Is Gujarat Kidney & Super Speciality IPO Good or Bad – Detailed Review

00:00 / 00:00

Gujarat Kidney & Super Speciality Limited’s IPO is set to open its initial public offering from December 22, 2025, to December 24, 2025. When considering applying for this IPO, potential investors might have questions about whether the Gujarat Kidney & Super Speciality IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Gujarat Kidney & Super Speciality IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Gujarat Kidney & Super Speciality IPO Review

Gujarat Kidney & Super Speciality Limited's IPO is open for subscription from December 22, 2025, to December 24, 2025, with listing expected on December 30, 2025, on NSE and BSE.

The company operates as a regional healthcare provider headquartered in Vadodara, specializing in multi-speciality and super-speciality medical services. Its core business involves operating a chain of hospitals with a focus on secondary and tertiary care, offering specialized treatments in renal sciences (nephrology and urology), and managing in-hospital pharmacies. The company currently operates across seven hospitals and four pharmacies, primarily serving the central region of Gujarat.

A key revenue driver is its specialized focus on renal sciences and its asset-light strategy, which involves operating through leased facilities and strategic acquisitions to achieve high capital efficiency. As of June 30, 2025, the company reported an average bed occupancy rate of 54.77%, with 80.64% of revenue coming from self-paying patients. The Promoters are Dr. Pragnesh Yashwantsinh Bharpoda, Dr. Bhartiben Pragnesh Bharpoda, Dr. Yashwantsingh Motisinh Bharpoda, and Anitaben Yashwantsinh Bharpoda.

The company operates within the growing Indian hospital industry, which is projected to reach Rs 8.2 lakh crore by FY26 at a CAGR of 12.32%. Growth is driven by an ageing population, a rise in non-communicable diseases (contributing to 66% of mortality), and a significant demand-supply gap in hospital bed density. Government initiatives like Ayushman Bharat and the expansion of medical tourism (projected to reach USD 13 billion by 2026) further support this market.

Gujarat Kidney & Super Speciality's financial performance shows rapid turnaround growth and sector-leading margins.

Operating Revenue surged from near-zero in FY23 to Rs 40.24 crore in FY25, reaching Rs 15.26 crore in Q1 FY26.

The company achieved an EBITDA margin of 41.12% in FY25, significantly higher than peers like Yatharth Hospital (25.01%) and GPT Healthcare (22.56%).

Profit After Tax (PAT) grew to Rs 9.5 crore in FY25, with a PAT margin of 35.41% in Q1 FY26.

Return on Equity (RoE) stood at 36.61% for FY25, highlighting a highly capital-efficient model compared to the peer average.

Strengths include its Pre-eminence in Renal Sciences, an Asset-Light Business Model, a Proven Inorganic Growth through Roll-Up Strategy, Regional Dominance in underserved Tier-2 and Tier-3 markets, and Experienced Doctor-Promoter Leadership.

Risks include a Limited Revenue Track Record (significant operations only since 2024), Geographic Concentration Risk in Gujarat, Execution Risk of Greenfield Expansion (new women's hospital), Dependence on Skilled Medical Talent, and Potential Integration Challenges with newly acquired hospitals.

The Rs 250.80 crore IPO comprises a complete Fresh Issue of 2,20,00,000 shares and there are no offer for sale (OFS). Proceeds will be used to fund the acquisition of Parekhs Hospital (Rs 77 crore), settle payments for Ashwini Medical Centre (Rs 12.40 crore), increase shareholding in Harmony Medicare (Rs 10.78 crore), fund capital expenditure for a new hospital in Vadodara (Rs 30.10 crore), purchase robotic equipment (Rs 6.83 crore), and for general corporate purposes and further acquisitions (Rs 112.49 crore).

The shares are priced in the band of Rs 108 to Rs 114 per share, with a lot size of 128 shares.

Company Overview of Gujarat Kidney & Super Speciality IPO

Gujarat Kidney and Super Speciality Limited is a regional healthcare provider headquartered in Vadodara, Gujarat, specializing in multi-speciality and super-speciality medical services. Incorporated in 2019, the Company has focused its operations on secondary and tertiary care in the central region of Gujarat.

Core Business & Market Position

The Company's primary business involves:

Operating a chain of multi-speciality hospitals.

Providing integrated healthcare services with a focus on secondary and tertiary care.

Offering specialized treatments in renal sciences such as nephrology and urology.

Managing in-hospital pharmacies to support patient care.

The table illustrates the service-wise revenue segment of Gujarat Kidney and Super Speciality Limited on a restated consolidated basis.

Particulars | Three Months ended June 30, 2025 (Rs Crore) | Financial Year ended March 31, 2025 (Rs Crore) | Financial Year ended March 31, 2024 (Rs Crore) | Financial Year ended March 31, 2023 (Rs Crore) |

Inpatient (IPD) Revenue | 12.38 | 33.01 | 4.01 | 0.00 |

Outpatient (OPD) Revenue | 1.14 | 2.79 | 0.32 | 0.00 |

Pharmacy Sales | 1.08 | 3.46 | 0.43 | 0.00 |

Other Services | 0.67 | 0.98 | 0.01 | 0.00 |

Total Revenue from Operations | 15.26 | 40.24 | 4.77 | 0.00 |

Bed Occupancy: The average bed occupancy rate stood at 54.77% for the three-month period ended June 30, 2025.

Patient Mix: For the period ended June 30, 2025, self-payers and others accounted for 80.64% of the revenue from the Vadodara and Godhra hospitals.

Promoters and Leadership: The Promoters of the Company are Dr. Pragnesh Yashwantsinh Bharpoda, Dr. Bhartiben Pragnesh Bharpoda, Dr. Yashwantsingh Motisinh Bharpoda, and Anitaben Yashwantsinh Bharpoda.

Industry Overview of Gujarat Kidney & Super Speciality IPO

Gujarat Kidney and Super Speciality Limited operates within the regional healthcare market of Gujarat, with a structural backdrop of accelerating healthcare infrastructure, rising medical demand, and niche specialisation in renal sciences. The Company's business environment is deeply rooted in the demand for integrated secondary and tertiary care, which are critical for addressing the rising incidence of non-communicable diseases and lifestyle-related illnesses in urban and semi-urban populations.

Market Segment | Value as of FY24 | FY26 (Projected) | CAGR |

Indian Hospital Industry | Rs 6.50 lakh crore | Rs 8.2 lakh crore | 12.32% |

Key Market Driving Factors

Infrastructure and Public Spending Growth: India has witnessed a notable increase in public spending on healthcare, with government health expenditure reaching approximately 1.9% of GDP in FY24, up from 1.28% in FY19. The government plans to raise this to 2.5% by 2025 under the National Health Policy.

Demand-Supply Gap in Bed Density: India currently faces a significant shortage of hospital beds relative to its population. To meet national standards, the country aims to achieve a target of 3 beds per 1,000 people, necessitating the addition of millions of new beds by 2025.

Demographic Shifts and Disease Profile: An ageing population and a rise in lifestyle-related non-communicable diseases (NCDs) are increasing the demand for specialized tertiary care. NCDs such as cardiovascular diseases, cancers, and diabetes currently contribute to approximately 66% of total mortality in India as of 2019.

Government Policy Support: Initiatives such as the Ayushman Bharat scheme (PM-JAY) have significantly expanded healthcare access to underserved segments, with millions of authorized hospital admissions recorded since inception.

Medical Tourism Expansion: India has emerged as a major global hub for medical tourism, attracting nearly 6.34 lakh medical tourists in 2023 due to high-quality care and globally competitive pricing. The medical value travel market is projected to reach USD 13 billion by 2026.

Financial Overview of Gujarat Kidney & Super Speciality IPO

Particulars | Three Months ended June 30, 2025 | Financial Year ended March 31, 2025 | Financial Year ended March 31, 2024 | Financial Year ended March 31, 2023 |

Revenue from Operations | 15.26 | 40.24 | 4.77 | 0 |

EBITDA | 8.63 | 16.55 | 1.95 | -0.01 |

EBITDA Margin | 56.52% | 41.12% | 40.86% | N/A |

Profit after Tax | 5.4 | 9.5 | 1.71 | -0.01 |

PAT Margin | 35.41% | 23.61% | 35.90% | N/A |

Return on Equity (RoE) | 15.85% | 36.61% | 15.86% | -1.67% |

Return on Capital Employed (RoCE) | 18.91% | 37.65% | 9.79% | -1.70% |

Note: The Return on Equity and Return on Capital Employed figures for the three months ended June 30, 2025, have not been annualised. The provided data is derived from the Restated Consolidated Financial Information, which represents the actual historical performance of the company and its subsidiaries. It does not include the adjustments found in the Unaudited Proforma Condensed Combined Financial Information, which illustrates the theoretical impact of recently completed or potential acquisitions like Ashwini Medical Centre and Parekhs Hospital.

Revenue from operations surged from nil in FY23 to Rs 40.24 crore in FY25 as the company transitioned to full-year operations. This momentum continued into Q1FY26, reaching Rs 15.26 crore.

Operational scale drove a turnaround from a loss in FY23 to an EBITDA of Rs 16.55 crore in FY25. For the three-month period ended June 30, 2025, EBITDA stood at Rs 8.63 crore. Profitability stabilized with an EBITDA margin of 41.12% in FY25. This expanded significantly to 56.52% in Q1FY26, driven by a high-value clinical case mix.

PAT experienced robust growth, rising from a loss in FY23 to Rs 9.5 crore in FY25. The company maintained this trend with a profit of Rs 5.4 crore for the quarter ended June 30, 2025. Bottom-line efficiency remained strong at 23.61% in FY25. The margin improved to 35.41% in Q1 FY26, reflecting effective management of the multispeciality network.

Utilizing an asset-light strategy, the company achieved a stabilized RoE of 36.61% in FY25. For the three months ended June 30, 2025, RoE was 15.85%. RoCE grew to 37.65% in FY25, highlighting superior earnings generation from invested capital and improved asset utilization across its seven hospitals. RoCE for Q1FY26 was 18.91%.

Strengths and Risks of Gujarat Kidney & Super Speciality IPO

Let's examine the strengths and weaknesses to determine if the Gujarat Kidney & Super Speciality IPO is a good or bad investment for investors.

Strengths

Pre-eminence in Renal Sciences: The company has established a strong specialized presence in renal sciences, offering sub-specialties in urology, nephrology, and renal transplants, which creates a repeat and sticky patient base.

Asset-Light Business Model: Gujarat Kidney operates through leased facilities and strategic acquisitions, allowing for rapid scale-up and higher capital efficiency without the heavy burden of land ownership.

Proven Inorganic Growth through Roll-Up Strategy: The company has a successful track record of acquiring existing hospitals and integrating their infrastructure and patient flows, which significantly reduces execution time compared to building from scratch.

Regional Dominance in Underserved Markets: By focusing on Tier-2 and Tier-3 cities in central Gujarat, the company operates in areas with stable, growing healthcare demand and less competition than major metro cities.

Experienced Doctor-Promoter Leadership: Led by Dr. Pragnesh Yashwantsinh Bharpoda, the management team consists of medical professionals with deep clinical expertise, ensuring a high standard of specialized care.

Risks

Limited Revenue Track Record: The company has a very short history of significant revenue operations, with FY23 income being near zero before a rapid jump following business transfers in early 2024.

Geographic Concentration Risk: Operations are exclusively concentrated in Gujarat; any regional disruption, such as changes in local healthcare policies or natural disasters, could materially impact growth and earnings.

Execution Risk of Greenfield Expansion: A portion of the IPO proceeds is earmarked for building a new women’s hospital in Vadodara, and any delays in approvals or cost escalations could affect financial performance.

Dependence on Skilled Talent: The business relies heavily on the ability to attract and retain specialized doctors and nursing staff, higher attrition or increased talent competition could degrade the quality of care.

Acquisition Integration Challenges: While buying hospitals facilitates growth, the long-term success of the company depends on efficiently aligning cultures and retaining key medical professionals from acquired entities.

Strategies of Gujarat Kidney & Super Speciality IPO

Execute Strategic Acquisitions: The company aims to aggressively expand its hospital network by acquiring operational facilities, such as the proposed purchase of Parekhs Hospital in Ahmedabad, to add immediate scale and footprint.

Enhance Capacity through Greenfield Expansion: A core part of the strategy involves setting up new specialized facilities, specifically the planned construction of a 50-bed women's healthcare hospital in Vadodara to diversify service offerings.

Deepen Technology and Robotics Integration: The company plans to enhance its clinical capabilities by investing in advanced robotic surgical equipment for its Vadodara hospital, aiming to reduce patient recovery times and improve surgical precision.

Drive Operational Efficiency and Cost Management: By centralizing procurement across its 7 hospitals and 4 pharmacies, the company aims to leverage economies of scale to reduce costs for medical consumables and pharmaceutical supplies.

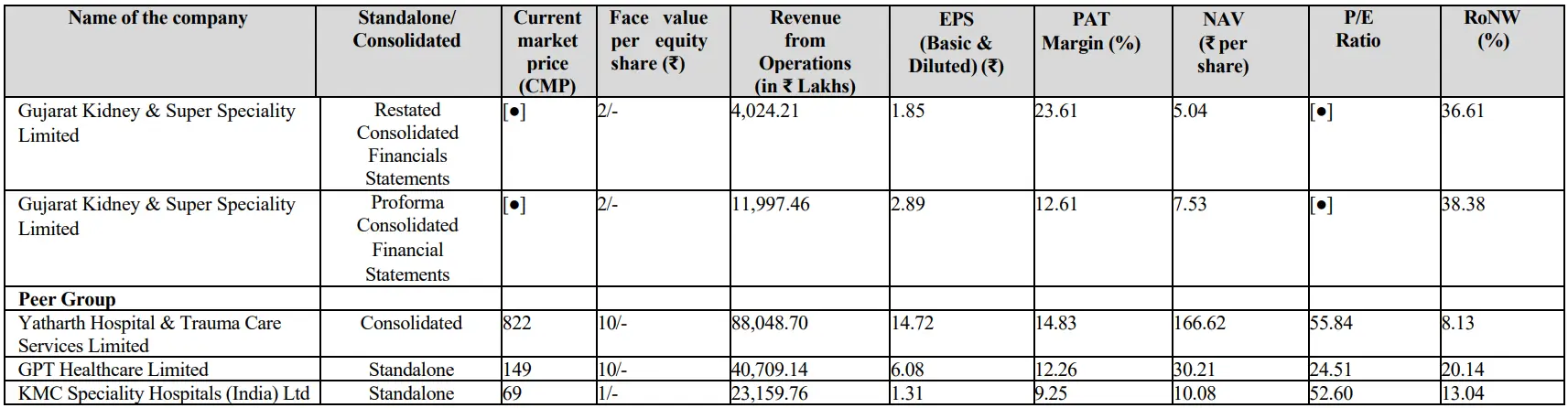

Gujarat Kidney & Super Speciality IPO vs. Peers

In terms of core operating profitability, the Company's EBITDA Margin for FY25 stood at 41.12%. The EBITDA margin is significantly higher than that reported by its key listed peers, including Yatharth Hospital (25.01%), GPT Healthcare (22.56%), and KMC Speciality Hospitals (9.25%). This higher margin profile suggests a competitive edge in operational efficiency and specialized high-value medical services.

The Company exhibits a markedly superior performance in capital efficiency, reflected by a Return on Equity (RoE) of 36.61% in FY25. This vastly surpasses the ROE of its peer group for the same period, which ranges from a low of 7.97% (Yatharth Hospital) to a high of 21.41% (GPT Healthcare). This outstanding RoE highlights the highly profitable and capital-efficient nature of Gujarat Kidney & Super Speciality’s business model in the regional healthcare market.

Objectives of Gujarat Kidney & Super Speciality IPO

The IPO comprises a complete fresh issue of 2,20,00,000 shares, amounting to Rs 250.80 crore. The proceeds will be used for the following purposes:

Proposed acquisition of Parekhs Hospital at Ahmedabad (Rs 77 crore)

Part-payment of purchase consideration for the acquired Ashwini Medical Centre (Rs 12.40 crore)

Acquisition of additional shareholding of the company’s subsidiary, Harmony Medicare Private Limited situated in Bharuch (Rs 10.78 crore)

Funding Capital Expenditure towards setting up a new hospital in Vadodara (Rs 30.10 crore)

Buying robotics equipment for Gujarat Kidney & Super Speciality hospital in Vadodara (Rs 6.83 crore)

Full or part repayment of certain outstanding secured borrowings availed by the Company (Rs 1.2 crore)

Funding inorganic growth through unidentified acquisitions and General Corporate Purposes (Rs 112.49 crore)

Gujarat Kidney & Super Speciality IPO Details

IPO Dates

The Gujarat Kidney & Super Speciality IPO date window for subscription opens on December 22, 2025, and closes on December 24, 2025. The allotment of shares to investors will take place on December 26, 2025, and the company is expected to be listed on the NSE and BSE on December 30, 2025.

IPO Issue Price

The Gujarat Kidney & Super Speciality IPO share price is set in the price band of Rs 108 to Rs 114 per share. This means you would require an investment of Rs. 14,592 per lot (128 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Gujarat Kidney & Super Speciality is issuing a total fresh issue of 2,20,00,000 shares valued at Rs 250.80 crores, which will be used for the objectives related to the acquisition, capital expenditure and other business activity purposes.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on December 26, 2025, through the registrar's website, MUFG Intime India Private Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Gujarat Kidney & Super Speciality are expected to be listed on the NSE and BSE on December 30, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Gujarat Kidney & Super Speciality IPO

Important IPO Details | |

Bidding Date | December 22, 2025 to December 24, 2025 |

Allotment Date | December 26, 2025 |

Listing Date | December 30, 2025 |

Issue Price | Rs 108 to Rs 114 per share |

Lot Size | 128 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category