Is Aye Finance IPO Good or Bad – Detailed Review

00:00 / 00:00

Aye Finance Limited’s IPO is set to open its initial public offering from February 09, 2026, to February 11, 2026. When considering applying for this IPO, potential investors might have questions about whether the Aye Finance IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive analysis of Aye Finance IPO, covering its business operations and fundamental analysis from its RHP to help you make an informed investment decision.

Aye Finance IPO Review

Aye Finance Limited's IPO is open for subscription from February 09, 2026, to February 11, 2026, with listing expected on February 16, 2026, on NSE and BSE.

The company is a technology-driven non-banking financial company (NBFC) with a strong growth trajectory that specializes in providing micro-scale MSMEs across India with a comprehensive suite of business loan solutions. It operates as a leading lender in the underserved micro-enterprise ecosystem and is a top provider of small-ticket business loans for working capital and expansion, serving over 70 business clusters as of September 30, 2025. Its core business focus is on providing credit to manufacturing, trading, and service sectors, which form the backbone of its interest income.

The platform serves an ecosystem of 5,86,825 active unique customers across a pan-India network of 568 branches as of September 30, 2025, leveraging a customer-first, phygital (physical and digital), and scalable technology platform with 100% paperless loan sanctioning. The company does not have an identifiable promoter; Elevation Capital V Limited is the largest institutional shareholder with a 16.03% stake pre-offer on a fully diluted basis.

The company operates within the Indian MSME Credit Economy, which is undergoing rapid digital and formal transformation. The total addressable MSME credit gap in India is estimated at approximately Rs 34 lakh crore as of FY25 and is projected to grow at a CAGR of 17% to 19% between FY25 and FY27. This growth is structurally fuelled by mass adoption of technology, favourable demographics, and the high potential of the underserved micro-enterprise segment, where NBFCs currently account for a 16.6% share.

Aye Finance’s financial performance from FY23 to FY25 reflects robust top-line growth and a significant move toward profitability. Net Interest Income (NII) grew from Rs 368.53 crore in FY23 to Rs 857.96 crore in FY25, achieving an approximate 52.56% CAGR. Profit After Tax (PAT) demonstrated a strong growth trend, rising from Rs 39.87 crore in FY23 to Rs 175.25 crore in FY25, with a reported PAT of Rs 64.6 crore for H1 FY26. Operating efficiency improved as the cost-to-income ratio decreased from 66.03% in FY23 to 50.10% in FY25. The Return on Equity (RoE) stood at 12.12% in FY25, while Assets Under Management (AUM) reached Rs 6,027.62 crore by September 2025.

Key strengths include Leading Small-Ticket MSME Lending with a niche focus, a Unique Cluster-Based Underwriting Methodology, a Diversified Pan-India Presence (568 branches across 18 states), and Technology-Driven Operational Efficiency. Risks involve Asset Quality Pressure (Net NPA increased to 1.78% in H1 FY26), High Exposure to Unsecured Loans (37.97% of AUM), Negative Cash Flows from Operating Activities (Rs 454.87 crore used in H1 FY26), and Strict Regulatory/RBI Supervisory Risk.

The IPO consists of a total issue of 7,82,94,572 shares valued at Rs 1,010 crores, comprising an Offer for Sale (OFS) of 2,32,55,813 shares (Rs 300 crores) and a Fresh Issue of 5,50,38,759 shares (Rs 710 crores). The proceeds from the fresh issue will be used to augment the capital base of the company to meet future capital requirements arising from the growth of the business and asset portfolio.

Shares are priced in the band of Rs 122 to Rs 129 per share, with a lot size of 116 Shares.

Company Overview of Aye Finance IPO

Aye Finance Limited is a technology-driven non-banking financial company (NBFC) with a strong growth trajectory that specialises in providing micro-scale MSMEs across India with a comprehensive suite of business loan solutions. The company operates as a leading lender in the underserved micro-enterprise ecosystem and is a top provider of small-ticket business loans for working capital and expansion, serving over 70 business clusters as of September 30, 2025.

Its core business focus is on providing credit to manufacturing, trading, and service sectors, which form the backbone of its interest income.

The diversified product portfolio includes specialized lending products such as:

Hypothecation Loans: Both secured and unsecured loans for working capital.

Mortgage Loans: Longer-term loans fully secured against property collateral.

Saral Property Loans: Flexible secured loans for cases with established but hard-to-charge property titles.

Supply Chain Finance (SwitchPe): A credit-backed payment solution for merchants.

The platform serves an ecosystem of 586,825 active unique customers across a pan-India network of 568 branches as of September 30, 2025.

The core operational strength is built around a customer-first, phygital (physical and digital), and scalable technology platform with a commitment to operational resilience. This strength is demonstrated by its in-house data science capabilities, resulting in 100% paperless loan sanctioning and 100% cashless disbursements.

Furthermore, the company has successfully expanded its presence across 18 states and 3 union territories, maintaining a near-constant focus on high-touch engagement through thousands of field-based loan advisors. As of September 30, 2025, the company has achieved significant scale with Rs 6,027.62 crore in Assets Under Management (AUM). The table below shows the top sector-wise AUM exposure:

Industry Sector | AUM Exposure (%) |

Trading | 49.68% |

Livestock rearing | 27.12% |

Manufacturing and others | 13.26% |

Service and job work | 9.94% |

The company does not have an identifiable promoter. Elevation Capital V Limited is the largest institutional shareholder with a 16.03% stake pre-offer on a fully diluted basis. Key leadership includes Sanjay Sharma (Managing Director and Executive Director), Niraj Kumar Kaushik (Deputy Chief Executive Officer), and Sovan Satyaprakash (Interim Chief Financial Officer).

Industry Overview of Aye Finance IPO

Aye Finance Limited operates within the Indian MSME Credit Economy, a financial sector undergoing rapid digital and formal transformation, primarily driven by mass adoption of "phygital" technology, favourable demographics, and the proliferation of formal credit to underserved micro-enterprises.

The total unmet credit demand for MSMEs in India is estimated to be approximately Rs 103 lakh crore as of FY25. Within this, the addressable credit demand is estimated at approximately Rs 76 lakh crore, of which formal financing currently meets Rs 42 lakh crore, leaving a total addressable MSME credit gap of around Rs 34 lakh crore as of FY25. This strong trajectory is projected to continue, with the overall MSME portfolio expected to grow at a Compound Annual Growth Rate (CAGR) of 17% to 19% between FY25 and FY27.

The accelerated formalization of micro-enterprises, with 98% of the country’s 5.77 crore MSMEs classified as micro-scale businesses in FY25, significantly shifts the focus toward grassroots lending.

Crucially, the segment remains a largely underpenetrated market, with NBFCs currently accounting for a 16.6% share of the total MSME credit sector (up from 9.2% in FY19) and 90.86% of micro-enterprises owning assets but often lacking formal bank-grade documentation, indicating massive untapped potential for specialized underwriting, cluster-based assessment, and sophisticated collateral-backed lending solutions.

Within this intensely competitive and regulated environment, the industry is navigating challenges such as the potential impact of high operational costs for servicing small-ticket loans, vulnerability to borrower overleveraging and macroeconomic stress, and adapting to extensive RBI Scale Based Regulations and frequent changes in compliance requirements, including those for asset classification, interest rate models, and provisioning norms.

Financial Overview of Aye Finance IPO

Particulars | September 30, 2025 (Rs Crores) | September 30, 2024 (Rs Crores) | March 31, 2025 (Rs Crores) | March 31, 2024 (Rs Crores) | March 31, 2023 (Rs Crores) |

Net Interest Income | 474.97 | 410.98 | 857.96 | 622.16 | 368.53 |

Cost to Income Ratio (%) | 52.62% | 48.39% | 50.10% | 50.96% | 66.03% |

Profit After Tax | 64.6 | 107.8 | 175.25 | 171.68 | 39.87 |

Return on Net Worth (RoE) | 7.63% | 15.26% | 12.12% | 17.28% | 5.46% |

Return on Assets (RoA) | 1.92% | 4.03% | 3.13% | 4.29% | 1.47% |

Net NPA Ratio (%) | 1.78% | 1.15% | 1.40% | 0.91% | 1.28% |

The Net Interest Income (NII) has shown robust growth, driven by expansion across its lending ecosystem. NII increased from Rs 368.52 crore in FY23 to Rs 622.15 crore in FY24 and accelerated significantly to Rs 857.96 crore in FY25, achieving an approximate CAGR of 52.56% from FY23 to FY25. This momentum continued into the latest half-year, with NII reaching Rs 474.96 crore for the six months ending September 30, 2025.

In the cost-to-income ratio part, core business efficiency is seen through optimised margins derived from leveraging its scalable technology platform and phygital network effects. The ratio demonstrated a downward trajectory, improving from 66.03% in FY23 to 50.96% in FY24 and maintaining steady at 50.10% in FY25. While expansion costs led to a slight uptick to 52.62% for the six months ending September 30, 2025, the overall trend reflects significantly improved operational leverage over the last three years.

Profit After Tax (PAT) has demonstrated a significant trend of growth, reflecting the company's successful scale-up. PAT rose substantially from Rs 39.87 crore in FY23 to Rs 171.67 crore in FY24 and reached Rs 175.25 crore in FY25. For the latest six-month period ending September 30, 2025, the company reported a PAT of Rs 64.59 crore, supported by consistent interest margins and growing AUM despite seasonal market fluctuations.

The Return on Equity (RoE) tracks the profitability relative to the shareholders' equity. The RoE showed massive improvement, moving from 5.46% in FY23 to a peak of 17.28% in FY24 before stabilising at 12.12% in FY25. This trajectory correlates directly with the sharp increase in net profit and efficient capital utilization during the expansion of the loan book.

The Return on Average Total Assets (RoA) demonstrates the operational scale and asset efficiency of the platform. RoA expanded from 1.47% in FY23 to 4.29% in FY24 before settling at 3.13% in FY25 as the asset base grew. The company maintains a strong capital structure with total assets standing at Rs 7,116 crore as of September 30, 2025.

The Net Non-Performing Assets (Net NPA) ratio highlights the effectiveness of the company's cluster-based underwriting. The Net NPA ratio improved from 1.28% in FY23 to a robust 0.91% in FY24, though it edged up to 1.40% in FY25 and 1.78% as of September 30, 2025. According to the Aye Finance IPO details, the company continues to maintain a high Provision Coverage Ratio of 64.47% to manage potential credit risks ahead of the aye finance ipo date.

Strengths and Risks of Aye Finance IPO

Let's examine the strengths and weaknesses to determine if the Aye Finance IPO is a good or bad investment for investors.

Strengths

Leading Small-Ticket MSME Lender with Niche Focus: Aye Finance is recognized as a leading NBFC providing business loans to the underserved micro-scale MSME ecosystem in India. As of September 30, 2025, the company served 5,86,825 active unique customers with an Assets Under Management (AUM) of Rs 6,027.62 crore, focusing on a target segment with annual turnovers between Rs 20 lakhs and Rs 1 crore.

Unique Cluster-Based Underwriting Methodology: The company has pioneered a proprietary business cluster based underwriting framework. This methodology leverages a deep understanding of over 70 specific business clusters, such as shoe manufacturing or dairy farming to accurately estimate cash flows and profit margins for borrowers who typically lack formal financial documentation or established credit histories.

Diversified Pan-India Presence with High Customer Retention: Aye Finance is the most geographically diversified lender among the Peer MSME-focused NBFCs. As of September 30, 2025, it operated through 568 branches across 18 states and 3 union territories, ensuring no single state contributes more than 15.77% to its total AUM. Furthermore, it demonstrated strong customer loyalty with a 41.16% repeat retention rate as of the same period.

Technology-Driven Operational Efficiency: The core business model combines a high-touch field presence with high-tech digital capabilities. This phygital approach enables 100% paperless loan sanctioning and 100% cashless disbursements. The efficiency of this model is evidenced by a significant reduction in the cost-to-income ratio, which improved from 66.03% in FY23 to 50.10% in FY25.

Access to Diversified and Cost-Effective Funding: The company maintains a robust liability profile with access to capital from 82 different lenders as of September 30, 2025. This includes public and private sector banks, DFIs, and external commercial borrowings. This diversified base has enabled a competitive average cost of borrowings of 11.21% (annualized) for the six months ended September 30, 2025.

Risks

Asset Quality Pressure and Rising NPAs: The company's Gross NPA (GNPA) ratio has increased from 2.49% as of March 31, 2023, to 4.21% as of March 31, 2025, and reached 4.85% as of September 30, 2025. This rise is primarily attributed to market stress and overleveraging among certain borrowers, and there is no assurance that asset quality will not deteriorate further.

High Exposure to Unsecured Loans: A significant portion of the company’s AUM consists of unsecured hypothecation loans, which comprised 37.97% of the total AUM as of September 30, 2025. These loans carry higher credit risks as they are not backed by realizable property collateral, making recovery more difficult in the event of default.

Negative Cash Flows from Operating Activities: Aye Finance has experienced negative cash flows from operating activities in the past, primarily due to the high volume of loan disbursements required to fuel growth. For the six months ended September 30, 2025, the net cash used in operating activities was Rs 454.87 crore, which may impact future liquidity if capital raising is disrupted.

Strict Regulatory and RBI Supervisory Risk: As an NBFC-ML, the company is subject to periodic inspections and stringent regulations by the RBI. Past inspections have noted deficiencies in areas like internal audit coverage and security registration. Failure to comply with evolving regulations or adverse findings in future inspections could lead to penalties or restrictions on business growth.

Vulnerability to Macroeconomic and Seasonal Fluctuations: The company's business is highly sensitive to the economic health of the MSME sector and semi-urban infrastructure. Additionally, the business is subject to seasonality, with higher borrowing demands typically occurring in the third and fourth quarters of the fiscal year due to increased retail and harvest activity.

Strategies of Aye Finance IPO

Increase AUM per Branch through Deeper Penetration: The company intends to focus on increasing productivity within its existing 568 branches. By leveraging its established presence and maturing branch network, Aye Finance aims to serve more customers per branch, targeting an increase from the current average of 1,033 customers to drive higher economies of scale.

Aggressive Growth of the Mortgage Loan Portfolio: A key pillar of the growth strategy is to scale the mortgage loan portfolio, which increased from 1.86% of AUM in FY23 to 19.28% as of September 30, 2025. By shifting the mix toward longer-tenor, property-secured loans, the company aims to enhance portfolio stability and long-term profitability.

Continuous Investment in Technology and Data Science: Aye Finance plans to upgrade its LOS, LMS, and CMS systems. The strategy involves deploying more advanced AI or ML models to improve credit decisioning, currently 23.88% straight-through process and optimizing field collection through geolocation analytics.

Improving Operating Leverage through Automation: The company aims to further reduce its operating expenditure ratio by automating routine back-office tasks and enhancing staff productivity. By training employees on advanced digital tools and improving conversion rates on repeat loans, the company expects to lower the cost-to-income ratio below the current 52.62%.

Optimize Borrowing Costs and Diversify Lender Base: Aye Finance intends to continue diversifying its sources of capital by building deeper relationships with large commercial banks and increasing the use of co-lending and direct assignment transactions. This strategy is aimed at lowering the average cost of funds and maintaining a healthy Asset Liability Management (ALM) position.

Aye Finance IPO vs. Peers

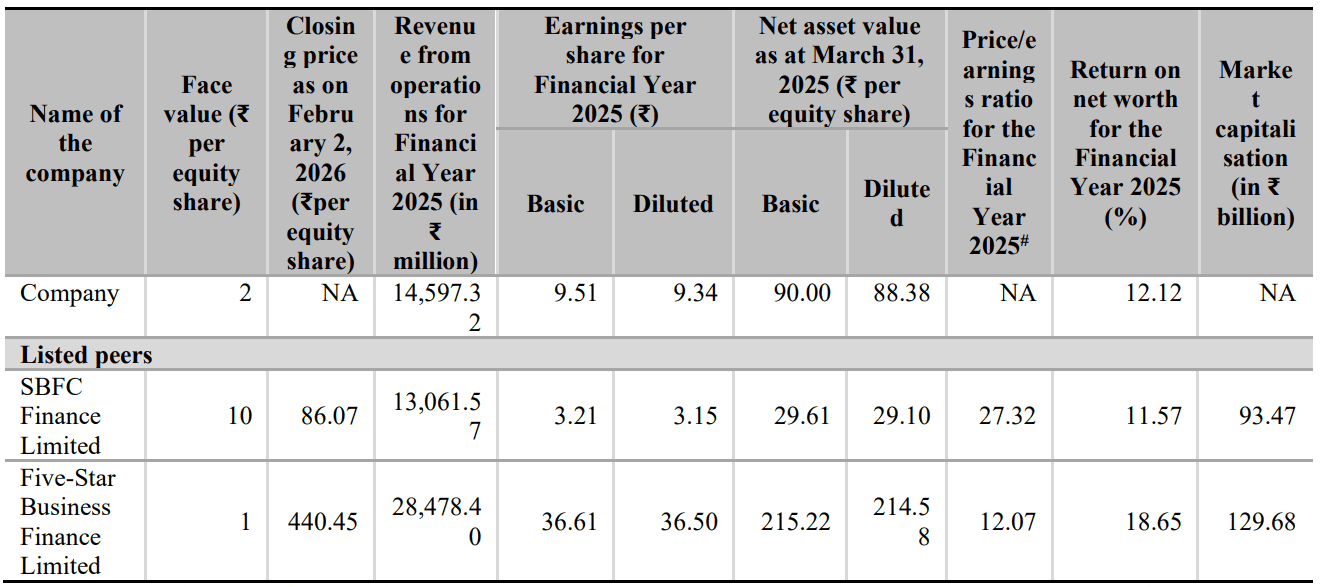

The company showcases competitive operational efficiency among its domestic counterparts in the NBFC space. Aye Finance achieved a Net Interest Margin (NIM) of 15.31% in FY25, which underscores its ability to generate high yields from its niche cluster-based lending model. In comparison, Five-Star Business Finance recorded a NIM of 16.07% for the same period, while SBFC Finance reported a NIM of 9.93%, highlighting Aye Finance's strong standing in translating its loan book scale into efficient core interest income.

When examining profitability metrics, Aye Finance reported a Return on Equity (RoE) of 12.12% for FY25, reflecting its transition into sustained profitability following its expansion phase. This figure is slightly ahead of SBFC Finance’s reported RoE of 11.57%. In contrast, Five-Star Business Finance reported a higher RoE of 18.65% for FY25, showcasing differing levels of financial leverage and asset-mix performance across the peer set.

Objectives of Aye Finance IPO

The offering consists of a total of 7,82,94,572 shares worth Rs 1,010 crores, out of which the fresh issue of 5,50,38,759 shares is valued at Rs 710 crores and the offer for sale of 2,32,55,813 shares is valued at Rs 300 crores, respectively. The selling shareholders in this IPO are:

Alpha Wave India I LP, MAJ Invest Financial Inclusion Fund II K/S, CapitalG LP, and LGT Capital Invest Mauritius PCC, with Cell E/VP and Vikram Jetley, will receive the offer-for-sale proceeds.

However, the Rs 710 crore fresh issue proceeds will be used to augment the capital base of the company arising out of the growth of the business.

Aye Finance IPO Details

IPO Dates

Aye Finance IPO will be open for subscription from February 09, 2026, to February 11, 2026. The allotment of shares to investors will take place on February 12, 2026, and the company is expected to be listed on the NSE and BSE on February 16, 2026.

IPO Issue Price

Aye Finance is offering its shares in the price band of Rs 122 to Rs 129 per share. This means you would require an investment of Rs. 14,964 per lot (116 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Aye Finance is issuing a total of 7,82,94,572 shares aggregating to Rs 1,010 crore. Of this, the fresh issue comprises 5,50,38,759 shares worth Rs 710 crore, which will be used for the company’s stated objectives, while the remaining 2,32,55,813 shares worth Rs 300 crore are being offered for sale and will be received by the selling shareholders in the IPO.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on February 12, 2026, through the registrar's website, Kfin Technologies Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Aye Finance are expected to be listed on the NSE and BSE on February 16, 2026.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Important IPO Details | |

Bidding Date | February 09, 2026 to February 11, 2026 |

Allotment Date | February 12, 2026 |

Listing Date | February 16, 2026 |

Issue Price | Rs 122 to Rs 129 per share |

Lot Size | 116 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category