Is Pace Digitek IPO Good or Bad – Detailed Review

00:00 / 00:00

Pace Digitek Limited's IPO is set to open its initial public offering from September 26, 2025, to September 30, 2025. When considering applying for this IPO, potential investors might have questions about whether the Pace Digitek IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Pace Digitek IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Pace Digitek IPO Review

Pace Digitek Limited is an Indian company that provides integrated solutions in the telecom infrastructure industry, with a focus on telecom towers and optical fiber cables. The company’s business is diversified across three main verticals: telecommunications, energy, and information and communication technology (ICT). The company has a presence in several Indian states and also operates in Myanmar and Africa.

The IPO is a fresh issue of 3,74,04,018 shares, aggregating to Rs 819.15 crore. The price band is set at Rs 208 to Rs 219 per share, with a lot size of 68 shares. The IPO will be open from September 26, 2025, to September 30, 2025, and the company is expected to be listed on the NSE and BSE on October 6, 2025. The company plans to use the net proceeds from the fresh issue for funding capital expenditure to set up a BESS (Battery Energy Storage Systems) project awarded by Maharashtra State Electricity Distribution Company Limited for its subsidiary and for general corporate purposes.

Financially, the company has shown robust growth. Revenue from operations increased significantly from Rs 503.19 crore in Fiscal 2023 to Rs 2,438.78 crore in Fiscal 2025. This growth was primarily driven by a large 4G saturation project. Profit after tax (PAT) also saw a remarkable increase from Rs 16.53 crore to Rs 279.10 crore over the same period. The company's EBITDA and PAT margins have also shown a consistent upward trend. While the company's return metrics like RoE and RoCE have shown strong performance, they have also fluctuated. The debt-to-equity ratio has decreased to 0.13 in Fiscal 2025, indicating a lower reliance on debt.

Key strengths of Pace Digitek include its position as an integrated, end-to-end solutions provider, a strong and healthy order book of Rs 7,633.6 crore as of March 31, 2025, and a demonstrated track record of profitable growth. The company also benefits from advanced manufacturing and technical expertise, with three facilities in Bengaluru. However, the company is exposed to several risks, including a high customer concentration (top 10 customers contributing over 90% of revenue in the last three fiscal years), heavy dependence on government and public sector projects, and potential working capital and liquidity challenges as evidenced by negative operating cash flow in Fiscal 2025.

Company Overview of Pace Digitek IPO

Pace Digitek Limited is a company that provides solutions in the telecom infrastructure industry, with a focus on telecom towers and optical fiber cables. The company undertakes manufacturing, installation, and commissioning services of products, as well as providing operation and maintenance services for sites, including tower erection and laying optical fiber cables as part of turnkey solutions. The company has expanded its operations to include products, projects, and services across three main business verticals: telecommunications, energy, and information and communication technology (ICT).

The company's business verticals include:

Telecommunications: Pace Digitek provides end-to-end integrated solutions in telecom tower infrastructure and optical fiber cables (OFC). This includes manufacturing equipment for the telecom industry, offering operations and maintenance (O&M) services, and executing turnkey projects for tower erection and OFC networks.

Energy: The company undertakes solar energy projects, including the solarization of telecom towers, and provides battery energy storage systems (BESS) solutions. These projects are executed on a 'build, own, and operate' or 'engineering, procurement, and construction' (EPC) basis. Additionally, it manufactures and supplies lithium-ion battery systems and other power management solutions.

Information, Communication, and Technology (ICT): The company offers customized surveillance systems, smart classrooms, and smart kiosks for agricultural initiatives.

Pace Digitek has a strong presence in several Indian states and has also expanded its operations internationally to Myanmar and Africa. The company has six subsidiaries, including a step-down subsidiary. Its subsidiary, Lineage Power Private Limited, manufactures and supplies integrated power management systems for telecom sites. Another subsidiary, Pace Renewable Energies Private Limited, is involved in renewable energy projects, including solar and BESS solutions.

As per the provided financial information for Fiscal 2025, the company's telecommunications segment accounts for 94.22% of the revenue, followed by energy at 5.59%, and ICT/Others at 0.19%. The company has a demonstrated track record of growth, with revenue from operations increasing from Rs 503.19 crores in Fiscal 2023 to Rs 2,438.78 crores in Fiscal 2025.

Industry Overview of Pace Digitek IPO

Pace Digitek is a multi-disciplinary solutions provider with a strong focus on the telecom infrastructure industry, particularly on telecom towers and optical fibre cables (OFC). The company provides a range of products and services, including manufacturing, installation, commissioning, and operation & maintenance (O&M) of telecom sites, as part of its turnkey solutions. The business is structured around three main verticals, and the outlook is as follows:

Telecommunications: The Indian telecom sector, in which Pace Digitek operates, is the second largest globally by subscriber count, and the industry has seen significant growth in data consumption, driven by factors like the rollout of 4G and 5G services, affordable smartphones, and increasing rural internet penetration. The optical fibre EPC industry, a key component of this sector, was valued at approximately Rs 84,000 crore in fiscal 2024 and is projected to grow to Rs 13,500 to Rs 14,000 crore by fiscal 2028, a CAGR of 12.5% to 13.5% driven by the increasing demand for high-speed internet and government projects like BharatNet.

Energy: The solar renewable energy sector in India is also expanding rapidly, with India ranking third globally in solar power capacity. Solar power capacities are expected to reach 170 to 180 GW over the fiscal years 2026 to 2030, driven by strong government backing and schemes like the PM Surya Ghar Yojana.

The company's performance is highly reliant on a small number of customers and is concentrated in specific geographical regions. Its top 10 customers contributed over 90% of its revenue in each of the past three fiscal years. As of March 31, 2025, the company had a healthy order book of Rs 7,633.6 crore.

Financial Overview of Pace Digitek IPO

Particulars | March 31, 2025 (Rs in crores) | March 31, 2024 (Rs in crores) | March 31, 2023 (Rs in crores) |

Revenue from Operations | 2,438.78 | 2,434.49 | 503.2 |

EBITDA | 505.13 | 423.75 | 39.75 |

EBITDA Margin (%) | 20.71% | 17.41% | 7.90% |

Profit after tax | 279.1 | 229.87 | 16.53 |

PAT Margin (%) | 11.44% | 9.44% | 3.29% |

Return on Equity (RoE) (%) | 23.09% | 40.53% | 4.93% |

Return on Capital Employed (RoCE) (%) | 37.89% | 40.85% | 6.99% |

Debt-Equity Ratio (in times) | 0.13 | 0.87 | 0.57 |

The financial performance of Pace Digitek over the three fiscal years ending March 31, 2023, 2024, and 2025 demonstrates a strong and consistent growth trend across all key areas.

Revenue from Operations shows a robust upward trend, increasing from Rs 503.20 crore in Fiscal 2023 to Rs 2,434.49 crore in Fiscal 2024, and then to Rs 2,438.78 crore in Fiscal 2025. This substantial growth, particularly between Fiscal 2023 and 2024, is primarily attributed to a 4G saturation project awarded by a public sector telecom company, which significantly increased the company’s revenue from EPC (Engineering, Procurement, and Construction) projects.

EBITDA and its corresponding margin highlight strong operational efficiency. EBITDA increased significantly from Rs 39.75 crore in Fiscal 2023 to Rs 423.75 crore in Fiscal 2024, and then to Rs 505.13 crore in Fiscal 2025. The EBITDA margin also shows a positive trend, rising from 7.90% in Fiscal 2023 to 17.41% in Fiscal 2024, and further to 20.71% in Fiscal 2025. This consistent growth in margin indicates improved operational profitability.

Profit After Tax (PAT) has shown consistent and remarkable growth. The company's net profit increased from Rs 16.53 crore in Fiscal 2023 to Rs 229.87 crore in Fiscal 2024, and then to Rs 279.10 crore in Fiscal 2025. The PAT margin also saw a significant upward trend, increasing from 3.29% in Fiscal 2023 to 9.44% in Fiscal 2024, and further rising to 11.44% in Fiscal 2025.

The company's return metrics demonstrate a mix of strong and declining performance. Return on Equity (RoE) shows a significant increase from 4.93% in Fiscal 2023 to 40.53% in Fiscal 2024, before dropping to 23.09% in Fiscal 2025. Conversely, Return on Capital Employed (RoCE) shows a strong performance in Fiscal 2024, increasing from 6.99% in Fiscal 2023 to 40.85% in Fiscal 2024, before declining to 37.89% in Fiscal 2025.

Financially, the company's Debt-Equity Ratio has fluctuated, rising from 0.57 in Fiscal 2023 to 0.87 in Fiscal 2024 and back down to 0.13 in Fiscal 2025. The decrease in 2025 suggests the company is becoming less reliant on debt. Overall, the financial performance of Pace Digitek reflects a company with significant revenue and profit growth, but with fluctuating return metrics that need a deeper look.

Strengths and Risks of Pace Digitek IPO

Let's delve into the strengths and weaknesses to assess if the Pace Digitek IPO is good or bad for investors.

Strengths

Integrated, end-to-end solutions provider: The company has evolved from a telecom equipment manufacturer to a provider of fully integrated, end-to-end solutions in the telecom infrastructure sector. Its capabilities span from manufacturing power management systems and lithium-ion batteries to executing turnkey projects, including tower erection and optical fiber cable laying, as well as providing ongoing operation and maintenance (O&M) services.

Diversified business segments and strong order book: Pace Digitek operates across three key verticals, namely telecom, energy, and ICT, which helps mitigate reliance on a single sector. The company's diversified business model is supported by a strong and healthy order book of Rs 7,633.6 crore as of March 31, 2025, providing multi-year revenue visibility.

Robust financial performance: The company has a demonstrated track record of profitable growth, with a significant increase in revenue from operations, EBITDA, and profit after tax (PAT) over the last three fiscal years. In Fiscal 2025, the company achieved an EBITDA margin of 20.71% and a PAT margin of 11.44%. Its financial risk profile has also improved, with a reduced debt-to-equity ratio of 0.13 as of March 31, 2025.

Advanced manufacturing and technical expertise: The company operates three manufacturing facilities in Bengaluru, which are certified with various quality and environmental management systems and have achieved CMMI Level 3 certification. It also has an in-house R&D team that works on improving system design and expanding its product offerings.

Experienced management: The company is guided by qualified promoters and a technically proficient senior management team with deep industry knowledge, which is crucial for operating in a complex and R&D-intensive industry.

Risks

High customer concentration: A significant portion of the company's revenue is derived from a limited number of key customers. The top 10 customers have contributed over 90% of revenue from operations in the last three fiscal years, making the company vulnerable to customer dependency risk.

Dependence on government and public sector projects: Pace Digitek's business is heavily reliant on contracts from government and public sector entities, which it secures through a tender-based process. This exposes the company to risks such as intense competition, bureaucratic delays, and the potential for a negative impact on its financial performance if it fails to secure these bids or faces price undercutting.

Working capital and liquidity challenges: Despite its profitability, the company has experienced a working capital strain, evidenced by negative operating cash flow in Fiscal 2025 and an increase in trade receivables days. Delays in executing large projects or a stretch in receivables could impact the company's cash flow and liquidity position.

Sectoral dependence: While the company is diversifying into energy and ICT, a significant portion of its revenue, over 94%, still comes from the telecom sector. This makes the business susceptible to sector-specific risks and economic downturns within the telecom industry.

Strategies of Pace Digitek IPO

Expansion in the energy sector: The company plans to grow its operations in the energy sector, particularly in Battery Energy Storage Systems (BESS), and capitalize on the government's push for renewable energy. It has recently commenced operations at a new manufacturing facility for BESS in Bidadi, Karnataka.

Focus on turnkey projects: The company aims to leverage its expertise in end-to-end solutions, from manufacturing to O&M, to secure and execute large-scale projects, including the 4G saturation project for BSNL.

Geographical expansion: The company plans to deepen its presence in existing markets like Maharashtra, Gujarat, Karnataka, and the North East, and explore new opportunities, including projects for solar pumps and the 'KAVACH Project' for Indian Railways. It also has a global presence in Africa and Myanmar, where it intends to replicate its successful business model.

Strengthening R&D and product offerings: Pace Digitek plans to continually develop its product range by augmenting its R&D capabilities to improve system design and expand its solutions suite.

Pace Digitek IPO vs. Peers

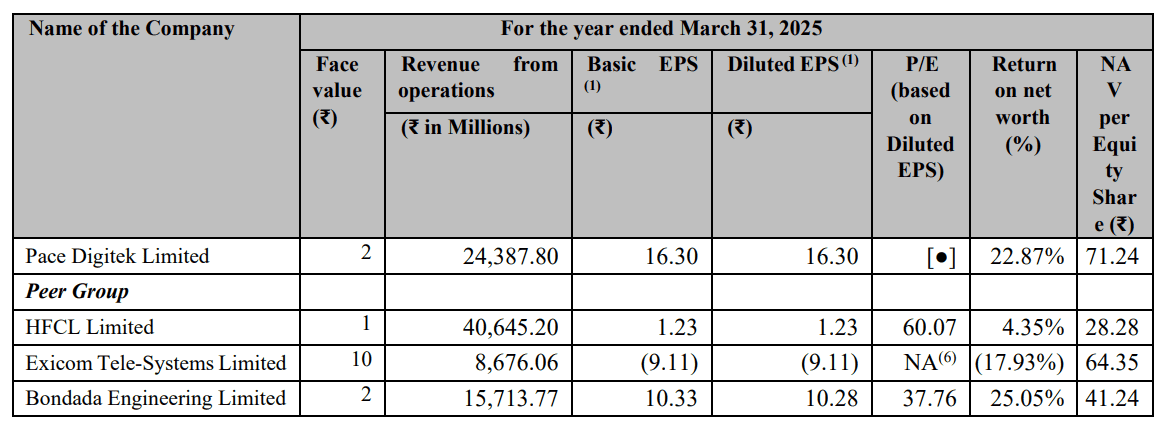

Pace Digitek reported a revenue from operations of Rs 2,438.78 crores in Fiscal 2025. This figure is significantly higher than Exicom Tele-Systems' Rs 867.60 crores and Bondada Engineering's Rs 1,571.37 crores in the same period, but is smaller than HFCL's Rs 4,064.52 crores. Pace Digitek's revenue growth of 383.81% from Fiscal 2023 to Fiscal 2024 highlights its strong expansion, especially when compared to its peers.

In terms of profitability, Pace Digitek maintains healthy margins. Its EBITDA margin for Fiscal 2025 was 20.71%, while its PAT margin was 11.44%. These figures are higher than those of its peers, as HFCL reported an EBITDA margin of 12.48% and a PAT margin of 4.26%, and Bondada Engineering recorded an EBITDA margin of 11.67% and a PAT margin of 7.34% in the same fiscal year.

Pace Digitek's return metrics reflect its efficiency. The company's Return on Net Worth (RoNW) stood at 22.87% for Fiscal 2025. This is competitive with Bondada Engineering's RoNW of 25.05% and significantly higher than HFCL's 4.35%. Similarly, Pace Digitek's Return on Capital Employed (ROCE) of 37.89% is higher than all its competitors, with HFCL, Exicom, and Bondada Engineering reporting ROCEs of 8.16%, -9.61%, and 27.35%, respectively.

The company's debt-to-equity ratio of 0.13 in Fiscal 2025 indicates a moderate level of leverage. This is lower than its peers, with HFCL at 0.33, Exicom at 0.74, and Bondada Engineering at 0.38, indicating a more favorable financial position.

Overall, Pace Digitek has established a strong position as a provider of comprehensive telecom and energy infrastructure solutions. While its revenue is not the largest among its peers, its high profitability margins, impressive growth in some periods, and solid return on capital highlight its operational efficiency and strategic direction.

Objectives of Pace Digitek IPO

Pace Digitek is planning to do fresh issues valued at around Rs 819.15 crores, which will be utilised for the proceedings, such as:

Funding the capital expenditure to set up a BESS project awarded by Maharashtra State Electricity Distribution Company Limited for its subsidiary (Pace Renewable Energies), worth Rs 630 crore.

General Corporate Purposes.

Pace Digitek IPO Details

IPO Dates

Pace Digitek IPO will be open for subscription from September 26, 2025, to September 30, 2025. The allotment of shares to investors will take place on October 01, 2025, and the company is expected to be listed on the NSE and BSE on October 06, 2025.

IPO Issue Price

Pace Digitek is offering its shares in the price band of Rs 208 to Rs 219 per share. This means you would require an investment of Rs. 14,892 per lot (68 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Pace Digitek is planning to overall fresh issue shares totalling 3,74,04,018 shares, which are worth Rs 819.15 crores.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on October 01, 2025, through the registrar's website, MUFG Intime Private Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Pace Digitek will be listed on the NSE and BSE on October 06, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Important IPO Details | |

Bidding Date | September 26, 2025 to September 30, 2025 |

Allotment Date | October 01, 2025 |

Listing Date | October 06, 2025 |

Issue Price | Rs 208 to Rs 219 per share |

Lot Size | 68 Shares |

FAQs:

Q1: What is the issue size of Pace Digitek Limited IPO?

The total issue size is Rs 819.15 crore, which is a total fresh issue of 3,74,04,018 shares.

Q2: What’s the minimum investment for Pace Digitek IPO?

68 shares per lot, requiring Rs 14,892 (at upper band).

Q3: How does Pace Digitek compare to peers?

Pace Digitek's profitability margins and returns on capital are generally higher than its peers, while its debt-to-equity ratio is lower.

Q4: Who is managing Pace Digitek IPO?

Unistone Capital Private Limited is the book-running lead manager for the IPO.

Q5: What are Pace Digitek's latest financials and EBITDA trends

Pace Digitek's latest financials for Fiscal 2025 show a revenue of Rs 2,438.78 crore, and EBITDA reached Rs 505.13 crore with a 20.71% margin in Fiscal 2025.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category