Is Shringar House of Mangalsutra IPO Good or Bad – Detailed Review

00:00 / 00:00

Shringar House of Mangalsutra Limited's IPO is set to open its initial public offering from September 10, 2025, to September 12, 2025. When considering applying for this IPO, potential investors might have questions about whether the Shringar House of Mangalsutra IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Shringar House of Mangalsutra IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Shringar House of Mangalsutra IPO Review

Shringar House of Mangalsutra Limited's IPO is a book-built issue of Rs 400.95 crore, consisting entirely of a fresh issue of 2.43 crore equity shares. The IPO will be open for subscription from September 10 to September 12, 2025, with a price band of Rs 155 to Rs 165 per share and a lot size of 90 shares. The company plans to use the net proceeds primarily for funding its working capital requirements, amounting to Rs 280 crore, and for general corporate purposes.

Shringar House of Mangalsutra is a leading designer and manufacturer specializing in a wide variety of Mangalsutras for the business-to-business (B2B) segment. The company supplies its products, which include over 15 collections and 10,000 active SKUs, to corporate clients, wholesalers, and retailers across 24 states and four union territories in India, as well as internationally. It also offers a job-work service, processing bullion into Mangalsutras for corporate clients. The company operates a single, integrated manufacturing facility in Mumbai, combining traditional craftsmanship with modern technology.

Financially, the company has demonstrated a consistent and strong upward trend. Its revenue from operations grew from Rs 950.22 crore in Fiscal 2023 to Rs 1,429.82 crore in Fiscal 2025. The company's profitability has also improved significantly, with its net profit after tax nearly doubling from Rs 31.11 crore in Fiscal 2024 to Rs 61.14 crore in Fiscal 2025. Shringar House also has strong return metrics, with a Return on Equity (RoE) of 36.20% and a Return on Capital Employed (RoCE) of 32.43% for Fiscal 2025, both of which are the highest among its listed peers. The company has also reduced its debt-to-equity ratio, indicating a stronger balance sheet.

Key strengths of the company include its established B2B client base, specialization in Mangalsutras with a wide range of designs, and a single, integrated manufacturing facility with stringent quality control. The company's consistent financial growth and experienced promoters further contribute to its strengths.

However, potential investors should be aware of the risks, such as the company's entire revenue being dependent on a single product (Mangalsutras), a high geographical concentration of revenue in Maharashtra, and a reliance on key customers without long-term contracts. The business is also working capital-intensive and dependent on a single manufacturing facility and a network of karigars.

Company Overview of Shringar House of Mangalsutra IPO

Shringar House of Mangalsutra Limited is a leading designer and manufacturer specializing in a wide variety of Mangalsutras in India. The company's business model is focused on the business-to-business (B2B) segment, supplying its products to corporate clients, wholesalers, and retailers across 24 states and four union territories in India, as well as internationally to countries including the UK, USA, New Zealand, UAE, and the Republic of Fiji. In addition to direct sales, the company also offers a job-work service to its corporate clients, where it manufactures Mangalsutras from bullion supplied by the client. The company processed a total of 1,320.72 kgs, 1,221.19 kgs, and 870.26 kgs of bullion into Mangalsutras for Fiscal 2025, 2024, and 2023, respectively.

The company's product portfolio includes over 15 collections and more than 10,000 active SKUs, featuring various stones like American diamonds, cubic zirconia, pearls, and semi-precious stones, in 18k and 22k gold purity. The designs cater to a diverse range of customers, from traditional to contemporary, and for daily wear as well as special occasions like weddings and festivals. Shringar House of Mangalsutra operates a single, integrated manufacturing facility in Mumbai, Maharashtra, spanning 8,300 sq. ft., which combines traditional craftsmanship with modern technology like 3D printing and laser cutting. They earn 98.59% of operational revenue from Domestic, 1.37% from Exports, and the remaining 0.04% from Others as of Fiscal 2025. The promoters of the company are Chetan N. Thadeshwar, Mamta C. Thadeshwar, Viraj C. Thadeshwar, and Balraj C. Thadeshwar. The company contributed to around 6% of the organized Mangalsutra market in India in calendar year (CY) 23.

Industry Overview of Shringar House of Mangalsutra IPO

The company operates in the Indian gems and jewelry sector, with a specialized focus on the Mangalsutra market. The overall Indian jewelry market was valued at approximately Rs 4.97 lakh crore in calendar year (CY) 2023 and is projected to reach Rs 11 lakh crore by CY2032, growing at a compound annual growth rate (CAGR) of 8.8%. This growth is driven by rising disposable incomes, an increase in the number of weddings, and a growing preference for branded and certified jewelry.

The Indian Mangalsutra market specifically was valued at Rs 17,800 crore in CY23 and is expected to grow at a CAGR of 5.8% over the next decade, reaching an estimated Rs 30,300 crore by CY32. This market is primarily driven by:

Cultural Significance: The Mangalsutra is a traditional and sacred necklace, making it an essential purchase for weddings and a consistent part of the Indian jewelry market.

Design Evolution: While traditional designs still hold the largest market share (62.3% in CY23) , there is a growing demand for modern (32.4%) and customized (5.3%) Mangalsutras, particularly among younger consumers.

Material Preferences: Gold Mangalsutras dominate the market with a 52.3% share, followed by silver (31.3%) and diamond (12.3%) options, reflecting a range of consumer budgets and preferences.

Regional Demand: The market is segmented by region, with South India accounting for the largest share (39.7%), followed by West & Central India (26.9%), North India (19.7%), and East India (13.7%) as of CY23.

The Indian jewelry market is seeing a shift towards the organized sector, influenced by factors like compulsory hallmarking, GST compliance, and consumer demand for transparency. This trend is leading to market consolidation, which benefits organized players like Shringar House of Mangalsutra. The organized jewelry retail penetration in India significantly improved between CY20 and CY23.

Financial Overview of Shringar House of Mangalsutra IPO

Particulars | March 31, 2025 (Rs crore) | March 31, 2024 (Rs crore) | March 31, 2023 (Rs crore) |

Revenue from Operations | 1,429.82 | 1,101.52 | 950.22 |

EBITDA | 92.61 | 50.76 | 38.89 |

EBITDA Margin (%) | 6.48% | 4.61% | 4.09% |

Net Profit after tax | 61.14 | 31.11 | 23.36 |

Net Profit Margin (%) | 4.27% | 2.82% | 2.46% |

Return on Equity (%) | 36.20% | 25.65% | 24.84% |

Return on Capital Employed (%) | 32.43% | 21.52% | 19.46% |

Debt-Equity Ratio | 0.61 | 0.8 | 0.88 |

The financial performance of Shringar House of Mangalsutra over the three fiscal years ending March 31, 2023, 2024, and 2025 demonstrates a consistent and strong upward trend in both revenue and profitability.

Revenue from operations shows robust growth, increasing from Rs 950.22 crore in Fiscal 2023 to Rs 1,101.52 crore in Fiscal 2024, and further to Rs 1,429.82 crore in Fiscal 2025. This sustained top-line growth, with a notable 29.80% jump between Fiscal 2024 and Fiscal 2025, reflects the company's ability to scale its business and capture opportunities from market demand.

EBITDA and its corresponding margin have shown significant improvement, highlighting improved operational efficiency. EBITDA grew from Rs 38.89 crore in Fiscal 2023 to Rs 50.76 crore in Fiscal 2024, and then surged to Rs 92.61 crore in Fiscal 2025. The EBITDA margin has also expanded consistently from 4.09% in Fiscal 2023 to 6.48% in Fiscal 2025.

Profit After Tax (PAT) has followed a similar impressive trajectory. The company's net profit increased from Rs 23.36 crore in Fiscal 2023 to Rs 31.11 crore in Fiscal 2024, and then nearly doubled to Rs 61.14 crore in Fiscal 2025. The net profit margin also improved from 2.46% to 4.27% from Fiscal 2023 to Fiscal 2025, indicating better cost management.

The company's return metrics demonstrate strong capital management. Return on Equity (RoE) and Return on Capital Employed (RoCE) have both improved year-on-year, with RoE rising from 24.84% in Fiscal 2023 to 36.20% in Fiscal 2025, and RoCE increasing from 19.46% to 32.43% during the same period. This indicates the company is generating increasingly high returns from its equity and the capital it utilises.

Financially, the company's Debt-Equity Ratio has been on a downward trend, decreasing from 0.88 in Fiscal 2023 to 0.61 in Fiscal 2025. This suggests the company is becoming less reliant on debt and is strengthening its balance sheet. Overall, the financial performance of Shringar House of Mangalsutra reflects a strong and well-managed company.

Strengths and Risks of Shringar House of Mangalsutra IPO

Let's delve into the strengths and weaknesses to assess if the Shringar House of Mangalsutra IPO is good or bad for investors.

Strengths

Established B2B client base and long-standing relationships: Shringar has a strong client network built over 15 years, supplying to corporate clients, wholesalers, and retailers across 24 states in India and five countries internationally. In Fiscal 2025, the company's revenue distribution was 33.99% from corporate clients, 54.47% from retailers, and 11.50% from wholesalers, showcasing a diversified customer base.

Specialized in Mangalsutras with design innovation: The company is a specialized designer and manufacturer of Mangalsutras with a portfolio of over 15 collections and 10,000 unique store-keeping units (SKUs). This specialization allows the company to cater to diverse customer tastes, from traditional to contemporary, supported by a team of 22 in-house designers.

Integrated manufacturing facility with quality control: Operating a single, integrated facility in Mumbai, the company combines traditional craftsmanship with modern technology like 3D printing and laser cutting. This setup enables stringent, three-stage quality control checks, including the use of XRF machines, ensuring product purity and authenticity for all its hallmarked jewelry.

Consistent financial growth: The company has demonstrated robust financial performance, with revenue from operations growing at a CAGR of 22.67% between Fiscal 2023 and Fiscal 2025. Net profit after tax grew by 96.48% from Rs 31.10 crore in Fiscal 2024 to Rs 61.11 crore in Fiscal 2025, reflecting improved profitability and operational scale.

Experienced promoters and management: The company is led by experienced promoters, including Chetan N. Thadeshwar, with over 40 years of experience, a second-generation entrepreneur. The management team's deep industry knowledge helps in formulating effective business strategies, driving innovation, and maintaining strong client relationships.

Risks

Dependence on a single product: The company's entire revenue is dependent on the sale and supply of Mangalsutras. Any reduction in demand or inability to manufacture this single product could severely impact its business, financial performance, and overall cash flow.

Geographical concentration: A significant portion of the company's revenue is generated from the state of Maharashtra, which accounted for 49.50% of revenue from operations in Fiscal 2025. Adverse economic or political developments in this region could have a material impact on the company's business and financial results.

Reliance on key customers: The company lacks long-term contracts with its major clients. In Fiscal 2025, the top 1 client contributed 15.31% and the top 10 clients accounted for 39.92% of the operational revenue. The loss of any of these key customers could lead to a significant decline in revenue and adversely affect the company's financial condition.

Working capital-intensive business model: The business requires substantial working capital to finance gold procurement, which demands immediate payment, while the company extends a credit period of 15 to 25 days to its clients. Negative cash flows from operating activities were recorded at Rs (7.09) crore and Rs (14.12) crore for Fiscal 2025 and 2024, respectively.

Dependency on a single manufacturing facility and karigars: The company relies on its sole manufacturing facility in Mumbai and a network of over 100 karigars. Any disruption, slowdown, or inability to retain these skilled artisans could have a material adverse effect on production schedules and business operations.

Strategies of Shringar House of Mangalsutra IPO

Establish a pan-India supply chain network: The company plans to expand into new domestic markets by creating a pan-India supply chain model through third-party intermediaries. This strategy aims to leverage a diverse product portfolio and gain market share in currently untapped regions.

Strengthen relationships with existing clients: Shringar's strategy involves deepening engagement with existing clients by meeting their expansion needs and aiming for recurring sales. It plans to scale up operations to match the growth of organized retailers, who are key clients.

Invest in marketing and brand-building: The company intends to continue showcasing its designs at national and regional B2B exhibitions and trade shows, such as the India International Jewellery Show (IIJS) and India Gem and Jewellery Show (GJS) events. It also plans to collaborate with celebrities for product endorsements to increase brand visibility and market presence.

Augment fund-based working capital capacity: To support its growth, the company plans to allocate Rs 280 crore from the IPO proceeds towards funding its working capital requirements. This will help the company manage its inventory and trade receivables more efficiently and capitalize on market opportunities.

Focus on reducing operating costs and improving efficiency: The company's goal is to improve profitability by consistently optimizing costs and enhancing operational efficiency. This includes continuous product improvements and leveraging backward integration capabilities to increase production and minimize wastage.

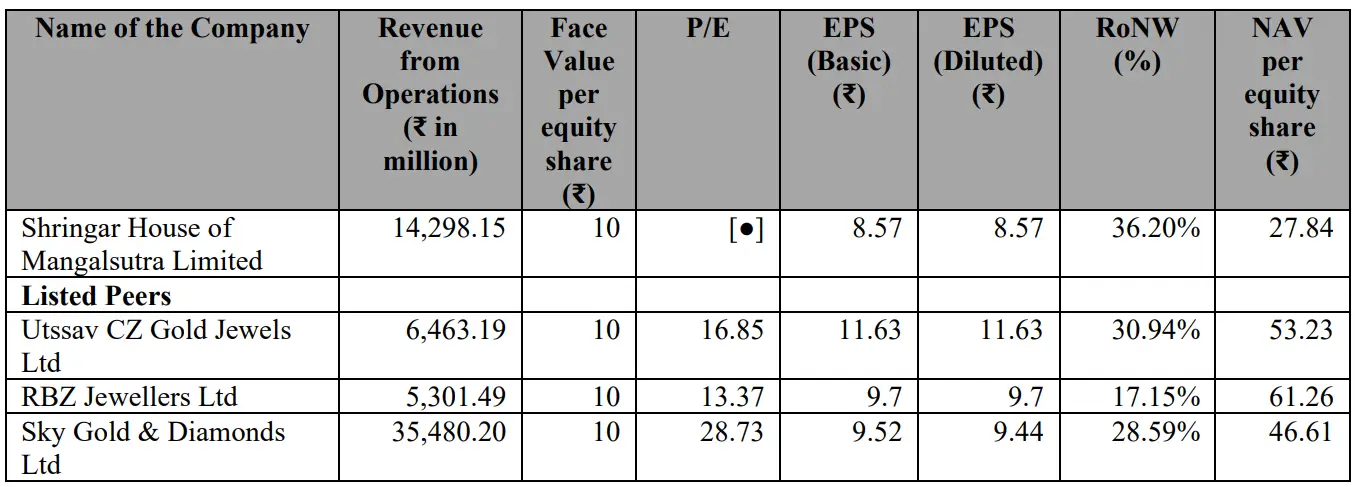

Shringar House of Mangalsutra IPO vs. Peers

Source: RHP of the company

In Fiscal 2025, Shringar House of Mangalsutra's revenue from operations was Rs 1,429.81 crore. This is significantly higher than Utssav CZ Gold Jewels Limited's Rs 646.31 crore and RBZ Jewellers Limited's Rs 530.14 crore, but lower than the industry leader Sky Gold & Diamonds Limited, which reported Rs 3,548.02 crore. Shringar's revenue from operations grew by 29.80% year-on-year in Fiscal 2025.

Shringar House's profitability metrics are strong, reflecting efficient operations. For Fiscal 2025, its EBITDA margin was 6.48%, an increase from 4.61% in Fiscal 2024. While lower than RBZ Jewellers' 12.24%, it is competitive with Sky Gold & Diamonds' 6.46% and Utssav CZ Gold Jewels' 6.24%. Its net profit margin of 4.27% is also competitive with its peers.

The company's return metrics highlight its efficient use of capital. Shringar House's Return on Equity (RoE) was 36.20% for Fiscal 2025, which is the highest among its peers, outperforming Utssav CZ Gold Jewels' 30.94%, Sky Gold & Diamonds' 28.59%, and RBZ Jewellers' 17.15%. Similarly, its Return on Capital Employed (RoCE) was 32.43%, also the highest in the peer group.

Shringar House of Mangalsutra's debt-to-equity ratio of 0.61 for Fiscal 2025 is lower than Sky Gold & Diamonds' 0.92 and Utssav CZ Gold Jewels' 1.03. This indicates a more prudent financial approach compared to some peers. Its working capital of 70 days is a bit higher than Sky Gold's 67 days, and compared to Utssav's 75 days, it is lower. However, it is significantly lower than RBZ Jewellers' 228 days.

Overall, Shringar House of Mangalsutra demonstrates a strong financial position with superior returns on capital and a healthy debt profile. Its focused specialization in Mangalsutras, while a risk, has enabled it to achieve high profitability and capital efficiency compared to its more diversified peers.

Objectives of Shringar House of Mangalsutra IPO

The offer comprises only a fresh issue. The fresh issue will fund the company's ongoing requirements worth Rs 400.95 crore, and the proposed to be utilised for:

Funding the working capital requirements of the company, amounting to Rs 280 crores.

General corporate purposes.

Shringar House of Mangalsutra IPO Details

IPO Dates

Shringar House of Mangalsutra IPO will be open for subscription from September 10, 2025, to September 12, 2025. The allotment of shares to investors will take place on September 15, 2025, and the company is expected to be listed on the NSE and BSE on September 17, 2025.

IPO Issue Price

Shringar House of Mangalsutra is offering its shares in the price band of Rs 155 to Rs 165 per share. This means you would require an investment of Rs. 14,850 per lot (90 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Shringar House of Mangalsutra is planning to issue fresh issue totalling 2,43,00,000 shares, which are worth Rs 400.95 crores.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on September 15, 2025, through the registrar's website, MUFG Intime India Private Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Shringar House of Mangalsutra will be listed on the NSE and BSE on September 17, 2025.

IPO Grey Market Premium (GMP)

As per Investor Gain, the shares of Shringar House of Mangalsutra GMP stood at 15.15% higher from the upper band price of Rs 165 dated 09th September 2025 at 3:32 P.M. The estimated profits from the upper price band and total number of shares in a lot translate to Rs 2,250. The Shringar share is expected to list at a premium of Rs 190 per share.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Shringar House of Mangalsutra IPO

Important IPO Details | |

Bidding Date | September 10, 2025 to September 12, 2025 |

Allotment Date | September 15, 2025 |

Listing Date | September 17, 2025 |

Issue Price | Rs 155 to Rs 165 per share |

Lot Size | 90 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category