotment Status Online

00:00 / 00:00

Once you apply for an upcoming IPO, the next thing on your mind is whether you've received an allotment. But the real question is, how and where to check IPO allotment status?

Fortunately, this process is quick and hassle-free. You can check IPO allotment through the official websites of NSE, BSE, or via the IPO registrar’s portals such as Link Intime, KFintech, or Bigshare Services.

In this article, we’ll walk you through what IPO allotment means and how to check IPO allotment status step-by-step manner.

What is IPO Allotment?

IPO allotment refers to the process by which shares are assigned to investors who have applied for them during a company's Initial Public Offering (IPO). Since demand for shares often exceeds supply, especially in popular IPOs, the allotment process ensures a fair and transparent distribution among all applicants.

Some of the common features of IPO allotment are as follows:

Allotment is based on the number of shares offered and the total bids received in each investor category (Retail, Non-Institutional Investors, Qualified Institutional Buyers).

Only valid applications with correct details and meeting the cut-off price are considered; invalid applications are rejected.

If the IPO is undersubscribed, all valid applicants receive the shares they requested.

If the IPO is oversubscribed, shares are allotted either by a lottery system or on a pro-rata basis.

Allotment is typically completed within 3-4 days after the IPO subscription period ends.

The registrar publishes a "Basis of Allotment" document detailing the allocation process and results.

Shares allotted are credited directly to the investors’ Demat accounts; refunds are issued for unallotted shares.

Unsubscribed shares in the QIB category are not available for allocation to other categories.

Where to Check IPO Allotment Status?

One of the most important things that you must know about IPO allotment status check is where you can do the same. Well, there are so many options to check for. Though the steps might vary, the basic need remains the same. So, the table below shares the brief details of the options available for you:

Platform | What is it? | Requirement to Check Status | Additional Info |

Registrar (e.g., Link Intime, KFinTech, Bigshare, Cameo) | An independent agency appointed to manage IPO applications and the allotment process. Handles application processing, share allotment, and publishes allotment status online. | PAN, Application Number, or Demat Account Number | The most direct and detailed source; each IPO has a designated registrar. |

NSE (National Stock Exchange) | Leading Indian stock exchange where IPO shares are listed; offers online allotment status check. | PAN and Application Number | Official, reliable; covers IPOs listed on NSE. |

BSE (Bombay Stock Exchange) | Major Indian stock exchange; provides online IPO allotment status facility. | PAN and Application Number | Official, reliable; covers IPOs listed on BSE. |

Depositories (NSDL, CDSL) | Organizations that hold securities in electronic form and notify investors about IPO allotment via email/SMS. | Registered Email or Mobile Number | Investors receive direct notifications after allotment. |

Now that you know the platforms to check IPO allotment status, go through the steps to do the same.

How to Check IPO Allotment Status by PAN Number

Checking your IPO allotment status using your PAN number is quick and easy. Just follow these simple steps to know whether you have received shares in the IPO.

Step 1: Visit the IPO allotment status page of the registrar (e.g., Link Intime, KFinTech, Bigshare) or the BSE website.

Step 2: Select the IPO you applied for from the dropdown list.

Step 3: Choose the option to search by PAN.

Step 4: Enter your 10-digit PAN number accurately.

Step 5: Click the “Submit” or “Search” button.

Step 6: View your allotment status on the screen.

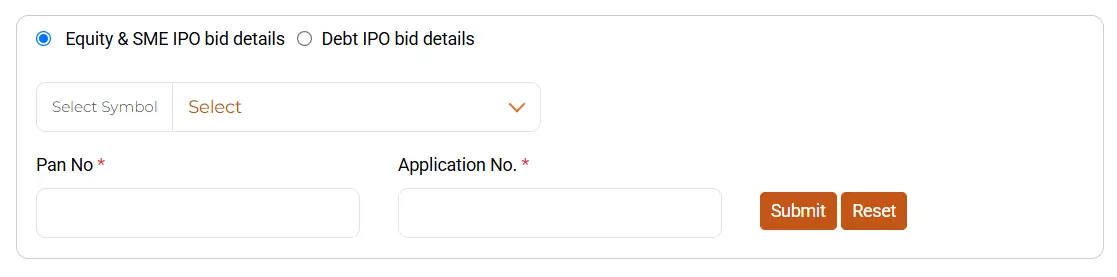

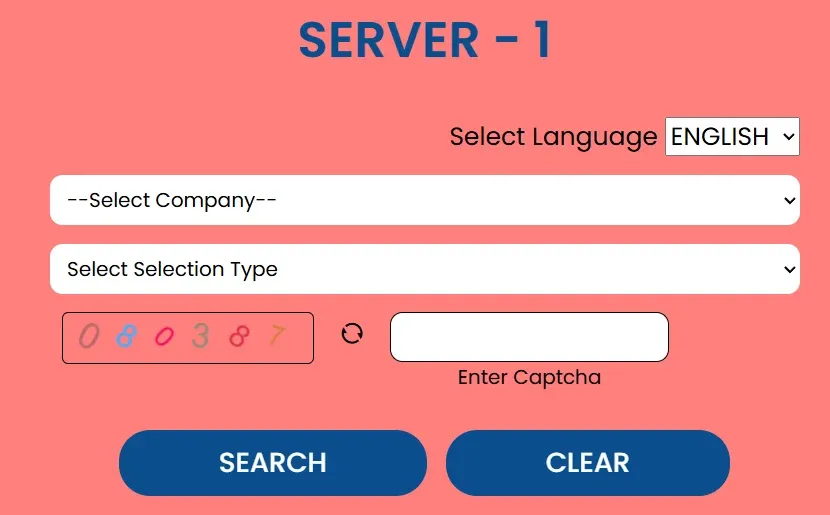

How to Check IPO Allotment Status on NSE

Once the allotment process is complete, you can easily check your IPO allotment status on the NSE website. The platform provides a quick way to verify your share allocation online.

Step 1: Visit the NSE IPO allotment status page.

Step 2: Select the IPO from the dropdown menu.

Step 3: Enter your application number.

Step 4: Complete the captcha and click “Submit.”

Step 5: View your allotment status displayed on the screen.

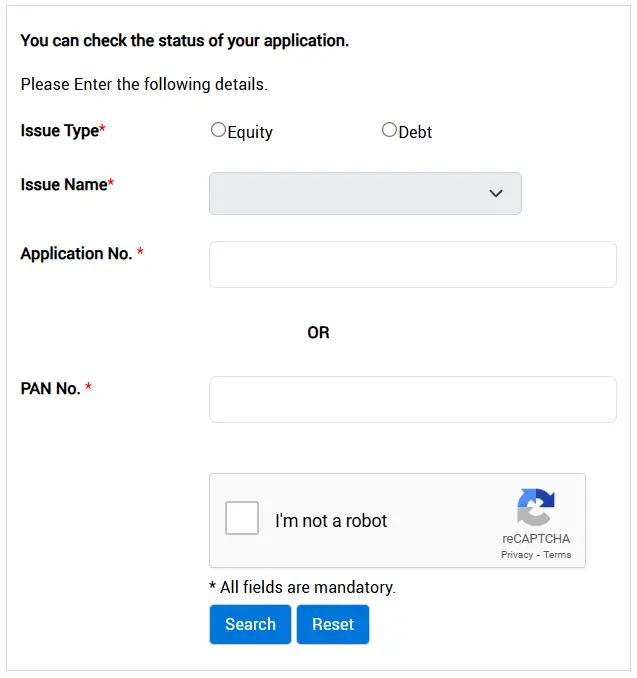

How to Check IPO Allotment Status on BSE

The BSE website offers a simple and reliable method to check your IPO allotment status. Investors can verify their share allocation by entering their PAN and application number details. The steps to follow for BSE IPO allotment check are as follows:

Step 1: Go to the BSE IPO allotment status page.

Step 2: Select “Equity” as the issue type.

Step 3: Choose the IPO name from the dropdown list.

Step 4: Enter your application number and PAN.

Step 5: Complete the captcha and click “Search.”

Step 6: Your allotment status will be displayed.

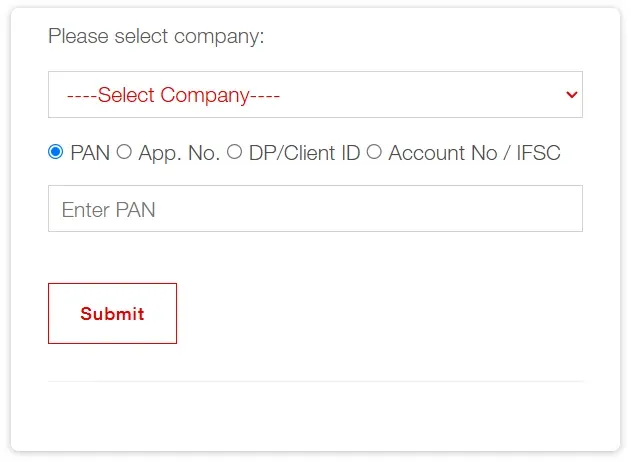

How to Check IPO Allotment on Link Intime Website

Link Intime is a leading registrar managing IPO allotments. On its website, you can quickly and securely check your allotment status by entering your PAN or application details.

Step 1: Visit the Link Intime IPO allotment page.

Step 2: Select the IPO you applied for.

Step 3: Enter your PAN, application number, or DP/Client ID.

Step 4: Click “Search” to view your allotment status.

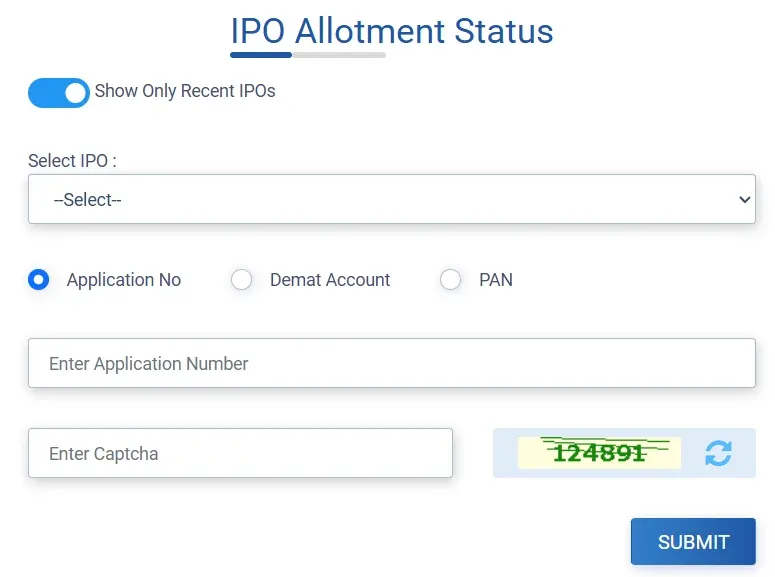

How to Check IPO Allotment Status in KFintech Website

KFinTech manages allotment for many IPOs. Their website allows investors to check allotment status easily by submitting PAN, application number, or Demat details. Here are the steps for the same:

Step 1: Go to the KFinTech IPO allotment page.

Step 2: Select the IPO name from the dropdown.

Step 3: Enter your PAN, application number, or DP/Client ID.

Step 4: Click “Submit” to check your status.

How to Check IPO Allotment on Bigshare Website

Bigshare is another registrar that provides online IPO allotment status. Investors can quickly check their share allocation by entering their PAN or application details on the Bigshare portal.

Step 1: Visit the Bigshare IPO allotment page.

Step 2: Select the IPO from the list.

Step 3: Enter your PAN, application number, or DP/Client ID.

Step 4: Click “Search” to see your allotment status.

Conclusion

The wait after applying for an IPO can be stressful. But the most important thing is that you should not be worried about how to check the IPO allotment status. In fact, you can do this easily online with the help of various options available, which are discussed here.

You just need a couple of minutes and basic details, and that's it. But while you go for IPO allotment status check, ensure you go on trusted online platforms only. This will ensure you get the right answer with no misinformation at all.

FAQs

Q1. At what time is the IPO allotment status declared?

IPO allotment status is usually released in the evening, about 3 to 4 working days after the IPO closes. The exact time may vary, but you can expect it within this duration. Always check the official registrar or stock exchange website for accurate updates.

Q2. Is the SME IPO allotment process the same as mainboard IPOs?

Yes, the basic process is the same for both SME and mainboard IPOs. However, SME IPOs are listed on different platforms like NSE Emerge or BSE SME. Now, since the subscription volumes are lower, they might get allotted sooner as compared to the rest.

Q3. On what basis is IPO allotment done?

IPO allotment depends on demand and the investor category. If oversubscribed, shares are allotted by lottery or on a proportionate basis. Only valid applications that meet all requirements, including price and documentation, are considered. The registrar releases a Basis of Allotment document for full transparency.

Q4. When can I check the IPO allotment status?

You can check the IPO allotment status 3 to 4 days after the IPO closes. The registrar updates it on their website, and stock exchanges also provide access. Once live, you can use your PAN, application number, or DP ID to view your status online.

Q5. How do I know if the IPO has been allotted to me or not?

To check if you've received an allotment, visit the registrar’s or exchange’s IPO status page. Enter your PAN or application number. If allotted, the number of shares will be shown. You may also receive an SMS or email once shares are credited to your Demat account.

Check Out These Related Articles |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category