Is ICICI Prudential Asset Management Company IPO Good or Bad – Detailed Review

00:00 / 00:00

ICICI Prudential Asset Management Company Limited’s IPO is set to open its initial public offering from December 12, 2025, to December 16, 2025. When considering applying for this IPO, potential investors might have questions about whether the ICICI Prudential Asset Management Company IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive ICICI Prudential Asset Management Company IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

ICICI Prudential Asset Management Company IPO Review

ICICI Prudential Asset Management Company Limited's IPO is open for subscription from December 12, 2025, to December 16, 2025, with listing expected on December 19, 2025, on NSE and BSE.

The company operates as a prominent player in the Indian Asset Management Industry and is a joint venture between ICICI Bank Limited and Prudential Corporation Holdings Limited. Its core business involves managing mutual funds, providing portfolio management services (PMS), managing alternative investment funds (AIFs), and offering advisory services to offshore clients. The company manages a diverse product portfolio, including 143 mutual fund schemes, the largest number in India as of September 30, 2025.

A key revenue driver is its market leadership and scale: it is the Largest AMC in Active Mutual Fund QAAUM (13.3% market share) and the Largest in the Equity Segment QAAUM (13.6% market share) as of September 30, 2025. It also boasts the Largest Individual Investor Franchise with a Monthly Average AUM (MAAUM) of Rs 6,61,030 crore. The Promoters are ICICI Bank Limited (51.0%) and Prudential Corporation Holdings Limited (49.0%) of the pre-offer paid-up Equity Share capital.

The company operates within the rapidly growing Indian Mutual Fund market, with the Indian Mutual Fund QAAUM projected to grow at a CAGR of 16–18% from FY25 to March 2030, driven by the financialization of household savings, the consistent growth of Systematic Investment Plans (SIPs), favourable demographics, and increasing digital adoption. The Alternative Investment Fund (AIF) segment is also anticipated to grow significantly at a CAGR of 31–33%.

ICICI Prudential Asset Management Company's financial performance shows strong, accelerating growth and exceptional capital efficiency.

Operating Revenue grew by 38.70% YoY to Rs 4,682.78 crore in FY25.

The company was the most profitable AMC in India in terms of operating profit before tax, holding a 20% market share for FY25.

Profit After Tax (PAT) grew by 29.32% YoY to Rs 2,650.66 crore in FY25.

Return on Equity (RoE) has continuously improved, reaching an annualized 86.8% for the six months ended September 30, 2025, demonstrating a sector-leading, highly capital-efficient model.

Strengths include its Market Leadership in Key Segments (Active Mutual Fund and Equity QAAUM), Largest Individual Investor Franchise, a Highly Profitable and Capital Efficient business model (highest operating profit market share and RoE), Diversified Product Portfolio, and Strong Promoter Backing (ICICI Bank and Prudential Corporation).

Risks include Reliance on Market or Economic Conditions (AUM-based fee structure), potential negative impact from Investment Underperformance, the challenges of a Highly Regulated Industry (SEBI regulations, fee structure changes), and Dependence on Promoters' Reputation and the Termination Risk of Key Agreements.

The Rs 10,602.65 crore IPO comprises a complete Offer for Sale (OFS) of 4,89,72,994 shares. All proceeds will go to the selling shareholder, Prudential Corporation Holdings Limited, and the company will not receive any funds from the offering.

The shares are priced in the band of Rs 2,061 to Rs 2,165 per share, with a lot size of 6 shares.

Company Overview of ICICI Prudential Asset Management Company IPO

ICICI Prudential Asset Management Company Limited is a prominent player in the Indian financial sector, operating as a joint venture between ICICI Bank Limited and Prudential Corporation Holdings Limited. The Company has a history of over 30 years in the asset management industry.

Core Business

The Company's primary business involves:

Managing mutual funds.

Providing portfolio management services (PMS).

Managing alternative investment funds (AIFs).

Providing advisory services to offshore clients.

ICICI Prudential AMC’s scale and market share:

Largest AMC in Active Mutual Fund QAAUM: The Company holds a 13.3% market share in Active Mutual Fund Quarterly Average Assets Under Management (QAAUM) as of September 30, 2025.

Second Largest AMC in Total QAAUM: It ranked as the second largest AMC in India with a total QAAUM market share of 13.2% as of September 30, 2025.

Largest in Equity Segment: It is the largest AMC in terms of Equity and Equity Oriented Schemes QAAUM with a 13.6% market share as of September 30, 2025.

Largest Individual Investor Franchise: The Company had the highest Individual Investor Monthly Average AUM (MAAUM) of Rs 6,61,030 crore and a market share of 13.7% as of September 30, 2025.

Assets Under Management (AUM) and Profitability

The Company manages a diverse product portfolio across mutual funds and a growing Alternates business.

Particulars | As of September 30, 2025 (Rs in crore) | As of March 31, 2025 (Rs in crore) | CAGR (FY23–FY25) |

Total Mutual Fund QAAUM | 10,14,760 | 8,79,410 | 32.70% |

Active Mutual Fund QAAUM | 8,63,570 | 7,55,230 | 29.70% |

Equity and Equity-Oriented Schemes QAAUM | 5,66,630 | 4,87,650 | 40.00% |

Alternates QAAUM (PMS, AIF, Advisory): Rs 72,930 crore as of September 30, 2025.

Profitability: ICICI Prudential AMC was the most profitable asset management company in India in terms of operating profit before tax, holding a 20% market share for the FY25.

Digital Adoption: For the six months ended September 30, 2025, 95.3% of its mutual fund purchase transactions were executed across digital platforms.

Promoters and Leadership

The Promoters of the Company are ICICI Bank Limited, holding 51.0% of the pre-offer paid-up Equity Share capital. Prudential Corporation Holdings Limited was holding 49% of the pre-offer paid-up Equity Share capital.

The Board of Directors and Key Managerial Personnel (KMP) include: Sandeep Batra: Chairman and Nominee Director of ICICI Bank Limited, Nimesh Vipinbabu Shah: Managing Director and Chief Executive Officer, Sankaran Naren: Executive Director and Chief Investment Officer, Naveen Kumar Agarwal: Chief Financial Officer and Rakesh Shetty: Chief Compliance Officer and Company Secretary.

Industry Overview of ICICI Prudential Asset Management Company IPO

ICICI Prudential Asset Management Company Limited operates within the rapidly growing Indian Asset Management Industry, with a structural backdrop of accelerating financialisation of savings and strong domestic economic growth. The Company's business environment is deeply rooted in the Indian Mutual Fund market, where organised participation is increasing.

Market Segment | Value as of FY25 | Projected Value (March 2030) | CAGR (FY25–FY30) |

Indian Mutual Fund QAAUM | Rs 67.4 lakh crore | Rs 147 to 155 lakh crore | 16–18% |

Systematic Investment Plans (SIP) AUM | Rs 13.4 lakh crore | Rs 44 lakh crore | 25–27% |

Alternative Investment Fund (AIF) | Rs 13.5 lakh crore | Rs 53 to 56 lakh crore | 31–33% |

Key Market Driving factors that can propel this growth:

Financialization of Household Savings: The rise in disposable income and a gradual shift in household savings patterns towards financial assets drive industry growth. This is evidenced by mutual funds accounting for 12% of household financial assets in Fiscal 2025, up from 8% in Fiscal 2022.

SIP as a Growth Engine: Systematic Investment Plans (SIPs) contribute significantly to AUM stability and growth, driving approximately 60% of total equity and equity-hybrid fund flows in FY25. Monthly systematic inflows reached Rs 4,800 crore in September 2025.

Favourable Demographics: India possesses one of the world's largest young populations, with a median age of 28 years. This large pool of working-age individuals fuels long-term demand for investment products.

Increasing Digital Adoption: Technology has streamlined the investment process; digital channels accounted for 95.3% of the Company's mutual fund purchase transactions in the six months ended September 30, 2025.

Low Market Penetration: Despite the substantial growth, the Indian mutual fund industry has a relatively low reach, with approximately 53.4 million unique investors in FY25, accounting for about 4% of India’s population, indicating immense headroom for future expansion.

Diversification in Alternate Assets: The Alternative Investment Fund (AIF) segment is emerging as a significant growth driver, anticipated to grow at a high rate driven by demand from high-net-worth individuals (HNIs) and institutional investors seeking differentiated strategies.

Financial Overview of ICICI Prudential Asset Management Company IPO

Particulars | Six Months ended September 30, 2025 (Rs Crore) | Financial Year ended March 31, 2025 (Rs Crore) | Financial Year ended March 31, 2024 (Rs Crore) | Financial Year ended March 31, 2023 (Rs Crore) |

Operating Revenue | 2,732.95 | 4,682.78 | 3,375.90 | 2,689.18 |

Operating Revenue Yield | 0.52% | 0.52% | 0.52% | 0.52% |

Operating Profit Before Tax | 1,932.82 | 3,236.16 | 2,312.80 | 1,858.17 |

Profit After Tax (PAT) | 1,617.74 | 2,650.66 | 2,049.73 | 1,515.78 |

Return on Equity (RoE) | 86.8% | 82.80% | 78.90% | 70.00% |

Note: The Operating Revenue Yield and Return on Equity figures for the six months ended September 30, 2025, have been annualised.

Operating Revenue has shown strong, accelerating growth. Operating Revenue increased by 25.53% from Rs 2,689.18 crore in FY23 to Rs 3,375.90 crore in FY24. This growth accelerated significantly to Rs 4,682.78 crore in FY25, representing a 38.70% YoY growth, driven primarily by an increase in Assets Under Management (AUM). Revenue further increased to Rs 2,732.95 crore in the six months ended September 30, 2025, up 24.97% from the comparative period.

Operating Revenue Yield has remained highly consistent. The yield, representing operational revenue as a percentage of Average AUM, has been remarkably stable at 0.52% for FY23, FY24, and FY25. For the six months ended September 30, 2025, the annualized yield remained strong at 0.52%, demonstrating sustained monetization efficiency despite market and AUM fluctuations.

Operating Profit Before Tax reflects exceptional and improving operational efficiency. Operating Profit Before Tax (OPBT) has grown consistently from Rs 1,858.17 crore in FY23 to Rs 2,312.80 crore in FY24, and further to Rs 3,236.16 crore in FY25. This upward trend continued, reaching Rs 1,932.82 crore for the six months ended September 30, 2025. This consistent growth highlights the benefits of scale and the inherently capital-light structure of the asset management business.

Profit After Tax (PAT) has shown robust, accelerating growth. PAT grew from Rs 1,515.78 crore in FY23 to Rs 2,049.73 crore in FY24, a 35.21% YoY growth, and further increased to Rs 2,650.66 crore in FY25, marking a 29.32% YoY growth. PAT for the six months ended September 30, 2025, was Rs 1,617.74 crore, maintaining the strong growth trajectory.

Return on Equity (RoE) demonstrates a sector-leading and continuously enhancing capital-efficient model. RoE has steadily improved from 70.0% in FY23 to 78.9% in FY24, stabilizing at an impressive 82.8% in FY25. For the six months ended September 30, 2025, the annualized RoE further increased to 86.8%, cementing the Company’s position as a high-return, capital-efficient business.

Strengths and Risks of ICICI Prudential Asset Management Company IPO

Let's examine the strengths and weaknesses to determine if the ICICI Prudential Asset Management Company IPO is a good or bad investment for investors.

Strengths

Market Leadership in Key Segments: ICICI Prudential AMC is the largest asset management company in India in terms of active mutual fund QAAUM with a 13.3% market share, and the largest in Equity and Equity Oriented Schemes QAAUM with a 13.6% market share as of September 30, 2025.

Largest Individual Investor Franchise: The Company boasts the highest Individual Investor Monthly Average AUM (MAAUM) in the Indian mutual fund industry at Rs 6,61,030 crore as of September 30, 2025, providing a stable, sticky asset base.

Highly Profitable and Capital Efficient: The Company was the most profitable asset management company in India in terms of operating profit before tax, with a 20% market share for FY25. Its business model is capital efficient, demonstrated by a high Return on Equity of 86.8% (annualised) for the six months ended September 30, 2025.

Diversified Product Portfolio: The Company manages 143 mutual fund schemes, the largest number of schemes in India as of September 30, 2025, across various asset classes (equity, debt, ETFs, index funds, and Alternates), enabling it to cater to diverse investor needs and market conditions.

Strong Promoter Backing and Trusted Brand: The Company benefits significantly from the strength and reputation of its promoters: ICICI Bank Limited, one of India’s largest private sector banks and Prudential Corporation Holdings Limited, a leading life and health insurer in Asia and Africa, fostering high investor confidence.

Risks

Reliance on Market or Economic Conditions: A large portion of revenue is derived from management fees based on AUM. Adverse market fluctuations, economic downturns, or changes in investment sentiment could reduce AUM, leading to a decline in management fees.

Investment Underperformance: If the Company’s investment products like mutual funds, PMS and AIFs underperform their respective benchmarks, it could trigger increased investor redemptions and declining inflows, negatively impacting AUM and profitability.

Highly Regulated Industry: The Company operates in a highly regulated environment controlled by SEBI. Any breach of regulations may lead to penalties, restrictions, or license cancellation. Changes in rules, particularly regarding the Total Expense Ratio (TER) or fee structures, could constrain earnings.

Dependence on Promoters' Reputation: The business relies heavily on the "ICICI" and "Prudential" brands. Any damage to the reputation of either promoter or their group entities could adversely affect customer confidence and the Company's financial health.

Termination Risk of Key Agreements: The continuation of a significant portion of fee income relies on the Investment Management Agreement with the ICICI Prudential Mutual Fund. This agreement, along with other portfolio management or advisory agreements, may generally be terminated by counterparties, making future revenues potentially unpredictable.

Strategies of ICICI Prudential Asset Management Company IPO

Maintain Focus on Investment Performance: The core strategy is to consistently deliver investment outperformance relative to benchmarks through a disciplined and structured investment process, proprietary fundamental research, and a conservative, risk-calibrated approach.

Expand Customer Base and Distribution Network: The Company aims to expand its reach by scaling its direct-to-consumer digital channels, strengthening relationships with existing distributors, including leveraging ICICI Bank's network, and expanding market penetration domestically and internationally (IFSC GIFT City, DIFC).

Grow Alternates Business: The strategy includes a focus on scaling the high-potential Alternates business, like PMS and AIFs, through organic and potential inorganic growth like integrating the identified business from ICICI Venture Funds Management Company Limited by introducing bespoke, outcome-oriented investment solutions.

Diversify Product Portfolio: The Company is committed to continuous expansion and diversification of its mutual fund products, such as launching new thematic or sectoral funds like the ‘ICICI Prudential Conglomerate Fund’, and intends to introduce specialized investment fund offerings for the affluent segment.

Leverage Technology and Digital Capabilities: The strategy involves continuous investment in cloud-based technology, digital platforms like i-Invest, and data analytics to optimize customer acquisition, enhance the investor/distributor experience, and drive overall operational efficiency.

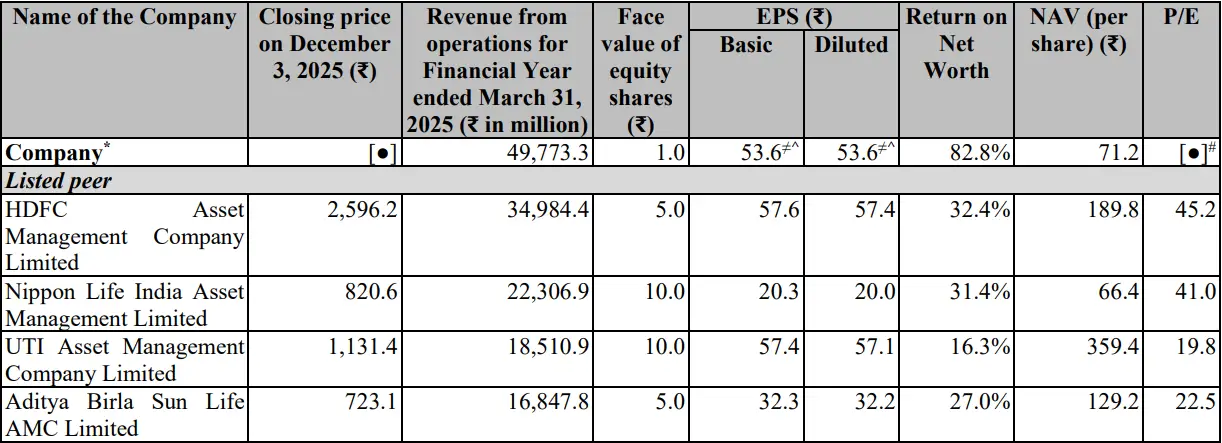

ICICI Prudential Asset Management Company IPO vs. Peers

In terms of core operating profitability, the Company's Operating Margin for FY25 stood at 0.36%. This margin ties with HDFC Asset Management Company Limited's margin of 0.36%, indicating competitive operational efficiency among the largest peers. This margin is higher than those reported by other key listed peers, including Nippon Life India Asset Management Limited (0.25%), Aditya Birla Sun Life AMC (0.25%) and UTI Asset Management Company Limited (0.18%).

The Company exhibits a markedly superior performance in capital efficiency, reflected by a Return on Equity (RoE) of 82.8% in FY25. This vastly surpasses the RoE of its peer group, which ranges from a low of 17.5% (UTI AMC) to a high of 32.4% (HDFC AMC). This outstanding RoE highlights the highly profitable and capital-efficient nature of ICICI Prudential AMC’s business model.

Objectives of ICICI Prudential Asset Management Company IPO

The IPO comprises a complete offer for sale of 4,89,72,994 shares, amounting to Rs 10,602.65 crore. All proceeds from this OFS will go to the selling shareholder, Prudential Corporation Holdings Limited. Since the issue includes no fresh shares, the company itself will not receive any funds from the offering.

ICICI Prudential AMC IPO Details

IPO Dates

The ICICI Prudential AMC IPO date window for subscription opens on December 12, 2025, and closes on December 16, 2025. The allotment of shares to investors will take place on December 17, 2025, and the company is expected to be listed on the NSE and BSE on December 19, 2025.

IPO Issue Price

The ICICI Prudential AMC IPO share price is set in the price band of Rs 2,061 to Rs 2,165 per share. This means you would require an investment of Rs. 12,990 per lot (6 shares) if you are bidding for the IPO at the upper price band.

IPO Size

ICICI Prudential Asset Management Company is issuing a total offer for sale of 4,89,72,994 shares valued at Rs 10,602.65 crores, which will be received by the selling shareholder in this IPO.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on December 17, 2025, through the registrar's website, Kfin Technologies Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of ICICI Prudential Asset Management Company are expected to be listed on the NSE and BSE on December 19, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for ICICI Prudential Asset Management Company IPO

Important IPO Details | |

Bidding Date | December 12, 2025 to December 16, 2025 |

Allotment Date | December 17, 2025 |

Listing Date | December 19, 2025 |

Issue Price | Rs 2,061 to Rs 2,165 per share |

Lot Size | 6 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category