Is Fujiyama Power Systems IPO Good or Bad – Detailed Review

00:00 / 00:00

Fujiyama Power Systems Ltd. is launching its initial public offering (IPO), which will be open from November 13 to November 17, 2025. The total issue size is Rs.828 crore, consisting of a fresh issue of Rs.600 crore and an offer for sale of Rs.228 crore. The question now is: is the Fujiyama Power Systems initial public offering (IPO) a good or bad investment? This article will provide information on the company's business, financials, and growth analysis to help you decide whether investing is worthwhile.

Fujiyama Power Systems IPO Review

Fujiyama Power Systems Ltd.'s initial public offering (IPO) is valued at Rs.828 crore, consisting of a fresh issue of Rs.600 crore and an offer for sale (OFS) of Rs.228 crore. This book-building issue will be open for subscription from November 13 to November 17, 2025. The company has fixed a price band of Rs.216 to Rs.228 per share, with one lot consisting of 65 shares. The IPO primarily aims to raise funds to set up a new manufacturing facility in Ratlam, Madhya Pradesh, repay certain borrowings, and for general corporate purposes. Fujiyama Power Systems Ltd. manufactures a wide range of products in the solar industry, including on-grid, off-grid, and hybrid systems. It has four state-of-the-art manufacturing plants located in Uttar Pradesh, Haryana, and Himachal Pradesh. The company has over 725 distributors, 5,500+ dealers, and an exclusive "Shoppe" franchise network of 1,100. Financially, the company reported revenue growth of 67% and PAT growth of 245% in FY2025. Its ROE is 39.40% and ROCE is 41.01%. Given the company's strong distribution network, experienced management, and growing profits, this IPO could be an attractive opportunity for investors, although it's important to pay attention to competition and policy risks.

Company Overview of Fujiyama Power Systems Ltd.

Fujiyama Power Systems Ltd. was founded in 2017. It is a leading manufacturer in the rooftop solar industry, providing a variety of energy solutions, including on-grid, off-grid, and hybrid solar systems. The company's business model is focused on meeting the growing demand for renewable energy and sustainable power solutions. Fujiyama Power Systems has a comprehensive product portfolio of over 522 SKUs, including solar inverters, panels, batteries, UPS systems, charge controllers, and solar management units. The company has four state-of-the-art manufacturing facilities located in Greater Noida (Uttar Pradesh), Parwanoo (Himachal Pradesh), Bawal (Haryana), and Dadri (Uttar Pradesh). These plants hold international certifications such as ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018, demonstrating its commitment to quality, environmental, and safety standards. The company's distribution network consists of over 725 distributors, 5,546 dealers, and 1,100 exclusive "Shoppe" franchisees, who provide customers with customized solar solutions. Additionally, the company has a team of over 600 trained service engineers who provide after-sales service and technical support to customers. Fujiyama Power Systems also exports its products to countries such as the United States, Bangladesh, and the United Arab Emirates, further strengthening its international presence and brand credibility.

Industry Overview of Fujiyama Power Systems Ltd.

The market for solar energy and renewable energy products in India is expected to grow rapidly in the coming years. A growing population, rapid urbanization, rising incomes, and increasing consumer interest in clean energy are strengthening this sector. India's solar power capacity grew at a compound annual growth rate (CAGR) of 7.5% between fiscal years 2020 and 2025, from 35 gigawatts to 62 gigawatts. The country has now become the fifth largest solar power producer in the world. The Indian rooftop solar market size has grown from 8.1 gigawatts in 2020 to approximately 18 gigawatts in 2025 and is expected to reach 30 gigawatts by 2030, with an estimated growth rate of approximately 12%. Demand in the solar inverter and battery segments is also growing at a rate of 10-15% annually.

The Indian government's promotion of electric vehicles, solar panel installation, and the Green Energy Mission is opening up new opportunities for domestic manufacturing companies. Key demand in the solar industry is coming from various segments: domestic use: where people are installing rooftop solar systems to meet their electricity needs; industrial and commercial sectors: where solar power is becoming a key tool for reducing costs and maintaining sustainable operations; export markets: global demand for solar inverters, batteries, and solar management systems is steadily increasing. Government programs like the "National Solar Mission" and "Energy Security Policy" have further increased investment potential in this sector. Overall, India's solar power sector will expand rapidly in the coming years, and companies like Fujiyama Power Systems are poised to lead this growing market.

Financial Overview of Fujiyama Power Systems Ltd.

Fujiyama Power Systems Ltd. reported strong financial performance in FY2025, reflecting continued improvements in the company's operational efficiency and profitability. The company's performance is a result of its diversified product portfolio, improved cost control, and high production efficiency.

Fujiyama Power Systems' total revenue in FY2025 was Rs.1,550.09 crore, representing an increase of approximately 67% compared to Rs.927.20 crore in the previous year. Its net profit (PAT) was Rs.156.34 crore, representing a significant increase of 245% from Rs.45.30 crore in the previous year. The company's EBITDA was Rs.248.52 crore, and its EBITDA margin was 16.13%, indicating improved cost management and operational efficiency.

In terms of financial ratios, the company's ROE (Return on Equity) was 39.40%, ROCE (Return on Capital Employed) was 41.01%, and PAT margin was 10.15%, reflecting its high profitability and capital efficiency. The company's total assets are Rs. 1,013.96 crore and net worth is Rs. 396.82 crore.

Fujiyama Power Systems' financial stability demonstrates its strong position in the rapidly growing solar and renewable energy market. Its strong balance sheet, robust cash flow, and low debt ratio (Debt/Equity 0.87) make it an attractive option for investors. This financial performance reflects the success of its strategy based on its expanding distribution network and high-quality products.

Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 1,243.88 | 1,013.96 | 609.64 | 514.56 |

Total Income | 597.79 | 1,550.09 | 927.20 | 665.33 |

Profit After Tax | 67.59 | 156.34 | 45.30 | 24.37 |

EBITDA | 105.89 | 248.52 | 98.64 | 51.60 |

NET Worth | 464.34 | 396.82 | 239.54 | 193.08 |

Reserves and Surplus | 436.33 | 368.81 | 215.00 | 70.55 |

Total Borrowing | 432.83 | 346.22 | 200.19 | 211.14 |

Strengths of Fujiyama Power Systems Ltd.

Modern and High-Quality Manufacturing Infrastructure :

Fujiyama Power Systems Ltd. boasts state-of-the-art and quality-focused manufacturing facilities, which play a key role in enhancing production capacity and efficiency. The company's four plants in Greater Noida (Uttar Pradesh), Parwanoo (Himachal Pradesh), Bawal (Haryana), and Dadri (Uttar Pradesh) are equipped with modern technology and are ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018 certified.

Strong Distribution Network and Wide Reach :

The company's distribution network spans across India, comprising over 725 distributors, 5,546 dealers, and over 1,100 exclusive "Shoppe" franchises. This extensive network enables Fujiyama to deliver its product range to customers across the country.

Excellent After-Sales Support System :

Fujiyama Power Systems provides its customers with high-level after-sales support and technical assistance through over 602 trained service engineers. This helps increase customer satisfaction and brand loyalty.

Leader in Innovation and Technological Advancement :

The company's research and development (R&D) department continuously works on product improvements and new technologies. Innovations in solar inverters, hybrid systems, and batteries keep Fujiyama ahead of competitors.

Diverse and Advanced Product Portfolio :

Fujiyama has a product portfolio of over 522 SKUs, including solar PCUs, on-grid, off-grid, and hybrid inverters, solar panels, lithium-ion batteries, and UPS systems. This diversity gives the company the ability to meet various market needs.

Experienced Leadership and Dedicated Team :

The company's promoters Pawan Kumar Garg, Yogesh Dua, and Sunil Kumar have years of experience in the solar energy industry. An experienced management team and dedicated workforce are the backbone of Fujiyama's success, ensuring long-term growth and sustainability.

Risks of Fujiyama Power Systems Ltd.

Dependence on Government Policies and Subsidies :

Fujiyama Power Systems' business is primarily engaged in the solar energy industry, which is heavily dependent on government schemes, subsidies, and renewable energy policies. Any changes to government solar subsidies or incentive schemes could impact the company's revenue and growth rate.

Intense Competition in the Renewable Energy Industry :

Many domestic and international companies are engaged in the solar and renewable energy sector in India. This increasing competition requires Fujiyama Power Systems to continuously improve the pricing, quality, and technological innovation of its products to maintain its market position.

High Working Capital Requirement :

The company requires a high working capital requirement due to its large distribution network and inventory management. Any delays or imbalances could impact the company's cash flow.

Raw Material Price Fluctuations :

Prices of key raw materials used in the company's products, such as lithium, copper, and other metals, fluctuate based on international markets. This could pressure the company's margins if costs increase.

Debt Levels and Interest Exposure :

The company's total borrowings stood at Rs.432.83 crore as of FY2025. Although the company plans to use a portion of the IPO proceeds to partially repay borrowings, debt management may remain a challenge in a rising interest rate environment.

Strategies of Fujiyama Power Systems Ltd.

Expansion of a New Manufacturing Unit in Ratlam, Madhya Pradesh :

The company plans to establish a new manufacturing facility in Ratlam, Madhya Pradesh, to further strengthen its production network. Approximately Rs.180 crore of the IPO proceeds will be used for this project. This expansion will help increase both the company's production capacity and distribution efficiency.

Strengthening Brand Presence Across India :

Fujiyama Power Systems is further strengthening its brand presence across India through its 1,100-plus "Shoppe" franchise network. The aim is to reach more customers and ensure easy availability of solar solutions in every region.

Focus on Product Diversification and Technological Innovation :

The company is focusing on further expanding its extensive product portfolio of 522+ SKUs. Fujiyama aims to maintain its leadership in innovation in the Indian solar industry through technological improvements in solar inverters, batteries, hybrid systems, and energy management units.

Export Expansion to International Markets :

Fujiyama Power Systems already exports its products to countries such as the United States, Bangladesh, and the UAE. The company is now working to expand its presence in other markets in Asia and Europe.

Special Emphasis on Research and Development (R&D) :

The company is further strengthening its R&D department to develop energy-efficient, sustainable, and environmentally friendly solar products. The aim is to improve product quality and achieve cost efficiencies through new technologies.

Fujiyama Power Systems IPO Peer Comparison

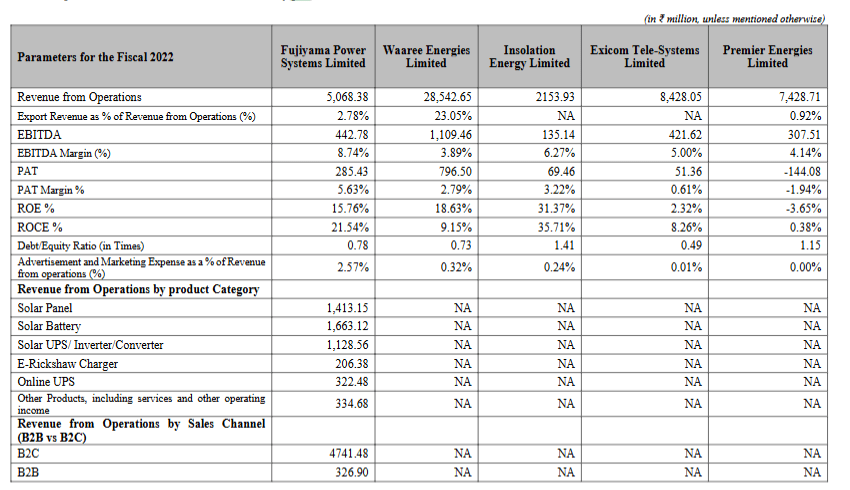

For FY22, Fujiyama Power Systems Ltd. demonstrated strong financial performance compared to its competitors. The company's Revenue from Operations was Rs.5,068.38 million, placing it in a significant position among leading solar energy companies such as Waaree Energies Ltd., Insolation Energy Ltd., Exicom Tele-Systems Ltd., and Premier Energies Ltd.

The company's EBITDA was Rs.442.78 million, with an EBITDA margin of 8.74%, reflecting cost management and operational efficiency. During the same period, the company's net profit (PAT) was Rs.285.43 million, and the PAT margin was 5.63%, outperforming many peers.

Fujiyama Power Systems' ROE was 15.76% and ROCE was 21.54%, indicating excellent return on capital. Meanwhile, the Debt-to-Equity Ratio stood at 0.78, indicating financial stability. The company's Advertising & Marketing expenses were 2.57% of total revenue, indicating that the company is continuously focusing on brand expansion.

By product category, Fujiyama's largest contributions came from Solar Batteries (Rs. 1,663.12 million) and Solar Panels (Rs. 1,413.15 million). Additionally, the company manufactures products such as Solar UPS/Inverter Converters and E-Rickshaw Chargers, which generated revenues of Rs. 126.53 million and Rs. 206.38 million, respectively.

The company's primary sales channel was B2C (Rs. 4,741.48 million), while B2B generated revenues of Rs. 326.90 million. This indicates that Fujiyama's business is primarily retail-driven.

Overall, Fujiyama Power Systems Ltd. is proving to be an emerging major player in the solar power industry due to its strong profitability, better capital efficiency and wider product portfolio compared to its competitors.

Objectives of Fujiyama Power Systems Ltd. IPO

Financing for Establishing a New Manufacturing Facility in Ratlam, Madhya Pradesh :

The company will use approximately Rs.180 crore of the proceeds from its IPO to establish a new manufacturing unit in Ratlam district, Madhya Pradesh. The facility is being built to produce solar panels, solar inverters, and lithium-ion batteries, with a combined annual production capacity of 2,000 MW in each segment. The plant will meet the growing demand for solar energy in Western and Southern India, as well as strengthen the company's export potential. The Ratlam project is expected to provide the company with cost control, production flexibility, and higher profitability.

The total estimated cost of this project is Rs.2,666.10 million, of which Rs.2,500.00 million will be funded by the IPO proceeds, and the remaining amount will be obtained as a loan from Axis Bank. The loan will have a tenure of 96 months, including a 12-month moratorium period, and the interest rate is fixed at the Repo Rate + 2.5% per annum.

The project will cover construction, civil works, machinery procurement, IT infrastructure, utility systems, freight, consultancy, and other expenses. According to the project, commercial production is expected to commence by March 2026.

Repayment/Prepayment of Borrowings :

The company will use a significant portion of the proceeds from the IPO approximately Rs. 275 crore to partially or fully repay its outstanding debt. This move is aimed at improving the company's debt-to-equity ratio, reducing interest costs, and strengthening its balance sheet.

The company's total outstanding debt by the end of FY 2024 will be Rs. 3,011.70 million. Of this amount, approximately 99.61% of outstanding borrowings will be settled through the capital raised from the IPO.

General Corporate Purposes :

The remaining proceeds from the IPO will be used to meet working capital requirements, new business initiatives, and general corporate expenses. This will include investments in operational expansion, research and development (R&D), marketing initiatives, and technological improvements.

Flexibility in Fund Utilization :

The Company has clarified that fund allocation may be revised as needed based on market conditions, costs, government approvals, or strategic changes. This decision will be made at the discretion of the Company's management, in accordance with applicable laws.

Fujiyama Power Systems IPO Details

Fujiyama Power Systems IPO Date :

The Fujiyama Power Systems Ltd. IPO will be open to investors from November 13, 2025, to November 17, 2025. Allotment of the company's shares will take place on November 18, 2025, and its shares will be listed on the BSE and NSE on November 20, 2025.

Fujyama Power Systems IPO Price Band :

The company has priced its shares at Rs. 216 to Rs. 228 per share. If you bid at the upper price band, an investment of Rs. 14,820 will be required for one lot (65 shares).

Fujyama Power Systems IPO Size :

Fujiyama Power Systems Ltd. is raising a total of Rs. 828 crore through this issue. Of this, Rs. 600 crore will be in the form of a fresh issue and Rs. A portion of Rs.228 crore is being issued as an Offer for Sale (OFS). The total number of shares will be approximately 36.3 million (36,315,789).

Fujiyama Power Systems IPO Allotment Status :

Investors who applied for this IPO can check their IPO Allotment Status on November 18, 2025. This information can be found on the BSE, NSE, the registrar's website, or your stockbroker platform.

Fujiyama Power Systems IPO Listing Date :

The company's shares will be listed on the BSE and NSE on November 20, 2025 (Thursday).

IPO Application Link :

If you want to invest in this IPO, open your demat account with Rupeezy and enjoy a simple, secure, and fast IPO application experience. Rupeezy's platform helps make the investment process seamless and hassle-free.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category