Is WeWork India Management IPO Good or Bad – Detailed Review

00:00 / 00:00

WeWork India Management Limited's IPO is set to open its initial public offering from October 03, 2025, to October 07, 2025. When considering applying for this IPO, potential investors might have questions about whether the WeWork India Management IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive WeWork India Management IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

WeWork India Management IPO Review

WeWork India Management Limited is India's largest premium flexible workspace operator by total revenue in the last three Fiscals. The company specializes in providing flexible, high-quality, fully serviced office spaces, including custom-built managed offices and private offices, primarily to large enterprises, Global Capability Centres (GCCs), and small/mid-size businesses. It operates across key Tier 1 cities, including Bengaluru, Mumbai, Hyderabad, Pune, Gurugram, Noida, Delhi, and Chennai. A core strategic focus is on high-quality assets, with approximately 94% of its portfolio in Grade A developments.

The proposed IPO is an Offer for Sale (OFS) of 4,62,96,296 shares by existing shareholders (Embassy Buildcon LLP and 1 Ariel Way Tenant Limited), aiming to raise around Rs 3,000 crores. Critically, the company will not receive any proceeds from this IPO, as the funds go directly to the selling shareholders. The price band is set between Rs 615 and Rs 648 per share, with a lot size of 23 shares. The IPO will be open from October 03, 2025, to October 07, 2025, and is expected to list on the NSE and BSE on October 10, 2025.

Financially, the company has demonstrated a strong turnaround. Revenue from Operations grew from Rs 1,314.52 crores in Fiscal 2023 to Rs 1,949.21 crores in Fiscal 2025. Its EBITDA margin has also consistently improved, peaking at 63.41% in Fiscal 2025. Most notably, the company pivoted from persistent losses to a net profit of Rs 128.10 crores in Fiscal 2025, achieving a diluted EPS of Rs 9.87. However, this profit was partly due to a deferred tax effect, and the article notes the company is "yet to be profitable, considering aspects below the EBITDA level," suggesting sustained bottom-line profitability remains a challenge.

Key strengths include its leadership position in a market projected to grow at a CAGR of 18-20% through CY 2027, the exclusive license for the globally recognized "WeWork" brand, a premium pricing strategy with a Revenue to Rent Multiple of 2.68, and a stable revenue base with 75.67% of Net Membership Fees from Enterprise Members.

Major risks involve a significant asset-liability mismatch, where it secures long-term fixed-cost leases (average 8.48 years) but offers shorter membership tenures (average 26 months), creating vulnerability to market downturns. The company is also exposed to reputation risk from its global partner, WeWork Global, as evidenced by the U.S. bankruptcy filing. Furthermore, operations are highly concentrated, with Bengaluru and Mumbai contributing 66.25% of Net Membership Fees, and the company will receive no capital from this OFS to fund its future expansion.

Company Overview of WeWork India Management IPO

WeWork India Management Limited is a leading premium flexible workspace operator in India, which has been the largest operator by total revenue based on the past three Fiscals. The company specializes in providing flexible, high-quality, fully serviced office spaces to a diverse clientele, including large enterprises, Global Capability Centres (GCCs), small and mid-size businesses, and individuals. Its solutions range from custom-built managed offices and private offices to digital products like WeWork All Access and Virtual Office.

The company operates across India's key Tier 1 cities, including Bengaluru, Mumbai, Hyderabad, Pune, Gurugram, Noida, Delhi, and Chennai. A core component of its strategy is a focus on high-quality assets: as of June 30, 2025, approximately 94% of its portfolio (7.07 million square feet) was in Grade A developments. As of the same date, its network consisted of 68 Operational Centres offering 1,14,077 Desks Capacity and 7.67 million square feet of Leasable Area.

WeWork India's core business model involves securing bare-shell properties on long-term leases, undertaking customized fit-outs, and operating them as branded flexible workspaces. It also operates under an "operator model" where it manages spaces on behalf of landlords and provides specialized facility management services. The model effectively attracts and retains large corporate clients. For the quarter ended June 30, 2025, 75.67% of its Net Membership Fees were derived from Enterprise Members, demonstrating the sticky nature of its service offering.

The company has demonstrated consistent financial and operational growth. For Fiscal 2025, the Revenue from Operations was Rs 1,949.21 crores. As of June 30, 2025, the Occupancy Rate in Operational Centres was 76.48% (and 81.23% in Mature Centres). Its average portfolio level Revenue to Rent Multiple of 2.68 (Fiscal 2025) exceeds the typical industry range of 1.9x to 2.5x, reflecting a premium pricing strategy.

Industry Overview of WeWork India Management IPO

WeWork India Management Limited is a key player in India's booming flexible workspace segment, which has emerged as one of the world's most mature flexible office ecosystems. The flexible workspace stock across Tier 1 cities grew from 35 million square feet at the end of CY2020 to over 88 million square feet by Q1 CY2025. This stock is forecasted to grow to approximately 140 to 144 million square feet across Tier 1 cities by the end of CY2027 at a robust Compound Annual Growth Rate (CAGR) of approximately 18% to 20%.

The market's expansion is fundamentally driven by four key factors:

Evolving Corporate Real Estate (CRE) Strategy and Hybrid Work Models: Companies of all sizes are increasingly integrating flexible spaces into a Core+Flex strategy to achieve portfolio agility, capital efficiency, and scalability, with the number of companies dedicating over 10% of their space to flex expected to jump from 42% (Q1 CY2024) to 59% by CY2026. This shift is reinforced by companies adopting a stricter return-to-office stance, often preferring at least three days in the office per week.

Strong Demand from Global and Domestic Enterprises: International firms, particularly those establishing Global Capability Centres (GCCs), are major demand drivers, leveraging India's vast and skilled talent pool. GCCs are a key absorption segment, projected to account for 35%–40% of total office leasing activity in CY2025, with many new entrants opting for readily available flexible workspace solutions. Simultaneously, the continued rise of domestic companies and startups, fueled by strong corporate performance and government initiatives like Startup India, ensures robust domestic leasing demand.

Flight-to-Quality and Amenitization: There is a pronounced preference among occupiers for Grade A properties and experiential workplaces. Businesses prioritize spaces that offer sophisticated amenities (including wellness rooms, event spaces, and dedicated IT services), prioritize ESG compliance, and are technologically integrated to improve employee experience and productivity. WeWork India is strategically positioned here, operating almost entirely in Grade A developments.

Attractive Unit Economics for Tenants: Flexible workspace solutions provide tenants with capital efficiencies by allowing them to convert CapEx (Capital Expenditure) into OpEx (Operating Expenditure). This is attractive for rapid scaling or consolidation, simplifying operations by providing end-to-end management from a single vendor.

Financial Overview of WeWork India Management IPO

Particulars | March 31, 2025 (Rs in crores) | March 31, 2024 (Rs in crores) | March 31, 2023 (Rs in crores) |

Revenue from Operations | 1,949.21 | 1,665.14 | 1,314.52 |

EBITDA | 1,235.95 | 1,043.79 | 795.61 |

EBITDA Margin (%) | 63.41% | 62.69% | 60.52% |

Profit after tax (PAT) | 128.1 | -135.77 | -146.81 |

PAT Margin (%) (on Total Income) | 6.33% | -7.82% | -10.32% |

Return on Equity (RoE) (%) | 63.80% | - | - |

Return on Capital Employed (RoCE) (%) | 37.52% | 54.05% | 30.32% |

The financial performance of WeWork India Management over the three fiscal years ending March 31, 2023, 2024, and 2025 demonstrates a remarkable financial turnaround, driven by sustained top-line expansion and significant gains in operational efficiency.

Revenue from Operations shows a robust upward trend, indicating successful scaling of the business. Revenue increased from Rs 1,314.52 crores in Fiscal 2023 to Rs 1,665.14 crores in Fiscal 2024 (a 26.67% increase), and further to Rs 1,949.21 crores in Fiscal 2025 (a 17.06% increase). This consistent growth trajectory reflects the company's strong footing as a leading flexible workspace operator in India, leveraging capacity expansion and successful member acquisition in key Tier 1 cities.

EBITDA and its corresponding margin highlight a solid and continually improving core operational performance across the periods. EBITDA increased sharply from Rs 795.61 crores in Fiscal 2023 to Rs 1,043.79 crores in Fiscal 2024 (a 31.20% increase), and further to Rs 1,235.95 crores in Fiscal 2025 (an 18.41% increase). Crucially, the EBITDA margin demonstrates steady operational leverage, consistently rising from 60.52% in Fiscal 2023 to 62.69% in Fiscal 2024, and peaking at 63.41% in Fiscal 2025. This continuous margin expansion suggests effective cost management and a resilient core business model capable of absorbing increasing operating scale.

Profit After Tax (PAT) marks the most significant achievement, demonstrating a successful pivot from persistent losses to strong profitability. The net loss narrowed from Rs 146.81 crores in Fiscal 2023 to Rs 135.84 crores in Fiscal 2024 (a 6.87% reduction in loss). In Fiscal 2025, the company achieved a major turnaround, posting a strong net profit of Rs 128.18 crores. The accompanying PAT margin shifted from negative figures (?10.32% in FY23 and ?7.82% in FY24) to a solid 6.33% in Fiscal 2025. The profit was due to a deferred tax effect. They are yet to be profitable, considering items below the EBITDA level.

The company's return metrics, like RoE or RoCE, and balance sheet dynamics reveal the impact of rapid growth and significant lease accounting under Ind AS 116. The company operated with negative Net Worth in Fiscals 2023 and 2024, reflecting accumulated losses. In Fiscal 2025, the successful financial turnaround resulted in positive Net Worth, leading to an exceptionally high Return on Equity (RoE) of 63.80%.

The Return on Capital Employed (RoCE), based on adjusted non-GAAP measures, shows volatility, peaking at 54.05% in FY24 before settling at 37.52% in FY25. This high volatility is primarily due to the substantial increase in the "Adjusted Capital Employed" base year-on-year, a denominator effect caused by capital investments and accounting entries related to right-of-use assets (Ind AS 116). Financially, the Debt-Equity Ratio highlights the balance sheet's leverage profile. In Fiscals 2023 and 2024, this ratio was technically distorted by the negative equity.

Overall, the financial performance of WeWork India Management reflects a strong-growth enterprise that has achieved a critical and successful transition to profitability in Fiscal 2025. The core business is robust, as shown by strong EBITDA margins, and operational scale is driving the financial health required for sustainable future growth.

Strengths and Risks of WeWork India Management IPO

Let's delve into the strengths and weaknesses to assess if the WeWork India Management IPO is good or bad for investors.

Strengths

Strong Brand Recognition and Global Network: The company holds the exclusive license for the globally recognized "WeWork" brand in India, benefiting from extensive market awareness and high customer advocacy, evidenced by an NPS score of 74.8 in Fiscal 2025.

Leadership in a High-Growth Market: WeWork India is the largest operator by total revenue in the last three Fiscals, positioned in a flexible workspace market projected to grow at a robust CAGR of 18% to 20% across Tier 1 cities through CY 2027.

Premium Positioning and Superior Unit Economics: The business commands premium pricing, reflected in a Revenue to Rent Multiple of 2.68 (Fiscal 2025), significantly above the industry average of 1.9x to 2.5x. This premiumization drives strong Adjusted EBITDA margins (21.61% in Fiscal 2025).

High-Quality, Sticky Enterprise Member Base: Revenue is concentrated in resilient segments, with Enterprise Members contributing 75.67% of Net Membership Fees in Q1 FY26. Member retention is strong, with 45.39% of desks sold in Q1 FY26 coming from existing members who expanded their portfolios.

Strategic Real Estate Backing and Portfolio Quality: Backed by the Embassy Group, the company operates a high-quality portfolio, with 94% of its area (as of June 30, 2025) secured in prime Grade A commercial developments, which facilitates favorable lease terms and access to top tenants.

Risks

Asset-Liability Mismatch and Fixed Lease Obligations: The company relies on long-term fixed-cost leases with landlords with a weighted average primary lease tenure of 8.48 years, but offers shorter membership tenures with an average of 26 months, creating a vulnerability to market downturns and an inability to cover fixed costs.

Exposure to Brand or Reputation Risk from Global Partner: The license to use the "WeWork" brand under the Operating and Management Agreement (OMA) ties the Indian entity to the reputation and stability of WeWork Global, exposing it to fallout from global disruptions, such as the U.S. bankruptcy filing by WeWork Inc.

Historical Losses and Capital Needs: The company recorded net losses and negative diluted Earnings Per Share in the three months ended June 30, 2025, Fiscal 2024, and Fiscal 2023, indicating that achieving consistent, sustained profitability remains a critical challenge.

High Geographic Concentration Risk: Operations are heavily concentrated, with Bengaluru and Mumbai alone contributing 66.25% of the Net Membership Fees in the three months ended June 30, 2025, subjecting revenues to localized economic slowdowns or regulatory changes.

No Proceeds from the Offer for Sale: The proposed IPO is entirely an Offer for Sale by existing shareholders, meaning the company will receive no capital to directly fund its expansion, service debt, or support future working capital requirements.

Strategies of WeWork India Management IPO

Focus on Unit Economics and Margin Improvement: The core strategy is to maximize profitability per space by sustaining premium pricing, continually improving operational efficiency, and reducing Corporate Costs as a percentage of Total Revenue (7.99% in Fiscal 2025).

Product and Technology Innovation and Diversification: Investing heavily in technology, including developing a localized "WWI" app expected to launch in Q3FY26 and growing its digital SaaS products (WeWork Workplace) and value-added services.

Deepening Presence and Strategic Expansion: Continue targeted expansion within Tier 1 cities and key high-demand micro-markets to create a critical mass (clustering effect), attract large tenants, and further leverage economies of scale.

Targeting Global Capability Centres (GCCs): Strategically focusing on the high-growth GCC sector by offering bespoke, scalable, and fully managed office solutions designed to meet the complex compliance and growth needs of multinational corporations.

Data-Backed Decision Making for Efficiency: Employing advanced internal tools like REScout for site selection to make data-driven decisions on real estate sourcing, design, and operations, resulting in lower operational expenses and improved metrics like a reduced capital expenditure per desk from Rs 1,46,786 in Fiscal 2025 to Rs 1,32,665 as of June quarter Fiscal 2026.

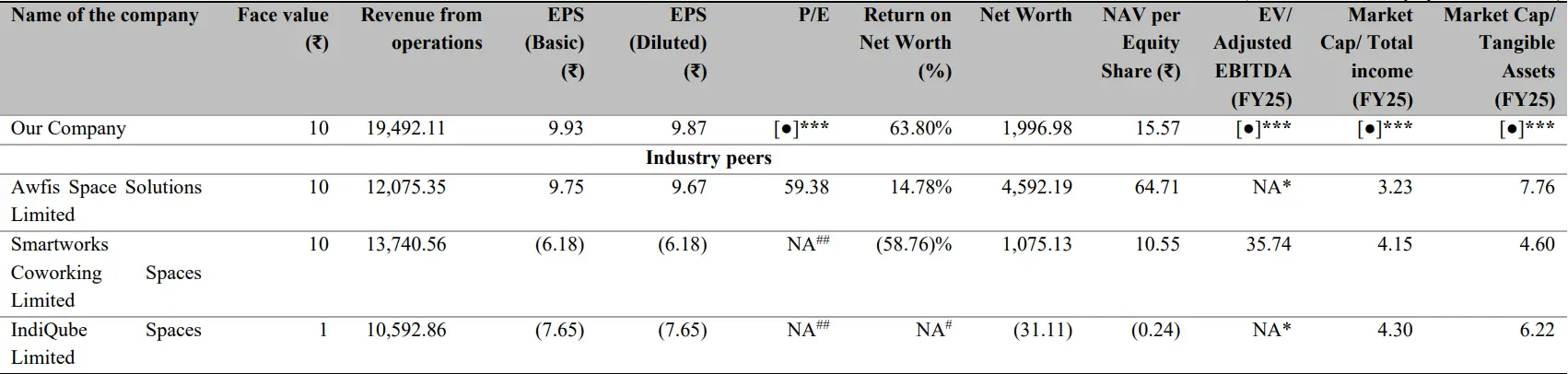

WeWork India Management IPO vs. Peers

In Fiscal 2025, WeWork India Management reported Revenue from Operations of Rs 1,949.21 crores. This places the company at the largest scale among its listed peers in terms of reported operational revenue: Smartworks Coworking Spaces with Rs 1,374.05 crores, Awfis Space Solutions with Rs 1,207.53 crores, and IndiQube Spaces with Rs 1,059.28 crores.

WeWork India is positioned as the scale leader, a key factor in leveraging economies of operation and managing its fixed-cost base. Profitability in EPS, WeWork India Management achieved a diluted EPS of Rs 9.87 in FY25, indicating strong bottom-line profitability and demonstrating better financial health than some peers, like Awfis Space Solutions, with a diluted EPS of Rs 9.67, Smartworks Coworking Spaces, with a loss of Rs 6.1,8, and IndiQube Spaces Limited, with a loss of Rs 7.65.

While all operators report high EBITDA margins due to Ind AS 116 accounting, the Adjusted EBITDA Margin provides a clearer view of core operational efficiency after accounting for actual rental outflows. WeWork India's margin profile is highly competitive, reflecting superior cost control and premium pricing. It stands as follows: WeWork India Management with 21.61%, Smartworks Coworking Spaces with 12.53%, and for other peers, the Adjusted EBITDA data is not publicly comparable for this period. The company’s RoNW stood at 63.80%, which is significantly higher. However, it is due to fiscal 2025 profitability, and with a low base effect.

Overall, WeWork India Management leads the peer group in scale. However, like other rapidly expanding players, it must continue to manage its fixed-cost liabilities and demonstrate sustained growth to maintain its valuation metrics.

Objectives of WeWork India Management IPO

WeWork India Management is planning to offer for sale valued at around Rs 3,000 crores, which will be received by the selling shareholders, and they are Embassy Buildcon LLP and 1 Ariel Way Tenant Limited. The company does not receive any proceeds from this IPO.

WeWork India Management IPO Details

IPO Dates

WeWork India Management IPO will be open for subscription from October 03, 2025, to October 07, 2025. The allotment of shares to investors will take place on October 08, 2025, and the company is expected to be listed on the NSE and BSE on October 10, 2025.

IPO Issue Price

WeWork India Management is offering its shares in the price band of Rs 615 to Rs 648 per share. This means you would require an investment of Rs. 14,904 per lot (23 shares) if you are bidding for the IPO at the upper price band.

IPO Size

WeWork India Management is planning to offer for sale totalling 4,62,96,296 shares, which are worth Rs 3,000 crores.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on October 08, 2025, through the registrar's website, MUFG Intime India Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of WeWork India Management are expected to be listed on the NSE and BSE on October 10, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for WeWork India Management IPO

Important IPO Details | |

Bidding Date | October 03, 2025 to October 07, 2025 |

Allotment Date | October 08, 2025 |

Listing Date | October 10, 2025 |

Issue Price | Rs 615 to Rs 648 per share |

Lot Size | 23 Shares |

FAQs:

Q1: What is the issue size of WeWork India Management Limited's IPO?

The total issue size is Rs 3,000 crore, which is a total offer for sale of 4,62,96,296 shares.

Q2: What’s the minimum investment for the WeWork India Management IPO?

23 shares per lot, requiring Rs 14,904 (at upper band).

Q3: How does WeWork India Management compare to peers?

WeWork India Management's peers in the flexible workspace industry are Awfis Space Solutions, Smartworks Coworking Spaces, and IndiQube Spaces. When compared to its peers, WeWork India is the largest operator by total revenue for the past three fiscals, and reported the highest EBITDA in FY2025. It is one of the few players to be net profitable in FY25.

Q4: Who is managing the WeWork India Management IPO?

JM Financial Limited, ICICI Securities Limited, Jefferies India Private Limited, Kotak Mahindra Capital Company Limited, and 360 ONE WAM Limited are the book-running lead managers for the IPO.

Q5: What are WeWork India Management's latest financials and EBITDA trends?

WeWork India Management's latest financials for Fiscal 2025 include a revenue from operations of Rs 1,949.21 crores and a Profit after tax (PAT) of Rs 128.19 crores. The company's EBITDA for Fiscal 2025 was Rs 1,235.95 crores, and its EBITDA Margin was 63.41%.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category