Is Shadowfax Technologies IPO Good or Bad – Detailed Review

00:00 / 00:00

Shadowfax Technologies Limited’s IPO is set to open its initial public offering from January 20, 2026, to January 22, 2026. When considering applying for this IPO, potential investors might have questions about whether the Shadowfax Technologies IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Shadowfax Technologies IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Shadowfax Technologies IPO Review

Shadowfax Technologies Limited’s IPO is open for subscription from January 20, 2026, to January 22, 2026, with the company expected to list on the NSE and BSE on January 28, 2026.

Shadowfax Technologies Limited is a technology-led third-party logistics (3PL) company headquartered in Bengaluru, Karnataka. Incorporated in 2015, the company provides an end-to-end logistics platform for India’s digital commerce ecosystem through an asset-light, crowdsourced model. As of September 30, 2025, Shadowfax serviced 14,758 pin codes across India, catering to e-commerce, quick commerce, food delivery platforms, D2C brands, and on-demand mobility players.

The company’s core business spans express logistics, hyperlocal delivery, and specialised logistics services. Express services, including forward deliveries, reverse pickups, and same-day deliveries, form the largest revenue contributor at nearly 69% of operating revenue.

Hyperlocal services support 10–30 minute delivery requirements for quick commerce and food platforms, while specialised services include critical logistics and dark-store operations. Shadowfax operates India’s largest gig-based last-mile network among 3PL players, with over 200,000 active delivery partners, enabling rapid scalability without heavy capital investment.

Shadowfax operates in India’s fast-growing technology-led logistics and digital commerce supply chain industry. Structural tailwinds such as rapid digital adoption, the rise of D2C brands, and consumer preference for instant delivery are driving strong demand. India’s quick commerce GMV is projected to grow at 50–62% CAGR between FY25 and FY30, while e-commerce shipment volumes are expected to grow at 23–27% CAGR, creating a long runway for organised 3PL players like Shadowfax.

Despite these strong industry tailwinds, logistics remains a low-margin and execution-intensive business. Sustained value creation will depend on Shadowfax’s ability to improve operating margins, diversify its client base, and manage scale-related operational risks.

Shadowfax Technologies’ financial performance reflects a strong turnaround and improving profitability.

While the turnaround in profitability is encouraging, investors should note that margins are still relatively thin. With adjusted EBITDA margins below 3%, the company has limited buffer against cost inflation or unexpected operational disruptions.

Revenue from operations grew from Rs 1,415.12 crore in FY23 to Rs 2,485.13 crore in FY25, supported by expansion in express and hyperlocal services.

Adjusted EBITDA turned positive from a loss of Rs 101.65 crore in FY23 to Rs 48.67 crore in FY25, with margins improving to 1.96% and further expanding to 2.86% in H1FY26.

The company achieved full-year profitability in FY25 with a PAT of Rs 6.43 crore, which strengthened to Rs 21.04 crore in H1FY26 alone.

Return on Equity (RoE) improved from -80.90% in FY23 to 0.97% in FY25, reaching 3.03% in H1FY26, indicating better capital efficiency as scale improves.

Key strengths of Shadowfax include its full-stack, technology-driven logistics platform, market leadership in reverse logistics and 3PL quick commerce by order volume, high capital efficiency with a Capital Turnover Ratio of 3.96x, and a strong proprietary AI-based technology moat that optimises routing, partner allocation, and fraud detection. The company’s asset-light and crowdsourced model provides flexibility and scalability in a highly competitive market.

However, investors should be mindful of risks such as high client concentration, with the top five customers accounting for over 74% of FY25 revenue, thin operating margins that remain sensitive to fuel, wage, and lease costs, operational risks in reverse logistics, and potential regulatory changes affecting gig workers, which could increase compliance and partner costs.

The Rs 1,907 crore IPO comprises a fresh issue of Rs 1,000 crore and an Offer for Sale (OFS) of Rs 907 crore by existing investors, including Flipkart, IFC, Qualcomm, and Mirae Asset funds. Proceeds from the fresh issue will be used for network infrastructure expansion, lease payments, branding and marketing, inorganic acquisitions, and general corporate purposes.

The IPO is priced in a band of Rs 118 to Rs 124 per share, with a lot size of 120 shares. Overall, Shadowfax Technologies presents itself as a high-growth, technology-led logistics player transitioning into sustained profitability, offering investors exposure to India’s rapidly expanding digital commerce and quick commerce ecosystem, albeit with execution and margin-related risks to monitor.

Company Overview of Shadowfax Technologies IPO

Shadowfax Technologies Limited is a technology-led third-party logistics (3PL) company headquartered in Bengaluru, Karnataka. Incorporated in 2015, the company specialises in providing a full-stack logistics platform for digital commerce through an asset-light, crowdsourced model. Operating with a service network that reached 14,758 Indian pin codes as of September 30, 2025, the company facilitates logistics for e-commerce, quick commerce, food marketplaces, and on-demand mobility segments.

Core Business & Market Position

The company's primary business involves:

Providing express logistics, including forward parcel delivery, reverse pickups, and same-day "Prime" deliveries for e-commerce and D2C brands.

Operating a massive hyperlocal network to support the 3PL requirements of quick commerce and food delivery platforms within 10–30 minute windows.

Managing specialised logistics services such as critical logistics for high-value items and strategic dark store operations for slotted fulfillment.

Leveraging a crowdsourced fleet of over 200,000 active delivery partners allows for high scalability without the burden of heavy fixed-asset ownership.

The table illustrates the segment-wise revenue growth of Shadowfax Technologies Limited on a restated consolidated basis.

Particulars | Six Months ended Sept 30, 2025 (Rs Crore) | % of Revenue from Operations | Financial Year ended March 31, 2025 (Rs Crore) | % of Revenue from Operations |

Express Service Revenue | 1,238.73 | 68.60% | 1,716.09 | 69.05% |

Hyperlocal Service Revenue | 359.35 | 19.90% | 513.24 | 20.65% |

Other Logistics Services Revenue | 207.57 | 11.50% | 255.8 | 10.30% |

Total Revenue from Operations | 1,805.64 | 100.00% | 2,485.13 | 100.00% |

Operational Efficiency: The Capital Turnover Ratio for the Company stood at 3.96x for the Financial Year ended March 31, 2025, which is the highest among its listed 3PL peers in India.

Market Share: As of H1FY26, Shadowfax has expanded its market share in the express service line to approximately 23%, establishing itself as a market leader in reverse pickup shipments and 3PL quick commerce solutions by order volume.

Promoters and Leadership: The promoters of the company are Abhishek Bansal and Vaibhav Khandelwal. The leadership is headed by Abhishek Bansal, who serves as the Chairman, Managing Director, and Chief Executive Officer, supported by Vaibhav Khandelwal as the Whole-Time Director and Chief Technology Officer.

Industry Overview of Shadowfax Technologies IPO

Shadowfax Technologies Limited operates within the technology-led logistics and third-party logistics (3PL) industry in India, with a specific focus on the digital commerce ecosystem. The sector functions against a structural backdrop of rapid digitalization, shifting consumer preferences toward speed and convenience, and an expanding ecosystem of D2C (Direct-to-Consumer) brands. The Company's business environment is deeply rooted in the demand for integrated supply chain solutions that bridge the gap between online platforms and end-consumers across e-commerce, quick commerce, and on-demand hyperlocal segments.

Industry Outlook

Market Segment | Value as of FY25 | FY30 (Projected) | CAGR (FY25–FY30) |

Quick Commerce GMV | Rs 0.53 lakh crore | Rs 4.0 - 6.0 lakh crore | 50% - 62% |

E-commerce Shipments (Volume) | 490 - 530 crore | 1,500 - 1,600 crore | 23% - 27% |

Key Market Driving Factors

Expanding Digital Funnel: The primary demand driver is the growth of India's online shopper base, projected to reach 365–430 million by FY30. This is fuelled by affordable smartphones, low data costs, and government-led initiatives like the India Stack and Digital India.

Convenience-Led Consumption: A fundamental shift in consumer behaviour toward instant gratification is driving the quick commerce surge. High urban density and time-constrained lifestyles in Tier-1 cities have made 10–30 minute delivery windows a standard expectation rather than a luxury.

Rise of the D2C and SME Ecosystem: The proliferation of direct-to-consumer brands and small-to-medium enterprises requiring specialised logistics, such as quality-checked reverse pickups and same-day delivery, has expanded the addressable market for agile 3PL players.

Unbundling of Supply Chains: Major horizontal e-commerce platforms and captive logistics arms are increasingly outsourcing specialized legs of their operations (such as last-mile delivery and reverse logistics) to 3PL providers to manage peak demand and reduce fixed overheads.

Gig Economy and Fleet Scalability: The logistics industry is benefiting from a vast pool of gig workers, projected to reach 24 million by FY30. This allows players to maintain a flexible, variable-cost workforce that can scale in real-time based on fluctuating demand patterns.

Financial Overview of Shadowfax Technologies IPO

Particulars | Six Months ended September 30, 2025 (Rs Cr) | Financial Year ended March 31, 2025 (Rs Cr) | Financial Year ended March 31, 2024 (Rs Cr) | Financial Year ended March 31, 2023 (Rs Cr) |

Revenue from Operations | 1,805.64 | 2,485.13 | 1,884.82 | 1,415.12 |

Adjusted EBITDA | 51.56 | 48.67 | 19.29 | -101.65 |

Adjusted EBITDA Margin | 2.86% | 1.96% | 1.02% | -7.18% |

Profit after Tax / (Loss) | 21.04 | 6.43 | -11.88 | -142.64 |

Return on Equity (RoE) | 3.03% | 0.97% | -2.82% | -80.90% |

Revenue from Operations has shown a strong growth trajectory with significant historical scaling. Revenue increased by approximately 33.19% from Rs 1,415.12 crore in FY23 to Rs 1,884.82 crore in FY24, driven primarily by the expansion of the express service line and increased pin code coverage. In FY25, revenue continued its upward momentum to stand at Rs 2,485.13 crore, representing a growth of 31.85% YoY, supported by robust demand in the hyperlocal and quick commerce segments.

Adjusted EBITDA has shown remarkable recovery and structural improvement, transitioning from losses to consistent gains over the observed period. Adjusted EBITDA improved significantly from a loss of Rs 101.65 crore in FY23 to a profit of Rs 19.29 crore in FY24, marking a key inflection point for the company. In FY25, Adjusted EBITDA grew to Rs 48.67 crore, representing an exceptional YoY growth of 152.28%. This turnaround highlights the effectiveness of the company’s cost-optimization strategies and the inherent scalability of its crowdsourced model.

Adjusted EBITDA margin reflects a consistent structural leap in operational profitability. The margin expanded sharply from -7.18% in FY23 to 1.02% in FY24. In FY25, the company further strengthened its operational efficiency, reporting a margin of 1.96%. For the six months ended September 30, 2025, the Adjusted EBITDA margin continued its expansion to reach 2.86%.

Profit/loss after tax has exhibited a significant path toward stability and strength. The company successfully narrowed its losses from Rs 142.64 crore in FY23 to Rs 11.88 crore in FY24, a reduction of 91.67%. In FY25, Shadowfax achieved full-year profitability, reporting a PAT of Rs 6.43 crore. This momentum accelerated significantly in the first half of the current fiscal year, with the company reporting a PAT of Rs 21.04 crore for the six months ended September 30, 2025.

Return on Equity (RoE) demonstrates a rapid improvement in capital utilization efficiency as the company scales. The RoE improved from a deep negative of -80.90 in FY23 to -2.82% in FY24, eventually turning positive at 0.97% in FY25. For the six months ended September 30, 2025, the RoE stood at 3.03%, reflecting the company’s ongoing transition into a self-sustaining and profitable technology-led logistics enterprise.

Strengths and Risks of Shadowfax Technologies IPO

Let's examine the strengths and weaknesses to determine if the Shadowfax Technologies IPO is a good or bad investment for investors.

Strengths

Agile and Customizable Technology-Led Logistics: Shadowfax is the only 3PL player of scale in India offering a comprehensive full-stack platform that services both end-to-end e-commerce delivery and last-mile solutions for quick commerce and food delivery. This versatility allows the Company to provide a faster go-to-market for diverse enterprise clients.

Largest Last-Mile Gig-Based Infrastructure: The Company operates India’s largest crowdsourced last-mile delivery fleet among 3PL e-commerce players. As of September 30, 2025, the platform leveraged 205,864 average quarterly unique transacting delivery partners, providing unparalleled scalability without the high fixed costs of a traditional workforce.

Extensive Nationwide Network with Asset-Light Model: Shadowfax has built a massive network encompassing 14,758 pin codes through 4,299 touchpoints and 53 sort centers. By leasing all logistics facilities and linehaul trucks while owning the automation technology, the Company achieved a high Capital Turnover Ratio of 3.96x in FY25.

Market Leadership in Complex High-Growth Segments: As of FY25, Shadowfax is a dominant market leader in specialized logistics segments, including reverse pickup shipments (returns with doorstep quality checks) and 3PL quick commerce solutions, where its order volume consistently outpaces industry peers.

Proprietary AI Moat: The Company’s in-house tech stack, including SF Maps (address intelligence for non-standard Indian addresses) and Frodo (delivery partner lifecycle management), enables optimized routing and supply-demand matching, which significantly reduces misrouting and delivery failures.

Risks

Substantial Client Concentration: The Company is heavily dependent on a few key commercial relationships. Its largest client contributed 48.91% of revenue in H1FY26, and the top five clients accounted for 74.11% of total revenue in FY25. The loss of any major platform like Flipkart or Meesho would materially impact financial stability.

Vulnerability of Non-Exclusive Gig Workforce: Shadowfax relies on a crowdsourced network of delivery partners with whom it has no exclusive arrangements. Shifts in worker availability, demands for higher incentives, or the entry of new competitors for gig labor could disrupt operations and escalate partner expenses.

Low Margin Profile and Sensitivity to Costs: Despite reaching profitability in FY25, the Company operates on thin Adjusted EBITDA margins (2.86% in H1FY26). Escalating fuel prices, lease costs, or wage inflation could reverse recent gains and result in continued losses or negative cash flows.

Operational Risks in Reverse Logistics: A significant portion of the business involves high-complexity reverse pickups. In H1FY26, lost or damaged shipment costs amounted to Rs 148.2 crore, driven by operational errors or mishandling, which directly erodes the bottom line as volumes scale.

Regulatory Shifts in Gig Economy Laws: Proposed changes to Indian labor laws, such as the Code on Social Security, 2020, could require the Company to contribute toward social security for gig workers, potentially increasing employee and compliance costs significantly.

Strategies of Shadowfax Technologies IPO

Consistent Market Share Expansion Driven by Deepening Customer Relationships: Shadowfax focuses on expanding its wallet share with existing clients and acquiring new ones across its service portfolios. A key priority is growing its presence with D2C brands and SMEs, as these clients typically offer superior yield profiles and value the company’s technology-driven customization and speed.

Continue to Expand Service Portfolio: The Company aims to launch and scale specialized logistics solutions to serve a broader spectrum of industries. This includes developing capabilities for banking, financial services and insurance (BFSI), parcel deliveries, cross-border parcel movements, and expanding the large and heavy shipment supply chain for e-commerce clients.

Continue to Strengthen and Expand the Network: Shadowfax plans to deepen its infrastructure by increasing pin code coverage and enhancing supply chain capacity at strategic locations. A significant portion of the Fresh Issue is dedicated to network infrastructure, including the commissioning of automated cross-belt sorters at six key sortation centers to increase throughput and reduce manual errors.

Continue to Invest in Technology: To maintain its competitive edge, the Company will continue developing its proprietary platform. Strategic focus areas include enhancing generative AI capabilities for resource allocation and demand forecasting, as well as strengthening the SF Shield module to improve network security and fraud detection across all supply chain nodes.

Enabling EV Fleets and Sustainability: Responding to client demand for sustainable solutions, the company is building a three-way marketplace for electric vehicles. Shadowfax aims to transition its biker fleet to predominantly EVs within the next five years and plans to open offline EV centers in high-demand areas to provide delivery partners with easy access to vehicle rentals.

Inorganic Growth Through Strategic Acquisitions: The company intends to pursue acquisitions that build specialized vertical capabilities and expand its geographical reach. This follows the successful acquisition of CriticaLog in 2025, which strengthened the Company’s ability to handle high-value and time-critical shipments. A portion of the IPO proceeds is specifically allocated for such unidentified inorganic initiatives.

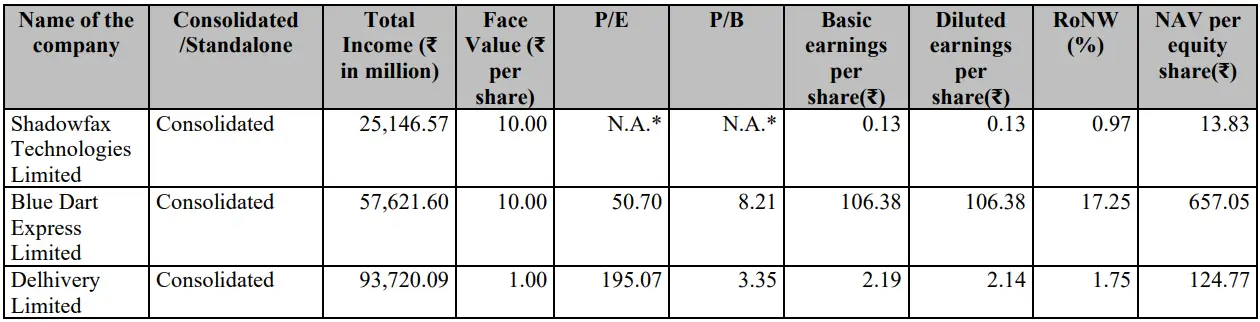

Shadowfax Technologies IPO vs. Peers

Shadowfax Technologies Limited reported revenue from operations of Rs 2,485.13 crore in FY25. On a restated consolidated basis, the Company's revenue is lower compared to its larger listed peer group, which includes Delhivery Limited (Rs 8,931.90 crore) and Blue Dart Express Limited (Rs 5,720.18 crore). This comparison indicates that while Shadowfax is a high-growth technology-led player, its current scale is smaller than that of these established market leaders.

In terms of core operating profitability, the Company's Adjusted EBITDA Margin for FY25 stood at 1.96%. The Adjusted EBITDA margin is higher than that reported by its key listed peer, Delhivery Limited (1.65%), indicating a competitive edge in operational efficiency despite its smaller scale. Blue Dart, with its premium air-express model, does not have a directly comparable adjusted EBITDA metric provided in the same context, but Shadowfax’s ability to maintain a positive and growing margin reflects its successful transition toward profitability.

The Company is working toward improving its capital efficiency, reflected by a Return on Equity (RoE) of 0.97% in FY25. While this is currently lower than the RoE of its peer group for the same period, Blue Dart Express (17.25%) and Delhivery Limited (1.75%), it represents a significant turnaround from the negative RoE of -80.90% reported in FY23. This improving trajectory highlights the evolving profitability and capital-efficient nature of Shadowfax’s crowdsourced business model as it scales within the Indian logistics market.

Objectives of Shadowfax Technologies IPO

The IPO comprises a total issue of 15,38,12,096 shares aggregating to Rs 1,907 crore. Of this, 8,06,45,161 shares worth Rs 1,000 crore are being issued as a fresh issue, while the remaining 7,31,66,935 shares valued at Rs 907 crore are offered through an offer for sale (OFS).

The OFS proceeds will be received by the selling shareholders, which include Flipkart Internet Private Limited, Eight Roads Investments Mauritius II Limited, International Finance Corporation, Qualcomm Asia Pacific Pte. Ltd., Nokia Growth Partners IV, L.P., NewQuest Asia Fund IV (Singapore) Pte. Ltd., Mirae Asset–Naver New Growth Fund I, and Mirae Asset–GS Retail New Growth Fund I.

The company plans to utilise the proceeds from the fresh issue for the following purposes:

Capital Expenditure towards network infrastructure: Rs 423.43 crore

Lease Payments for new first mile centers, last mile centers and sort centers: Rs 138.64 crore

Branding, Marketing and Communications Cost: Rs 88.57 crore

Unidentified inorganic acquisitions and general corporate purposes: Rs 349.36 crore

Shadowfax Technologies IPO Details

IPO Dates

The Shadowfax Technologies IPO date window for subscription opens on January 20, 2026, and closes on January 22, 2026. The allotment of shares to investors will take place on January 23, 2026, and the company is expected to be listed on the NSE and BSE on January 28, 2026.

IPO Issue Price

The Shadowfax Technologies IPO share price is set in the price band of Rs 118 to Rs 124 per share. This means you would require an investment of Rs. 14,880 per lot (120 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Shadowfax Technologies plans to raise Rs 1,907 crore through its IPO by issuing 15,38,12,096 shares, comprising a Rs 1,000 crore fresh issue and a Rs 907 crore offer for sale, with the latter benefitting the selling shareholders.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on January 23, 2026, through the registrar's website, Kfin Technologies Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Shadowfax Technologies are expected to be listed on the NSE and BSE on January 28, 2026.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Shadowfax Technologies IPO

Important IPO Details | |

Bidding Date | January 20, 2026 to January 22, 2026 |

Allotment Date | January 23, 2026 |

Listing Date | January 28, 2026 |

Issue Price | Rs 118 to Rs 124 per share |

Lot Size | 120 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category