Is Tata Capital IPO Good or Bad – Detailed Review

00:00 / 00:00

Tata Capital Limited’s IPO is set to open its initial public offering from October 06, 2025, to October 08, 2025. When considering applying for this IPO, potential investors might have questions about whether the Tata Capital IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Tata Capital IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Tata Capital IPO Review

Tata Capital Limited's IPO opens on October 06 and ends on October 08, 2025. It operates as the flagship financial services arm of the Tata Group and is regulated by the RBI as an Upper Layer Non-Banking Financial Company. The company offers a comprehensive suite of over 25 lending products to individuals, SMEs, and corporates, managing Total Gross Loans of approximately Rs 2.33 lakh crores as of June 30, 2025. A key recent development was the amalgamation of Tata Motors Finance Limited (TMFL) to become a full-stack vehicle finance provider.

The company leverages a robust 'phygital' omni-channel distribution model with 1,516 branches and strong digital platforms. The NBFC sector is rapidly expanding, with credit projected to grow at a CAGR of 15-17% (FY25-FY28), driven by strong macroeconomic growth and accelerating financial inclusion in India.

Tata Capital's financial performance (FY23-FY25) shows strong top-line growth, with Total Income surging by 55.9% in FY25 (to Rs 28,369.87 crore), largely due to the TMFL merger. Profit After Tax (PAT) grew consistently to Rs 3,664.66 crore in FY25. Asset quality remains superior to many peers, with a Gross Stage 3 Loans Ratio of 1.9% in FY25, though this metric and Net NPA (0.8% in FY25) showed a post-merger increase. Return on Equity (RoE) stood at 12.6% in FY25, reflecting dilution from capital base expansion.

Key strengths include the flagship brand equity of the Tata Group, market leadership (third-largest diversified NBFC), the highest credit rating of AAA, a comprehensive product suite, and a strong digital and analytics core. Risks involve exposure to Credit Risk (especially from the merged TMFL book) and Unsecured Loans (20.0% of Total Gross Loans); interest rate fluctuations; and the regulatory mandate to list by December 31, 2025.

The IPO aims to raise Rs 15,511.87 crore, comprising a fresh issue of Rs 6,846 crore and an Offer for Sale of Rs 8,665.87 crore. The net proceeds from the fresh issue will be fully utilised for the Augmentation of Tier 1 Capital. Shares are priced in the band of Rs 310 to Rs 326 per share, with listing expected on October 13, 2025.

Company Overview of Tata Capital IPO

Tata Capital Limited is the flagship financial services arm of the esteemed Tata Group and is regulated by the RBI as an Upper Layer Non-Banking Financial Company. Since commencing its lending operations in 2007, the company has established itself as one of the largest diversified NBFCs in India. It offers a comprehensive suite of over 25 lending products designed for a diverse clientele spanning salaried and self-employed individuals, small and medium enterprises (SMEs), and large corporates.

The company leverages a robust 'phygital (Physical and digital),' omni-channel distribution model to achieve wide market penetration. As of June 30, 2025, Tata Capital served 7.3 million customers and managed Total Gross Loans of approximately Rs 2.33 lakh crores. Its extensive physical footprint comprises 1,516 branches across 27 States and Union Territories, complemented by a digital ecosystem and strategic partnerships with over 30,000 Direct Selling Agents (DSAs), 400 OEMs, and 8,000 dealers.

A key operational development was the amalgamation of Tata Motors Finance Limited (TMFL) into Tata Capital Limited, effective May 8, 2025. This merger was undertaken to consolidate the lending businesses, enhance geographical reach, and strengthen the company's position as a full-stack provider of vehicle finance. Tata Capital maintains a strong asset quality, demonstrated by a Gross Stage 3 Loans Ratio of 2.1% as of June 30, 2025, and consistently holds the highest possible domestic credit rating of AAA.

Industry Overview of Tata Capital IPO

Tata Capital Limited operates within the highly regulated and rapidly expanding Indian Financial Services sector, specifically as a diversified Non-Banking Financial Company (NBFC). The growth of this sector is intrinsically linked to India's robust macroeconomic environment, characterized by strong GDP growth and accelerating financial inclusion.

The Non-Banking Financial Company (NBFC) credit market has demonstrated remarkable resilience, growing from approximately Rs 23 lakh crores in Fiscal 2019 to an estimated Rs 48 lakh crores at the end of Fiscal 2025 (FY25). This growth trajectory is expected to continue rising faster than overall systemic credit, with NBFC credit projected to grow at a Compound Annual Growth Rate (CAGR) of 15-17% between FY25 and FY28. This segment is capitalizing on its ability to provide flexible lending solutions and penetrate underserved geographical and customer segments overlooked by traditional banks.

Retail credit, a key focus area for Tata Capital, is a primary driver of this financial expansion. Retail credit outstanding stood at approximately Rs 82 lakh crores as of FY25, having grown at a strong CAGR of 15.1% since Fiscal 2019. It is projected to sustain this momentum, growing at a CAGR of 14-16% between FY25 and FY28, making it an increasingly attractive market segment. Furthermore, penetration remains low, exemplified by India's household mortgage-to-GDP ratio of 16.6% in FY25, indicating vast, untapped potential compared to developed and peer developing economies.

This sustained market expansion is driven by several structural factors such as India's favourable demographic dividend (high working-age population), accelerating urbanization, rising disposable incomes, and the formalization of the economy. Government and regulatory initiatives, such as the digital public infrastructure (India Stack, UPI, Account Aggregators), are improving transparency and financial access, positioning the NBFC sector for robust, long-term growth.

Financial Overview of Tata Capital IPO

Particulars | March 31, 2025 (Rs crore) | March 31, 2024 (Rs crore) | March 31, 2023 (Rs crore) |

Net Interest Income | 10,690.13 | 6,798.24 | 5,310.26 |

Net Interest Margin (%) | 5.20% | 5.00% | 5.10% |

Total Income | 28,369.87 | 18,198.38 | 13,637.49 |

Cost to Income (%) | 42.10% | 42.00% | 37.90% |

PAT | 3,664.66 | 3,150.21 | 3,029.20 |

Gross NPA (%) (Gross Stage 3 Loans Ratio) | 1.90% | 1.50% | 1.70% |

Net NPA (%) (Net Stage 3 Loans Ratio) | 0.80% | 0.40% | 0.40% |

RoE (%) | 12.60% | 15.50% | 20.60% |

RoA (%) | 1.80% | 2.30% | 2.90% |

The financial performance of the company of Tata Capital over the three fiscal years ending March 31, 2023, 2024, and 2025 reflects strong top-line growth and improving underlying profitability, driven by expanding market reach and strategic inorganic growth, particularly in FY25.

Revenue from Operations, such as Total Income and NII, has shown a significant upward trend, confirming the company's aggressive growth strategy. Total Income increased substantially from Rs 13,637.49 crore in FY23 to Rs 18,198.38 crore in FY24 (a 33.4% increase) and further surged to Rs 28,369.87 crore in FY25 (a 55.9% increase). This accelerated growth in FY25 was due to the merger with Tata Motors Finance Limited (TMFL), which significantly enlarged the gross loan book. Net Interest Income (NII), the core earning metric, mirrored this growth, rising from Rs 5,310.26 crore in FY23 to Rs 6,798.24 crore in FY24, and climbing sharply to Rs 10,690.13 crore in FY25.

Net Interest Margin (NIM) has demonstrated stability, moving from 5.10% in FY23 to 5.00% in FY24, and slightly improving to 5.20% in FY25. This stability suggests sound asset-liability management, effectively balancing the cost of funds with the yield generated by the rapidly expanding and evolving loan portfolio.

When it comes to efficiency, the Cost to Income ratio remained effectively flat from 42.00% in FY24 to 42.10% in FY25, following a highly efficient 37.90% in FY23. The ability to maintain this ratio almost flat despite absorbing the operational and employee costs of the TMFL merger indicates strong underlying operating leverage and expense control at the newly expanded scale.

Profit After Tax (PAT) has consistently grown, although at a slower pace than the top-line in FY25, highlighting pressure points post-merger. PAT increased from Rs 3,029.20 crore in FY23 to Rs 3,150.21 crore in FY24 (a 4.0% growth) and then increased by 16.3% to Rs 3,664.66 crore in FY25. The lag in PAT growth compared to Total Income growth suggests increased costs, specifically higher finance costs and a significant increase in impairment provisions in FY25, reflecting the integration of the acquired book.

Return Metrics such as RoE and RoA show a notable decline over the period. Return on Equity (RoE) fell from 20.60% in FY23 to 15.50% in FY24 and further to 12.60% in FY25. Similarly, Return on Assets (RoA) declined from 2.90% in FY23 to 2.30% in FY24 and 1.80% in FY25. The subsequent decline reflects the compression of margins in a competitive market and the simultaneous increase in the capital base due to fresh equity infusions and the large scale brought in by the TMFL merger, which have diluted return ratios despite strong absolute growth.

Asset Quality shows a deterioration in the latest fiscal year, largely due to the integration of the acquired portfolio. The Gross NPA (Gross Stage 3 Loans Ratio) trended 1.70% in FY23 to 1.50% in FY24, ending with 1.90% in FY25. Critically, the Net NPA (Net Stage 3 Loans Ratio) doubled from 0.40% in FY24 to 0.80% in FY25. This sharp rise in delinquencies reflects the different credit profile of the acquired TMFL book and necessitated an increase in loan impairment allowances during FY25.

Strengths and Risks of Tata Capital IPO

Let's delve into the strengths and weaknesses to assess if the Tata Capital IPO is good or bad for investors.

Strengths

Flagship & Brand Equity: Tata Capital is the flagship financial services arm of the Tata Group, leveraging the trusted "Tata" brand. This parentage provides strong backing, as demonstrated by Promoter equity infusion of Rs 8,970 crores since 2007.

Market Leadership and Scale: The third largest diversified NBFC in India by Total Gross Loans (Rs 2,26,550 crores as of June 30, 2025) and one of the fastest growing in the large diversified NBFC category (37.3% CAGR in Total Gross Loans from FY23 to FY25).

Superior Asset Quality: Prudent risk management results in stable and strong asset quality metrics, with Gross Stage 3 Loans Ratio at 2.1% and Net Stage 3 Loans Ratio at 1.0% as of June 30, 2025, which are among the best in its peer group.

Highest Credit Rating and Diversified Funding: Holds the highest possible domestic credit rating of AAA (from CRISIL, ICRA, CARE, and India Ratings) and an international rating of BBB/Stable (from S&P Global Ratings, as of August 2025). It maintains a highly diversified funding mix, with no single lender contributing more than 10% of total borrowings.

Comprehensive Product Suite and Omni-channel Reach: Offers the most comprehensive suite of 25+ lending products among large diversified NBFCs. It operates a strong 'phygital' omni-channel network of 1,516 branches (as of June 30, 2025) and robust digital platforms, with 97.1% of customers onboarded digitally in the three months ended June 30, 2025.

Digital and Analytics Core: Technology is integrated across the full lending value chain, driving efficiency (Operating Expenses Ratio of 2.4% for Q1 FY26) and risk management (over 80 predictive analytical models deployed across collections as of June 30, 2025).

Risks

Credit Risk and Asset Quality: Exposed to customer default risk, with Gross Stage 3 Loans constituting 2.1% of Total Gross Loans as of June 30, 2025. Failure to effectively manage this exposure, particularly in the merged TMFL portfolio, could impact profitability.

Unsecured Loan Exposure: Unsecured Gross Loans comprised 20.0% of Total Gross Loans as of June 30, 2025. These loans present a higher inherent credit risk given the lack of collateral for recovery.

Interest Rate Fluctuations and Asset Liability Mismatch: Exposed to interest rate fluctuations on both fixed-rate loans (36.3% of Total Gross Loans) and fixed-rate borrowings (55.0% of Total Borrowings) as of June 30, 2025, which could adversely affect the Net Interest Margin Ratio.

Reliance on Brand Licensing: The ability to use the valuable "Tata" brand is governed by a licensing agreement with the Promoter, which requires payment of an annual subscription fee (0.25% of annual net revenue). Termination of this agreement or any negative publicity related to the Tata Group could adversely affect the business and reputation.

Enforcement Delays: The company faces potential delays and additional expenses in enforcing legal rights and recovering amounts owed by defaulting customers due to legal complexities and an underdeveloped land records infrastructure in India.

Strategies of Tata Capital IPO

Sustain Growth and Enhance Product Footprint: Continue the growth trajectory by enhancing product offerings, such as scaling Affordable Housing Loans and Secured Business Loans, and expanding the geographic footprint, particularly targeting Tier 2 and Tier 3 cities through its "Phygital" omni-channel model.

Strengthen Risk and Collection Infrastructure: Continuously strengthen the risk management framework, refine underwriting processes using advanced analytics, and optimize ML or GenAI-based collection models to enhance efficiency and maintain high asset quality.

Capitalize on TMFL Merger Synergies: Fully integrate TMFL to become a full-stack vehicle finance provider, diversify the vehicle portfolio by increasing the share of used and Light Commercial Vehicle (LCV) financing, reduce the cost of acquired TMFL debt, and leverage the expanded network and customer base for cross-selling opportunities.

Digital Transformation and Cost Efficiency: Drive further digital adoption by investing in AI, ML, and GenAI across the entire lending value chain to automate processes, enhance employee productivity, reduce the Cost to Income Ratio, and deliver a superior customer experience.

Optimize Funding and Capital Adequacy: Maintain the highest credit rating to ensure a competitive Average Cost of Borrowings Ratio, continually diversify the liability mix with long-term instruments like Non Convertible Debentures (NCD) and External Commercial Borrowings (ECB), and strategically use the IPO proceeds to improve Tier I capital for future growth and regulatory compliance.

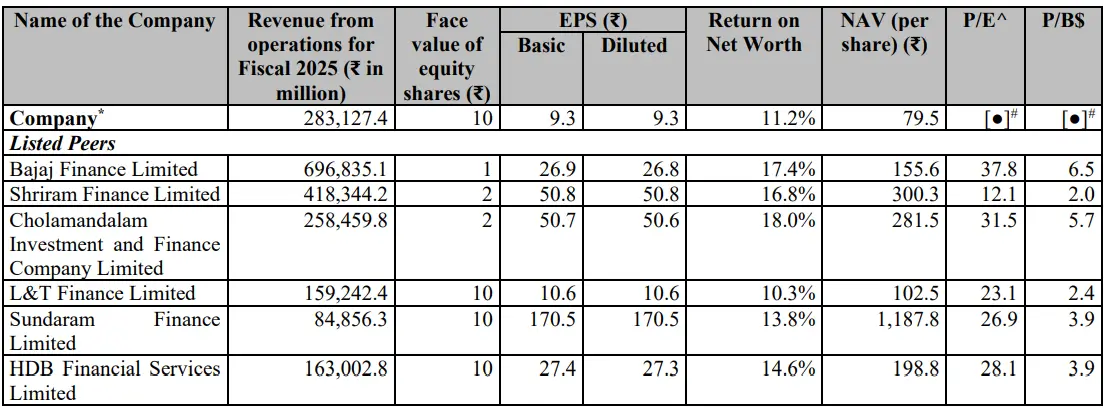

Tata Capital IPO vs. Peers

With a Total Gross Loans CAGR of 37.29%, reaching Rs 2,26,550 crores in FY25, Tata Capital outpaced most major diversified NBFC peers, including Shriram Finance (19.07%) and Aditya Birla Capital (25.24%), and was closely aligned with Cholamandalam Investment & Finance (31.56%), highlighting a clear strategy for aggressive yet measured market scale.

Tata Capital consistently maintained superior asset quality, reporting a Gross Stage 3 Loans Ratio of 1.9% in Fiscal 2025. This risk profile was only bested by the largest peer, Bajaj Finance (1.0%), and was significantly better than Shriram Finance (4.6%), Cholamandalam Investment & Finance (4.0%), and Aditya Birla Capital (2.2%), underscoring a strong internal risk and underwriting framework despite its high growth rate.

In terms of profitability, Tata Capital's Return on Equity (RoE) stood at 12.6% in FY25. While robust, this was below the sector-leading RoE reported by Cholamandalam Investment & Finance (19.7%) and Bajaj Finance (19.2%). However, Tata Capital holds the highest possible domestic credit rating of AAA from all major domestic agencies, reinforcing its financial strength and enabling competitive funding, with its Total Borrowings to Total Equity ratio at 6.6x in FY25. The Tier 1 Capital Adequacy Ratio (CRAR) of 12.8% provides a healthy capital buffer, exceeding regulatory requirements.

Operationally, Tata Capital boasts the most comprehensive loan product suite among large diversified NBFCs and is one of only three major peers with an international credit rating of BBB (S&P Global Ratings). Overall, Tata Capital exhibits robust growth and a strong conservative profile, significantly outperforming the projected overall NBFC credit growth of 15 to 17% over the FY23-FY25 period.

Objectives of Tata Capital IPO

The offer comprises a fresh issue and an offer for sale. The selling shareholders will receive Rs 8,665.87 crores from the offer for sale component. The net proceeds from the fresh issue of Rs 6,846 crore are proposed to be utilised for:

Augmentation of Tier 1 Capital of the company to meet future capital requirements, including onward lending. This development will absorb 100% of the Net Fresh Issue proceeds from the IPO.

Tata Capital IPO Details

IPO Dates

Tata Capital IPO will be open for subscription from October 06, 2025, to October 08, 2025. The allotment of shares to investors will take place on October 09, 2025, and the company is expected to be listed on the NSE and BSE on October 13, 2025.

IPO Issue Price

Tata Capital is offering its shares in the price band of Rs 310 to Rs 326 per share. This means you would require an investment of Rs. 14,996 per lot (46 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Tata Capital is issuing a total of 47,58,24,280 shares, which are worth Rs 15,511.87 crores. Out of which 26,58,24,280 shares of offer for sale are worth Rs 8,665.87 crore, and the remaining 21,00,00,000 shares are fresh issue worth Rs 6,846 crore.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on October 09, 2025, through the registrar's website, MUFG Intime Private Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Tata Capital will be listed on the NSE and BSE on October 13, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Important IPO Details | |

Bidding Date | October 06, 2025 to October 08, 2025 |

Allotment Date | October 09, 2025 |

Listing Date | October 13, 2025 |

Issue Price | Rs 310 to Rs 326 per share |

Lot Size | 46 Shares |

FAQs:

Q1: What is the issue size of Tata Capital Limited's IPO?

The total issue size is Rs 15,511.87 crore, out of which the offer for sale is worth Rs 8,665.87 crores, and Rs 6,846 crores is the fresh issue.

Q2: What’s the minimum investment for the Tata Capital IPO?

46 shares per lot, requiring Rs 14,996 (at upper band).

Q3: How does Tata Capital compare to peers?

Tata Capital's peers in the diversified NBFC industry are Bajaj Finance, Shriram Finance, Cholamandalam Investment and Finance, and Aditya Birla Capital. When compared to its peers, in the Total Gross Loans, they outperformed Shriram Finance and Aditya Birla Capital by growing at a CAGR of 37.29% during FY23 to FY25. With a Superior asset quality of Gross Stage 3 Loans Ratio of 1.9%, only bested by Bajaj Finance of 1.0%.

Q4: Who is managing the Tata Capital IPO?

Kotak Mahindra Capital Company Limited, Axis Capital Limited, BNP Paribas, Citigroup Global Markets India Private Limited, HDFC Bank Limited, HSBC Securities and Capital Markets (India) Private Limited, ICICI Securities Limited, IIFL Capital Services Limited, J.P.Morgan India Private Limited, and SBI Capital Markets Limited are the book-running lead managers for the IPO.

Q5: What are Tata Capital's latest financials?

Tata Capital's latest financials for Fiscal 2025 include a Total Income of Rs 28,369.87 crores and a Profit After Tax (PAT) of Rs 3,664.66 crores. The company's Net Interest Income (NII) for Fiscal 2025 was Rs 10,690.13 crores, and its Net Interest Margin (NIM) was 5.20%.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category