Best Time to Buy and Sell Stock: A Smart Investor’s Guide

00:00 / 00:00

We often try to perfect our timing in life and work, and the stock market is no different. Investors and traders continually seek the optimal time to buy and sell stocks to maximise their returns on every opportunity. But the market is influenced by many unpredictable factors, like economic data, geopolitics, wars, policy changes, and unexpected global events that can disrupt even the best plans. In this article, we’ll look at some of the best times to buy and sell stock and explore daily and seasonal patterns, economic events that influence prices, and highlight common mistakes to avoid. Let’s dive in.

Can You Really Time the Market?

Timing the stock market means trying to predict when prices will rise or fall so you can buy low and sell high. While this sounds simple, many experts agree it’s extremely hard to do consistently. Even professional fund managers often miss the best days. Most market experts suggest focusing on time in the market instead of chasing every peak and dip.

However, in the market, we as investors or traders know that markets can be both rational and irrational. In the middle of this uncertainty, we need to find the best time to buy and sell the stock so you can make the most of opportunities and aim for better returns backed up by discipline and research.

Best Time to Buy Stocks During the Day

Many investors wonder when to buy stocks during the day to get the best price. The stock market doesn’t move randomly. Sometimes it follows a pattern every trading day. The first hour after the market opens is often the most volatile because investors react to overnight global news, company results, or economic reports. Many professional traders enjoy this time because quick price swings can offer more profit opportunities.

However, for new investors, buying in this early chaos can be risky because prices jump up and down rapidly. If you wait and look at midday hours, like around 11 am to 1 pm, when the market often settles. During this time, when big news is out, the prices can move more steadily.

The last hour of trading, which is known as the closing session, can be volatile again as traders adjust and close positions or fresh news triggers late moves. Traders need to be smarter, and their market exposure should be in tandem with risk to avoid unnecessary panic and losses. Consult a financial advisor who has experience in the market and is SEBI registered before receiving advice.

Best Time to Buy Stocks in India

When investing in India, knowing how the local market behaves helps you plan better entry points. India’s main stock exchanges, the National Stock Exchange (NSE) and the BSE (formerly known as the Bombay Stock Exchange), operate from 9:15 am to 3:30 pm Indian Standard Time (IST), from Monday to Friday (excluding national holidays and weekends). The first 15 minutes, which is 9:00 to 9:15 am is the pre-market session, where big orders can show you which way prices might move at the open.

In India, Mondays can be unpredictable because investors react to weekend news, global events, or sudden policy announcements. So, you can often see gap-ups or gap-downs when the market opens. Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) also strongly influence the market. Their bulk buying or selling can push prices up or down rapidly, especially near opening and closing times.

If you’re a retail investor, focus on the steady hours after the morning rush. Keep an eye on major events like RBI policy meetings, corporate earnings, or any major events about the company.

Best Months and Seasons to Invest in Stocks

Some investors plan not just by time of day but by time of year. Shares often show patterns linked to events, festival seasons, or global cycles.

Key Seasonal Patterns:

Pre-Budget Rally: Before India’s Union Budget, which usually falls on February 1 of every year, investors anticipate tax rate cuts, new policies, and government spending. Stocks that are focused towards infrastructure, banking, or agriculture-related, often rally weeks either upside or downside ahead of the Budget speech. Traders position early to catch any positive surprise from the announcement.

Diwali Muhurat Trading: This Muhurat Trading is a symbolic, hour-long session where many investors buy shares for good luck. While the session itself is brief, optimism often lifts stocks during this festive period. Families and brokers see it as an auspicious time to start new investments, often with a long-term horizon.

Santa Claus Rally: Globally, the stock market sometimes rises in the last week of December into early January. Fund managers clean up portfolios, and New Year optimism might drive fresh buying. This short rally can help lift stocks that declined earlier in the year.

Industry Cycles

Besides daily and seasonal patterns, every industry goes through its own cycle of growth and slowdown. Understanding these industry cycles helps you find the best time to enter or exit a stock. For example, when an industry is in an upcycle, which is driven by high demand, innovation, or a favourable outlook, companies in that sector often outperform, and likewise the same during an industry downtrend. We will take Tata Elxsi as an example to understand in a broader perspective.

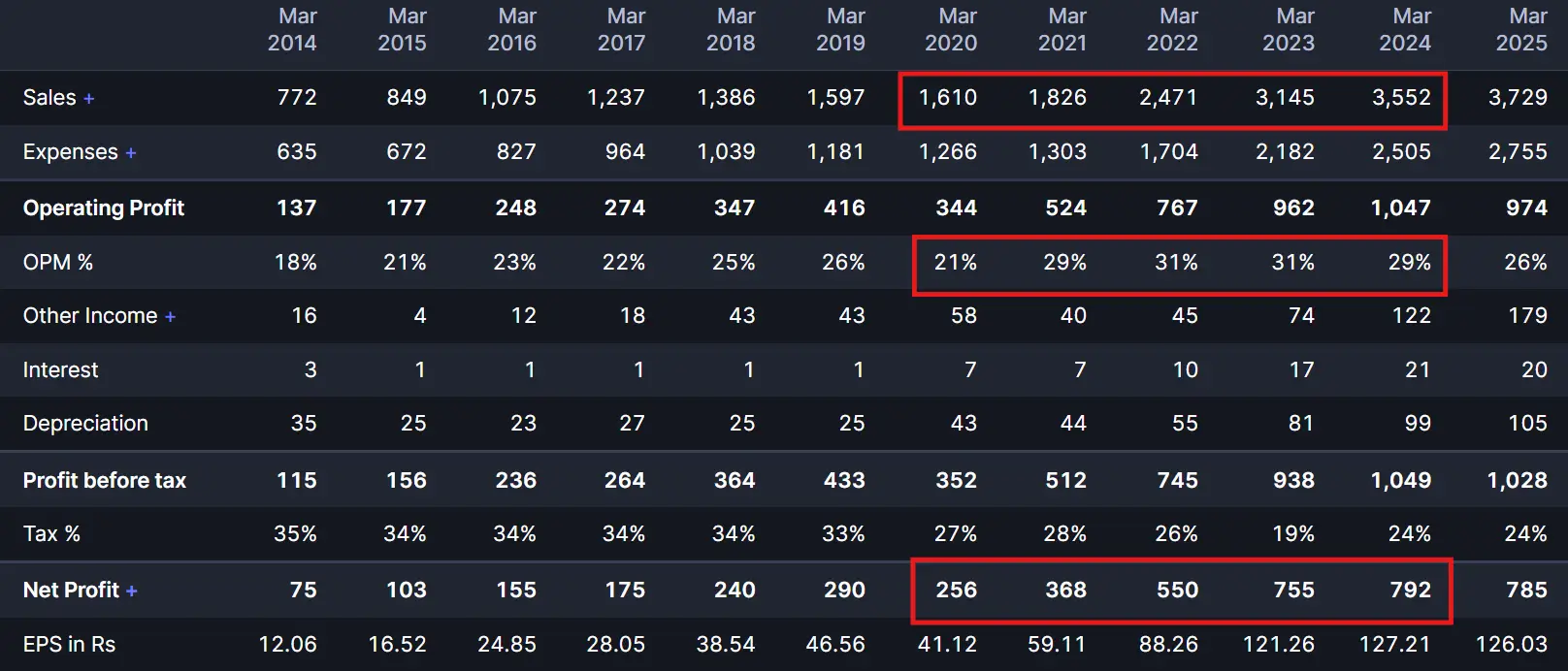

Between FY20 and FY24, Tata Elxsi experienced significant fundamental growth, mirrored by its stock performance. In FY20, revenue was Rs. 1,610 Crores, operating margins (OPM) were 21%, and net profit was Rs. 256 Crores. During this period, the stock was at low levels, trading around Rs. 500-1,000.

Driven by industry tailwinds and strong financials, revenue surged to Rs 2,471 in FY22, Rs 3145 in FY23, OPM improved to 31% in FY22 and maintained steady in FY23 and net profit climbed to Rs 550 crores in FY22 and Rs 755 crores in FY23. This impressive growth was reflected meteorically on the stock price, which soared from its lows to peak near Rs. 10,000 during FY23.

However, as growth slowed in FY23 itself, the stock price took a hit, following the company's outlook, industry headwinds, and high valuations. Following these events, the OPM took a hit in FY24 and FY25, and net profit slowed down despite a slight increase in revenues. During that period it consolidated, trading within the Rs. 5,000 to 7,000 range. This demonstrates how understanding industry cycles and company financials is crucial for investors to capitalise on opportunities during an upcycle and recognise signs of a downturn through constant awareness of management commentary and peer comparisons.

How Economic Events Impact the Best Time to Buy and Sell Stock

Whenever significant economic data is released, the market often adjusts in advance based on expectations. If the actual data is favourable, prices usually react positively; if it disappoints, markets can fall. In these situations, you can look for companies likely to benefit from the news and take advantage of short-term price movements. Here are some of the main events mentioned below:

Central Bank Policy Decisions (RBI, US Fed): When the RBI or the US Federal Reserve changes interest rates, markets react quickly. A rate hike can lead to a decline in stock prices, while a rate cut often lifts sentiment. Investors watch these announcements to plan their entries and exits accordingly.

GDP Growth Data: Quarterly GDP figures show whether an economy is expanding or slowing down. Strong GDP growth can boost investor confidence and push stocks higher. Weak numbers may trigger a sell-off.

Inflation Reports (CPI, WPI): Inflation numbers directly affect interest rate decisions. Higher inflation often leads to tighter policies, which can negatively impact stocks. When inflation cools, markets react positively and expect a rate cut. Investors need to check monthly inflation data through government websites like MOSPI before making big buy or sell decisions.

Corporate Earnings Announcements: The quarterly results season can swing individual stock prices sharply. A company beating expectations can attract fresh buying. A poor result can trigger sharp selling. Investors time their entry and exit points based on earnings expectations and industry trends.

Indian Union Budget and Major Government Policies: India’s annual budget outlines tax changes and spending plans. Sectors like infrastructure, banking, and agriculture react quickly to new initiatives. Traders often buy ahead of the budget, hoping for positive news, then adjust their trades once details about government decisions are disclosed to the public.

Combining SIP and Timing: A Smart Investing Strategy

Combining smart market timing with regular Systematic Investment Plans (SIPs) can boost your returns in the short term. However, rupee cost averaging helps smooth out ups and downs over the long run. Let’s look at an example to debunk a myth about the timing of SIPs with an example.

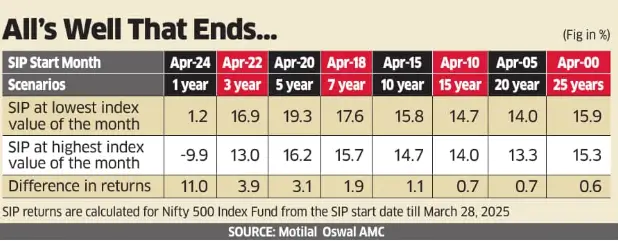

The above table, from Economic Times shows that trying to perfectly time your monthly investments in an SIP rarely matters in the long run.

The above study shows:

Scenario where you started a 1-year SIP in April 2024: If you always invested at the lowest point, you earned 1.2%. If you always invested at the highest, you lost 9.9%. That's an 11% difference. Short-term timing has a big impact.

Scenario where you started a 10-year SIP in April 2015: The difference shrinks dramatically. Investing at the lowest point earned 15.8%, while investing at the highest point still got you 14.7%. The difference is a mere 1.1%.

Scenario where you started a 25-year SIP in April 2000: The impact of timing becomes almost negligible. The difference in returns between investing at the lowest versus the highest point was only 0.6%.

In short, consistently investing over many years smooths out market fluctuations, making precise monthly timing largely irrelevant to your overall returns.

Common Mistakes to Avoid When Timing the Market

Timing the market looks easy in theory, but it stumbles upon many investors in reality. Some mistakes repeat over and over, costing people valuable returns. Here are some of the traps that you can avoid.

Tips and Rumours: Many investors buy or sell based on random stock tips or unverified news. Acting on rumours without checking facts often leads to losses. Always do your own research instead of trusting social media or tips to avoid capital losses.

Predict Every High and Low: In search of profits, trying to catch the exact top or bottom drains your effort and energy. Even seasoned traders find it tough to pick the perfect entry or exit points every time. Focus on good price ranges instead of hunting for the impossible perfect moment.

Emotions Drive Decisions: Fear and greed can destroy the best plans. Investors panic-sell during small dips or get greedy when prices surge. Emotional reactions lead to buying high and selling low, which is the exact opposite of smart investing.

Ignoring Fundamentals: Traders rely only on charts and short-term trends, while for investors, it is not the same case. They should look at whether the business is strong or weak, its financials, management quality, and growth potential before timing any buy or sell.

Overtrading: After a bad trade, many people jump right back in to recover the lost funds quickly. This revenge trading often leads to more losses. Instead, pause, review what went wrong, strategise, and plan your next move.

Conclusion

As we near the conclusion of the article, we have understood the best time to buy and sell stock and looked into different scenarios. Timing the market is not only about perfection. It’s about using trends and cycles and being disciplined to make better decisions. Stay informed, analyse the data, and invest consistently; that can help you create wealth over time.

FAQs

Q1. What is the best month to invest in stocks in India?

Historically, pre-budget months like January and festive seasons like Diwali can be positive for markets, but trends change every year.

Q2. Is it better to invest lumpsum or through SIPs?

Combining SIPs with occasional lumpsum investments during market dips can balance risk and timing.

Q3. Can you really time the stock market successfully?

Timing the market is possible occasionally, but doing it consistently is extremely difficult, even for professionals. Always focus on time in the market.

Q4. How do central bank interest rate decisions impact stock prices?

Interest rate hikes often cool markets, while interest rate cuts usually boost investor sentiment in the market. Investors need to track the RBI and US Fed meetings closely to understand the sentiment.

Q5. Should I invest during a market crash?

Sharp corrections can create opportunities to buy quality, fundamentally strong stocks. But always invest based on research and not follow the herd and panic. Consult a financial advisor to understand your risk profile if necessary.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category