Is Oswal Pumps IPO Good or Bad - Detailed Review

00:00 / 00:00

Oswal Pumps Limited IPO is kicking off its initial public offering, which will be open from June 13, 2025, to June 17, 2025. While considering applying for this IPO, certain questions may arise in your mind, including whether the Oswal Pumps IPO is good or bad, whether it is worth investing in this IPO, and so on.

This article offers a comprehensive Oswal Pumps IPO review, covering its business operations and fundamental analysis to help you make an informed investment choice.

Oswal Pumps IPO Review

Oswal Pumps is gearing up for its Initial Public Offering (IPO), aiming to raise Rs 1,387.34 crore. The proceeds are primarily earmarked to fund the company’s capital expenditure, support the establishment and debt repayment of its subsidiary Oswal Solar, reduce existing borrowings, and meet general corporate purposes.

Speaking about the financials of the company for the last three financial years, the company has shown strong growth, with revenue rising from Rs 360.38 crore in FY22 to Rs 758.57 crore in FY24. EBITDA more than tripled during the same period, with margins improving from 10.69% to 19.79%, reflecting better cost control and scale. PAT increased nearly sixfold to Rs 97.67 crore in FY24, boosting PAT margins to 12.83%. Return ratios have been exceptional, with RoE reaching 88.73% and RoCE at 81.85% in FY24, indicating efficient capital deployment.

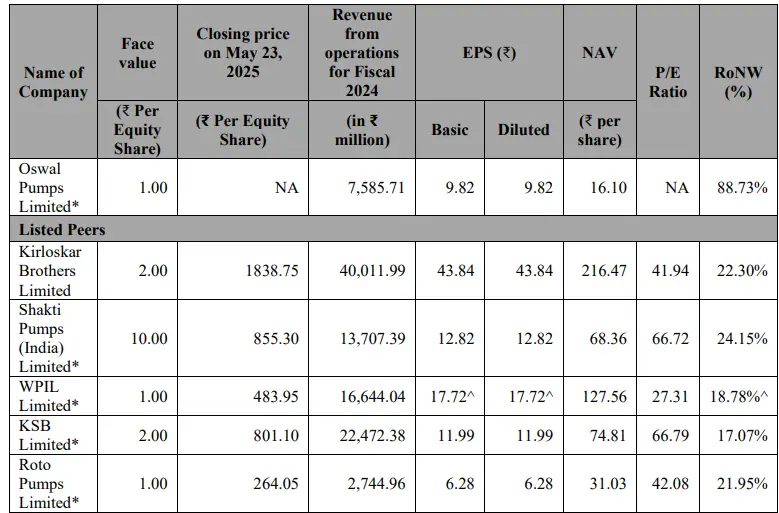

Oswal Pumps Ltd, with revenue of Rs 758.57 crore in FY24, is smaller than major players like Kirloskar Brothers and KSB Ltd but aligns well with mid-sized peers such as WPIL and Shakti Pumps. Its EPS of Rs 9.82 is moderate, falling below larger peers but outperforming smaller ones like Roto Pumps. What distinctly sets Oswal apart is its exceptionally high RoE of 88.73%, the highest among all peers, indicating superior capital efficiency.

That said, potential investors are strongly advised to conduct their own independent analysis and consult financial advisors before making any investment decision. Keep reading to find out more about the company’s background, business model, and growth strategy.

Company Overview of Oswal Pumps IPO

Oswal Pumps began its operations in 2003 with the manufacturing of low-speed monoblock pumps and has since expanded to produce grid-connected and solar-powered submersible and monoblock pumps, electric motors, and solar modules under the ‘Oswal’ brand. With over 22 years of experience, the company serves diverse sectors including agriculture, residential, commercial, and industrial applications.

In 2019, Oswal entered the solar pump segment through the PM Kusum Scheme, and by 2021, began offering complete turnkey solar pumping systems, including pumps, modules, mounting structures, controllers, and installation services. By December 31, 2024, it had executed 38,132 such systems across states like Haryana, Rajasthan, Uttar Pradesh, and Maharashtra, becoming one of the largest suppliers under the scheme in just four years.

The company’s revenue grew at a CAGR of 45.07% from FY22 to FY24, supported by operational efficiency, sustainability efforts like recycling scrap metal for components, and innovation in smart pump controllers with mobile-based features. Its Karnal-based facility, spanning over 41,000 sq. m., is among India’s largest single-site pump manufacturing plants and is strategically located near major agricultural states. Oswal is also ALMM-listed, reflecting its compliance with national quality standards and reinforcing its strong industry reputation.

Industry Overview of Oswal Pumps IPO

The Indian pump industry is experiencing strong growth, projected to expand from Rs 38,050 crore in FY25 to Rs 59,190 crore by FY30, driven by infrastructure development, industrialization, and supportive government initiatives like Jal Jeevan Mission, Swachh Bharat Mission, and the PM Kusum Scheme. The agricultural pump segment is especially promising, with increasing adoption of solar-powered pumps, modern irrigation needs, and subsidy-backed programs.

The solar pump market in India is expected to grow at a CAGR of 19.5%, with a massive untapped potential, particularly in replacing 80 lakh diesel pumps and serving over 11.4 crore farmers without access to any pumps. This creates a market opportunity of approximately Rs 3,60,000 crore, where Oswal Pumps already accounts for around 38% of the total solar pump installations under the PM Kusum Scheme.

Beyond solar, demand for centrifugal, monoblock, and multistage pumps continues to grow across agriculture, residential, and industrial applications. The Indian electric motor market, closely linked to pump usage, is projected to grow from Rs 340 crore (USD 4.1 billion) in FY25 to Rs 660 crore (USD 8 billion) by FY30, at a CAGR of 14.3%.

Policies like Atmanirbhar Bharat and the PLI Scheme are also promoting domestic manufacturing of components like solar modules, an area where Oswal is expanding. Backed by integrated manufacturing, alignment with national priorities, and strong demand, Oswal Pumps is well-positioned to capitalise on the ongoing boom in India’s pump and solar equipment market.

Financial Overview of Oswal Pumps IPO

Over the last three financial years, the company has exhibited a robust growth path, as reflected in its steadily increasing revenue. The revenue from operations rose from Rs 360.38 crore in FY22 to Rs 385.04 crore in FY23 and then sharply jumped to Rs 758.57 crore in FY24.

The company’s Profit After Tax (PAT) had increased by more than 2x YoY, from Rs 16.92 crore in FY22 to Rs 34.19 crore in FY23 and reaching Rs 97.67 crore in FY24. PAT margins followed a similar trend, rising from 4.69% in FY22 to 12.83% in FY24. These figures reflect enhanced net profitability and better utilization of resources.

For the nine months of FY25, the company has reported an operating revenue and net profit of Rs. 1065.67 crores and Rs. 216.70 crores, respectively, even surpassing the previous financial year's performance. This growth indicates the company’s successful scale-up in production and sales operations, with an increasing market presence across multiple sectors, including agriculture and infrastructure.

This strong profitability performance has translated into outstanding returns to shareholders. Return on Equity (RoE) surged from 58.88% in FY22 to 88.73% in FY24, indicating that the company is generating significant profit from its equity base. Similarly, Return on Capital Employed (RoCE) rose from 27.01% in FY22 to 81.85% in FY24, showing that the company is effectively utilizing both equity and borrowed capital to generate profits. These metrics suggest excellent financial management and operational leverage.

In summary, the company has demonstrated impressive financial growth and operational excellence over the past three years. Its strategic focus on solar solutions, strong execution capabilities, and efficient cost management have driven superior profitability and high returns on capital. This performance positions the company well for sustained growth in the renewable energy and pump manufacturing sectors.

Strengths and Risks of Oswal Pumps IPO

Let’s dive into the strengths and weaknesses to assess if the Oswal Pumps IPO is good or bad for investors.

Strengths

Leadership in solar agricultural pumps under the PM Kusum Scheme:

With a revenue CAGR of 45.07% between FY22 and FY24, the company has emerged as one of the fastest-growing and largest suppliers of solar-powered agricultural pumps under the PM Kusum Scheme, offering turnkey solutions directly and through partners like Tata Power Solar.Vertically integrated operations:

The company has established strong backward integration across pumps and solar module manufacturing, supported by its associate Walso Solar Solution, enabling cost efficiency, product development, and margin improvement.Strong in-house design expertise:

The company’s engineering team focuses on cost-effective product innovation using advanced tools like AutoCAD, SolidWorks, and simulation software, leading to material savings and improved product performance.Diverse product portfolio:

With over 22 years of experience, the company offers a wide range of pumps, electric motors, and solar modules under the ‘Oswal’ brand, catering to agricultural, residential, and industrial needs with varied technical specifications, helping expand market reach and reduce dependency on any single segment.Strong regional presence:

The company has a well-established presence in key agricultural states like Haryana and growing reach in Maharashtra, Uttar Pradesh, Rajasthan, Chhattisgarh, and Punjab, with over 95% of operational revenue in recent fiscals coming from India, reflecting a strong and expanding domestic footprint.Wide distribution and market reach:

With 925 distributors across India and a growing retail presence through 248 Oswal Shoppes, the company has built a strong distribution network and brand visibility. It serves both retail and institutional customers, participates in government schemes like PM Kusum, exports to 22 countries, and supports operations through a dedicated sales, marketing, and customer service team.

Risks

High dependency on the PM Kusum Scheme:

A significant portion of the company’s revenue is derived from Turnkey Solar Pumping Systems supplied under the PM Kusum Scheme. However, the business remains vulnerable to changes in government policy or tender outcomes, which could materially impact its operations.Customer concentration risk:

The business is heavily reliant on its top 10 customers, who contributed over 78% of its revenue in the nine months ended December 31, 2024. Any loss or reduction in orders from these key clients could significantly impact their operations, financial performance, and cash flows.Dependence on copper and solar cell supply:

The company’s profitability is closely tied to the availability and pricing of copper and solar cells, which are critical raw materials for its products. Any supply disruptions, price volatility, or challenges in sourcing quality solar cells, especially given its limited procurement experience, could adversely affect their production quality, working capital, and overall financial performance.Export exposure and regulatory risks:

The company exports to over 22 countries, contributing between 3.70% and 11.64% of its revenue from operations in recent years. Its international revenue may face risks from economic slowdowns, regulatory changes, trade barriers, or increased duties in export markets, potentially affecting its financial performance and global competitiveness.

Strategies of Oswal Pumps IPO

Focused on integration, automation, and strategic growth:

The company aims to enhance margins and efficiency by integrating key manufacturing processes like no-bake and aluminium die casting, producing VFDs and controller components in-house, automating core operations such as press, welding, and CNC systems, and pursuing strategic acquisitions to boost technology and product innovation.Leveraging government schemes for market expansion:

The company plans to strengthen its leadership in solar-powered agricultural pumps by capitalizing on opportunities under the PM Kusum Scheme, expanding into key states like Maharashtra and Madhya Pradesh, and offering solar solutions directly to farmers to meet irrigation needs and reduce fuel costs.Boosting solar module capacity with backward integration:

The company plans to expand its solar module manufacturing capacity by 1,500 MW and integrate key components like aluminium frames, EVA sheets, junction box back sheets, and on-grid inverters in-house to enhance quality control, reduce costs, and support both domestic and international demand, including planned exports to the U.S. and Europe.Expanding product portfolio in industrial pumps and electric motors:

The company plans to launch a broader range of industrial pumps, including centrifugal, screw, and chemical pumps, as well as vibrant electric motors tailored for industries like construction and food processing, to tap into the fast-growing domestic and global demand for these products and strengthen its market share in these categories.Strengthen domestic footprint and expand global reach:

The company aims to grow its distributor network across key Indian states like Karnataka, Gujarat, and Tamil Nadu, while also scaling exports to both existing and new international markets such as Spain, Sri Lanka, and South Africa. In parallel, it plans to expand its 'Oswal Shoppe' outlets to boost retail visibility, deepen distributor relationships, and drive both domestic and export-led growth.

Oswal Pumps IPO Vs Peers

With a revenue of Rs 758.57 crore in Fiscal 2024, Oswal Pumps Ltd is smaller in scale compared to major industry players like Kirloskar Brothers Ltd (Rs 4,001.20 crore) and KSB Ltd (Rs 2,247.24 crore). However, it holds a respectable position alongside mid-sized peers such as WPIL Ltd (Rs 1,664.40 crore) and Shakti Pumps India Ltd (Rs 1,370.74 crore).

On the profitability front, Oswal reported an EPS of Rs 9.82, which is lower than Kirloskar’s Rs 43.84 and KSB’s Rs 11.99, but is in line with mid-tier players like WPIL (Rs 17.72) and higher than Roto Pumps (Rs 6.28). Its NAV per share stood at Rs 16.10, reflecting a stable asset base.

What truly sets Oswal Pumps apart is its exceptionally high Return on Net Worth/ Return on Equity (RoNW/ RoE) of 88.73%, which far exceeds that of all listed peers. In comparison, Shakti Pumps reported 24.15%, Kirloskar Brothers 22.30%, and KSB 17.09%. This indicates that Oswal Pumps is delivering superior returns on shareholder equity, demonstrating strong internal efficiency, prudent capital deployment, and a highly effective business model despite its smaller revenue base.

Objectives of Oswal Pumps IPO

The issue by the IPO will be used by the company for the following purposes:

To finance the specific capital expenditure requirements of the Company.

To invest in its wholly-owned subsidiary, Oswal Solar, through equity, for the establishment of new manufacturing facilities in Karnal, Haryana.

To prepay or repay, either partially or fully, certain outstanding borrowings of the company.

To invest in Oswal Solar, through equity, for the purpose of prepayment or repayment of select outstanding borrowings taken by the subsidiary.

To meet general corporate requirements.

Oswal Pumps IPO Details

IPO Dates

Oswal Pumps IPO will be open for subscription from June 13, 2025, to June 17, 2025. The allotment of shares to investors will take place on June 18, 2025, and the company will be listed on the NSE and BSE on June 20, 2025.

IPO Issue Price

Oswal Pumps is offering its shares in the price band of Rs 584 to Rs 614 per share. This means you would require an investment of Rs. 14,736 per lot (24 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Oswal Pumps is issuing a total of 2,25,95,114 shares, which are worth Rs 1,387.34 crores. From the total issue, a total of 1,44,95,114 shares worth Rs 890 crores are through Fresh Issue, and 81,00,000 shares worth Rs 497.34 crores are through Offer for Sale.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on June 18, 2025, through the registrar's website: MUFG Intime India Private Limited, BSE, NSE, or their stockbroker platform.

IPO Listing Date

The shares of Oswal Pumps will be listed on the NSE and BSE on June 20, 2025.

IPO Application Link

Open a demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Important IPO Details | |

Bidding Date | June 13, 2025 to June 17, 2025 |

Allotment Date | June 18, 2025 |

Listing Date | June 20, 2025 |

Issue Price | Rs 584 to Rs 614 per share |

Lot Size | 24 Shares |

All Category