Is Trualt Bioenergy Ltd IPO Good or Bad

00:00 / 00:00

Trualt Bioenergy Limited is launching its initial public offering (IPO), which will be open from September 25, 2025, to September 29, 2025. The total issue size is Rs. 839.28 crore, which includes both the fresh issue and the offer for sale. Consequently, investors are understandably wondering whether the Trualt Bioenergy IPO is a good or bad investment opportunity, or whether it carries significant risk. This article will provide a comprehensive review of the company's business model, industry trends, and financial analysis to help investors make an informed decision.

Trualt Bioenergy IPO Review

Trualt Bioenergy Limited's initial public offering (IPO) is valued at Rs.839.28 crore (approximately $1.8 billion), comprising a fresh issue of Rs.750 crore (approximately $1.75 billion) and an offer for sale (OFS) of Rs.89.28 crore (approximately $1.8 billion). The IPO will be open for subscription from September 25, 2025, to September 29, 2025. The company has set a price band of Rs.472 to Rs.496 per share, with a minimum lot size of 30 shares. The proceeds raised through the issue will be primarily used for capital expenditure, working capital requirements, and general corporate purposes.

The company was incorporated in 2021 and has one of the largest ethanol production capacities (2000 KLPD) in India. By FY2025, the company has a 3.6% market share in ethanol production capacity. Additionally, the company is active in biofuels and compressed biogas (CBG) production. As of March 2025, its subsidiary, Leafinity, operates a CBG plant with a capacity of 10.20 TPD. Additionally, the company has signed MoUs with Japan Gas Company and Sumitomo Corporation Asia & Oceania Private Limited to expand CBG production.

Truult Bioenergy has also demonstrated strong financial performance. In FY2025, the company's revenue increased by 54% to Rs.1,968.53 crore, while profit jumped 361% to Rs.146.64 crore. The company has a ROE of 28.27% and ROCE of 10.88%, while the debt-to-equity ratio is 2.02.

Given these factors, Trualt Bioenergy Limited is a strong player in the biofuel sector and plans to further accelerate its growth through this IPO. However, high debt burden remains a challenge for the company.

Company Overview of Trualt Bioenergy Ltd.

Trualt Bioenergy Limited was founded in 2021. The company's promoters are Vijaykumar Murugesh Nirani, Vishal Nirani, and Sushmita Vijaykumar Nirani. Within a short period of time, the company has established a strong presence in the biofuel sector and is now considered one of India's leading ethanol producing companies. The company's core business is ethanol production and compressed biogas (CBG). Currently, Trualt Bioenergy has an installed ethanol production capacity of 2,000 kilo liters per day (KLPD), making it India's largest ethanol producer. By FY 2025, the company projects a 3.6% market share in ethanol production capacity.

As of March 2025, the company's subsidiary, Leafinity, operates a CBG plant with a capacity of 10.20 TPD (tonnes per day). To further expand CBG production, the company has signed a Memorandum of Understanding (MoU) with Sumitomo Corporation Asia & Oceania Private Limited, a Japanese gas company. This partnership provides the company with technical support and expansion opportunities internationally.

The company's production facilities also strengthen its operations. By March 2025, Truult Bioenergy will have a total of five distillery units in Karnataka, four of which operate on molasses and syrup-based feedstocks. This diversified production base helps the company build a scalable and sustainable operation.

As part of its future strategy, Truult Bioenergy does not want to be limited to traditional ethanol and CBG. The company plans to enter several new verticals, including second-generation ethanol, sustainable aviation fuel (SAF), and mevalonolactone (MVL) and related biochemicals. Entering these new sectors will not only provide the company with an opportunity to expand its business portfolio but also capitalize on the growing demand for clean energy and green chemicals in the long term.

Overall, Trualt Bioenergy Limited is a company poised to establish a strong position in India's rapidly growing biofuel sector through its established production capacity, international partnerships, and new future prospects.

Industry Overview of Trualt Bioenergy Ltd.

The biofuel and ethanol industry in India is expected to be one of the fastest-growing sectors in the coming years. The government has made the Ethanol Blending Program (EBP) a key component of the National Energy Policy, aiming to reduce dependence on imported crude oil and reduce carbon emissions by blending ethanol with gasoline. India currently achieves over 12% ethanol blending and plans to increase this target to 20% by 2025. This policy will directly benefit ethanol and biofuel manufacturers, and companies like Trualt Bioenergy IPO are in a strong position to capture this growth trend.

Demand for compressed biogas (CBG) is also gradually increasing in the country. The government has launched the SATAT (Sustainable Alternative Towards Affordable Transportation) initiative for CBG production and distribution, with a target of setting up over 5,000 CBG plants. This is making CBG an alternative and sustainable fuel source. Companies with a strong presence and technical expertise in this sector, like Trualt Bioenergy, stand to benefit significantly in the future.

Demand for clean energy and green fuels is also growing globally. Alternative energy sources like Sustainable Aviation Fuel (SAF), Second-Generation Ethanol (2G Ethanol), and Green Hydrogen are no longer just options but essential for international energy security and climate change policies. Research and investment in this area is rapidly increasing in India, which could present significant opportunities for domestic companies in the coming years.

Overall, India's biofuel and ethanol industry has the potential to become a strong growth story over the next 5–10 years. Government policy support, rising domestic consumption, and international cooperation are making this sector attractive to investors. Consequently, the Trualt Bioenergy IPO offers investors a significant opportunity to gain early exposure to this emerging sector.

Financial Overview of Trualt Bioenergy Ltd.

Particulars | 31 March 2024 | 31 March 2023 | 31 March 2022 |

Total Assets (Rs. Lakhs) | 2,41,908.13 | 1,85,597.93 | 6.15 |

Equity (Rs. Lakhs) | 26,460.71 | 24,049.47 | 4.87 |

Non-current Liabilities (Rs. Lakhs) | 1,09,299.32 | 1,17,295.17 | - |

Current Liabilities (Rs. Lakhs) | 1,06,148.10 | 44,253.29 | 1.28 |

Revenue from Operations (Rs. Lakhs) | 1,28,018.77 | 76,238.03 | - |

Total Expenses (Rs. Lakhs) | 1,23,531.31 | 71,339.52 | 1.23 |

Profit Before Tax (Rs. Lakhs) | 4,487.46 | 4,898.51 | 1.23 |

Profit After Tax (Rs. Lakhs) | 3,180.84 | 3,545.99 | 1.23 |

Earnings per Share (INR) | 354.25 | 7.10 | 2.02 |

Cash & Cash Equivalents (Rs. Lakhs) | 2,335.04 | 477.91 | 6.10 |

TruAlt Bioenergy Limited (formerly TruAlt Energy Limited) has been experiencing consistent financial strength over the past few years. A review of the company's income, profit, and balance sheet clearly demonstrates its continued strength in the renewable energy and bioenergy sector.

Revenue & Profit Growth

FY 2022 (as of March 31, 2022) : The company recorded revenue from operations of Rs.69,557.98 lakh. Other income was Rs.66.42 lakh, resulting in a total income of Rs.69,624.40 lakh.

Profit before tax (PBT) was Rs.5,026.95 lakh, after total expenses of Rs.64,597.45 lakh. Net profit after tax (PAT) was Rs.3,761.64 lakh.

H1 FY 2023 (six months to September 30, 2022) : The company's revenue was Rs. 39,800.98 lakh, with other income of Rs. 33.73 lakh, resulting in a total income of Rs. 39,834.71 lakh. With total expenses of Rs. 38,024.39 lakh, the profit before tax was Rs. 1,810.32 lakh and net profit was Rs. 1,354.70 lakh.

These figures indicate that the company's revenue stream and profitability have remained stable and are gradually improving.

Balance Sheet : As of September 30, 2022, the company's total assets were Rs. 1,18,678.20 lakh, of which non-current assets were Rs. 1,05,192.36 lakh and current assets were Rs. 13,485.84 lakh.The company's equity stood at Rs. 1,03,324.19 lakh.

Considering its debt position, non-current liabilities were only Rs. 49.20 lakh and current liabilities were Rs. 15,354.01 lakh. This means the company's debt-to-equity ratio is very low and the balance sheet is quite balanced.

Cash Flow Overview

FY 2022:

Net cash flow from operating activities was Rs. 17,456.48 lakh.

Investing activities generated an outflow of Rs. -55,053.43 lakh.

Financing activities generated a cash inflow of Rs. 32,367.30 lakh.

The combined cash and bank balance at the end of the year was Rs. 696.40 lakh.

H1 FY 2023:

Net cash flow from operating activities was Rs. 6,916.57 lakh.

Investing activities experienced an outflow of Rs. -14,785.60 lakh.

Financing activities experienced an inflow of Rs. 8,292.63 lakh.

Cash and bank balance at the end of the period was Rs. 1,120.00 lakh.

Key Financial Indicators

EBITDA Margin (FY22): Around 12–13%.

PAT Margin (FY22): Around 5.4%.

Debt-to-Equity: Nearly zero, indicating a strong balance sheet.

ROE and ROCE: Due to the company's large equity base, ROE and ROCE are moderate but indicate stable profitability.

The company's financial position is strong, with a very low debt burden and positive operating cash flow. Additionally, revenues and profits are growing steadily, strengthening the prospects for expansion and investment in the future.

Strengths of Trualt Bioenergy Ltd.

Largest Installed Ethanol Production Capacity : TruAlt Bioenergy is one of India’s leading ethanol producers with an installed capacity of 2,000 KLPD, making it a significant player in the country’s biofuel sector. This large-scale production capacity provides economies of scale and ensures consistent supply to meet growing domestic demand.

Strategic Location of Distilleries : The company operates five distillery units in Karnataka, strategically positioned to optimize raw material sourcing and logistics. Four of these units use molasses and syrup-based feedstocks, enabling efficient and cost-effective operations.

Strong Industry Tailwinds : TruAlt Bioenergy benefits from favorable government policies, such as the ethanol blending mandate, which supports the growth of the biofuels sector in India. This positions the company to capitalize on increasing demand for sustainable fuel solutions.

Focus on Technological Innovation and Expansion : The company emphasizes innovation through its integrated operations and has plans to expand into second-generation ethanol, sustainable aviation fuel, and Mevalonolactone (MVL) production. Collaborations with international firms for CBG capacity expansion further enhance its growth potential.

Experienced Promoters and Management Team : Promoters Vijaykumar Murugesh Nirani, Vishal Nirani, and Sushmitha Vijaykumar Nirani bring extensive industry experience, complemented by a skilled management team capable of executing large-scale projects and driving operational excellence.

Established Customer Base and Demand Pipeline : TruAlt Bioenergy maintains strong, long-term relationships with customers across the ethanol and CBG sectors. This entrenched customer network ensures a stable revenue stream and a healthy order pipeline, supporting sustainable growth.

Risks of Trualt Bioenergy Ltd.

High Debt-to-Equity Ratio : The company's debt/equity ratio is 2.02, which indicates that the company relies heavily on borrowing to fund its operations and expansion. This means the company may incur high interest payments, especially if profitability does not reach expected levels. Furthermore, financial pressures may increase if there is economic uncertainty in the market or raw material prices increase. Investors should note that high debt levels can increase investment risk.

Dependence on Government Policies and Ethanol Prices : Trualt Bioenergy's core business is ethanol production, which is directly dependent on government policies and ethanol pricing. Changes in the Indian government's ethanol blending policy, support prices, or other subsidies could impact the company's revenue and profits. For example, if the government reduces ethanol demand or reduces its price, this would adversely impact the company's profitability.

Raw Material Supply Risks : The Company's production base is molasses and grains. Unstable raw material supplies, weather uncertainties, or shortages from farmers could increase production costs. Consequently, the Company's profits could decline. Furthermore, fluctuations in raw material prices impact the Company's cost structure and increase risks for investors.

Industry Competition and Pricing Pressures : Many large and small competitors are active in the ethanol and biofuel industry. Competition can make it challenging for the Company to control production costs and maintain competitive pricing in the market. If the Company is unable to obtain better prices for its products, it could impact both profitability and market share.

Implementation Risks in New Business Areas : The Company plans to expand into new verticals such as second-generation ethanol, sustainable aviation fuel, and Mevalonolactone (MVL) and other Allied Biochemicals. These projects involve high technical complexity, investment costs, and operational risks. Delays in implementing new technology, higher costs, or a decline in demand could increase investor risk.

Project and Expansion Plan Risk : The Company is investing in expanding its CBG production capacity and building new units. Failure to complete such projects on time, increasing costs, or delaying regulatory approvals could impact the Company's plans. This could impact financial performance and shareholder valuation.

External Economic and Industry Risks : The ethanol and biofuel industry is dependent on global oil prices, currency rates, and agricultural production. Changes in global oil prices, economic recessions, or reduced agricultural production could put pressure on the Company's operations and profitability.

Strategies of Trualt Bioenergy Ltd.

Expansion of Ethanol Production Capacity : Trualt Bioenergy is one of India's largest ethanol producers, with an installed production capacity of 2,000 kiloliters per day (KLPD). The company is implementing multi-feedstock operations to expand its ethanol production capacity, aiming to maximize production and reduce costs by using various raw materials such as grains, molasses, and syrups. Specifically, the company is installing a new unit with a capacity of 300 KLPD at its TBL Unit 4, which will enable the use of grain-based raw materials and improve production diversity and cost-effectiveness.

CBG (Compressed Biogas) Production Expansion : Trualt Bioenergy's business is not limited to ethanol. Its subsidiary, Leafinity, operates a CBG production plant with a capacity of 10.20 TPD (tonnes per day). The company has pursued international partnerships to expand its CBG production capacity, signing MoUs with a Japanese gas company and Sumitomo Corporation Asia & Oceania Pte. Ltd. These partnerships will play a key role in technical collaboration and production expansion, making CBG production more efficient and sustainable.

Entering New Technologies and Fuels : Truall Bioenergy plans to invest in second-generation ethanol (2G Ethanol) and sustainable aviation fuel (SAF). Second-generation ethanol technology produces ethanol from agricultural residues and non-food crops, reducing environmental impact and increasing raw material diversity. Sustainable aviation fuel produces lower carbon emissions than traditional fossil fuels. This initiative will provide the company with a competitive advantage in environmentally friendly energy solutions and strengthen its position in the future energy market.

Diversification into High-Value Biochemicals : The company is also expanding its business into high-value biochemicals such as Mevalonolactone (MVL) and Allied Biochemicals. This strategy will help develop high-margin product lines and enter new markets. These chemicals are used in the pharmaceutical, food, and other industrial sectors, ensuring revenue growth and business diversification for the company.

Production Infrastructure and Strategic Advantages : Trualt Bioenergy's production facilities are located in Karnataka, including five distillery units, four of which operate on molasses and syrup-based feedstock. The company's excellent geographical location and focus on technological innovation enable it to capitalize on favorable industry opportunities. An experienced management team and strong customer network help ensure stable demand and long-term growth.

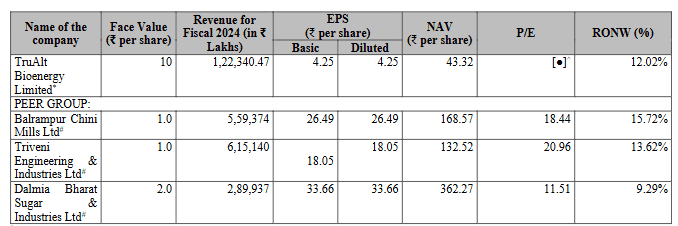

Trualt Bioenergy IPO Peer Comparison

Trualt Bioenergy Limited's financial performance appears balanced and rising compared to its listed industry peers. The company has a price per share of Rs.10 and revenue of Rs.1,22,340.47 lakh in FY2024. During this period, the company's EPS was Rs.4.25 and NAV was Rs.43.32 per share, while its ROE was 12.02%. These figures indicate that Trualt Bioenergy has established a competitive position in terms of its financial performance and value creation for investors.

When compared with other major industry peers, Balrampur Chini Mills Ltd had an EPS of Rs.26.49 and an ROE of 15.72%, Triveni Engineering & Industries Ltd had an EPS of Rs.18.05 and an ROE of 13.62%, while Dalmia Bharat Sugar & Industries Ltd had an EPS of Rs.33.66 and an ROE of 9.29%. This comparison clearly shows that Trualt Bioenergy has stable growth and has the potential to emerge competitive in the industry. As per financial KPIs, the company has shown a consistent increase in revenue between FY 2022 and 2024. Its revenue was Rs.76,238.03 lakh in 2022, which increased to Rs.1,22,340.47 lakh in 2023. EBITDA also improved, rising from a marginal loss (Rs.1.23 lakh) in 2022 to Rs.18,808.51 lakh in 2024. EBITDA margin improved from -13.78% in 2022 to 15.37% in 2023 and 15.37% in 2024. Similarly, PAT margin improved from -4.65% in 2022 to 2.60% in 2024.

Return on Capital Employed (ROCE) also improved from -11.38% in 2022 to 7.42% in 2024, while Net Debt increased from Rs.1,14,532.02 lakh in 2022 to Rs.1,66,133.14 lakh in 2024. This indicates that the company has effectively managed its capital resources and debt structure.

Looking at operational KPIs, the number of distillery units in the company remained at 3 from 2022 to 2024. The total ethanol/distillery capacity was 590 KLPD in 2022, which increased to 1,400 KLPD in 2023 and 2024. Production also increased from 372 KLPD in 2022 to 597 KLPD in 2023 and 598 KLPD in 2024. Despite this, capacity utilization remained at 63% in 2022, 70% in 2023, and 43% in 2024, indicating that full capacity utilization remains limited despite the installation of new units and expansion of production capacity.

The company has pledged to regularly monitor and report KPIs, which are verified and certified by the Audit Committee on August 16, 2024. These KPIs help investors conduct an in-depth analysis of the company's financial health, operational efficiency, and industry position. Overall, Trualt Bioenergy's financial strength, operational efficiency, and competitiveness in the industry make it an attractive option for investors.

Objectives of Trualt Bioenergy IPO

Funding for Capital Expenditure : The primary purpose of the IPO proceeds is to finance the construction and equipment purchase of a grain-based ethanol unit for multi-feed operation at TBL Unit 4. This includes civil works, plant and machinery, other fixed assets, and initial operating expenses. The total estimated expenditure is Rs.17,268 lakh, as certified by ITCOT Limited.

Civil works include foundation and structure construction, concrete and RCC work, tiling, painting, granite, and other construction work.

Plant and machinery includes grain silos, grain handling and milling systems, liquefaction and fermentation sections, DCGS dryers, utilities, and structural work.

2. Funding for Working Capital Requirements : The Company's business is working capital intensive as raw material prices fluctuate seasonally and ethanol sales depend on the bidding process of Oil Marketing Companies (OMCs). The proceeds from the IPO will enable the Company to:

Manage inventory at the end of the sugarcane crushing season.

Purchase raw materials required for production throughout the year.

Make timely payments to suppliers by reducing the trade payable period.

3. General Corporate Purposes : A portion of the proceeds from the IPO will be used for general corporate purposes, ensuring operational efficiency and financial stability.

4. Alignment with the Company's Growth Strategy : All of these objectives are consistent with Trualt Bioenergy's long-term growth strategy. The establishment of a grain-based ethanol unit and multi-feed operation will enhance production capacity, working capital funding will help in navigating seasonal fluctuations and proper management of corporate resources will strengthen the financial performance of the company.

Trualt Bioenergy IPO Details

IPO Dates : Trualt Bioenergy IPO will be open for subscription from September 25, 2025, to September 29, 2025. Allotment for this IPO is expected to take place on September 30, 2025, and the company's shares will be listed on the BSE and NSE on October 3, 2025.

IPO Issue Price : Trualt Bioenergy is offering its shares in a price band of Rs. 472 to Rs. 496 per share. Consequently, retail investors will need to invest a minimum of Rs. 14,880 for one lot, i.e., 30 shares.

IPO Size : The company will issue a total of 1,69,20,967 shares through this IPO, amounting to a total size of Rs. 839.28 crore. This includes a fresh issue of Rs. 750.00 crore and an offer for sale (OFS) of Rs. 89.28 crore.

IPO Allotment Status : Investors who have applied for this IPO can check their allotment status on September 30, 2025, through the registrar's website, BSE, NSE, or their stockbroker platform.

IPO Listing Date : Trualt Bioenergy shares will be listed on the BSE and NSE on October 3, 2025.

IPO Application Link : Open a demat account with Rupeezy today and make the IPO application process easy and fast. With a user-friendly platform, Rupeezy makes IPO applications a completely hassle-free experience.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category