What Is Piotroski Score in Stock Market? Meaning and How It Works

00:00 / 00:00

What all things do you consider when you plan to invest in the stock market? Well, as a matter of fact, when investors plan to invest in the stock market, they start by evaluating the options they have. They compare the company's performance against that of the industry standard. This involved detailed financial and technical analysis.

But there is one of the most important parameters that you must keep in mind. This is the Piotroski Score. It helps identify fundamentally strong companies using a set of financial parameters. This is a 9-point score, which helps to ensure that the company you plan to invest in is fundamentally strong on the rating scale.

But how? Well, first you need to understand what is Piotroski Score. So, read this guide to know all the details you need to ensure that you evaluate and invest in the right manner.

What Is Piotroski Score?

The Piotroski Score is a financial scoring system. It was developed by Joseph Piotroski, a professor at Stanford University. This scoring system was developed to measure the financial strength of a company. It is also known as the Piotroski F-Score. This helps investors identify fundamentally strong yet undervalued stocks.

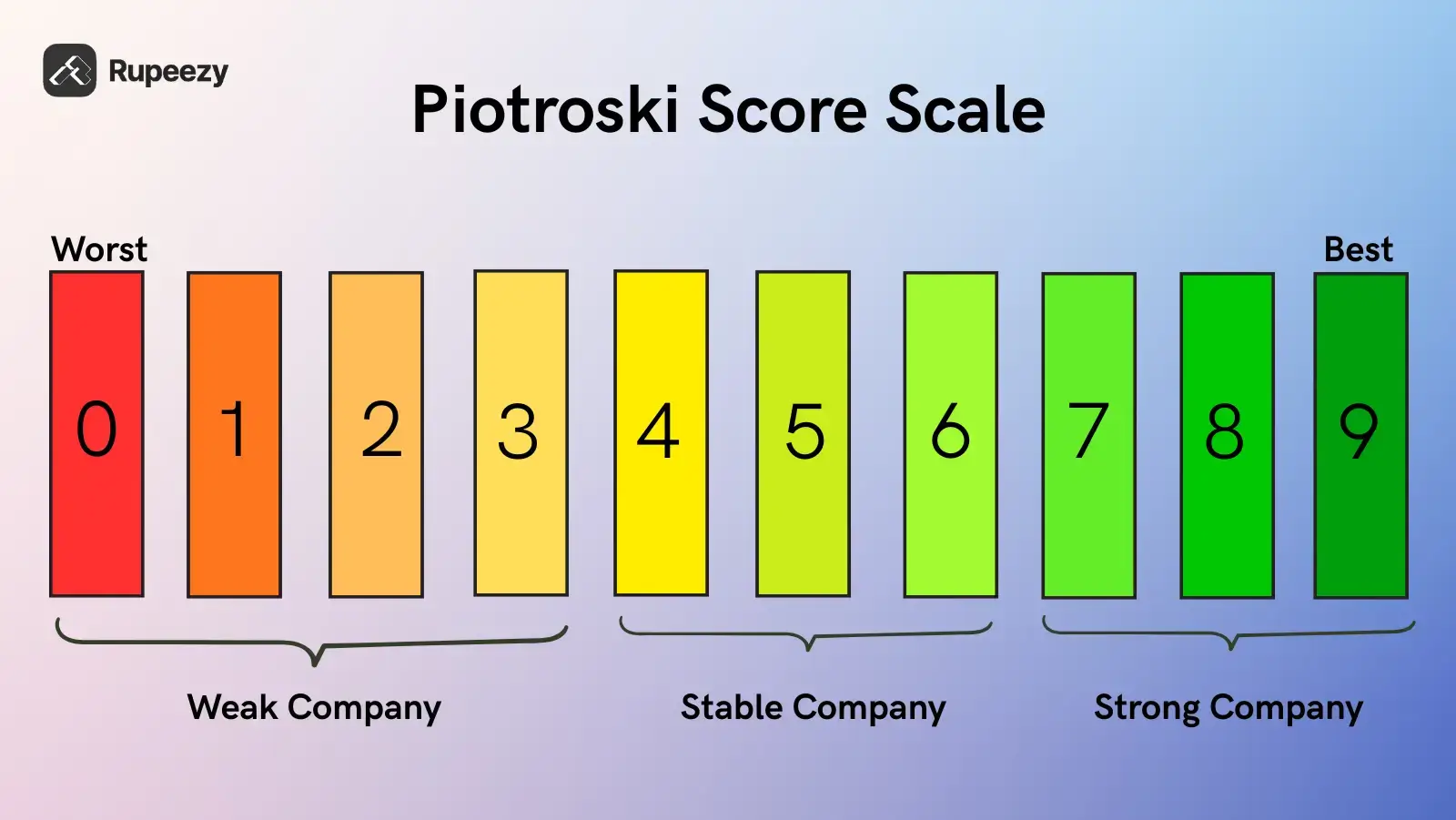

This score ranges from 0 to 9. The score is being given to the company on 9 factors and reflects how well the company is performing across all the factors. A company receives one point for each positive indicator and zero for a negative one.

In general:

Score 7–9: Financially strong company with sound fundamentals.

Score 4–6: Moderate strength, may need further review.

Score 0–3: Weak fundamentals and potentially risky investment.

Profitability: This helps to measure the overall performance of the company to see how well it is generating profits.

Leverage, Liquidity, and Funding: Focus on accessing the assets and liabilities of the company. This will help you with better management of the debt and will ensure better returns.

Operating Efficiency: This is where you evaluate the working of the company. It shows how well the company is using its assets and controlling the costs.

In simple terms, the Piotroski Score is a quick and effective way to screen companies. This scale allows you to check which of the companies in an industry have strong balance sheets and consistent performance. This is quite helpful for investors and allows you to ensure efficient investing.

How to Calculate Piotroski Score

The Piotroski Score is calculated by assigning points to nine financial criteria. These are grouped under three main categories:

Profitability

Leverage/Liquidity

Operating Efficiency

Each criterion scores 1 point if positive and 0 if negative. The total score ranges from 0 to 9. This can be used for any company that is listed on NSE or BSE. The parameters that are used for the analysis are as follows:

Category | Criteria | Condition for 1 Point | Purpose |

Profitability | Net Income | Positive net income for the year | Shows profitability |

Return on Assets (ROA) | ROA is positive | Measures the efficiency of asset use | |

Operating Cash Flow | Positive cash flow from operations | Reflects healthy cash inflow | |

Quality of Earnings | Cash flow > net income | Ensures profit is not accounting-based | |

Leverage & Liquidity | Change in Leverage | Long-term debt decreased year-over-year | Indicates lower financial risk |

Change in Current Ratio | The current ratio improved from last year | Reflects a better liquidity position | |

No New Equity Issued | No new shares were issued in the year | Avoids dilution of shareholder value | |

Operating Efficiency | Change in Gross Margin | Gross margin improved from last year | Shows cost control and pricing power |

Change in Asset Turnover | Asset turnover increased | Highlights improved asset utilization |

Now that you know the proper Piotroski Score meaning, you can evaluate why this is so effective. By using this, you can actually evaluate any stock and make the buy or sell call proper manner.

Interpretation of Piotroski Score

Once all nine parameters are evaluated, the total Piotroski Score provides a clear view of a company’s financial strength. Now, this score can fall into three categories. By doing so, you can effectively work on portfolio rebalancing by removing companies that are low-performing. So, here are the key interpretation points that you must know:

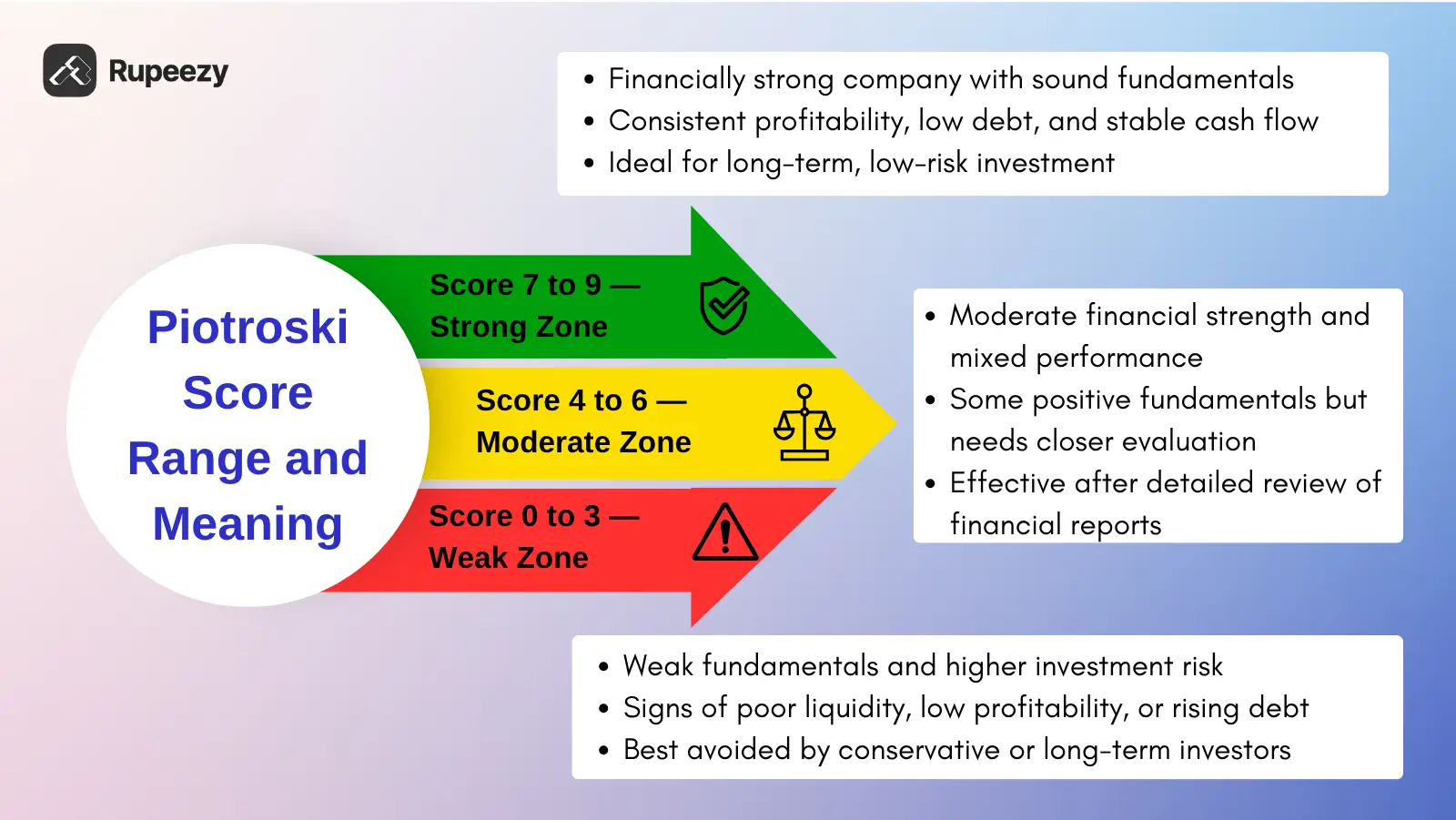

1. Strong (Score 7 to 9)

A company scoring between 8 and 9 is considered financially strong and stable. It shows consistent profitability and efficient asset management. This is the sign that the company is one with a healthy balance sheet. Such companies are often undervalued. These are the companies that can offer good long-term growth opportunities with lower risk.

2. Moderate (Score 4 to 6)

Scores in this range indicate average or moderate strength. The company may perform well in some areas. But when it comes to the overall performance, the company needs improvement. This is usually in the segments like debt control or operational efficiency. Investors should study the financial statements, and after proper analysis, they must invest.

3. Weak (Score 0 to 3)

A company in this range is financially weak. These are the companies that may face liquidity or profitability issues. It usually has high debt, poor cash flow, or declining margins. If you invest in these companies, you might not make the profits you wish, and this will be a risky deal.

In short, the Piotroski Score helps investors quickly identify strong companies. By doing so it reduces the risk of investing in weak companies, which is quite beneficial for investors.

Pros and Cons of Piotroski Score

The Piotroski Score is not a standalone tool. It works best when combined with other forms of analysis. These are generally the ratios like PEG, PE, or PB. You should also consider industry trends and management quality. So based on the same, the pros and cons of using the Piotroski Score are as follows:

Pros

Simple and easy-to-understand scoring model for all investors.

Helps identify undervalued yet financially strong companies.

Uses real financial data, reducing emotional or biased decisions.

Works well for value investors focusing on long-term gains.

Helps to filter out weak companies quickly.

Cons

Not good for startups, as the data is inconsistent.

Works on internal factors only and not broad factors.

Focuses only on the past and does not share anything for the future.

It can be less effective for sectors with high volatility.

Requires accurate and updated financial statements for reliability.

Some investors also amplify their positions by using margin-based buying. When you identify fundamentally strong companies through tools like the Piotroski Score, leveraging them through a Margin Trading Facility can help you increase your exposure strategically. But to make this approach cost-effective, it’s important to choose platforms that offer the lowest mtf interest rate, as lower financing costs allow you to hold quality stocks for longer.

Conclusion

The Piotroski Score is one of the simplest and most effective tools for assessing a company’s financial health. It helps you to evaluate the profitability, efficiency, and liquidity of the company, which is quite beneficial when it comes to investing.

But relying only on the Piotroski Score is not good enough. You need to actually combine this with other technical and financial analysis aspects that will make sure you are in a better position.

So, if you are planning to invest smartly, you need to use multiple tools and calculators to evaluate the company. This is where Rupeezy can be the perfect choice for you. Register and start investing right.

FAQs

What is a good Piotroski Score?

A score between 8 and 9 is considered excellent. This shows that the company has strong fundamentals.

Is Piotroski Score useful for beginners?

Yes. The score is very simple to understand and can be used by beginners as well.

Does Piotroski Score predict future performance?

No, it is based on past financial data and does not directly predict future performance.

Can the Piotroski Score change every year?

Yes, it is updated yearly based on the company’s latest financial statements.

Should I invest only based on Piotroski Score?

No, it should be used along with other financial ratios, sector analysis, and market trends for better investment decisions.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category