Is Dev Accelerator IPO Good or Bad

00:00 / 00:00

Dev Accelerator Limited is bringing its Initial Public Offering (IPO), which will be open for subscription from 10 September 2025 to 12 September 2025. The issue size of this IPO is Rs.143.35 crores and its price band has been fixed at Rs.56 to Rs.61 per share. The question now arising in the minds of investors is whether Dev Accelerator IPO is good or bad i.e. whether this IPO is a good investment option or not. This article provides a detailed review of Dev Accelerator IPO, which includes analysis of its business model and financial performance so that you can make the right investment decision.

Dev Accelerator IPO Review

Dev Accelerator Limited's IPO is worth Rs 143.35 crore, which is being brought as a completely fresh issue. In this, 2.35 crore new shares will be issued. This IPO will be open for subscription from September 10, 2025 to September 12, 2025 and its price band has been fixed at Rs 56 to Rs 61 per share. There will be 235 shares in one lot, that is, the minimum investment for a retail investor will be Rs 14,335.

The company will use the funds raised from this IPO primarily for fit-outs and security deposits for new centers (Rs 73.12 crore), partial or full repayment of debt (Rs 35 crore) and general corporate purposes. Dev Accelerator Limited, also known as DevX, is a flexible workspace provider that provides co-working spaces, managed offices and design services. As of May 2025, the company had 28 centers in 11 cities, with 14,144 seats and about 8.6 lakh square feet of area under management. Apart from this, the company is planning to start its first international center in Sydney (Australia) soon.

Financially, the performance of the company has improved rapidly. While the company had a loss of Rs 12.83 crore in FY 2023, the profit increased to Rs 0.43 crore in FY24 and Rs 1.74 crore in FY25. The company's income has increased from Rs 71.37 crore to Rs 178.89 crore during the same period. The EBITDA margin is above 50%, but the Debt/Equity ratio is 2.39, which is considered relatively high.

The strength of the company lies in its fast-growing business model, large client base and expansion of new centers. On the other hand, thin profit margins and high debt indicate risk for investors. Overall, investors will have to assess whether Dev Accelerator IPO is good or bad by considering the company's growth potential and the financial risks associated with it.

Company Overview of Dev Accelerator Ltd.

Dev Accelerator Limited, commonly known as DevX, was founded in the year 2017. The company's business model is based on flexible workspace solutions, including co-working spaces, managed offices and customized desks. The model is designed keeping in mind the changing needs of modern businesses, with special emphasis on remote work trends and flexible lease options.

As of May 2025, Dev Accelerator had 28 centers across 11 cities with a total of 14,144 seats and approximately 8,60,522 sq ft of area under management. The company also has a strong client base, serving over 250 clients, including large corporates, MNCs and SMEs. The company is continuously moving forward on its expansion. Letters of Intent (LOIs) have been signed for three new centers, including its first international center in Sydney (Australia). Apart from this, a new centre has also been leased in Surat. In the coming time, these centres will add 11,500 additional seats and new space of about 8,97,341 sq ft.

Dev Accelerator also has a subsidiary firm Needle and Thread Designs LLP, which provides design and execution services. Thus, the company has a strong presence not only in flexible office space but also in interior design and managed office setup.

Industry Overview of Dev Accelerator Ltd.

The coworking and flexible workspace industry in India is growing rapidly. Changing work culture, remote working trends and increasing demand for cost-efficient office solutions are strengthening this sector. Startups, SMEs and large companies are now preferring flexible office models, which has significantly increased the growth potential of this market.

The demand for coworking spaces has doubled in the last few years across the country, especially in major cities like Delhi-NCR, Mumbai, Hyderabad and Pune. Along with this, companies are adopting short and flexible agreements instead of long-term lease contracts.

Not only companies like Dev Accelerator (DevX) but many big players are active in this industry, including companies like WeWork India, Awfis, Smartworks and TableSpace. Despite tough competition, DevX has rapidly expanded its centers and client base.

The industry is expected to grow even further in the coming years as the demand for flexible workspace solutions continues to grow with India's digital economy expanding and global companies setting up operations in India. Overall, the sector Dev Accelerator operates in has a positive outlook and high growth potential.

Financial Overview of Dev Accelerator Ltd.

Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 540.38 | 411.09 | 282.42 |

Total Income | 178.89 | 110.73 | 71.37 |

Profit After Tax | 1.74 | 0.43 | -12.83 |

EBITDA | 80.46 | 64.74 | 29.88 |

Net Worth | 54.79 | 28.79 | 1.22 |

Total Borrowing | 130.67 | 101.05 | 33.20 |

Dev Accelerator Ltd. has recorded strong financial growth in recent years. The company's revenue increased from Rs 110.73 crore in FY24 to Rs 178.89 crore in FY25, representing an increase of approximately 62%.

Profit After Tax (PAT) has also improved tremendously. After recording a profit of Rs 0.43 crore in FY24, it increased to Rs 1.74 crore in FY25. This growth represents an increase of approximately 303%. At the same time, the company had a loss of Rs -12.83 crore in FY23, making this turnaround even more significant.

Total assets have seen a steady increase - from Rs 282.42 crore in FY23 to Rs 411.09 crore in FY24 and to Rs 540.38 crore in FY25. This indicates that the company is continuously investing in its business expansion and infrastructure.

On the operational front, EBITDA increased from Rs 29.88 crore in FY23 to Rs 64.74 crore in FY24 and Rs 80.46 crore in FY25. This shows that both the operational efficiency and profitability of the company are strengthening.

Net Worth has also increased from Rs 1.22 crore in FY23 to Rs 28.79 crore in FY24 and Rs 54.79 crore in FY25, which shows improvement in the financial position of the company. However, Total Borrowing has increased from Rs 33.20 crore in FY23 to Rs 101.05 crore in FY24 and Rs 130.67 crore in FY25, which indicates that the company's expansion is based on high debt.

Overall, Dev Accelerator Ltd. has reported significant growth in both revenue and profits between FY24 and FY25, along with strength in assets and net worth. But it will be important for investors to keep an eye on the rising debt levels.

Strengths of Dev Accelerator Ltd.

Strong Market Presence : Dev Accelerator Ltd. has a strong presence across major cities in India. It has built a trusted brand identity through its expansion and services.

Wide Client Base : The company serves 250+ corporates and MNCs. This large and diverse client base reflects its stable earnings and robustness of the business model.

Impressive Financial Growth : The company recorded remarkable financial performance in FY25. Revenue grew by 62% and Profit After Tax (PAT) grew by 303%. This shows that the company is not only running its operations efficiently but is also continuously improving profitability.

Strong EBITDA Margin : The company's EBITDA has improved consistently, which makes it clear that Dev Accelerator Ltd. is managing its expenses efficiently and performing strongly at the operational level.

Global Expansion Plans : After gaining a strong foothold in India, the company is now planning to expand internationally as well. The upcoming expansion in Sydney strengthens the company's global growth vision.

Diversified Offerings : Dev Accelerator Ltd.'s services are not limited to just coworking spaces. The company also offers diverse services like Managed Offices and Design Subsidiary, giving it an edge as a multi-solution provider.

Risks of Dev Accelerator Ltd.

High Debt Levels : The company's Debt-to-Equity Ratio is 2.39, which indicates that Dev Accelerator Ltd. is highly dependent on debt for its operations and expansion plans. High debt may increase interest costs in the future and put pressure on profitability.

Thin Profit Margin : Although the company has shown significant growth in revenue and PAT, its PAT margin is just 1%. Such a low net margin indicates that even small fluctuations at the operational or financial level can have a big impact on profitability.

Expensive Valuation : Dev Accelerator Ltd.'s IPO is being offered at a very high valuation. Its P/E Ratio is 233x Pre-IPO and 315x Post-IPO, which is very high compared to the sector. This may increase the uncertainty of return on investment for investors.

Competitive Industry : There is tough competition in the coworking and managed office space industry. Big players like WeWork, Awfis and Smartworks are already present. In such an environment, it may be challenging for Dev Accelerator Ltd. to maintain a consistent market share.

Expansion Risk : The company is expanding rapidly as part of its growth strategy, but this will require heavy capital expenditure. If this expansion fails to deliver the expected returns, the company's financial position may be negatively affected.

Strategies of Dev Accelerator Ltd.

Focus on domestic and international expansion : Dev Accelerator Ltd. is planning to expand its strong presence in India as well as enter the international arena. The company's strategy is to establish its operations in key business hubs in the country as well as overseas markets like Sydney.

Managed Office Solutions for Corporates : The company is focused on the fast-growing Managed Office Solutions segment. This model provides flexible and affordable office solutions to corporate clients, helping Dev Accelerator Ltd. ensure long-term revenue streams.

Synergy from Design Subsidiary : The company is making co-working and managed office solutions more attractive and customized by using its Design Subsidiary. This synergy gives the company a distinct identity and competitive edge in the market.

Use of IPO funds : The funds raised from the IPO will be used primarily for debt repayment and expansion of fit-outs. This will strengthen the company's balance sheet and accelerate expansion plans.

Dev Accelerator IPO Peer Comparison

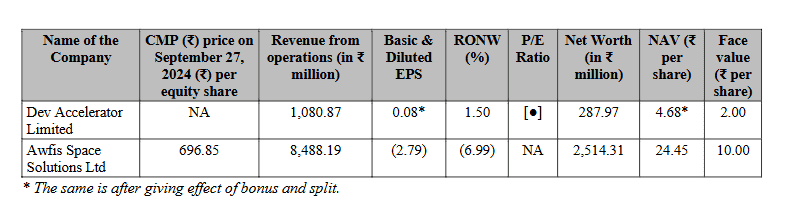

Comparing Dev Accelerator Limited with its listed peer Awfis Space Solutions Ltd., some interesting differences emerge. Dev Accelerator has a revenue of Rs.1,080.87 million in FY2024-25, while Awfis has a much higher revenue of Rs.8,488.19 million. In terms of profitability, Dev Accelerator has shown positive performance with Basic & Diluted EPS of 0.08 and RONW of 1.50%. In comparison, Awfis has a loss with EPS of -2.79 and RONW of -6.99%.

Comparing the net worth, Awfis has a net worth of Rs.2,514.31 million, which is much higher than Dev Accelerator (Rs.287.97 million). However, the Net Asset Value (NAV) per share stood at Rs.4.68 for Dev Accelerator and Rs.24.45 for Awfis. At the face value level, Dev Accelerator's share is Rs.2, while Awfis' face value is Rs.10 per share.

Overall, Dev Accelerator is still small in size but is showing profitability while Awfis is in loss despite operating at a large scale. This indicates that Dev Accelerator has achieved operational efficiency in its early growth stage. However, investors will have to consider its valuation carefully due to the small revenue base and limited net worth.

Objectives of Dev Accelerator IPO

The Company will use the Net Proceeds from this Issue for the following purposes:

1. Capital Expenditure for Fit-outs and Security Deposits in New Centres : The Company plans to set up new centres to expand its business in the coming years. Under this, Rs.689.57 million will be used, out of which approximately Rs.607.75 million will be spent on fit-outs (such as civil work, interiors, furniture, electrical work, HVAC, security and networking systems etc.) and Rs.81.82 million will be spent on security deposits. This capital expenditure will strengthen the Company's expansion strategy.

2. Partial or full repayment of certain borrowings and redemption of NCDs : The Company will use approximately Rs.300.00 million to repay loans and non-convertible debentures (NCDs) currently held by the Company from various banks and financial institutions. This will reduce the Company's debt burden, reduce interest expense and improve funding capacity for future growth plans.

3. Use for General Corporate Purposes : A portion of the net proceeds will be used for the general business purposes of the Company. This amount will not exceed 25% of the total Gross Proceeds. This will include working capital, operational requirements and other expenses related to business expansion.

Dev Accelerator IPO Details

IPO Dates : The subscription window for Dev Accelerator IPO will be open from 10th September 2025 to 12th September 2025. Allotment of shares to investors will be done on 15th September 2025 and listing of the company's shares is expected on 17th September 2025 on NSE and BSE.

IPO Issue Price : Dev Accelerator is offering its shares at a price of Rs. 51 per share. Each lot consists of 2000 shares, i.e. the minimum investment amount will be Rs. 1,02,000.

IPO Size : The company is issuing a total of 14 lakh shares, taking the total lot size to Rs. 7.14 crore. The entire issue is being brought as a fresh issue only.

IPO Allotment Status : Investors who have applied for Dev Accelerator IPO can check the allotment status on 15th September 2025. The information will be available on the official website of Skyline Financial Services Private Limited, the company's registrar, BSE, NSE and stockbroker platforms.

IPO Listing Date : Dev Accelerator shares will be listed on NSE and BSE on 17th September 2025.

IPO Application Link : Open a demat account with Rupeezy today and apply for Dev Accelerator IPO with ease. Rupeezy's easy and fast platform makes the IPO application process absolutely simple and hassle-free.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category