Is Excelsoft Technologies IPO Good or Bad – Detailed Review

00:00 / 00:00

Excelsoft Technologies Limited’s IPO is set to open its initial public offering from November 19, 2025, to November 21, 2025. When considering applying for this IPO, potential investors might have questions about whether the Excelsoft Technologies IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Excelsoft Technologies IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Excelsoft Technologies IPO Review

Excelsoft Technologies Limited's IPO is open for subscription from November 19, 2025, to November 21, 2025, with listing expected on November 24, 2025, on NSE and BSE.

The company is a software product company offering Artificial Intelligence (AI)-based cloud-native Software-as-a-Service (SaaS) products and solutions to large enterprise customers globally. It specialises in providing solutions for the learning and assessment market worldwide, focusing on technology innovation for secure, scalable digital solutions for high-stakes examinations, certification, and learning management.

The platform has a significant global presence, catering to 101 clients across 19 countries as of August 31, 2025. Its core operational strength is maintaining long-term relationships, with the average client vintage for the top 10 customers standing at 10.50 years as of June 30, 2025. The promoters hold an aggregate of 94.14% of the pre-offer paid-up equity share capital.

The company operates within the competitive global Learning and Assessment (L&A) market. The Global Assessment and Proctoring Market, representing Excelsoft's core domain, was valued at USD 10.83 billion in 2024 and is projected to grow at a global CAGR of 11.90% to reach USD 21.26 billion by 2030.

Excelsoft Technologies’ financial performance from FY23 to FY25 reflects robust top-line growth coupled with strong operational efficiency recovery. Revenue from operations grew strongly from Rs 195.10 crores in FY23 to Rs 233.29 crores in FY25.

Profit After Tax (PAT) achieved a strong recovery and record profit of Rs 34.69 crores in Fiscal 2025, recovering from a PAT of Rs 12.75 crores in FY24. Operating efficiency showed strong recovery, with the EBITDA margin improving significantly from 27.72% in FY24 to a positive 31.40% in FY25. The Return on Capital Employed (RoCE) recovered from 7.59% in FY24 to 16.11% in FY25.

Strengths include expertise in vertical SaaS across the entire learning and assessment lifecycle, long-term, stable global customer relationships (10.50 years average vintage), AI-Driven Product Innovation, and strategic focus.

Risks include high revenue concentration on a single key client (Pearson Education Group accounted for 59.24% of consolidated revenue for Q1FY26), Geographic Concentration in the USA market (60.61% of Q1 FY26 revenue), and historical negative cash flows from operating activities (Rs 4.758 crore for Q1 FY26).

The IPO consists of a total issue of 4,16,66,666 shares valued at Rs 500 crores, comprising an Offer for Sale (OFS) of 2,66,66,666 shares (Rs 320 crores) and a Fresh Issue of 1,50,00,000 shares (Rs 180 crores).

The shares are priced in the band of Rs 114 to Rs 120 per share, with a lot size of 125 shares.

Company Overview of Excelsoft Technologies IPO

Excelsoft Technologies is a global vertical Software-as-a-Service (SaaS) company offering Artificial Intelligence (AI)-based, cloud-native products and solutions primarily to large enterprise customers in the learning and assessment market worldwide. The core focus is on technology innovation to design, develop, and implement secure, scalable digital solutions for high-stakes examinations, certification, and learning management.

The company is driven by a mix of deep domain expertise and product engineering capabilities. Its vertical depth is rooted in the specific needs of the education and training sectors, serving qualifications and certification bodies, government entities, universities, schools, and educational publishers globally. Excelsoft’s platforms are cloud-based and built with open APIs, core to its commitment to security, scalability, and performance.

Its core business strength is built around an integrated suite of AI-led, proprietary products for the learning and assessment lifecycle:

SARAS e-Assessments: A secure and reliable platform for high-stakes examinations, supporting end-to-end assessment workflows, from test construction to smart analytics.

EasyProctor: An AI-enabled remote proctoring solution offering live, record-and-review, and automated monitoring capabilities to ensure exam integrity.

AI-Levate: An innovative suite of AI-powered micro-apps designed for incremental enhancement of existing systems, including automated question generation and AI-assisted marking.

SARAS Learning Management System: Platforms providing learning support, subscription management, and adaptive personalized learning for academic and corporate training requirements.

CollegeSPARC: An intelligent, data-driven student success platform that assists universities with academic planning, advising, and predictive analytics for student retention.

This robust product portfolio supports customers across its main business verticals, like Assessment and Proctoring Solutions, Learning and Student Success Systems, Educational Technology Services, and Learning Design and Content Services. The company is recognised for cultivating long-term relationships, with the average client vintage for its top 10 customers standing at 10.50 years as of June 30, 2025. The company maintains a significant global footprint, catering to 101 clients across 19 countries as of August 31, 2025.

The geographic split of the revenue from operations for the three months ended June 30, 2025, is detailed below:

Particulars | Amount (in Rs Crores) | % of Revenue from Operations |

North America | 33.82 | 60.69% |

Europe & UK | 13.67 | 24.53% |

India & Asia-Pacific (incl. Australia) | 8.23 | 14.78% |

Total Revenue from operations | 55.72 | 100.00% |

The Company’s Promoters are Pedanta Technologies Private Limited, Dhananjaya Sudhanva, Lajwanti Sudhanva, and Shruthi Sudhanva. Dhananjaya Sudhanva serves as the Chairman and Managing Director, and Shruthi Sudhanva as the Whole-Time Director. Subramaniam Ravi is the Chief Financial Officer. The promoters hold an aggregate of 94.14% of the pre-offer paid-up equity share capital.

Industry Overview of Excelsoft Technologies IPO

Excelsoft Technologies Limited operates within the competitive global Learning and Assessment (L&A) market, a specialized sector undergoing rapid digital transformation and driven by the pervasive integration of Artificial Intelligence (AI) and cloud computing. The company specializes in AI-based cloud-native vertical SaaS solutions for delivering, securing, and managing end-to-end high-stakes examinations, professional certifications, and corporate learning programs globally.

The Global Assessment and Proctoring Market, representing Excelsoft's core domain strength (SARAS and EasyProctor platforms), serves as the company's primary Total Addressable Market (TAM). This market was valued at USD 10.83 billion in 2024 and is projected to reach USD 21.26 billion by 2030, reflecting a strong CAGR of 11.90%.

The growth trajectory is notably high across key regions with APAC at 13.45% CAGR, North America with 12.07% CAGR, and Europe with 11.22% CAGR, respectively.

The EdTech SaaS sector is characterised by intense technological evolution, demanding continuous innovation, particularly in AI or ML, to maintain relevance. Excelsoft differentiates itself through deep vertical focus and platforms that support comprehensive assessment lifecycles. However, the sector faces several persistent structural challenges:

Technology and AI Disruption: The mandatory adoption of AI and machine learning in core processes, such as adaptive assessment, automated proctoring, necessitates substantial and continuous R&D investment to outpace competitors and prevent technology obsolescence.

Data Privacy and Governance: Companies must navigate and ensure compliance with stringent global regulations, including Europe’s GDPR and impending laws like India's DPDP Act, increasing the complexity and cost associated with collecting, securing, and processing sensitive learner and test-taker data.

Infrastructure and Scalability: Overcoming technical limitations related to internet connectivity and outdated infrastructure in developing regions remains a barrier to widespread adoption, affecting the reliability and accessibility of cloud-native and remote proctoring solutions.

Integration Complexity: EdTech platforms must seamlessly integrate with varied existing enterprise systems used by educational and certification bodies globally, requiring highly versatile and standard-compliant open APIs.

Financial Overview of Excelsoft Technologies IPO

Particulars | March 31, 2025 (Rs Crores) | March 31, 2024 (Rs Crores) | March 31, 2023 (Rs Crores) |

Revenue from Operations | 233.29 | 198.3 | 195.1 |

Gross Profit Margin | 61.67% | 57.60% | 61.09% |

EBITDA | 73.26 | 54.97 | 68.18 |

EBITDA Margin | 31.40% | 27.72% | 34.94% |

Profit/Loss after tax (PAT) | 34.69 | 12.75 | 22.41 |

Return on Equity (RoE) | 10.38% | 4.43% | 8.41% |

Return on Capital Employed (RoCE) | 16.11% | 7.59% | 11.03% |

The revenue from operations has demonstrated consistent growth, driven by expansion in the high-demand global EdTech and assessment market. Revenue increased from Rs 195.10 crore in FY23 to Rs 198.29 crore in FY24 and further to Rs 233.29 crore in FY25, showing resilient top-line expansion.

Core business profitability is reflected through consistently competitive gross profit margins, demonstrating effective cost management within the service delivery model. The gross profit margin remained strong, maintaining levels around 61.09% in FY23 and recovering to 61.67% in FY25 after a temporary dip to 57.60% in FY24. This stability underscores the high-margin nature of its specialized technology and content services.

EBITDA has shown strong recovery and momentum after a transient drop, reflecting improved operating leverage and scale in the SaaS model. EBITDA decreased from Rs 68.17 crore in FY23 to Rs 54.97 crore in FY24 but subsequently rebounded significantly to Rs 73.25 crore in FY25, showcasing organizational efficiency gains. The EBITDA margin followed this trend, moving from 34.94% in FY23 down to 27.72% in FY24 before expanding again to 31.40% in FY25, demonstrating effective cost control at scale.

Profit After Tax (PAT) has demonstrated resilience amidst strategic and market fluctuations. PAT decreased from Rs 22.41 crore in FY23 to Rs 12.75 crore in FY24 due primarily to increased employee and amortization costs, before achieving a strong recovery and record profit of Rs 34.69 crore in FY25.

The efficiency of capital usage and shareholder returns remains solid, influenced by its capital-intensive IT and R&D strategies. The Return on Equity (RoE) stood at 10.38% in FY25, recovering from a lower 4.43% in FY24. Similarly, the Return on Capital Employed (RoCE) recovered from 7.59% in FY24 to 16.11% in FY25, affirming management’s capability to generate returns from the capital deployed in its core technology business.

Strengths and Risks of Excelsoft Technologies IPO

Let's examine the strengths and weaknesses to determine if the Excelsoft Technologies IPO is a good or bad investment for investors.

Strengths

Expertise in Vertical SaaS for Learning and Assessment: The company possesses profound technical and domain expertise across the entire lifecycle of learning and assessment, enabling the creation of robust, right-fit, cloud-based products tailored for the EdTech sector.

Long-Term, Stable Global Customer Relationships: Excelsoft has successfully cultivated long-standing relationships with key global clients, evidenced by the impressive average client vintage for the top 10 customers standing at 10.50 years as of June 30, 2025.

AI-Driven Product Innovation and Focus: The company is strategically positioned to lead in the evolving market through active AI implementation, including the development of the AI-Levate suite for next-generation adaptive testing, smart analytics, and advanced proctoring capabilities such as EasyProctor.

Robust Security and Compliance Frameworks: Operations and technology platforms adhere to stringent global standards, holding certifications like ISO/IEC and ISO certifications, which demonstrate credibility and commitment to security and quality assurance required by high-stakes clients.

Experienced and Stable Management Leadership: The business benefits from a stable, long-tenured management team, including promoters Dhananjaya Sudhanva and Shruthi Sudhanva, whose over two decades of experience are crucial for strategic execution and navigating the specialized industry landscape.

Risks

High Revenue Concentration on a Single Key Client: There is a substantial dependency on the Pearson Education Group, which accounted for 59.24% of the consolidated total revenue for the three months ended June 30, 2025. Loss or significant reduction of business from this client would severely impact financial results.

Significant Contingent Liability from Corporate Guarantee: The Company faces a material financial risk due to a corporate guarantee of Rs 300 crore issued for its Corporate Promoter's NCDs. This liability represents 79.80% of the company's net worth as of June 30, 2025.

Exposure to Foreign Exchange and Geographic Concentration: The business is exposed to fluctuations in currency exchange rates and is heavily concentrated geographically, with 60.61% of revenue based on Q1FY26 derived from the USA market, making it vulnerable to regional economic or regulatory shifts.

Inability to Adapt to Rapid Technological Changes: Operating in a fast-evolving IT and SaaS industry, failure to continually innovate, upgrade service offerings, and keep pace with rapid technological disruption risks obsolescence and loss of competitive advantage.

Historical Negative Cash Flows from Operating Activities: The Company reported negative net cash flow from operating activities of Rs 4.758 crore for the most recent period as of 30th June 2025, highlighting potential volatility in cash conversion and raising questions about the sustainability of future liquidity.

Strategies of Excelsoft Technologies IPO

Increase Wallet Share and Global Client Acquisition: The core strategy is to improve revenue from existing customers by meeting their evolving needs while actively pursuing new clients through geographic expansion into new, high-potential regions like Egypt, France, Brazil, and the Philippines.

Inorganic Growth Through Strategic Acquisitions: The company intends to proactively seek synergistic acquisition targets within the EdTech sector to accelerate market entry, expand its portfolio, and leverage the IPO funding for increased market penetration.

Venture into the AI Spectrum and Develop AI-Based Products: A central focus is dedicated investment in and creation of AI-driven, transformative applications and solutions like adaptive testing and intelligent content generation to integrate AI into core platforms and maintain product leadership.

Develop and Modernise the Existing and New Product Portfolio: Continuously commit resources to R&D to upgrade current products like SARAS, EasyProctor, and launch new, cutting-edge platforms to ensure offerings remain state-of-the-art and competitive within the learning and assessment vertical.

Augment Sales and Marketing and Global Presence: Strengthen market penetration and improve brand visibility by establishing specialized sales and marketing teams across different global markets, focusing on thought leadership to secure high-value marquee customers.

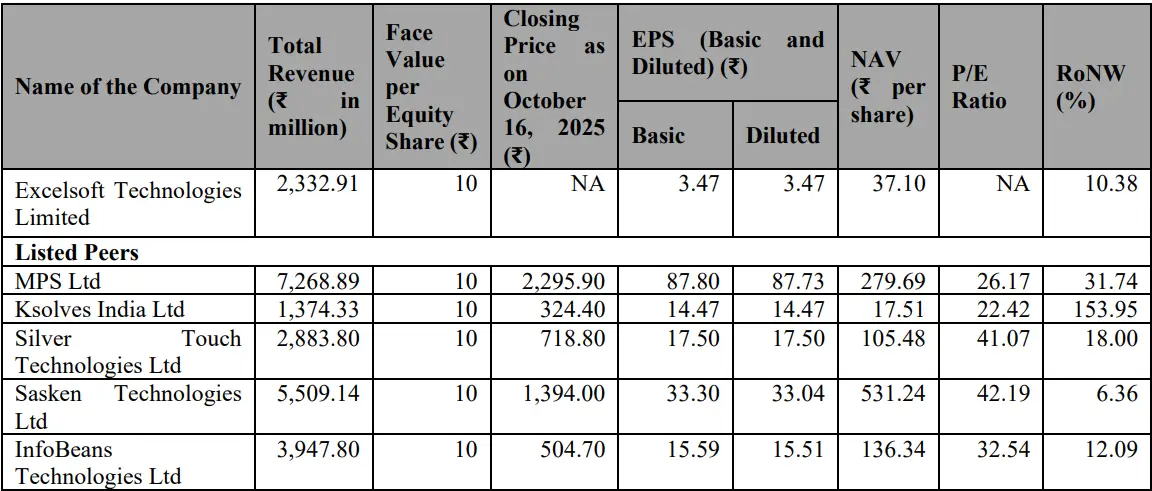

Excelsoft Technologies IPO vs. Peers

Operational Efficiency and Margins: Excelsoft demonstrates strong operational efficiency, reporting an EBITDA margin of 31.40% in FY25. This ranks competitively high within the peer group, standing nearly at par with MPS Ltd (30.64%) and Ksolves India Ltd (34.82%) and significantly surpassing Sasken Technologies Ltd (4.16%) and Silver Touch Technologies Ltd (13.01%).

Competitive Profitability Profile: The company achieved a solid PAT margin of 14.87% in FY25. While trailing the most profitable peer, Ksolves India Ltd (24.97%), this margin is robust, exceeding both Sasken Technologies Ltd (9.17%) and InfoBeans Technologies Ltd (9.62%).

Returns on Equity and Capital Employed: Excelsoft's efficiency in generating returns is mid-range, reflecting its developing scale. The Return on Equity (RoE) stood at 10.38%, and the Return on Capital Employed (RoCE) was 16.11% in Fiscal 2025. These returns are lower than the most efficient peers (Ksolves RoE 129.39%, MPS RoE 32.23%), but align closely with InfoBeans (RoE 11.75%, RoCE 17.48%).

Objectives of Excelsoft Technologies IPO

The offering consists of a total of 4,16,66,666 shares worth Rs 500 crores, out of which the offer for sale of 2,66,66,666 shares is valued at Rs 320 crores, and the fresh issue of 1,50,00,000 shares is valued at Rs 180 crores. The selling shareholders in this IPO are:

Pedanta Technologies Private Limited will receive the offer for sale proceeds.

However, the fresh issue proceeds will be used for the following objectives:

Funding Cost for land purchase and new building construction at Mysore (Rs 61.76 crores)

Funding expenses to upgrade external electrical systems for the existing plant in Mysore (Rs 39.51 crores)

Upgrading IT Infrastructure (Rs 54.63 crores)

General Corporate Purposes (Rs 24.1 crores)

Excelsoft Technologies IPO Details

IPO Dates

Excelsoft Technologies IPO will be open for subscription from November 19, 2025, to November 21, 2025. The allotment of shares to investors will take place on November 24, 2025, and the company is expected to be listed on the NSE and BSE on November 26, 2025.

IPO Issue Price

Excelsoft Technologies is offering its shares in the price band of Rs 114 to Rs 120 per share. This means you would require an investment of Rs. 15,000 per lot (125 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Excelsoft Technologies is issuing a total number of 4,16,66,666 shares valued at Rs 500 crores, out of which the offer for sale comprises 2,66,66,666 shares, worth Rs 320 crores, of which the selling shareholders will receive the proceeds. The remaining 1,50,00,000 shares worth Rs 180 crores will be of fresh issue, used for the objects of the issue.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on November 24, 2025, through the registrar's website, MUFG Intime India Private Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Excelsoft Technologies are expected to be listed on the NSE and BSE on November 26, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Excelsoft Technologies IPO

Important IPO Details | |

Bidding Date | November 19, 2025 to November 21, 2025 |

Allotment Date | November 24, 2025 |

Listing Date | November 26, 2025 |

Issue Price | Rs 114 to Rs 120 per share |

Lot Size | 125 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category