Uncovering India’s Top Stock Market Companies and Their Shareholding Patterns

00:00 / 00:00

Introduction

Today, we are coming up with the lists of stocks at 15-75 percent discount in (2019). We saw a decline in market followed by selling pressure from FII ‘s.

Many stocks have fallen drastically from thier respective 52-week high.

The purpose of this list is for information purpose only. In the first place do not think of this stocks as any recommendation.

My suggestion would be to check fundamentals of the company, if you are selecting.

Moreover use technical indicators like Moving Average Convergence Divergence MACD ,Exponential Moving Average EMA, Simple Moving Average SMA ,Relative Strength Index RSI for proper guidance.

All this indicators are eaisly explained click and learn more. Below are stocks with detailed information on performance in last one year.

Yes Bank Limited

- 52 week high – 404.00

Date – 20-AUG-2018 - 52 week low – 79.15

Date – 18-JUL-2019

Yes Bank was incorporated as a Public Limited Company on November 21, 2003.

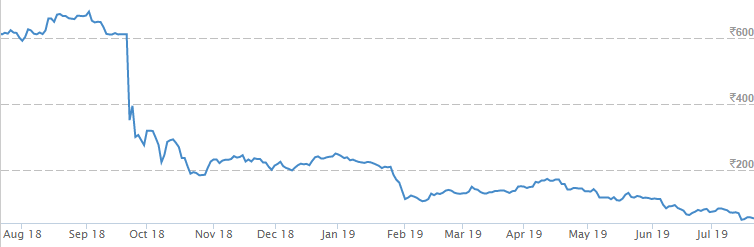

Below is the chart for the last 1 year representing moves

On chart D represents dividend. If you calculate return (YTD) it’s -52.81% . Where as Fall from 52 week high is -78.76% .

However the company has a good dividend track report and has consistently declared dividends for the last 5 years. Yes bank stocks is available for more than 75 percent discount in 2019 .

Shareholding Pattern (%)

Promoter’s -19.78

Public -80.22

Quarterly results in brief

(Rs crore)

Jun’ 19 | Mar’ 19 | Dec’ 18 | Sep’ 18 | Jun’ 18 | |

|---|---|---|---|---|---|

Sales | 7,816.15 | 7,856.54 | 7,958.94 | 7,231.23 | 6,578.04 |

Operating profit | 4,437.63 | 2,480.61 | 5,841.79 | 4,766.69 | 4,493.82 |

Interest | 5,535.30 | 5,350.61 | 5,292.53 | 4,813.68 | 4,358.90 |

Gross profit | 1,959.10 | 1,323.39 | 1,990.36 | 2,366.44 | 2,454.71 |

EPS (Rs) | 0.49 | -6.51 | 4.33 | 4.18 | 5.47 |

Indiabulls Housing Finance Limited

- 52 week high – 1,397.00

Date – 06-AUG-2018 - 52 week low – 487.85

Date – 19-JUN-2019

Have a look at the chart for IBULHSGFIN

On chart D represents dividend . If you calculate return (YTD) it’s -22.81% .

Where as Fall from 52 week high is -52.82% . Indiabulls Housing Finance Limited stocks is available for more than 50 percent discount in 2019 .

Shareholding Pattern (%)

Promoter’s -21.64

Public – 78.36

Quarterly results in brief

(Rs crore)

Mar’ 19 | Dec’ 18 | Sep’ 18 | Jun’ 18 | Mar’ 18 | |

|---|---|---|---|---|---|

Sales | 3,707.91 | 3,819.81 | 3,612.93 | 3,601.12 | 3,400.84 |

Operating profit | 3,461.52 | 3,403.53 | 3,368.16 | 3,311.14 | 2,835.28 |

Interest | 2,199.83 | 2,267.86 | 2,378.25 | 2,200.73 | 1,977.01 |

Gross profit | 1,263.28 | 1,363.79 | 1,258.78 | 1,298.74 | 1,140.20 |

EPS (Rs) | 20.48 | 22.29 | 21.87 | 22.69 | 22.33 |

For the year ending March 2019, Indiabulls Housing Finance has declared an equity dividend of 2000.00% amounting to Rs 40 per share.

At the current share price of Rs 643.00 this results in a dividend yield of 6.22%.

The company has a good dividend track report and has consistently declared dividends for the last 5 years.

Tata Motors Limited

- 52 week high – 282.00

Date – 10-SEP-2018 - 52 week low – 129.00

Date – 08-FEB-2019

Check out chart for last 1 year representing moves

If you calculate return (YTD) it’s -6.92% . However ,Fall from 52 week high is -43% .

Tata Motors limited stocks is available for more than 50 percent discount in 2019.

Tata Motors had last declared a dividend of 10.00% for the year ending March 2016.

Shareholding Pattern (%)

Promoter’s -38.37

Public – 61.63

Quarterly results in brief

(Rs crore)

Mar’ 19 | Dec’ 18 | Sep’ 18 | Jun’ 18 | Mar’ 18 | |

|---|---|---|---|---|---|

Sales | 18,561.41 | 16,207.67 | 17,758.69 | 16,803.11 | 19,779.32 |

Operating profit | 1,189.13 | 1,512.62 | 1,096.86 | 1,269.06 | 1,113.78 |

Interest | 389.14 | 468.08 | 443.12 | 493.23 | 446.43 |

Gross profit | 1,219.79 | 1,313.94 | 997.61 | 2,169.30 | 1,344.37 |

EPS (Rs) | 0.31 | 1.82 | 0.32 | 3.50 | -1.47 |

In the Year 1945 The Company was incorporated on 1st September at Mumbai.

To manufacture diesel vehicles for commercial use, excavators, industrial shunter, dumpers, heavy forgings and machine tools .

Maruti Suzuki India Limited

- 52 week high – 9,929.00

Date – 24-JUL-2018 - 52 week low – 5,710.10

Date -19-JUL-2019

Chart for the last 1 year movement

If you calculate return (YTD) it’s -21.21% . Furthermore Fall from 52 week high is -40.76% .

For the year ending March 2019, Maruti Suzuki India has declared an equity dividend of 1600.00% amounting to Rs 80 per share.

At the current share price of Rs 5920.00 this results in a dividend yield of 1.35%.

The company has a good dividend track report and has consistently declared dividends for the last 5 years. Stock is available for more than 40 percent discount in 2019 .

Shareholding Pattern (%)

Promoter’s -56.21

Public – 43.79

Quarterly results in brief

(Rs crore)

Mar’ 19 | Dec’ 18 | Sep’ 18 | Jun’ 18 | Mar’ 18 | |

|---|---|---|---|---|---|

Sales | 21,459.40 | 19,668.30 | 22,433.20 | 22,459.40 | 21,165.60 |

Operating profit | 2,263.40 | 1,931.10 | 3,431.30 | 3,351.10 | 3,015.00 |

Interest | 8.80 | 20.60 | 25.70 | 20.70 | 273.10 |

Gross profit | 3,122.30 | 2,827.80 | 3,932.20 | 3,602.20 | 3,336.90 |

EPS (Rs) | 59.46 | 49.31 | 74.19 | 65.41 | 62.32 |

Cox & Kings Limited

- 52 week high – 232.35

Date – 06-AUG-2018 - 52 week low –15.55

Date – 23-JUL-2019

Chart for the last 1 year movement

If you calculate return (YTD) it’s -89.12% . Moreover Fall from 52 week high is -92.21% .

For the year ending March 2018, Cox & Kings has declared an equity dividend of 20.00% amounting to Rs 1 per share.

At the current share price of Rs 15.55 this results in a dividend yield of 6.43%. The company has a good dividend track report and has consistently declared dividends for the last 5 years.

Cox & Kings Limited is available for more than 90 percent discount in 2019 . On January 29, 2007, Company became a public limited company .

Shareholding Pattern (%)

Promoter’s -39.73

Public – 60.27

Quarterly results in brief

(Rs crore)

Mar’ 19 | Dec’ 18 | Sep’ 18 | Jun’ 18 | Mar’ 18 | |

|---|---|---|---|---|---|

Sales | 570.09 | 596.31 | 646.38 | 1,003.00 | 561.67 |

Operating profit | 45.52 | 43.99 | 70.15 | 144.28 | 29.57 |

Interest | 35.11 | 31.28 | 26.09 | 34.96 | 33.30 |

Gross profit | 22.93 | 45.68 | 73.78 | 141.39 | 27.88 |

EPS (Rs) | 0.23 | 1.32 | 2.28 | 5.17 | 0.31 |

Dewan Housing Finance Corporation Limited

- 52 week high – 691.50

Date – 03-SEP-2018 - 52 week low – 44.50

Date – 16-JUL-2019

Chart for the last 1 year movement

If you calculate return (YTD) it’s -77.45% . Where as Fall from 52 week high is -91.87% .

Dewan Housing Finance Corporation had last declared a dividend of 55.00% for the year ending March 2018.

Dewan Housing Finance Corporation stock is available for more than 90 percent discount in 2019 .

In1984 the Company was incorporated in the State of Maharashtra on 11th April, in the name of Dewan Housing Finance & Leasing Co.Ltd.

They obtained the Certificate for Commencement of Business on 26th April 1984.

The name of the Company was changed to Dewan Housing Development Finance Ltd., and a fresh certificate was obtained on 26th September.

Shareholding Pattern (%)

Promoter’s -39.21

Public – 60.79

Quarterly results in brief

(Rs crore)

Mar’ 19 | Dec’ 18 | Sep’ 18 | Jun’ 18 | Mar’ 18 | |

|---|---|---|---|---|---|

Sales | 3,052.90 | 3,250.94 | 3,515.66 | 3,149.67 | 2,801.93 |

Operating profit | -544.42 | 2,889.93 | 3,081.37 | 2,833.50 | 2,461.51 |

Interest | 2,349.25 | 2,410.28 | 2,440.21 | 2,193.11 | 1,980.19 |

Gross profit | -2,889.96 | 484.60 | 644.72 | 646.81 | 487.56 |

EPS (Rs) | -70.85 | 9.99 | 13.98 | 13.87 | 9.96 |

PC Jeweller Limited

- 52 week high – 163.50

Date – 18-APR-2019 - 52 week low – 33.30

Date – 22-JUL-2019

Chart for the last 1 year movement

If you calculate return (YTD) it’s -58% . In fact Fall from 52 week high is -77.86% .PC Jeweller had last declared a dividend of 5.00% for the year ending March 2018.

PC Jeweller stock is available for more than 75 percent discount in 2019 .

Company was incorporated on April 13, 2005 in New Delhi under the Companies Act as a private limited company under the name ‘P Chand Jewellers Private Limited’ with the RoC.

Shareholding Pattern (%)

Promoter’s -48.21

Public – 51.79

Quarterly results in brief

(Rs crore)

Mar’ 19 | Dec’ 18 | Sep’ 18 | Jun’ 18 | Mar’ 18 | |

|---|---|---|---|---|---|

Sales | 2,191.46 | 2,119.10 | 1,635.08 | 2,423.21 | 2,103.22 |

Operating profit | -452.18 | 240.16 | 205.80 | 248.39 | 212.33 |

Interest | 71.25 | 88.79 | 97.67 | 82.68 | 83.65 |

Gross profit | -510.92 | 196.27 | 136.23 | 197.93 | 139.96 |

EPS (Rs) | -9.55 | 3.51 | 2.37 | 3.60 | 3.00 |

Jet Airways (India) Limited

- 52 week high – 366.95

Date – 16-NOV-2018 - 52 week low – 26.55

Date – 20-JUN-2019

Chart for the last 1 year movement

If you calculate return (YTD) it’s -83.82% . Further Fall from 52 week high is -87.76% . Jet Airways has not declared any dividend for the last several years.

It is available for more than 85 percent discount in 2019 . Jet Airways was incorporated on April 1, 1992 as a private company with limited liability under the Companies Act.

Commenced operations as an Air Taxi Operator on May 5, 1993 with a fleet of four leased Boeing 737 aircraft. Jet Airways became a public company on December 28, 2004.

Shareholding Pattern (%)

Promoter’s -51

Public – 49

Quarterly results in brief

(Rs crore)

Dec’ 18 | Sep’ 18 | Jun’ 18 | Mar’ 18 | Dec’ 17 | |

|---|---|---|---|---|---|

Sales | 6,147.98 | 6,161.15 | 6,010.46 | 5,924.85 | 6,086.20 |

Operating profit | -270.89 | -1,030.64 | -1,018.49 | -764.94 | 281.11 |

Interest | 256.86 | 231.38 | 248.88 | 236.04 | 222.13 |

Gross profit | -477.35 | -1,186.48 | -1,210.92 | -870.68 | 322.12 |

EPS (Rs) | -51.74 | -114.21 | -116.46 | -91.20 | 14.55 |

Shankara Building Products Limited

- 52 week high – 1,699.00

Date – 14-AUG-2018 - 52 week low – 315.50

Date – 23-JUL-2019

Chart for the last 1 year movement

If you calculate return (YTD) it’s -34.23% . If you see fall from 52 week high is -79.68% .

For the year ending March 2019, Shankara Building Products has declared an equity dividend of 15.00% amounting to Rs 1.5 per share.

Shankara Building Products limited is available for more than 75 percent discount in 2019.

Shankara Building Products limited At the current share price of Rs 320.60 this results in a dividend yield of 0.47%.

The company has a good dividend track report and has consistently declared dividends for the last 5 years.

Shareholding Pattern (%)

Promoter’s -56.21

Public – 43.79

Quarterly results in brief

(Rs crore)

Mar’ 19 | Dec’ 18 | Sep’ 18 | Jun’ 18 | Mar’ 18 | |

|---|---|---|---|---|---|

Sales | 548.72 | 530.87 | 574.01 | 698.77 | 678.33 |

Operating profit | 9.74 | 14.91 | 14.05 | 26.15 | 26.89 |

Interest | 7.60 | 9.08 | 9.46 | 9.07 | 8.71 |

Gross profit | 4.18 | 6.18 | 5.92 | 17.30 | 18.34 |

EPS (Rs) | 0.68 | 0.98 | 1.39 | 4.13 | 4.57 |

Graphite India Limited

- 52 week high – 1,127.00

Date – 10-AUG-2018 - 52 week low – 255.15

Date -22-JUL-2019

Chart for the last 1 year movement

If you calculate return (YTD) -62.17% . Fall from 52 week high is -74.65%.

For the year ending March 2019, Graphite India has declared an equity dividend of 2750.00% amounting to Rs 55 per share.

At the current share price of Rs 271.00 this results in a dividend yield of 20.3%. Graphite India is available for more than 70 percent discount in 2019 .

The company has a good dividend track report and has consistently declared dividends for the last 5 years.

Shareholding Pattern (%)

Promoter’s -65.22

Public – 34.78

Quarterly results in brief

(Rs crore)

Mar’ 19 | Dec’ 18 | Sep’ 18 | Jun’ 18 | Mar’ 18 | |

|---|---|---|---|---|---|

Sales | 1,390.00 | 1,562.00 | 2,008.00 | 1,777.00 | 1,212.22 |

Operating profit | 671.00 | 868.00 | 1,367.00 | 1,300.00 | 668.56 |

Interest | 4.00 | 3.00 | 3.00 | 1.00 | 1.99 |

Gross profit | 730.00 | 929.00 | 1,406.00 | 1,327.00 | 703.61 |

EPS (Rs) | 21.90 | 31.23 | 46.77 | 44.00 | 23.22 |

The company was incorporated on 2nd May, 1974 at Mumbai.

It manufactures graphite electrodes and anodes. The Company was promoted by H L Financial Consultants & Management Services Pvt. Ltd. (FICOM) and H L Investments Pvt. Ltd.

Few other Stocks at 15-75 percent discount

Eicher Motors Limited , Central Bank of India ,HEG Limited, Hero MotoCorp Limited, Vedanta Limited

56 stocks in the top 500 on the NSE are trading at a discount of 50-90 percent from their respective 52-week highs.

Do proper research before investing or trading in any of these stocks. I will end this blog with special quote relating to situation.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

Open Rupeezy account now. It is free and 100% secure.

Start Stock InvestmentAll Category