Is Nephrocare Health Services IPO Good or Bad – Detailed Review

00:00 / 00:00

Nephrocare Health Services Limited’s IPO is set to open its initial public offering from December 10, 2025, to December 12, 2025. When considering applying for this IPO, potential investors might have questions about whether the Nephrocare Health Services IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Nephrocare Health Services IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Nephrocare Health Services IPO Review

Nephrocare Health Services Limited's IPO is open for subscription from December 10, 2025, to December 12, 2025, with listing expected on December 17, 2025, on NSE and BSE.

The company operates as NephroPlus, is India’s largest and Asia's largest dialysis service provider in terms of treatments performed and revenue in FY25. It operates a global network of 519 clinics (as of September 30, 2025) across India, the Philippines, Uzbekistan, and Nepal, focusing on comprehensive dialysis care for Chronic Kidney Disease (CKD).

A key revenue driver is its asset-light, capital-efficient business model, relying heavily on Captive clinics in private hospitals and Public-Private Partnership (PPP) contracts. Together, these models contributed approximately 67.20% of the payment channel revenue in India for the period ended September 30, 2025. The company’s Promoters are Vikram Vuppala, Bessemer Venture Partners Trust, and other investment entities, holding an aggregate of 71.45% of the pre-offer paid-up Equity Share capital.

The company operates within the rapidly growing Indian Dialysis Services Market (projected to reach USD 1,979 Million by 2029, a CAGR of 19.30%), driven by factors like the increasing prevalence of CKD (ESRD patient pool projected to grow to 6.9 million by 2029) and major government health initiatives like the Pradhan Mantri National Dialysis Programme (PMNDP) and Ayushman Bharat Yojana.

Nephrocare Health Services’ financial performance shows strong, accelerating growth and improving operational efficiency. Revenue from operations grew by 33.50% YoY to Rs 755.81 crore in FY25. The EBITDA Margin has improved significantly, expanding from 11.11% in FY23 to a strong 22.05% in FY25 (23.30% in H1FY26). Profit After Tax (PAT) has reversed previous losses, reaching Rs 67.09 crore in FY25, with a corresponding PAT Margin of 8.88%. The company’s Return on Adjusted Capital Employed (RoACE) of 18.67% in FY25 is indicative of its capital-efficient model.

Strengths include its position as India’s/Asia's Largest Dialysis Service Provider and the 5th largest globally, Global Scale with Deep Penetration in Tier II/III Cities (77.35% of Indian clinics in Tier II/III), a Capital-Efficient and Diversified Operating Model (Captive/PPP), and Proven Clinical Excellence with proprietary RenAssure protocols.

Risks include Dependence on Captive and PPP Contracts, which make up a substantial portion of revenue, a High Attrition Rate Among Healthcare Professionals (53.05% for staff in FY25), Exposure to Foreign Exchange and Interest Rate Fluctuations due to international operations, and Risk of Extended Receivables with Trade Receivable Turnover Days of 126.68 in H1FY26.

The Rs 871.05 crore IPO consists of a Fresh Issue of Rs 353.40 crores and an Offer for Sale (OFS) of Rs 517.64 crores. The fresh issue proceeds will be used for Capital expenditure towards opening 167 new dialysis clinics in India (Rs 129.10 crores), Repayment or Prepayment of outstanding borrowings (Rs 136 crores), and General Corporate Purposes.

The shares are priced in the band of Rs 438 to Rs 460 per share, with a lot size of 32 shares.

Company Overview of Nephrocare Health Services IPO

Nephrocare Health Services Limited, operating as NephroPlus, is India’s largest and Asia's largest dialysis service provider in terms of treatments performed and revenue in FY25. The company operates in the chronic kidney disease (CKD) segment, focusing on providing comprehensive dialysis care through its global network.

The company’s core focus is on delivering high-quality, accessible, and value-driven dialysis care. The core competitive strength lies in its ability to scale operations efficiently using an asset-light, capital-efficient business model and its implementation of rigorous, proprietary RenAssure protocols for clinical excellence. A key component of its revenue is generated from Public-Private Partnerships (PPP) contracts and government schemes, alongside private hospital partnerships.

Nephrocare Health Services has a track record of expanding its network through both organic growth (Greenfield or Brownfield setups) and inorganic growth through acquisitions. As of September 30, 2025, the network comprised 519 clinics globally, having achieved this scale through various acquisitions, including DaVita India and multiple clinics in the Philippines.

The company is the only Indian dialysis service provider to have scaled internationally, with a presence in the Philippines, Uzbekistan, and Nepal. Its core business strength is built around a strategy to optimize operational efficiencies by focusing heavily on an asset-light model, particularly in India, where a large number of clinics operate under revenue-sharing (captive) arrangements within hospitals or rent-free PPP agreements.

The company provides core and ancillary dialysis services, including Haemodialysis, Home Haemodialysis (HHD), Dialysis on Call (DoC), and Dialysis on Wheels (DoW).

The revenue split by operating model for the income from dialysis and related services for the six months ended September 30, 2025:

Operating Model | Amount (Rs crore) | % of Dialysis Revenue |

Captive clinics | 172.86 | 36.66% |

Standalone clinics | 152.04 | 32.25% |

Public Private Partnership (PPP) | 146.58 | 31.09% |

Total Dialysis Revenue | 471.49 | 100.00% |

The revenue split by key payment channel in India for September 30, 2025:

Payment Channel | % of Revenue from Operations |

Captive Channels | 37.00% |

PPP | 30.20% |

Banking Channels | 24.96% |

Insurance | 7.84% |

Total Revenue from Operations | 100.00% |

The Company’s Promoters are Vikram Vuppala, Bessemer Venture Partners Trust, Edoras Investment Holdings Pte. Ltd., Healthcare Parent Limited, Investcorp Private Equity Fund II, and Investcorp Growth Opportunity Fund. The promoters hold an aggregate of 71.45% of the pre-offer paid-up Equity Share capital on a fully diluted basis.

Vikram Vuppala serves as the Chairman and Managing Director, Prashant Vinodkumar Goenka is the Chief Financial Officer, and Kishore Kathri is the Company Secretary and Compliance Officer.

Industry Overview of Nephrocare Health Services IPO

Nephrocare Health Services Limited operates within the rapidly growing Global Dialysis Services Market, with a primary focus on the highly underpenetrated and expanding Indian market. The dialysis sector in India is experiencing a significant transformation driven by increasing disease burden, organized private participation, and major government health initiatives.

Market Segment | Value as of 2024 | Projected Value (2029) | CAGR (2024–2029) |

Global Dialysis Services Market | USD 75.2 Billion | USD 106.2 Billion | 7.10% |

Indian Dialysis Services Market | USD 818.0 Million | USD 1,979.0 Million | 19.30% |

Key Market Driving factors that can propel this growth:

Increasing Prevalence of Chronic Kidney Disease (CKD): CKD is the third fastest-growing cause of death globally. The estimated pool of End-Stage Renal Disease (ESRD) patients requiring dialysis in India is projected to grow from 4.2 million in 2024 to 6.9 million by 2029.

Burden of Non-Communicable Diseases (NCDs): Diabetes (33%) and hypertension (13%) are the two largest drivers of CKD in India. India currently has an estimated 101 million diabetic patients, fuelling the perpetual demand for dialysis.

Government Schemes and PPP Model: Initiatives like the Pradhan Mantri National Dialysis Programme (PMNDP) promote the Public-Private Partnership (PPP) model, increasing service access for economically disadvantaged patients and ensuring stable revenue streams for providers like NephroPlus. The Ayushman Bharat Yojana (PMJAY) also covers dialysis costs, improving affordability.

Shift to Organized Care: The organized sector currently accounts for only about 20% of the Indian dialysis market, but is projected to see faster revenue growth compared to the unorganized sector. This shift is driven by the demand for standardized quality and protocols offered by large chains.

Infrastructure Shortfall: To meet current patient needs, India requires approximately 10,000 HD clinics and 105,000 HD machines, but currently operates with only about 5,000 clinics and 40,000 machines as of 2023.

Financial Overview of Nephrocare Health Services IPO

Particulars | Six Months ended September 30, 2025 (Rs Crores) | March 31, 2025 (Rs Crores) | March 31, 2024 (Rs Crores) | March 31, 2023 (Rs Crores) |

Revenue from Operations | 473.5 | 755.81 | 566.15 | 437.29 |

EBITDA Margin | 23.30% | 22.05% | 17.60% | 11.11% |

Profit after tax (PAT) | 14.23 | 67.09 | 35.13 | -11.79 |

PAT Margin | 3.00% | 8.88% | 6.21% | -2.70% |

Return on Equity (RoE) | 2.19% | 13.45% | 8.76% | -3.00% |

Return on Capital Employed (RoACE) | 11.99% | 18.67% | 10.00% | 0.44% |

Revenue from Operations has shown strong, accelerating growth. Revenue increased by 29.47% from Rs 437.29 crore in FY23 to Rs 566.15 crore in FY24. This growth accelerated to Rs 755.81 crore in FY25, representing a 33.50% YoY growth, driven primarily by strong domestic and international expansion and increased treatment volumes. Revenue further increased to Rs 473.50 crore in H1FY26.

EBITDA (excluding other income) Margin reflects a strong trajectory of operational efficiency. The margin significantly improved from 11.11% in FY23 to 17.60% in FY24, and further expanded to 22.05% in FY25, stabilizing at 23.30% in H1FY26. This demonstrates resilient operational performance amidst continuous expansion and cost management benefits from scale.

Profit After Tax (PAT) has shown a sharp turnaround from previous losses. The Company reversed a loss of -Rs 11.79 crore in FY23 to a profit of Rs 35.13 crore in FY24. PAT subsequently grew by over 91.07% to Rs 67.09 crore in FY25, reflecting revenue growth and operating leverage. PAT reached Rs 14.23 crore in H1FY26.

PAT Margin clearly reflects the improving net financial impact of the growth strategy. The margin sharply reversed from -2.70% in FY23 to 6.21% in FY24. It recovered further to 8.88% in FY25 and stood at 3.00% in H1FY26.

Return on Equity (RoE) has followed a trajectory mirroring the growth in profitability. RoE reversed from -3.00% in FY23 to 8.76% in FY24, stabilizing at 13.45% in FY25.

Return on Adjusted Capital Employed (RoACE) reflects the increasing returns generated from operating assets. RoACE rapidly grew from 0.44% in FY23 to 10.00% in FY24, and substantially improved to 18.67% in FY25.

Strengths and Risks of Nephrocare Health Services IPO

Let's examine the strengths and weaknesses to determine if the Nephrocare Health Services IPO is a good or bad investment for investors.

Strengths

India’s and Asia's Largest Dialysis Service Provider: Nephrocare Health Services is positioned as India’s largest and Asia's largest dialysis service provider in terms of treatments performed, revenue, and clinics in FY25. It is the fifth largest globally by treatments performed in FY25.

Global Scale with Deep Penetration in Tier II/III Cities: The company operates a global network of 519 clinics, including 468 in India, across 288 cities. Its network is highly distributed, with 77.35% of its clinics in India located in Tier II and Tier III cities, establishing it as the only Indian provider to successfully scale internationally.

Capital-Efficient and Diversified Operating Model: The company operates an asset-light model that minimises upfront capital expenditure by relying on revenue-sharing arrangements like Captive clinics and Public-Private Partnerships (PPPs). This model contributed significantly to operating revenue (Captive: 36.51%; PPP: 30.96% in H1FY26).

Proven Clinical Excellence and Technology Integration: The company maintains high clinical quality through its proprietary RenAssure protocols and owns patented technology like the Renova Dialyzer Reprocessing System. It operates a dedicated training academy, Enpidia, accredited by the Board of Nephrology Examiners Nursing and Technology (BONENT), ensuring a pipeline of trained staff.

Strong Financial Performance and Margin Expansion: The company has demonstrated significant financial improvement, evidenced by a rapid increase in EBITDA from Rs 48.59 crore in FY23 to Rs 166.63 crore in FY25 (85.18% CAGR). Its EBITDA margin increased from 11.11% to 22.05% over the same period.

Risks

Dependence on Captive and PPP Contracts: The business relies heavily on revenue generated from captive clinic arrangements with private hospitals (36.51% in H1FY26) and PPP contracts with government agencies (30.96% in H1FY26). Non-renewal, cancellation, or loss of tenders for these key contracts could materially impact revenues and growth prospects.

High Attrition Rate Among Healthcare Professionals: The business depends on retaining qualified professionals, with the attrition rate for nephrologists/doctors and related staff reported at 53.05% in FY25. Failure to attract or retain medical staff, particularly in new geographies, poses a risk to service quality and operational continuity.

Exposure to Foreign Exchange and Interest Rate Fluctuations: International operations, including in Uzbekistan and the Philippines, expose the company to adverse fluctuations in foreign currency exchange rates and interest rate volatility on its borrowings, which could affect financial condition and reported earnings.

Risk of Extended Receivables and Pricing Limits: The company is exposed to extended receivable cycles from third-party payers, government bodies, and insurers. Additionally, pricing for services is dependent on recommended or mandatory fees fixed under contract, limiting the ability to pass on cost increases, which impacts liquidity (Trade Receivable Turnover Days were 126.68 in H1FY26) and profitability.

Complexity of International Operations and Regulatory Compliance: Expanding into new international regions subjects the company to unique legal, tax, political, and economic risks in those foreign jurisdictions, like the Philippines, Uzbekistan. Non-compliance with differing local laws or unexpected regulatory reforms could adversely affect operations.

Strategies of Nephrocare Health Services IPO

Consolidate Leadership Position in India: The company plans to continue its expansion in India by aggressively opening new dialysis clinics, which aim to fund 167 new clinics through the Offer proceeds, while seeking new partnerships with hospitals, and simultaneously focusing on PPP opportunities for growth.

Scale International Operations through Acquisitions: The strategy is to continue pursuing strategic acquisitions and investments in existing international markets (Philippines, Uzbekistan, KSA) that are complementary to their growth objectives, allowing for immediate access to patients and operational synergies.

Expand to New International Markets: The company intends to further penetrate high-potential markets in Southeast Asia, the Commonwealth of Independent States (CIS), and the Middle East, leveraging its operating expertise and cost-efficient model to capitalize on growing global demand.

Improve Operational Efficiency and Supply Chain: The company aims to drive profitability by continuously improving operating efficiency, leveraging its network scale for favourable procurement rates, and expanding vertical integration through contract manufacturing for key dialysis consumables.

Focus on Innovation-led Digital Healthcare: Investment will continue in technology and digital healthcare solutions, including proprietary mobile applications and data platforms to improve clinical outcomes, ensure patient convenience, and drive operational efficiency and broader geographical reach.

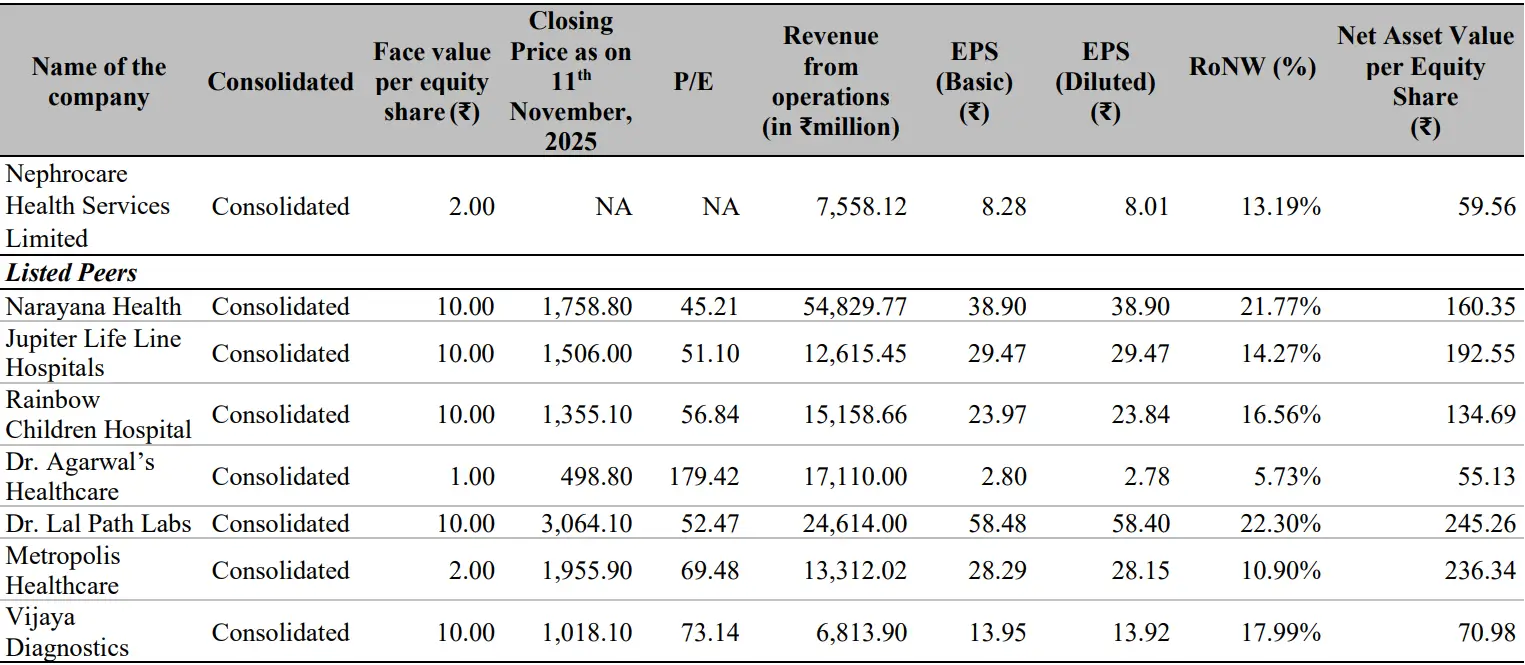

Nephrocare Health Services IPO vs. Peers

In terms of core operating profitability, Nephrocare Health Services' EBITDA Margin of 22.05% in FY25 is competitive, placing it within the range of hospital peers like Narayana Health (23.13%) and Jupiter Life Line Hospitals (23.51%). The margin is slightly lower than Dr. Agarwal's Healthcare (26.50%) and Dr. Lal Path Labs (28.26%), and substantially lower than the peak performer, Vijaya Diagnostics (39.95%).

The Company's PAT Margin of 8.88% is lower than the majority of the peer group, which sees margins ranging up to 21.10% (Vijaya Diagnostics). The Company exhibits a strong profile in terms of capital efficiency, which reflects its low-capital-intensity model.

Nephrocare Health Services recorded an impressive Return on Adjusted Capital Employed (RoACE) of 18.67% in FY25. This performance places its Return on Equity (RoE) of 13.45% above Metropolis Healthcare (11.96%) but below peers like Rainbow Children's Medicare (23.83%) and Narayana Health (24.25%).

Objectives of Nephrocare Health Services IPO

The offering consists of a total of 1,89,35,819 shares worth Rs 871.05 crores, out of which the offer for sale of 1,12,53,102 shares is valued at Rs 517.64 crores, and the fresh issue of 76,82,717 shares is valued at Rs 353.40 crores. The selling shareholders in this IPO are as follows:

Investcorp Private Equity Fund II, Healthcare Parent Limited, Investcorp Growth Opportunity Fund, Edoras Investment Holdings Pte. Ltd., Investcorp India Private Equity Opportunity Limited, International Finance Corporation, 360 One Special Opportunities Fund - Series 9, 360 One Special Opportunities Fund - Series 10 will receive the offer for sale proceeds.

However, the fresh issue proceeds will be used for the following objectives:

Capital expenditure towards opening new dialysis clinics in India (Rs 129.10 crores)

Repayment or Prepayment of outstanding borrowings availed by the company (Rs 136 crores)

General Corporate Purposes (Rs 88.3 crores)

Nephrocare Health Services IPO Details

IPO Dates

Nephrocare Health Services IPO will be open for subscription from December 10, 2025, to December 12, 2025. The allotment of shares to investors will take place on December 15, 2025, and the company is expected to be listed on the NSE and BSE on December 17, 2025.

IPO Issue Price

Nephrocare Health Services is offering its shares in the price band of Rs 438 to Rs 460 per share. This means you would require an investment of Rs. 14,720 per lot (32 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Nephrocare Health Services is issuing a total number of 1,89,35,819 shares valued at Rs 871.05 crores, out of which the fresh issue comprises 76,82,717 shares worth Rs 353.40 crores and the remaining 1,12,53,102 shares worth Rs 517.64 crores will be received by the selling shareholders in this IPO.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on December 15, 2025, through the registrar's website, Kfin Technologies Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Nephrocare Health Services are expected to be listed on the NSE and BSE on December 17, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Nephrocare Health Services IPO

Important IPO Details | |

Bidding Date | December 10, 2025 to December 12, 2025 |

Allotment Date | December 15, 2025 |

Listing Date | December 17, 2025 |

Issue Price | Rs 438 to Rs 460 per share |

Lot Size | 32 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category