Is Corona Remedies IPO Good or Bad – Detailed Review

00:00 / 00:00

Corona Remedies Limited’s IPO is set to open its initial public offering from December 08, 2025, to December 10, 2025. When considering applying for this IPO, potential investors might have questions about whether the Corona Remedies IPO is a good investment and if it's worth subscribing to.

This article provides a comprehensive Corona Remedies IPO review, covering its business operations and fundamental analysis to help you make an informed investment decision.

Corona Remedies IPO Review

Corona Remedies Limited's IPO is open for subscription from December 08, 2025, to December 10, 2025, with listing expected on December 15, 2025, on NSE and BSE.

The company is an India-focused, brand-centric pharmaceutical formulation company offering a diversified portfolio of high-growth therapies across chronic and sub-chronic segments, primarily focused on capturing value in the domestic Indian Pharmaceutical Market (IPM). It specialises in deep domain expertise in pharmaceutical R&D, advanced formulation manufacturing (oral solids, liquids, niche products) in EU GMP and WHO GMP-certified facilities, and a robust, vertically aligned ecosystem ensuring stringent quality and supply chain reliability.

The company's core operational strength is maintaining a high growth trajectory (second fastest-growing among top 30 IPM players), driven by a pan-India sales network of over 2,671 medical representatives focused on specialist doctors. The average tenure for its key therapeutic focus, Chronic/Sub-Chronic segments, stands at 70.10% of domestic sales. The promoters hold an aggregate of 72.50% of the pre-offer paid-up equity share capital.

The company operates within the highly specialized and competitive Indian Branded Pharmaceutical Formulation sector, offering high-growth portfolios primarily focused on the domestic market in Chronic and Specialty Therapeutic areas. The Global Pharmaceutical Market, Corona Remedies' primary domain, was valued at approximately $1,583 billion in 2024 and is projected to grow at a global CAGR of 5.5% to 6.5%. Concurrently, the Indian Domestic Formulation Market is expected to grow at a CAGR of 8% to 9% to reach Rs 3.3 to 3.5 lakh crore by FY30.

Corona Remedies’ financial performance from FY23 to FY25 reflects strong top-line growth coupled with accelerating profitability. Revenue from operations grew from Rs 884.05 crores in FY23 to Rs 1,196.42 crores in FY25 (a strong CAGR of 16.33%).

Profit After Tax (PAT) has shown robust and accelerating growth, increasing from Rs 84.93 crores in FY23 to Rs 149.43 crores in FY25. Operating efficiency showed significant expansion, with the EBITDA margin improving from 15.27% in FY23 to 20.55% in FY25. The Return on Capital Employed (RoCE) was 41.32% in FY25 (peaking from 28.36% in FY23), and the Return on Equity (RoE) was 27.50% in FY25, indicating high capital efficiency.

Strengths include Advanced and Vertically Integrated Manufacturing Capabilities (EU GMP/WHO GMP certified with backward integration for hormone APIs), High Growth Trajectory (second fastest-growing among top 30 IPM players), a Comprehensive Product Portfolio (71 brands with low NLEM exposure at 9.76% of sales), and Strategic Focus on high-growth Chronic and Specialty segments.

Risks include High Revenue Concentration (Top three therapeutic areas accounted for 62.40% of revenue in FY25), Dependence on "Engine" Brands (27 brands contributed 72.34% of domestic sales), Geographic Concentration in India (96.33% of revenue) with domestic sales concentrated in specific regions (47.30% in West Zone), and Exposure to Price Control and Regulatory Pressure (DPCO).

The IPO consists of a total Offer for Sale (OFS) of 61,71,101 shares valued at Rs 655.37 crores. The selling shareholders include Dr Kirtikumar Laxmidas Mehta, Minaxi Kirtikumar Mehta, Dipabahen Niravkumar Mehta, Brinda Ankur Mehta, Sepia Investments Limited, Anchor Partners, and Sage Investment Trust, who will receive the entire offer proceeds.

The shares are priced in the band of Rs 1,008 to Rs 1,062 per share, with a lot size of 14 shares.

Company Overview of Corona Remedies IPO

Corona Remedies is an India-focused, brand-centric pharmaceutical formulation company offering a diversified portfolio of high-growth therapies across chronic and sub-chronic segments, primarily focused on capturing value in the domestic Indian Pharmaceutical Market (IPM).

The core focus is on therapeutic leadership in specialized segments through a robust, vertically aligned ecosystem. This encompasses advanced in-house R&D for differentiated formulations, rigorous quality assurance standards, and scalable manufacturing processes designed for complex oral solids, liquids, and niche products, ensuring quality and supply chain reliability. The strategic orientation is built around consistent outperformance of the IPM growth rate, leveraging a proven track record of scaling proprietary "engine" brands in targeted specialities.

The company operates from two principal, quality-compliant manufacturing facilities in Gujarat (Bhayla) and Himachal Pradesh (Solan), with a third hormone manufacturing facility under development at Gujarat (Ahmedabad). This operational depth maintains internationally recognised certifications, forming the core of the company's commitment to stringent quality and consistency for both the domestic and selective international markets.

Its core business strength is built around an integrated suite of capabilities that enables end-to-end pharmaceutical development and marketing through a pan-India sales network. This network, comprising over 2,671 medical representatives, focuses strategically on engaging specialist and super-specialist doctors to drive prescription growth.

This robust product portfolio supports customers across its main therapeutic segments, including:

Chronic/Sub-Chronic Segments: (70.10% of Revenue) Women's Healthcare, Cardio-Diabeto, and Pain Management.

Specialty & Multi-Specialty Segments: (29.90% of Revenue) Urology, Vitamins or Minerals or Nutrients (VMN), Gastrointestinal, and Respiratory care.

Segment Wise Therapeutic Revenue Split (Moving Annual Total (MAT) June 2025 Domestic Sales)

Women's Healthcare: 28.56%

Cardio-Diabeto: 23.38%

Pain Management: 11.79%

Urology: 4.53%

Others: 31.74%

Geographic Revenue Split:

Particulars | % of Revenue from Operations (FY25) |

India (Domestic) | 96.33% |

International | 3.67% |

Total Revenue from Operations | 100.00% |

The company is recognised for its market agility and growth, achieving the distinction of being the second fastest-growing company among the top 30 IPM players by domestic sales between MAT June 2022 and MAT June 2025. The revenue profile remains highly weighted towards the domestic market, reflecting a concentrated strategy on the high-growth Indian sector.

The Promoters of the Company are Dr Kirtikumar Laxmidas Mehta, Niravkumar Kirtikumar Mehta, and Ankur Kirtikumar Mehta. They hold an aggregate of 72.50% of the pre-offer paid-up equity share capital.

The business is led by Niravkumar Kirtikumar Mehta (Managing Director and CEO) and Ankur Kirtikumar Mehta (Joint Managing Director), supported by an experienced senior management team.

Industry Overview of Corona Remedies IPO

Corona Remedies Limited operates within the highly specialized and competitive Indian Branded Pharmaceutical Formulation sector, offering a high-growth portfolio primarily focused on the domestic market in Chronic and Specialty Therapeutic areas. The industry is undergoing a significant transformation, driven by a growing disease burden, especially non-communicable or lifestyle diseases, accelerating patient access to care, and stringent regulatory oversight on quality and pricing.

The Global Pharmaceutical Market, a primary Total Addressable Market (TAM) for Corona Remedies, was valued at approximately $1,583 billion in 2024 and is projected to reach $2,100 to $2,200 billion by 2029, reflecting a solid CAGR of 5.5% to 6.5%.

Concurrently, the Indian Domestic Formulation Market is expanding rapidly, valued at approximately Rs 2.3 lakh crore in FY25 and is expected to grow at a CAGR of 8% to 9% to reach Rs 3.3 to 3.5 lakh crore by FY30. A key market driver within this is the Chronic and Sub-Chronic Segment, which is expected to clock a higher CAGR of 8.5% to 9.5% over the same period, providing stability and better revenue visibility due to the long-term nature of prescriptions.

The sector is characterized by intense regulatory scrutiny, deep technological requirements for formulation development, and a shift towards integrated, brand-centric models. Corona Remedies differentiates itself through its extensive capabilities, such as:

Vertical Alignment and Quality: Corona Remedies maintains EU GMP and WHO GMP-certified facilities and engages in backward integration through its Associate, La Chandra Pharmalab, for hormone APIs to enhance quality control and supply chain resilience.

Strategic Portfolio Focus: The company maintains a concentration on high-growth therapeutic areas such as Women's Healthcare, Cardio-Diabeto and commands leading positions with its "engine" brands such as Cor, Trazer, Myoril. Its low exposure to the regulated National List of Essential Medicines (NLEM) (9.76% of domestic sales in MAT June 2025) affords greater pricing flexibility compared to many peers.

The Pharmaceutical Formulation Sector faces several structural challenges, such as:

Price Control and Regulatory Pressure: The sector is highly exposed to government intervention, particularly the price caps imposed by the Drug Prices Control Order (DPCO). Frequent regulatory changes regarding drug quality, Fixed-Dose Combinations (FDCs), and marketing practices (UCPMP) necessitate continuous compliance investment.

Raw Material Supply Dependence: The sector is significantly exposed to price fluctuations and supply disruptions related to key Active Pharmaceutical Ingredients (APIs), particularly with a major dependence on imports from China for intermediates.

Quality Control and Entry Barriers: Maintaining uncompromising manufacturing quality standards like EU Good Manufacturing Practice (GMP) and rigorous regulatory approval processes creates significant capital and time-based barriers, protecting established manufacturers with accredited facilities.

Skill Shortages in R&D: The sector faces a persistent challenge in maintaining high-productivity R&D pipelines and attracting and retaining skilled talent, essential for developing complex generics and differentiated formulations.

Financial Overview of Corona Remedies IPO

Particulars | March 31, 2025 (Rs Crores) | March 31, 2024 (Rs Crores) | March 31, 2023 (Rs Crores) |

Revenue from Operations | 1,196.42 | 1,014.47 | 884.05 |

Gross Margin | 80.23% | 77.64% | 76.14% |

EBITDA Margin | 20.55% | 15.89% | 15.27% |

Profit after tax (PAT) | 149.43 | 90.5 | 84.93 |

PAT Margin | 12.49% | 8.92% | 9.61% |

Return on Equity (RoE) | 27.50% | 20.36% | 23.29% |

Return on Capital Employed (RoCE) | 41.32% | 31.19% | 28.36% |

Operating Cash Flow/EBITDA | 77.46% | 97.25% | 76.06% |

Revenue from Operations has demonstrated strong, consistent growth across the periods, indicative of the successful execution of expansion and acquisition strategies. Revenue increased from Rs 884.05 crores in FY23 to Rs 1,014.47 crores in FY24, and further to Rs 1,196.42 crores in FY25. This trend reflects a CAGR of 16.33% over the period, significantly driven by volume and new product launches, especially in the high-growth chronic segment.

Gross Margins reflect the Company's improved operational control and favourable product mix. The margin consistently expanded from 76.14% in FY23 to 77.64% in FY24, reaching 80.23% in FY25. This expansion highlights the Company's ability to maintain high margins despite scale-up, primarily due to focus on branded generics and strategic acquisitions.

EBITDA Margins show significant improvement in operating efficiency. The margin rose from 15.27% in FY23 to 15.89% in FY24, before increasing sharply to 20.55% in FY25. This trend demonstrates successful integration of acquired brands, operational leverage, and sustained focus on the high-margin chronic product segments.

Profit After Tax (PAT) has shown robust growth, accelerating significantly in the most recent fiscal year. PAT increased from Rs 84.93 crores in FY23 to Rs 90.50 crores in FY24, jumping by 65.11% to Rs 149.43 crores in FY25. This exponential growth in FY25 is a direct result of strong revenue growth and expanding operating margins.

PAT Margin mirrors the enhanced net profitability achieved through operating leverage. The margin decreased marginally from 9.61% in FY23 to 8.92% in FY24, but then expanded strongly to 12.49% in FY25. The sharp rise in FY25 indicates that revenue growth outpaced the increase in operating and non-operating expenses, particularly depreciation and finance costs.

Return on Equity (RoE) demonstrates consistent growth in shareholder returns. RoE increased from 23.29% in FY23 to 20.36% in FY24, a slight decline due to increased net worth from retained earnings, before surging to 27.50% in FY25. The high returns validate the strategy of growing through high-margin brands and efficient capital utilization.

Return on Capital Employed (RoCE) reflects exceptional efficiency in utilizing total deployed capital. RoCE increased steadily from 28.36% in FY23 to 31.19% in FY24, and demonstrated a strong jump to 41.32% in FY25. This consistently high and improving RoCE is a key indicator of financial health and strong asset utilization.

OCF/EBITDA, or Operating Cash Flow to EBITDA, demonstrates very high cash conversion quality. The ratio was 76.06% in FY23 and reached a peak of 97.25% in FY24, before settling at a still-high 77.46% in FY25. The consistently high ratio, near 100% in FY2024, confirms that the Company’s reported accounting profits are backed by robust operating cash generation.

Strengths and Risks of Corona Remedies IPO

Let's examine the strengths and weaknesses to determine if the Corona Remedies IPO is a good or bad investment for investors.

Strengths

Advanced and Vertically Integrated Precision Manufacturing Capabilities: Corona Remedies operates high-quality EU GMP and WHO GMP-certified manufacturing facilities in Gujarat and Himachal Pradesh, underpinning its stringent quality mandate for formulation production. This foundation is strategically complemented by a minority stake in La Chandra Pharmalab Private Limited (an EU-GMP API manufacturer), securing assured supply and vertical integration for key female hormone formulations.

Operations in Unique, Engineering-Led Manufacturing Ecosystems: The Company is characterized by its high growth trajectory in the Indian Pharmaceutical Market (IPM), identified as the second fastest-growing among the top 30 IPM companies by domestic sales between MAT June 2022 and MAT June 2025. This 16.77% CAGR highlights superior commercial execution over the IPM average.

Manufacturing Presence Across Three Continents: Corona Remedies focuses its operations primarily on the Indian domestic market, constituting over 96.33% of its revenue. Its marketing network, however, is wide, with 2,671 medical representatives as of June 30, 2025, focused on high-value prescription generation from specialists and super-specialists across 22 states.

Comprehensive Precision Product Portfolio: The Company has a diversified portfolio of 71 brands as of June 30, 2025, across key therapeutic areas like women’s healthcare, cardio-diabetes, and pain management. This breadth supports consistent revenue streams, with 27 "engine" brands contributing over 72.34% of domestic sales.

Long-Standing Relationships with High Entry Barrier Global Customers: Corona Remedies maintains a limited exposure to the National List of Essential Medicines at only 9.76% of sales as of MAT June 2025, which is significantly lower than the IPM average of 17.51%. This positioning provides crucial operational flexibility regarding pricing and margin protection against regulatory mandates.

Risks

High Revenue Concentration in Select Therapeutic Areas: The therapeutic areas of women's healthcare, cardio-diabeto, and pain management contributed an aggregate of Rs 225.72 crores (65.14%) and Rs 746.55 crores (62.40%) of the revenue from operations for the three months ended June 30, 2025, and the FY25, respectively. Failure of products in these areas or the emergence of competing products could adversely affect the business and results of operations.

Dependence on "Engine" Brands: A portfolio of 27 "engine" brands, specifically B-29 and Myoril, accounted for 72.34% of domestic sales during the Moving Annual Total (MAT) June 2025 period. Adverse developments affecting the sales of these key brands could have a material adverse effect on the Company's financial condition and cash flows.

Geographic Revenue Concentration in India: A significant majority of revenue is derived from operations within India, constituting 96.34% and 96.33% of revenue from operations during the three months ended June 30, 2025, and the Financial Year 2025, respectively. A fall in demand in India or failure to expand internationally could adversely affect the business.

Concentration of Domestic Sales in Specific States: A significant portion of domestic sales, around 47.30% for MAT June 2025, is concentrated in the "West Zone" (Gujarat, Maharashtra, Chhattisgarh, Goa, and Madhya Pradesh). Adverse regional developments could significantly impact sales, results of operations, and financial condition.

Exposure to Chronic and Sub-Chronic Segments: 70.10% of domestic sales for MAT June 2025 were derived from chronic and sub-chronic therapeutic segments. This reliance subjects the Company to risks from increased competition, changes in regulatory environments, and the emergence of new alternative drugs in these long-term treatment areas.

Strategies of Corona Remedies IPO

Further Increase Market Share within the Domestic Indian Pharmaceutical Market (IPM): The core strategy is to strengthen its position as the second fastest growing company among the top 30 in the IPM. This is achieved by increasing medical representative productivity, expanding the prescriber base, and intensifying engagement with super-specialist prescribers in urban and semi-urban areas to enhance its presence in high-value therapeutic segments.

Focus on Long Product Life Cycles and Progression: The Company remains committed to expanding its portfolio by launching new products such as Empagliflozin and Elagolix and developing brand line extensions within existing therapeutic areas. This focus prioritises medications in the chronic and sub-chronic segments (70.10% of domestic sales for MAT June 2025), which generally offer sustained revenue stability and profitability.

Expand into Other Therapeutic Areas and Deepen Presence: The Company aims to strategically expand its presence beyond its current coverage (33.56% of IPM therapeutic areas) into high-growth specialty areas like nephrology, CNS, oncology, and dermatology. A dedicated new Urology SBU is a key focus area for expansion.

Execute Strategic Acquisitions and Establish In-Licensing Agreements: The strategy involves ongoing evaluation of acquisitions, including companies or brands and licensing opportunities that address therapy gaps and are synergistic with its existing portfolio. Recent examples include the acquisition of the Myoril brand from Sanofi and in-licensing arrangements with Ferring Pharmaceuticals for products in women’s health and urology.

Expand Sales in Select Overseas Markets with a Focused Approach: The Company plans to strategically expand its international footprint across over 20 countries, leveraging its EU GMP certification and WHO accreditations to penetrate regulated markets. The focus is on expanding product registrations, strengthening customer penetration through local partners, and enhancing the R&D pipeline for differentiated hormone and specialty products.

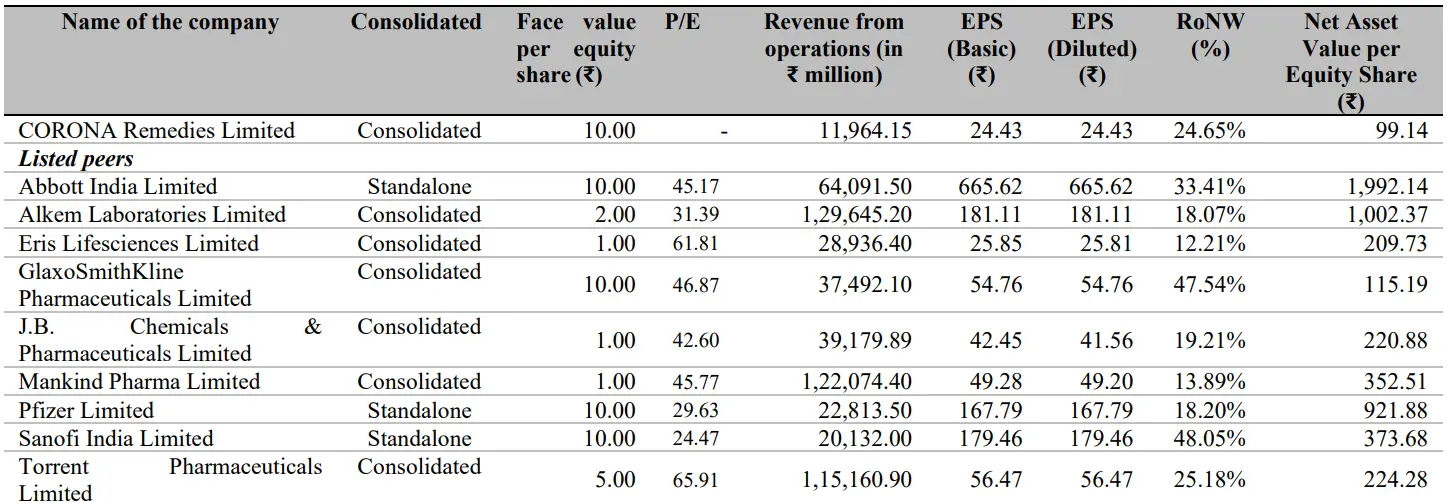

Corona Remedies IPO vs. Peers

In terms of core operating profitability, Corona Remedies' EBITDA Margin of 20.55% in FY25 is competitive and generally in line with or slightly better than comparable domestic players like Alkem Laboratories (19.40%). However, it trails highly specialized peers and MNCs known for margin strength, including Eris Lifesciences (35.20%), Pfizer (32.00%), and GlaxoSmithKline Pharmaceuticals (31.40%). The Company's PAT Margin of 12.49% is one of the lowest among the comparison group, trailing the majority of its peers who report net margins in the 15% to 33% range.

The Company exhibits a strong profile in terms of capital efficiency, which reflects its focus on being a high-growth, branded player with a growing presence in the chronic segment. Corona Remedies recorded an impressive Return on Equity (RoE) of 27.50% and a strong Return on Capital Employed (RoCE) of 41.32% in FY25.

This performance places its RoCE above many major domestic peers like J.B. Chemicals & Pharmaceuticals (24.33%) and Torrent Pharmaceuticals (31.00%), and its RoE above Alkem Laboratories (18.30%) and Torrent Pharmaceuticals (25.00%). This operational efficiency is supported by a growth strategy concentrated on higher-margin chronic and sub-chronic therapeutic areas and a comparatively lower exposure to price controls imposed under the National List of Essential Medicines (NLEM).

Objectives of Corona Remedies IPO

The total offer for sale of 61,71,101 shares worth Rs 655.37 crores will be received by the selling shareholders in this IPO, and they are:

Dr. Kirtikumar Laxmidas Mehta, Minaxi Kirtikumar Mehta, Dipabahen Niravkumar Mehta, Brinda Ankur Mehta, Sepia Investments Limited, Anchor Partners and Sage Investment Trust will receive the offer for sale proceeds.

Corona Remedies IPO Details

IPO Dates

Corona Remedies IPO will be open for subscription from December 08, 2025, to December 10, 2025. The allotment of shares to investors will take place on December 11, 2025, and the company is expected to be listed on the NSE and BSE on December 15, 2025.

IPO Issue Price

Corona Remedies is offering its shares in the price band of Rs 1,008 to Rs 1,062 per share. This means you would require an investment of Rs. 14,868 per lot (14 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Corona Remedies is issuing a total offer for sale of 61,71,101 shares valued at Rs 655.37 crores will be received by the selling shareholders in this IPO.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on December 11, 2025, through the registrar's website, Bigshare Services Private Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Corona Remedies are expected to be listed on the NSE and BSE on December 15, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Important IPO Details | |

Bidding Date | December 08, 2025 to December 10, 2025 |

Allotment Date | December 11, 2025 |

Listing Date | December 15, 2025 |

Issue Price | Rs 1,008 to Rs 1,062 per share |

Lot Size | 14 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category