Is Jinkushal Industries IPO Good or Bad – Detailed Review

00:00 / 00:00

Jinkushal Industries Limited's IPO is set to open its initial public offering from September 25, 2025, to September 29, 2025. When considering applying for this IPO, potential investors might have questions about whether the Jinkushal Industries IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Jinkushal Industries IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Jinkushal Industries IPO Review

Jinkushal Industries Limited's IPO is a book-built issue of Rs 116.15 crore, comprising a fresh issue of 86,35,935 shares aggregating up to Rs 104.54 crore and an offer for sale of 9,59,548 shares aggregating up to Rs 11.61 crore. The IPO will be open for subscription from September 25, 2025, to September 29, 2025, with a price band of Rs 115 to Rs 121 per share and a lot size of 120 shares. The company plans to use the net proceeds from the fresh issue for funding its long-term incremental working capital requirements (up to Rs 72.67 crore) and for general corporate purposes.

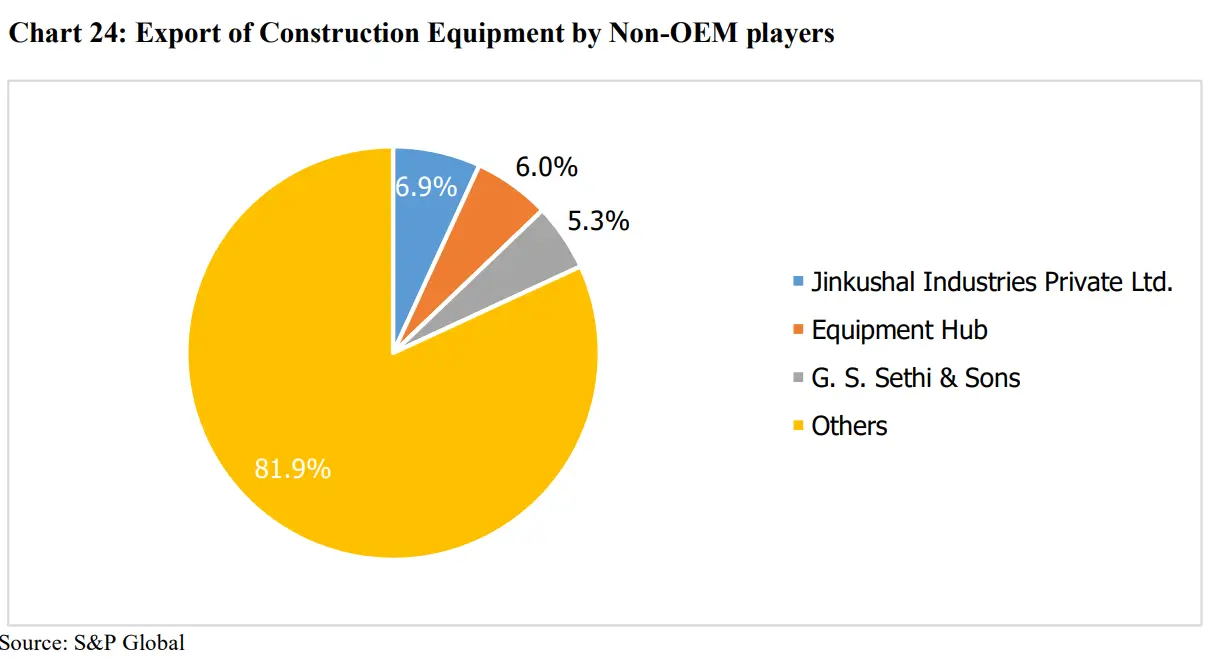

Jinkushal Industries is an export trading company specializing in new/customized and used/refurbished construction machinery for global markets. It was originally incorporated in 2007 as Zenith Tie-Up Private Limited. The company operates across three main business verticals: trading of new customized machines, exporting used/refurbished machines, and selling its own brand, "HexL" construction machines, which currently include backhoe loaders. The company holds a 6.9% market share, making it the largest non-OEM exporter of construction machines in India. It has a presence in over 30 countries and uses subsidiaries in the UAE and the USA to manage its international operations.

Financially, the company has shown a strong upward trend in revenue and profitability. Its revenue from operations grew from Rs 233.45 crore in Fiscal 2023 to Rs 380.56 crore in Fiscal 2025. Net profit after tax increased from Rs 10.12 crore in Fiscal 2023 to Rs 19.14 crore in Fiscal 2025. While the company has demonstrated consistent financial growth, some of its return metrics, such as Return on Capital Employed (RoCE), have declined from 34.11% in Fiscal 2023 to 18.39% in Fiscal 2025. The debt-to-equity ratio has fluctuated, but decreased from 1.06 in Fiscal 2024 to 0.58 in Fiscal 2025.

Key strengths of the company include its leading position as a non-OEM exporter, a business model that contributes to the circular economy through refurbishment, and an efficient supply chain. The launch of its own "HexL" brand is also seen as a strategic move to increase margins. However, potential investors should be aware of the risks, such as the company's heavy reliance on the export market (with 99.18% of revenue from overseas sales) and a limited number of key customers (top 10 customers accounted for 84.80% of revenue in FY25). The company has also experienced negative cash flows from operating activities in recent years, and the "HexL" brand has a limited operating history.

Company Overview of Jinkushal Industries IPO

Jinkushal Industries Limited is a company engaged in the export trading of new or customized and used or refurbished construction machinery to global markets. The company was originally incorporated in 2007 as Zenith Tie-Up Private Limited. Jinkushal Industries operates across three main business verticals:

Export trading of customized, modified, and accessorized new construction machines: The company sources new machines of various third-party OEM brands and improves their value through customization based on customer specifications.

Export trading of used/refurbished construction machines: The company procures used machines and refurbishes them either at its in-house facility in Raipur, Chhattisgarh, or through non-exclusive third-party centers, before exporting them to international markets.

Export trading of its own brand 'HexL' construction machines: The company launched its own brand, HexL, starting with backhoe loaders manufactured through a contract manufacturing arrangement in China.

The company's product portfolio includes hydraulic excavators, motor graders, backhoe loaders, soil compactors, wheel loaders, bulldozers, cranes, and asphalt pavers. As per the RHP, the company holds a 6.9% market share, making it the largest non-OEM (non-original equipment manufacturer) exporter of construction machines from India.

The company has a presence in over 30 countries, including the UAE, Mexico, the Netherlands, Belgium, South Africa, and the UK. A significant portion of its revenue is derived from Mexico and the UAE.

Jinkushal Industries has a subsidiary, Hexco Global FZCO, in the UAE, and a step-down subsidiary, Hexco Global USA LLC, in the USA, which helps manage its international operations. The company has shown consistent financial growth, with a 5-year revenue CAGR of 73.37%. In Fiscal 2025, the Sale of new construction machines contributed around 60.94%, followed by 34.63% from Used construction machines, 3.79% from own-brand contract-manufactured construction machines, 0.07% from Rental of construction machines, 0.29% from Income from logistics (warehousing,) and 0.28% from Other operating revenue.

Industry Overview of Jinkushal Industries IPO

Jinkushal Industries operates in the global construction equipment market, primarily as an export-focused trading company. The company is involved in selling new, customized, and used/refurbished construction machines, such as hydraulic excavators, motor graders, backhoe loaders, and cranes, to international markets.

The global market for used construction equipment was valued at an estimated USD 132.4 billion in CY24 and is projected to reach USD 177.2 billion by CY29, growing at a CAGR of 6.0%. This growth is driven by increasing infrastructure development in emerging economies and the cost-effectiveness of used equipment compared to new machinery. The market is also benefiting from new business models, a rise in equipment rental and leasing, and expanding digital marketplaces that facilitate transactions.

In India, the construction equipment industry is closely linked to the country's economic and infrastructure growth. The sector saw a 26% year-on-year growth in sales volume in FY24, fueled by increased construction activity in urban development, rural infrastructure, airports, ports, and mining.

The Indian government's continued focus on infrastructure, with a capital expenditure allocation of approximately Rs 5,63,777 crores in the Union Budget 2025-26, is expected to further boost demand for construction equipment.

Financial Overview of Jinkushal Industries IPO

Particulars | March 31, 2025 (Rs in crores) | March 31, 2024 (Rs in crores) | March 31, 2023 (Rs in crores) |

Revenue from Operations | 380.56 | 238.59 | 233.45 |

EBITDA | 28.6 | 27.57 | 14.68 |

EBITDA Margin (%) | 7.52% | 11.56% | 6.29% |

Profit after tax | 19.14 | 18.64 | 10.12 |

PAT Margin (%) | 5.03% | 7.81% | 4.33% |

Return on Equity (RoE) | 28.30% | 55.19% | 51.95% |

Return on Capital Employed (RoCE) | 18.39% | 29.44% | 34.11% |

Debt-Equity Ratio | 0.58 | 1.06 | 0.66 |

The financial performance of Jinkushal Industries over the three fiscal years ending March 31, 2023, 2024, and 2025 demonstrates a mixed trend, but with notable growth in key areas.

Revenue from Operations shows a strong upward trend, increasing from Rs 233.45 crore in Fiscal 2023 to Rs 238.59 crore in Fiscal 2024, and then to a significant Rs 380.56 crore in Fiscal 2025. This substantial growth, particularly between Fiscal 2024 and 2025, is primarily attributed to the consolidation of Hexco Global FZCO, a subsidiary that began operations on April 1, 2024, which positively impacted the overall revenue figures.

EBITDA and its corresponding margin highlight fluctuations in operational efficiency. EBITDA increased from Rs 14.68 crore in Fiscal 2023 to Rs 27.57 crore in Fiscal 2024, and then to Rs 28.60 crore in Fiscal 2025. The EBITDA margin, however, fluctuated, rising from 6.29% in Fiscal 2023 to 11.56% in Fiscal 2024, before decreasing to 7.52% in Fiscal 2025. This decrease in margin is attributed to increased operational expenses associated with the first year of the subsidiary's operations.

Profit After Tax (PAT) has shown consistent growth. The company's net profit increased from Rs 10.12 crore in Fiscal 2023 to Rs 18.64 crore in Fiscal 2024, and then to Rs 19.14 crore in Fiscal 2025. The PAT margin also saw a fluctuating trend, increasing from 4.33% in Fiscal 2023 to 7.81% in Fiscal 2024, and then declining to 5.03% in Fiscal 2025.

The company's return metrics demonstrate a mix of strong and declining performance. Return on Equity (RoE) shows a general upward trend from 51.95% in Fiscal 2023 to 55.19% in Fiscal 2024, before significantly dropping to 28.30% in Fiscal 2025. Conversely, Return on Capital Employed (RoCE) shows a consistent decline from 34.11% in Fiscal 2023 to 29.44% in Fiscal 2024, and further to 18.39% in Fiscal 2025.

Financially, the company's Debt-Equity Ratio has fluctuated, from 0.66 in Fiscal 2023 to 1.06 in Fiscal 2024 and back down to 0.58 in Fiscal 2025. The decrease in 2025 suggests the company is becoming less reliant on debt. Overall, the financial performance of Jinkushal Industries reflects a company with significant revenue growth, but with fluctuating profitability and return metrics that require further analysis.

Strengths and Risks of Jinkushal Industries IPO

Let's delve into the strengths and weaknesses to assess if the Jinkushal Industries IPO is good or bad for investors.

Strengths

Leading player in non-OEM construction equipment exports: According to the CareEdge Report, Jinkushal Industries is the largest non-OEM exporter of construction machines in India, with a 6.9% market share. The company has also been recognized as a Three-Star Export House by the Government of India.

Refurbishment and contribution to the circular economy: The company extends the life cycle of used machines through systematic refurbishment processes, which not only restores operational value but also promotes sustainable practices by reducing waste and conserving raw materials.

Diversified market presence and solutions: By offering a wide range of new, customized, and used or refurbished construction machines, the company reduces its dependence on any single product category or region. The company's portfolio includes popular machines like hydraulic excavators, backhoe loaders, and wheel loaders.

Efficient supply chain: The company has a diverse network of 228 suppliers, which allows it to source a wide range of new and used construction machines. It also works with six non-exclusive third-party refurbishment centers and has a contract manufacturing arrangement in China for its own brand, 'HexL'.

Launch and expansion of the 'HexL' brand: The company recently launched its own brand, 'HexL,' for backhoe loaders, which are manufactured through a contract manufacturing arrangement in China. This strategic move is intended to reduce dependence on third-party OEMs and improve gross margins.

Consistent financial track record: Jinkushal Industries has shown consistent financial growth, with a compound annual growth rate (CAGR) of 27.68% in revenue from operations from Fiscal 2023 to Fiscal 2025. Its profit after tax increased from Rs 10.11 crores in Fiscal 2023 to Rs 19.14 crores in Fiscal 2025.

Risks

Heavy reliance on the export market: Jinkushal Industries is highly dependent on the export market, with approximately 99.18% of its revenue from operations derived from overseas sales in the last three fiscal years. This exposes the company to risks associated with regulatory uncertainty, geopolitical instability, trade policy volatility, and tariff barriers.

Dependence on a limited number of customers: The company's revenue is highly concentrated among a few key customers. In Fiscal 2025, the top 10 customers accounted for 84.80% of the company's revenue from operations. The loss of any of these customers could have a material adverse effect on the business and financial results.

Negative cash flows: The company has experienced negative cash flows from operating activities in Fiscal 2024 and Fiscal 2025. These outflows were primarily due to increased working capital requirements and strategic investments.

Exposure to credit risk: The company is exposed to credit risk from its customers, particularly in overseas markets, as it extends credit periods and does not use formal risk mitigation measures like Export Credit Guarantee Corporation (ECGC) cover or Letters of Credit (LCs) for most transactions.

Limited operating history of the 'HexL' brand: The company recently launched its own brand, 'HexL,' in December 2024, and its long-term commercial viability and market acceptance are still uncertain. The brand's success depends on consistent product quality, after-sales service, and its ability to compete with established global brands.

Strategies of Jinkushal Industries IPO

Further integration and diversification: The company plans to strengthen its supply chain by expanding its network of vendors for procurement, refurbishment, and contract manufacturing. It also intends to place additional focus on its own brand, 'HexL,' to gain greater control over production quality and cost efficiency.

Sales volume growth: Jinkushal Industries plans to drive sales by leveraging its global distribution network, which includes regional dealer and distributor partnerships. It aims to increase sales volumes in all its business segments, including the new 'HexL' branded machines, as well as its refurbished and customized equipment.

Efficiency improvement and cost optimization: The company plans to improve its operational efficiencies by refining its procurement, refurbishment, and logistics processes. It also intends to invest in technology and process automation to improve accuracy, improve inventory management, and sustain long-term cost-effectiveness.

Expansion of product portfolio: The company plans to expand its product portfolio beyond its current offerings to include electric construction machines in the future. This expansion is aimed at meeting the evolving needs of the construction industry and aligning with the increasing demand for sustainable solutions.

Brand recognition: The company plans to strengthen its brand recognition through a structured marketing strategy that includes digital advertising, participation in international exhibitions, and direct client engagement. This is especially important for the newly launched 'HexL' brand.

Working capital optimization: Given the working capital-intensive nature of the business, the company aims to shorten its working capital cycle through better inventory management and stronger brand positioning. This will involve optimizing inventory turnover, reducing holding periods, and negotiating more favorable payment terms.

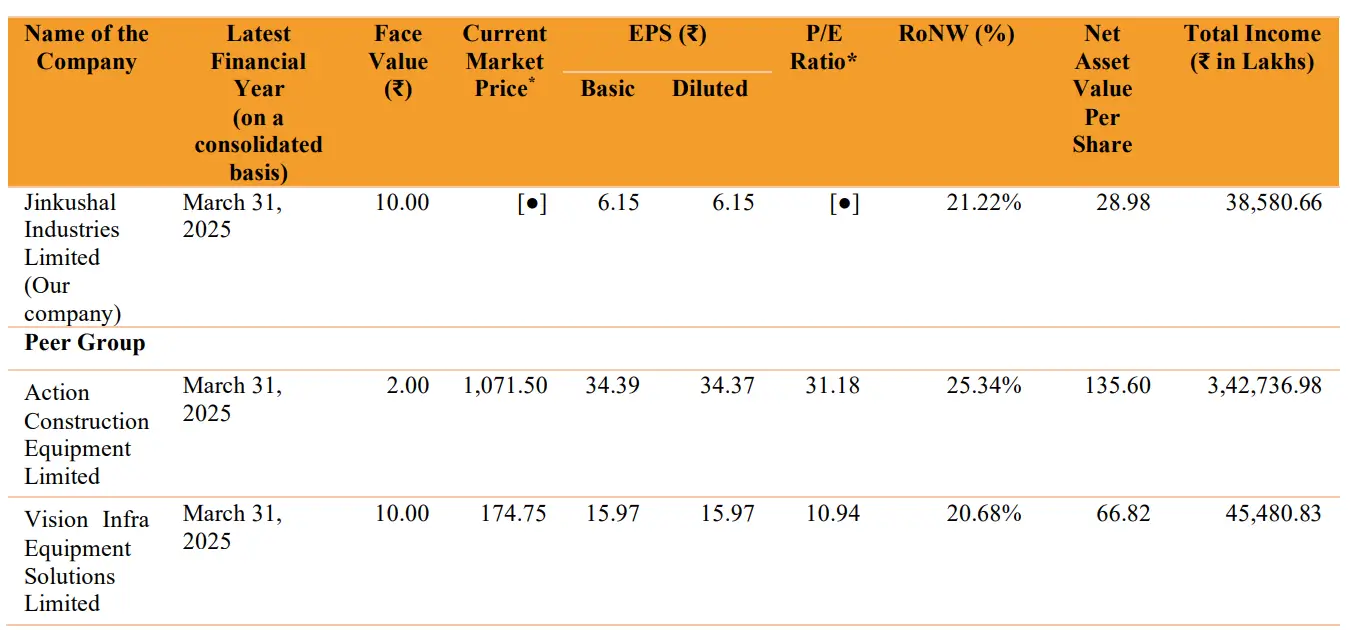

Jinkushal Industries IPO vs. Peers

Jinkushal Industries reported robust revenue from operations of Rs 380.55 crore in Fiscal 2025. While this is significantly smaller than the Rs 3,327.05 crore reported by the larger, publicly-listed ACE, it is competitive with VIESL's revenue of Rs 443.26 crore in the same period. Jinkushal's revenue growth of 59.50% from Fiscal 2024 to Fiscal 2025 highlights its strong expansion, especially when compared to ACE's 14.18% and VIESL's 33.22% growth in the same period.

In terms of profitability, Jinkushal Industries maintains healthy margins. Its EBITDA margin for Fiscal 2025 was 7.52%, while its PAT margin was 5.03%. These figures are lower than those of its peers, as ACE reported an EBITDA margin of 17.68% and a PAT margin of 12.30%, and VIESL recorded an EBITDA margin of 28.69% and a PAT margin of 7.68% in the same fiscal year.

Jinkushal Industries' return metrics reflect its efficiency. The company's Return on Net Worth (RoNW) stood at 21.22% for Fiscal 2025. This is competitive with VIESL's RoNW of 20.68% and ACE's 25.34%. Similarly, Jinkushal's Return on Capital Employed (RoCE) of 18.39% is lower than that of its larger competitors, with ACE and VIESL reporting RoCEs of 35.29% and 16.73%, respectively.

The company's debt-to-equity ratio of 0.58 in Fiscal 2025 indicates a moderate level of leverage. This is higher than ACE's low debt-to-equity ratio of 0.01 but is more favorable than VIESL's ratio of 1.69. The company's reliance on working capital loans is a key factor here.

Overall, Jinkushal Industries has established a strong position as a specialized exporter and refurbishment service provider, differentiating itself from the larger, domestic-focused OEM manufacturers. While it has lower revenue and profitability margins compared to its largest peers, its impressive growth rate and solid return on capital highlight its operational efficiency and strategic direction.

Objectives of Jinkushal Industries IPO

Jinkushal Industries is planning to issue a mix of fresh issues and offer for sale totalling Rs 116.15 crores. The shares sold by selling shareholders through the offer for sale are worth Rs 11.61 crore, and the remaining Rs 104.54 crore raised through fresh issue, which will be utilised for the proceedings, such as:

Funding the long-term incremental working capital requirements of the company, worth Rs 72.67 crore.

General Corporate Purposes.

Jinkushal Industries IPO Details

IPO Dates

Jinkushal Industries IPO will be open for subscription from September 25, 2025, to September 29, 2025. The allotment of shares to investors will take place on September 30, 2025, and the company is expected to be listed on the NSE and BSE on October 03, 2025.

IPO Issue Price

Jinkushal Industries is offering its shares in the price band of Rs 115 to Rs 121 per share. This means you would require an investment of Rs. 14,520 per lot (120 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Jinkushal Industries is planning to issue fresh issue and offer for sale totalling 95,99,548 shares, which are worth Rs 116.15 crores. Out of which fresh issue shares are 86,40,000 worth Rs 104.54 crores, and 9,59,548 shares of offer for sale worth Rs 11.61 crore sold by Promoter Anil Kumar Jain, Abhinav Jain, and Sandhya Jain.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on September 30, 2025, through the registrar's website, Bigshare Services Private Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Jinkushal Industries will be listed on the NSE and BSE on October 03, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Jinkushal Industries IPO

Important IPO Details | |

Bidding Date | September 25, 2025 to September 29, 2025 |

Allotment Date | September 30, 2025 |

Listing Date | October 03, 2025 |

Issue Price | Rs 115 to Rs 121 per share |

Lot Size | 120 Shares |

FAQs:

Q1: What is the issue size of Jinkushal Industries Limited IPO?

The total issue size is Rs 116.15 crore, which includes a fresh issue of 86,35,935 shares worth Rs 104.54 crore and an offer for sale of 9,59,548 shares worth Rs 11.61 crore.

Q2: What’s the minimum investment for Jinkushal Industries IPO?

120 shares per lot, requiring Rs 14,520 (at upper band).

Q3: How does Jinkushal compare to peers?

Largest Indian exporter of non-OEM construction equipment, strong supply chain, and diversified market presence; its own brand, HexL, is a new milestone.

Q4: Who is managing Jinkushal Industries IPO?

GYR Capital Advisors Private Limited is the book-running lead manager for the IPO.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category