Difference Between FII and DII

00:00 / 00:00

Ever wondered why the stock market suddenly goes up or down? It’s not just speculation or market noise, it’s about analysis, strategy, and informed decisions. The big investors like FIIs (Foreign Institutional Investors) and DIIs (Domestic Institutional Investors) play a major role. Understanding the behaviour of FII and DII can help you better understand the market pulse, whether you're an investor evaluating market sentiment or making your own investment decisions.

In this article, let’s explore what is FII and DII are, their types, the SEBI regulations on FII, the comparison of FII vs DII, and other aspects that will assist you in making better and more informed choices. Let’s continue to know more.

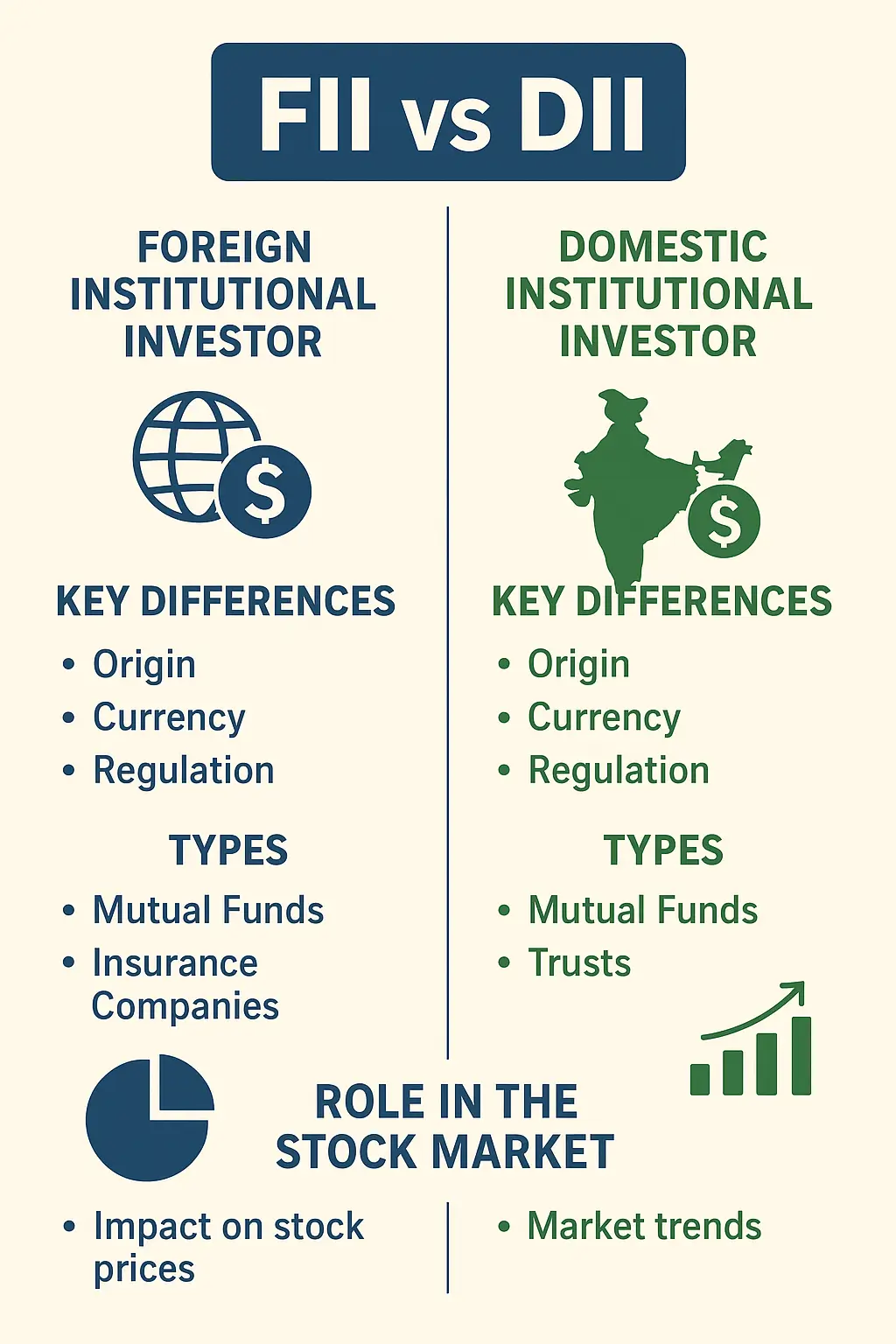

Differences Between FII and DII

After understanding what FIIs and DIIs are, along with their types, it's time to see the difference between FII and DII. The table below outlines the major points of comparison.

Aspects | Foreign Institutional Investors (FII) | Domestic Institutional Investors (DII) |

Meaning | Invests in a financial market outside the country. | Investing in a domestic financial market. |

Purpose | Diversifying portfolio and seeking returns. | The main purpose is to create wealth and stability |

Ownership | No control over the companies. | It might have representation on the board, and it can influence the decisions taken by the company. |

Investment Limit | The investment limit is just 24% of the entire paid-up capital. | There are no restrictions or limitations when it comes to the DII investments. |

Investment horizon | The investment period ranges from a few days to several months, falling within the short to medium-term horizon. | The investment period ranges from days to years, falling within the short to long-term horizon. |

Regulatory Body | The financial authorities of the host country. | Regulated by the domestic country. |

Sector Focus | It primarily focuses on the financial markets and assets | It focuses on a diverse range of sectors, including both financial and non-financial sectors. |

Taxation | Tax is based on capital gains. | Implications vary from one type of investment to another type of investment. |

FII vs DII: Impact on the Indian Market

FII’s activity often influences market sentiments. The market shows a bullish sentiment when FIIs show a net positive inflow, as it shows their confidence in the market. When their investment goals abruptly change or when there is a lack of clarity in the world, FIIs may make the market more volatile. FII's sudden purchases or sell-offs may cause price adjustments.

The long term investments of the DII are hugely significant for the stability of the markets . Their consistent participation and methodical approach to investing serve as a check on the potentially unpredictable actions of the FIIs. When FIIs outflow, DIIs start investing more to stabilize the market with their long-term investments. This helps in mitigating the impact of drastic and sudden changes in FII sentiment.

Analysing the FII vs DII Data

By the end of the year 2024, the investment dynamics between FII and DII saw a major change. The DII was able to achieve its highest holding of 16.90% as of 31 December 2024. An increase of almost 0.44% in one quarter. Whereas, FII reached its all-time low in 12 years, declining to 17.23% as of 31st of December 2024.

Due to the shift in ownership distribution, the ratio between FII and DII dropped to 1.02. This was mainly driven by strong inflows from domestic mutual funds, which boosted the DII investments by Rs. 1.54 lakh crore (approx) in the third quarter of the financial year 2025.

The FII holdings maintain a strong presence with an investment of more than $800 billion in Indian equities, though their share fell from an all-time high of 20% to 16% in 2024.

This trend between the FII and DII shows the growing influence of domestic investors on the Indian financial market, with DII investments closing the traditionally huge gap between FII and DII.

What is FII?

When foreign institutions from one country invest in another country’s markets, it’s called a Foreign Institutional Investment (FII). These institutions hold no registration nor headquartered in the invested country. Some of the examples include mutual funds, hedge funds, investment banks, and pension funds that invest in a country where they are not registered. FIIs improve market liquidity through capital inflow and outflow of the country they intend to invest in. Before we move on, let’s get some clarity on FII, FPI, and FDI.

Understanding Differences between FII, FPI, and FDI

People often confuse FII, FPI, and FDI and use the terms interchangeably, but in reality, they differ significantly from each other. FPI stands for Foreign Portfolio Investment. These are individual investors who invest money in different countries. FPIs don't actively participate in the market when compared to FIIs. FIIs are a subset of FPI, and most of these investors pool money from a large number of individual investors to invest in foreign markets. While FII and FPI don't have any control over the companies that they invest in. FDI refers to owning a majority stake in the company or project they invest in, based on a long-term horizon.

Types of FIIs

After understanding the meaning, here are some of the types of Foreign Institutional Investors (FII), and they are as follows:

International Multilateral Organisations: It is a collaboration between 3 or more countries that come together to tackle the financial and economic challenges of the world. Their main aim is to promote economic stability and development, along with providing financial support to the nations.

Sovereign Wealth Fund: These are government-owned investment funds. These are owned by governments and used to invest in stocks of different countries and to diversify their portfolios.

Foreign Central Banks: These are the apex monetary institutions of the respective countries. They act as the custodian of their country’s foreign reserves and use these reserves to invest in shares, bonds, and other securities in countries like India. A key objective of those institutions is to regulate and stabilize the exchange rate of their domestic currency.

Foreign Government Agencies: They are government entities and organizations that invest in the capital markets of foreign countries. This act helps to improve trade and foster diplomatic relations between those countries.

Foreign Mutual Funds: These pooled funds, collected from multiple investors in foreign countries, are invested in countries like India on behalf of their clients.

Foreign Pension Funds: Institutions operating pension funds that originate in foreign countries invest in the overseas market. They operate on a long-term basis and seek stable returns, which will help them meet the pension obligations.

Foreign Insurance companies: These foreign insurance companies invest in Indian companies through the collected premiums from their business. Their main objective is to gain more exposure and broaden investments in their portfolio to diversify risks and returns.

List of FIIs in India

With a clear understanding of FII vs DII types, it’s time to look at some of the biggest foreign institutions invested in India, and they fall under one of the categories we've just discussed.

Government of Singapore

Government Pension Fund Global (Norway)

Nalanda India Fund Limited

Vanguard Fund

Elara India Opportunities Fund

Amansa Holdings Private Limited

East Bridge Capital Master Fund Limited

Small Cap World Fund

Euro-Pacific Growth Fund

New World Fund

What is DII?

DII stands for Domestic Institutional Investors. These are individuals or organizations that invest in their own country's financial markets. A DII, which would be a company based in India, plays a key role in supporting the stock market, especially as Foreign Institutional Investors (FIIs) have shifted from being net buyers to net sellers.

Types of DIIs

Here are some of the types of Domestic Institutional Investors (DII) and they are as follows:

NBFC: An NBFC stands for Non-Banking Financial Company registered under the Companies Act, provides financial services similar to banks, but doesn't hold a banking license. These companies offer loans, credit facilities, and other financial services, but they do not accept traditional deposits like banks do.

Banks: These financial institutions act as a link between borrowers and savers. Their operations involve fund transfers, accepting deposits, and granting loans.

Mutual Funds: They gather funds from a large number of individual and institutional investors and allocate them to a diverse set of shares, bonds, and other securities.

Exchange-traded Funds (ETFs): These are tradable assets listed on stock markets like the NSE and BSE, thus allowing investors to buy and sell them throughout the trading day.

Insurance Companies: They offer insurance policies to individuals or entities, providing financial protection against potential losses or damages. In essence, they pool risks from a large number of policyholders and, in exchange for premiums, agree to compensate those policyholders when a covered event occurs. Those premiums are invested across equities and fixed income to generate returns for policyholders.

Pension Funds: It is a fund that helps in managing retirement savings and invests in diversified portfolios, which include both stocks and bonds.

List of DIIs in India

Listed below are some of the prominent domestic institutional investors in India

Banks and other Financial Institutions: SBI, HDFC, Kotak, and ICICI

Mutual Funds: SBI Mutual Fund, ICICI Prudential Mutual Fund, Nippon India Mutual Fund, and HDFC Mutual Fund.

Pension Funds: Employees Provident Fund Organization (EPFO) and National Pension System (NPS) Fund Manager.

Insurance Companies: Life Insurance Corporation of India (LIC), HDFC Life Insurance, SBI Life Insurance, and Axis Max Life Insurance.

How SEBI Regulates FII and DII

The investments from FII are allowed through the “Portfolio Investment Scheme” in India, which allows foreign bodies to invest in the financial markets. This framework allows investors to access the Indian companies' securities through the public exchanges like NSE and BSE.

But due to lots of rules and regulations, some of the most common rules are that FIIs can contribute up to 24% of a company’s paid-up capital and up to 20% of the paid-up capital of a public sector bank in India.

By setting a cutoff threshold 2% below the maximum investment, the Reserve Bank of India (RBI) keeps an eye on adherence to these limitations every day. When FIIs reach their sector-wise or regulatory investment limits in an Indian company, the RBI instructs banks to stop processing any further share purchases on behalf of FIIs.

Unlike FIIs, the Domestic Institutional Investors (DIIs) hold no restriction on the Ownership of companies in India.

Conclusion

In conclusion, while both FII and DII play vital yet contrasting roles in shaping the Indian stock market, understanding their moves can give investors more insights about market trends. The DIIs provide long-term stability and faith in domestic growth, but FIIs attract foreign capital and change market momentum with their short-term strategy.

Over the years, the Indian market has matured, lessening its need for FIIs, thanks to the surge in retail involvement and constant domestic investments through mutual funds, insurance, and pension funds. Investors can make better selections if they are aware of the investment habits of FIIs and DIIs.

Check Out These Related Articles |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category