Is Pine Labs IPO Good or Bad – Detailed Review

00:00 / 00:00

Pine Labs Limited’s IPO is set to open its initial public offering from November 07, 2025, to November 11, 2025. When considering applying for this IPO, potential investors might have questions about whether the Pine Labs IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Pine Labs IPO Review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Pine Labs IPO Review

Pine Labs Limited's IPO is open for subscription from November 04, 2025, to November 07, 2025, with listing expected on November 12, 2025, on NSE and BSE.

The company is a technology company focused on digitising commerce with a strong growth trajectory. It is the top provider of instant loans and EMI solutions at merchant checkouts and runs India's biggest gift and store credit card business based on total transaction money processed in FY25. Its core business focus is on the Digital Infrastructure and Transaction Platform, which constituted 70.53% of its revenue from operations for the three months ended June 30, 2025.

The platform serves an ecosystem of 988,304 merchants, 716 consumer brands and enterprises, and 177 financial institutions as of June 30, 2025, leveraging a customer-first, cloud-based, and scalable technology platform with 1.84 million Digital Check-out Points (DCPs). The company does not have an identifiable promoter; Peak XV Partners Pine Investment Holdings is the largest institutional shareholder with a 20.25% stake pre-offer.

The company operates within the high-growth Indian digital transaction economy, which is undergoing rapid digital transformation. The Total Addressable Market (TAM) in terms of total payment value for Pine Labs in India is estimated at approximately Rs 116.8 lakh crores (USD 1.4 trillion) as of FY25 and is projected to grow at a CAGR of 22% to 24% between FY25 and FY29, reaching around Rs 256 to Rs 276 lakh crores.

This growth is structurally fuelled by mass adoption of technology, favourable demographics, and the low penetration of merchants using Digital Check-out Points (around 10%), indicating massive untapped potential.

Pine Labs financial performance from FY23 to FY25 reflects robust top-line growth and a significant move toward profitability. Revenue from operations grew from Rs 1,597.66 crores in FY23 to Rs 2,274.27 crores in FY25, achieving an approximate 19.31% CAGR over the period. Profit After Tax (PAT) demonstrated a strong trend of loss reduction, narrowing from a net loss of Rs 265.15 crores in FY23 to a loss of Rs 145.49 crores in FY25 and reporting a net profit of Rs 4.79 crores in Q1 FY26.

Operating efficiency is high, with the adjusted EBITDA margin improving strongly to 15.68% in FY25 (and 19.57% in Q1 FY26). The Return on Adjusted Net Worth (RoNW) improved from (7.09%) in FY23 to (4.15%) in FY25. Platform Gross Transaction Value (GTV) expanded massively from Rs 4,39,727 crores in FY23 to Rs 11,42,497 crores in FY25.

Key strengths include Market Leadership and Ecosystem Command (largest gift card issuer and affordability solution enabler), Proven Scale and Transaction Growth (Rs 11.42 lakh crore GTV in FY25), Deep Partnerships and Cross-Selling Leverage, Technology-Driven Operational Efficiency (99.93% platform uptime), and a Robust Financial Trajectory (Q1 FY26 profitability turnaround).

Risks involve Recent Losses and Negative Cash Flows (net loss in FY25, negative cash flow in Q1 FY26), Regulatory and Supervisory Oversight Risk (as a licensed PA and PPI issuer), Significant Customer and Geographic Concentration (top 10 customers are 29.30% of Q1 FY26 revenue), Technology and Cybersecurity Vulnerabilities, and Material Contingent Liabilities (Rs 331.04 crores).

The IPO consists of a total issue of 17,64,66,426 shares valued at Rs 3,899.91 crores, comprising an Offer for Sale (OFS) of 8,23,48,779 shares (Rs 1,819.91 crores) and a Fresh Issue of 9,41,17,647 shares (Rs 2,080 crores). The proceeds from the Fresh Issue will be used for Repayment or prepayment of borrowings (Rs 532 crores), Investment in IT assets, cloud infrastructure, DCP procurement, and technology development (Rs 760 crores), Investment in Subsidiaries for international expansion (Rs 60 crores), and fund Unidentified Inorganic Acquisitions and General Corporate Purposes (Rs 728 crores). Shares are priced in the band of Rs 210 to Rs 221 per share, with a Lot Size of 67 Shares.

Company Overview of Pine Labs IPO

Pine Labs Limited is a technology company focused on digitising commerce with a strong growth trajectory that specializes in providing merchants, consumer brands, enterprises, and financial institutions with a comprehensive suite of digital payment and issuing solutions. The company runs India's biggest gift and store credit card business and is the top provider of instant loans and EMI solutions used at merchant checkout terminals, based on total transaction money processed in FY25.

Its core business focus is on the Digital Infrastructure and Transaction Platform, which constituted 70.53% of its revenue from operations for the three months ended June 30, 2025. The diversified product portfolio includes in-store and online payments, such as:

Affordability Solutions - EMI and cashback

FinTech Infrastructure – UPI, Account Aggregator, Bill Pay

Issuing and Acquiring Platform – prepaid, credit, debit, and forex card solutions.

The platform serves an ecosystem of 988,304 merchants, 716 consumer brands and enterprises, and 177 financial institutions as of June 30, 2025.

The core operational strength is built around a customer-first, cloud-based, and scalable technology platform with a commitment to operational resilience. This strength is demonstrated by its in-house technology stack capable of processing 5.68 billion transactions in FY25 and maintaining a near-constant 99.93% uptime for in-store and online payments from FY23 to FY25.

Furthermore, the company has successfully expanded its presence with 1.84 million Digital Check-out Points (DCPs) as of June 30, 2025. The company operates across India and growing international markets, including Malaysia, the UAE, Singapore, Australia, the U.S., and Africa, with 84.69% of its revenue originating from India and the remaining 15.31% from the rest of the world for the quarter ended June 30, 2025.

The company does not have an identifiable promoter. Peak XV Partners Pine Investment Holdings is the largest institutional shareholder with a 20.25% stake pre-offer on a fully diluted basis. Key leadership includes B. Amrish Rau (Chairman, Managing Director, and Chief Executive Officer), Kush Mehra (Executive Director, President, and Chief Business Officer – Digital Infrastructure and Transaction Platform), and Sameer Vasudev Kamath (Chief Financial Officer).

Industry Overview of Pine Labs IPO

Pine Labs Limited operates within the Indian Digital Transaction Economy, a financial sector undergoing rapid digital transformation, primarily driven by mass adoption of technology, favourable demographics, and the proliferation of low-cost payment instruments.

The Total Addressable Market in terms of total payment value for Pine Labs in India is estimated to be approximately Rs 116.8 lakh crores (USD 1.4 trillion) as of FY25. This strong trajectory is projected to continue, with the total market expected to grow at a Compound Annual Growth Rate (CAGR) of 22% to 24% between FY25 and FY29, reaching around Rs 256 to Rs 276 lakh crores (USD 3.0–3.3 trillion) by FY29.

The accelerated digitisation of payments, with 45% of all private consumption transactions being digital in FY25, significantly reduces reliance on cash. Crucially, the country remains an underpenetrated digital payments market, with approximately 10% of merchants currently using Digital Check-out Points (DCPs) and only 0.8 credit and debit cards per capita, indicating massive untapped potential for increased card usage, UPI adoption, and sophisticated point-of-sale solutions.

Within this intensely competitive and regulated environment, the industry is navigating challenges such as the potential impact of government-backed digital initiatives like UPI on traditional card-based models, vulnerability to cyberattacks and financial fraud, and adapting to extensive RBI regulations and frequent changes in compliance requirements, including those for lending and payment aggregation.

Financial Overview of Pine Labs IPO

Particulars | March 31, 2025 (Rs Crores) | March 31, 2024 (Rs Crores) | March 31, 2023 (Rs Crores) |

Revenue from operations | 2,274.27 | 1,769.55 | 1,597.66 |

Adjusted EBITDA | 356.72 | 158.2 | 196.8 |

Adjusted EBITDA Margin | 15.68% | 8.94% | 12.32% |

Profit/(Loss) after tax | -145.49 | -341.9 | -265.15 |

Return on Adjusted Net Worth | -4.15% | -9.65% | -7.09% |

Platform Gross Transaction Value | 11,42,497 | 6,08,436 | 4,39,727 |

The revenue from operations has shown robust growth, driven by expansion across its payments ecosystem. Revenue increased from Rs 1,597.66 crores in FY23 to Rs 1,769.55 crores in FY24 and accelerated significantly to Rs 2,274.27 crores in FY25, achieving an approximate CAGR of 19.31% from FY23 to FY25. This momentum continued into the latest quarter, with revenue reaching Rs 615.91 crores for the quarter ending June 30, 2025.

In the Operating Efficiency part, core business profitability is seen through increasing margins, derived from leveraging its scalable technology platform and ecosystem network effects. The adjusted EBITDA margin demonstrated an upward trajectory, improving from 12.32% in FY23 to 8.94% in FY24, then recovering strongly to achieve 15.68% in FY25. This margin growth reflects an improved efficiency, climbing further to a robust 19.57% for the quarter ending June 30, 2025.

Profit After Tax (PAT) has demonstrated a significant trend of loss reduction, culminating in a quarterly profit. Net losses narrowed substantially from Rs 265.15 crore in FY23 to Rs 341.90 crore in FY24 and were further reduced to Rs 145.49 crore in FY25. Critically, the company reported a net profit of Rs 4.79 crores for the quarter ending June 30, 2025, due to deferred tax credit.

The Return on Adjusted Net Worth (RoNW) tracks the profitability relative to the Adjusted Net Worth. The adjusted RoNW remained negative due to accumulated losses but showed improvement, moving from (7.09%) in FY23 to (9.65%) in FY24 and improving to (4.15%) in FY25. This improvement correlates directly with the significant narrowing of net losses over the period.

The Platform Gross Transaction Value (GTV) demonstrates massive operational scale and network adoption. GTV expanded from Rs 4,39,727 crores in FY23 to Rs 6,08,436 crores in FY24 before accelerating to Rs 11,42,497 crores in FY25. The company maintains a strong capital structure with total equity standing at Rs 3,565.50 crores as of June 30, 2025.

Strengths and Risks of Pine Labs IPO

Let's examine the strengths and weaknesses to determine if the Pine Labs IPO is a good or bad investment for investors.

Strengths

Market Leadership and Ecosystem Command: Pine Labs is recognised as the largest player in issuances of closed and semi-closed loop gift cards and the largest digital affordability solution enabler at Digital Check-out Points (DCPs) in India by processed value in FY25. This scale is built on an expansive ecosystem serving 988,304 merchants, 716 consumer brands and enterprises, and 177 financial institutions as of June 30, 2025.

Proven Scale and Transaction Growth: The platform has demonstrated high scale, processing Rs 11,42,497 crores in Gross Transaction Value (GTV) and facilitating 5.68 billion transactions in FY25. Operational reliability is ensured by achieving a near-constant 99.93% uptime for in-store and online payments from FY23 to FY25.

Deep Partnerships and Cross-Selling Leverage: The company maintains deep, long-term partnerships, some for over 10 years, with marquee entities like Croma and HDFC Bank, enabling a multi-product engagement model. This structure allows the company to cross-sell solutions across its digital infrastructure and issuing or acquiring platforms, deepening integration with core customers.

Technology-Driven Operational Efficiency: Core operations are underpinned by a full-stack, cloud-based, and API-first technology platform that promotes flexibility, scalability, and security. This efficiency is demonstrated by an improving operating margin, with the adjusted EBITDA margin increasing to 19.57% for the quarter ending June 30, 2025, up from 8.94% in FY24.

Robust Financial Trajectory and Profitability Turnaround: While historically loss-making, the company reported a net profit of Rs 4.78 crores for the three months ended June 30, 2025, marking a shift from a loss of Rs 27.88 crores in the corresponding period of the previous year.

Risks

Recent Losses and Negative Cash Flows: The company has incurred significant losses in the recent past (net loss of Rs 145.48 crores in FY25). Furthermore, it reported negative cash flows from operations amounting to Rs 281.19 crores for the three months ended June 30, 2025, with no assurance that it will achieve or sustain profitability in the future.

Regulatory and Supervisory Oversight Risk: The company's operations, particularly as a licensed Payment Aggregator (PA) and Prepaid Payment Instrument (PPI) issuer, are subject to extensive and stringent regulation, oversight, and inspection by the RBI and ReBIT. Any adverse observations, penalties, or non-compliance could significantly disrupt business operations or result in the revocation of operating licenses.

Significant Customer and Geographic Concentration: Revenue from operations is substantially concentrated, with the top 10 customers accounting for 29.30% of total revenue for the three months ended June 30, 2025. Geographically, the business is highly dependent on the Indian market, which constituted 84.69% of net revenue for the same period.

Technology and Cybersecurity Vulnerabilities: The reliance on digital technologies makes the platform vulnerable to cyberattacks, data breaches, software errors, and service interruptions. A prior incident resulted in a Rs 9.70 crore loss between December 2023 and January 2024 due to unauthorised international card transactions.

Material Contingent Liabilities: The company faces contingent liabilities totalling Rs 331.04 crores as of June 30, 2025. The materialisation of these liabilities, primarily related to unresolved indirect tax matters, could severely impact cash flows and financial condition, representing 14.22% of the company’s net worth.

Strategies of Pine Labs IPO

Scale and increase adoption and expand offerings: The strategy involves continuous investment to scale existing products, like in-store and online payments, enhancing adoption across merchant segments. This includes launching UPI-first offerings like the Mini DCP for small merchants and expanding affordability solutions beyond electronics to sectors like fashion and healthcare.

Broaden and deepen partnership ecosystem: Pine Labs aims to strengthen network effects by adding more financial institutions, consumer brands, and third-party software partners. This deepens customer engagement through cross-selling and leverages specialised sales teams to onboard more merchants across different verticals, reinforcing the platform's value.

Invest in technology platform: A key focus is on utilizing funds for IT assets, cloud infrastructure, and advancing technology development initiatives. This investment enhances platform resilience, innovates new solutions like the UPI switch, and ensures the core technology remains scalable and secure to handle increasing transaction volumes efficiently.

Enter new and expand within existing international markets: The company plans to globalise its offerings by expanding its presence in Southeast Asia, the UAE, Australia, and the U.S. This involves investing in local talent and customised technology solutions to achieve sufficient market penetration and client onboarding across these geographies.

Continue to pursue strategic acquisitions and investments: The company will selectively pursue acquisitions and investments to expand the business. These initiatives target enhancing the competitive position, acquiring new products or technologies, securing key expertise, and facilitating market entry into new geographies, building on past inorganic growth successes.

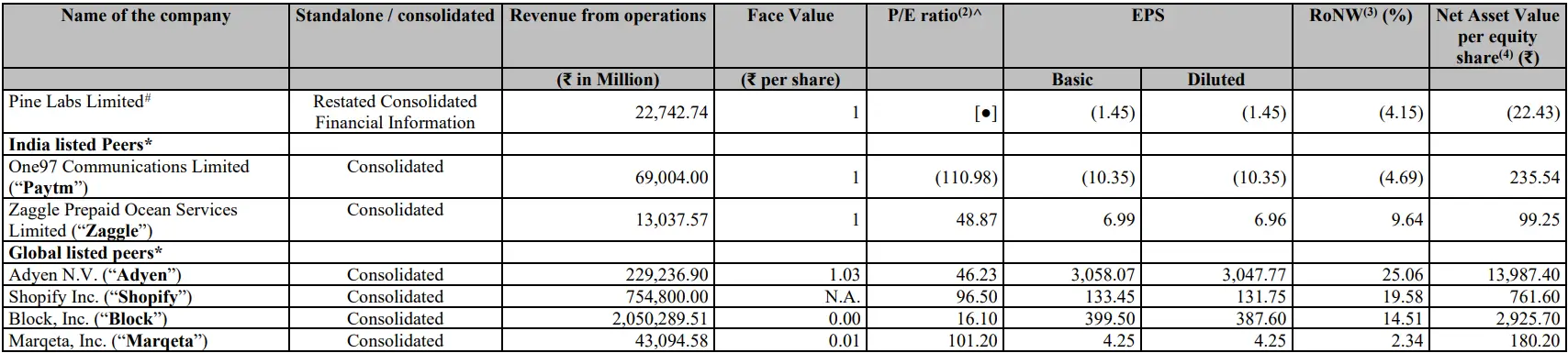

Pine Labs IPO vs. Peers

The company showcases superior operational efficiency among its domestic counterparts in the fintech space. Pine Labs achieved an adjusted EBITDA margin of 15.68% in FY25, which significantly outperformed Paytm, which recorded a margin of -10% for the period. It also surpassed Zaggle's adjusted EBITDA margin of 9.46%, underscoring Pine Labs' ability to translate its revenue scale into efficient core profitability.

When examining profitability metrics, Pine Labs reported an Adjusted Return on Net Worth (RoNW) of -4.15% for FY25, reflecting strategic investments and ongoing losses in that year. This figure is marginally better than Paytm's reported RoNW of -4.69%. In contrast, Zaggle reported a positive RoNW of 9.64% for FY25, showcasing differing levels of financial performance across the peer set.

Note: Due to limited public disclosures due to the nature of the business, this peer comparison relies solely on available data points and may not capture the full operational complexity of all companies.

Objectives of Pine Labs IPO

The offering consists of a total of 17,64,66,426 shares worth Rs 3,899.91 crores, out of which the offer for sale of 8,23,48,779 shares is valued at Rs 1,819.91 crores, and the fresh issue of 9,41,17,647 shares is valued at Rs 2,080 crores, respectively. The selling shareholders in this IPO are:

Peak XV Partners Pine Investment Holdings, Actis Pine Labs Investment Holdings Limited, Macritchie Investments Pte. Ltd., PayPal Pte. Ltd., Mastercard Asia/Pacific Pte. Ltd, AIM Investment Funds (on behalf of Invesco Developing Markets Fund), Madison India Opportunities IV, Lone Cascade, L.P., Lokvir Kapoor, and Sofina Ventures S.A. will receive the offer for sale proceeds.

However, the fresh issue proceeds will be used for the following objectives:

Repayment or prepayment of borrowings availed of by the Company (Rs 532 crores)

Investment in its Subsidiaries, namely Qwikcilver Singapore, Pine Payment Solutions, Malaysia, and Pine Labs UAE, for expanding our presence outside India (Rs 60 crores)

Investment in IT assets and expenditure towards cloud infrastructure (Rs 230 crores)

Expenditure towards procurement of DCPs (Digital Checkout Points) (Rs 430 crores)

Expenditure towards technology development initiatives (Rs 100 crores)

Unidentified Inorganic Acquisitions and General Corporate Purposes (Rs 728 crores)

Pine Labs IPO Details

IPO Dates

Pine Labs IPO will be open for subscription from November 07, 2025, to November 11, 2025. The allotment of shares to investors will take place on November 12, 2025, and the company is expected to be listed on the NSE and BSE on November 14, 2025.

IPO Issue Price

Pine Labs is offering its shares in the price band of Rs 210 to Rs 221 per share. This means you would require an investment of Rs. 14,807 per lot (67 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Pine Labs is issuing a total number of 17,64,66,426 shares valued at Rs 3,899.91 crores, out of which the offer for sale comprises 8,23,48,779 shares, worth Rs 1,819.91 crores, of which the selling shareholders will receive the proceeds. The remaining 9,41,17,647 shares worth Rs 2,080 crores will be of fresh issue, used for the objects of the issue.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on November 12, 2025, through the registrar's website, Kfin Technologies Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Pine Labs are expected to be listed on the NSE and BSE on November 14, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Important IPO Details | |

Bidding Date | November 07, 2025 to November 11, 2025 |

Allotment Date | November 12, 2025 |

Listing Date | November 14, 2025 |

Issue Price | Rs 210 to Rs 221 per share |

Lot Size | 67 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category