Is Ellenbarrie Industrial Gases IPO Good or Bad – Detailed Review

00:00 / 00:00

Ellenbarrie Industrial Gases Limited’s IPO is kicking off its initial public offering, which will be open from June 24, 2025, to June 26, 2025. While considering applying for this IPO, certain questions may arise in your mind, including whether the Ellenbarrie Industrial Gases IPO is good or bad, whether it is worth investing in this IPO, and so on.

This article offers a comprehensive Ellenbarrie Industrial Gases IPO review, covering its business operations and fundamental analysis to help you make an informed investment choice.

Ellenbarrie Industrial Gases IPO Review

Ellenbarrie Industrial Gases Limited (EIGL), an industrial gas company, is launching its IPO between June 24 to June 26, 2025, with a price band of Rs 380 to Rs 400 per share and plans to raise Rs 852.53 crore (?400 crore - Fresh Issue and Rs 452.53 crore - Offer for Sale). They operate nine facilities across East and South India. EIGL serves sectors like pharma, defence, and healthcare, offering gases such as oxygen, nitrogen, and hydrogen. It earns most revenue from bulk customers (66.75%) and has a high repeat client rate of 85.68%.

EIGL’s financials show strong growth, with revenue rising from Rs 205.11 crore in FY23 to Rs 312.48 crore in FY25, and PAT margin improving to 23.90%. The IPO proceeds will fund debt repayment and plant expansion. While EIGL outperforms peers like Linde India in margins and return ratios, it faces risks like regional concentration and limited long-term contracts. Strategic goals include nationwide expansion, entry into speciality gases, and in-house plant manufacturing to improve competitiveness and profitability.

Company Overview of Ellenbarrie Industrial Gases IPO

Ellenbarrie Industrial Gases Limited (EIGL), one of India's oldest industrial gas companies with over 50 years of experience, operates in East, Central, and South India. It manufactures and supplies a wide range of gases such as oxygen, nitrogen, argon, helium, hydrogen, carbon dioxide, acetylene, and more. They cater to industries such as pharmaceuticals, steel, healthcare, petrochemicals, infrastructure, railways, aviation, and defence. EIGL operates nine facilities, including three bulk manufacturing plants and six others (onsite and cylinder filling) spread across states like West Bengal, Andhra Pradesh, Telangana, and Chhattisgarh. Its supply model includes on-site production, bulk delivery through cryogenic tankers, and packaged gas cylinders.

As of FY25, bulk customers contributed 66.75% of revenue, onsite customers 15.64%, and packaged clients 17.61%. The client loyalty was reflected in the business, as 85.68% of revenue was from repeat buyers and remained somewhere consistent with 92.22% in FY24 and 90.70% in FY23. Prominent clients include Dr. Reddy’s, Laurus Labs, AIIMS, GMM Pfaudler, Air India Engineering Services, Jupiter Wagons, and key PSUs in the petrochemical sector. EIGL's leadership team leverages decades of industry expertise, and its in-house project engineering team manages turnkey installations, offering clients tailored, cost-efficient solutions.

Industry Overview of Ellenbarrie Industrial Gases IPO

The global industrial gases market is expanding due to demand from sectors like energy, chemicals, and electronics. Clean energy transition and increased medical oxygen use further drive growth. The global market reached approximately USD 105.6 billion in 2024 and is expected to grow at a CAGR of 5.5% to USD 131.1 billion by 2028.

In India, the industrial gases industry grows steadily, supported by rising manufacturing, healthcare, and infrastructure investments. The Indian market stood at USD 1.31 billion in 2024 and is projected to grow at a CAGR of 7.5% to reach USD 1.75 billion by 2028.

Government initiatives like Make in India, Atmanirbhar Bharat, and PLI schemes can improve domestic industrial activity; thus, they can boost gas demand. The medical and food processing sectors saw an increased usage. Advanced manufacturing technologies and increased environmental regulation fuel speciality gas needs. The market can benefit from greater private sector participation and rising demand for on-site gas generation solutions.

Financial Overview of Ellenbarrie Industrial Gases IPO

Particulars | March 31, 2025 | March 31, 2024 | March 31, 2023 |

Revenue from operations (Rs Cr) | 312.48 | 269.48 | 205.11 |

EBITDA (Rs Cr) | 109.74 | 61.53 | 33.59 |

EBITDA Margin (%) | 35.12% | 22.83% | 16.38% |

PAT (Rs Cr) | 83.29 | 45.29 | 28.14 |

PAT Margin (%) | 23.90% | 15.61% | 12.58% |

RoE (%) | 16.88% | 11.05% | 7.75% |

RoCE (%) | 13.71% | 10.93% | 6.07% |

The financial performance of Ellenbarrie Industrial Gases over the three fiscal years ending March 31, 2023, 2024, and 2025 showcases a robust growth trajectory and notable improvements in profitability and operational efficiency. Revenue from operations increased steadily from Rs 205.11 crore in FY23 to Rs 269.48 crore in FY24 and further to Rs 312.48 crore in FY25. This demonstrates a year-on-year growth of approximately 31.38% in FY24 and 15.96% in FY25, highlighting sustained demand across its customer base and the company’s expanding reach.

The company’s profitability has shown a sharp upward trend. EBITDA more than tripled from Rs 33.59 crore in FY23 to Rs 61.53 crore in FY24 and reached Rs 109.74 crore in FY25. This significant rise is an indication of improved cost management and growing scale. The EBITDA margin expanded from 16.38% in FY23 to 22.83% in FY24 and further to 35.12% in FY25, reflecting strong operating leverage and pricing discipline in its bulk and on-site gas segments.

Profit After Tax (PAT) rose from Rs 28.14 crore in FY23 to Rs 45.29 crore in FY24 and further to Rs 83.29 crore in FY25. The PAT margin followed a similar trajectory, increasing from 12.58% in FY23 to 15.61% in FY24 and reaching 23.90% in FY25. This growth in net profit displays not only efficient operations but also prudent cost control and improved realisation per unit of gas sold.

Return ratios further reinforce the company’s strong financial positioning. Return on Equity (RoE) improved from 7.75% in FY23 to 11.05% in FY24 and stood at 16.88% in FY25. Similarly, Return on Capital Employed (RoCE) rose from 6.07% in FY23 to 10.93% in FY24 and reached 13.71% in FY25. These gains reflect the company’s improving capital efficiency and its ability to generate superior returns from the capital deployed in assets, distribution, and operations. Overall, the company has delivered consistently higher margins, profitability, and return metrics over the period, indicating a well-managed and financially resilient business model.

Strengths and Risks of Ellenbarrie Industrial Gases IPO

Let’s dive into the strengths and weaknesses to assess if the Ellenbarrie Industrial Gases IPO is good or bad for investors.

Strengths

Diversified Sectoral Presence Across High-Growth Industries: Ellenbarrie serves a broad client base spread across sectors such as pharmaceuticals, healthcare, steel, aviation, defence, petrochemicals, infrastructure, and railways. This sectoral diversity minimises risk exposure to any one industry and creates stable revenue opportunities.

High Repeat Customer Rate: The company consistently derived a high proportion of its revenue from repeat clients, like 90.70% in FY23, 92.22% in FY24, and 85.68% in FY25. This reflects long-standing client relationships, dependable service quality, and a sticky customer base, which are especially crucial in a capital-intensive and highly regulated sector like industrial gases.

Balanced Revenue Model: Ellenbarrie’s revenue distribution is well-diversified across its three operating segments: bulk gases contributed 66.75% in FY25, onsite customers contributed 15.64%, and packaged gas sales contributed 17.61%. This mix helps mitigate the risk of overdependence on a single segment while allowing the company to serve varied customer sizes.

Manufacturing Footprint Across India: The company operates nine facilities, comprising three large Air Separation Units (ASUs), two onsite plants, and four cylinder-filling or distribution stations across West Bengal, Andhra Pradesh, Telangana, and Chhattisgarh. This regional spread improves last-mile delivery efficiency, reduces transportation costs, and ensures closer proximity to industrial hubs.

In-House Engineering and Execution Capabilities: They have a project engineering team that designs, installs, commissions, and operates on-site gas plants directly at customer premises without third-party EPC contractors. This end-to-end execution allows for cost optimisation, faster commissioning, and better customisation for clients.

Risks

Geographic Concentration in East and South India: While the company has multiple plants, its operations are concentrated in East and South India. This limits the national footprint and exposes it to regional disruptions such as political, environmental, or logistical ones. Scaling into North and West India may require significant capital expenditure and competitive positioning against larger, pan-India players.

High Dependence on Bulk Customers Exposed to Economic Cycles: In FY25, bulk customers made up 66.75% of the company’s revenue. These include large industrial clients whose demand may fluctuate with economic cycles, such as in steel, power, and infrastructure. A downturn in these sectors could lead to underutilisation of plant capacities and affect earnings.

Limited Long-Term Contracts in Non-Onsite Segments: While the onsite segment offers long-term visibility, the bulk and packaged gas segments operate largely on spot orders or short-term contracts. This exposes the business to price competition and order volatility, especially in tender-based public sector contracts where margins can be thin and non-renewal risk is high.

Exposure to Industrial Hazards and Stringent Regulations: As a manufacturer of flammable and pressurised gases, Ellenbarrie faces inherent safety and regulatory risks. Accidents, plant downtime, or compliance failures could lead to penalties, legal liabilities, or shutdowns. Continuous capex is needed for safety audits, pollution controls, and regulatory compliance across its facilities.

Competition from Larger and Multinational Players: The Indian industrial facilities have dominant players such as Linde India and INOX Air Products, who have larger scale, superior R&D, and better financial resources. This intensifies competition for large institutional contracts, especially in metros and central India, where Ellenbarrie’s regional dominance may not translate into national competitiveness.

Strategies of Ellenbarrie Industrial Gases IPO

Expand Portfolio of Gases, Especially Speciality Gases: Ellenbarrie aims to develop and market ultra-high purity and speciality gases, including green hydrogen and green ammonia, catering to industries like semiconductors, defence, and space. The company plans to leverage its experience and infrastructure to enter high-margin segments such as electronic gases.

Initiate Plant Manufacturing: The company plans to begin in-house manufacturing of plant components, complementing its project engineering capabilities. This vertical integration is expected to improve margins and project execution efficiency.

Expand Manufacturing Capacity and Establish Pan-India Presence: Ellenbarrie is commissioning multiple new plants, including a 220 TPD plant in Uluberia situated in West Bengal and another 250 TPD plant expected to be commissioned in October 2025 in West Bengal, to serve rising demand. These expansions will help transition the company from a regional to one of the large players.

Create a Balanced Mix of Merchant and Onsite Business: The company is diversifying its revenue model by building a mix of bulk merchant supply and long-term onsite gas generation contracts to reduce revenue volatility and deepen customer engagement.

Pursue Strategic Alliances and Acquisitions: Ellenbarrie is actively considering strategic acquisitions to scale and improve its technological capabilities and market presence while improving market share.

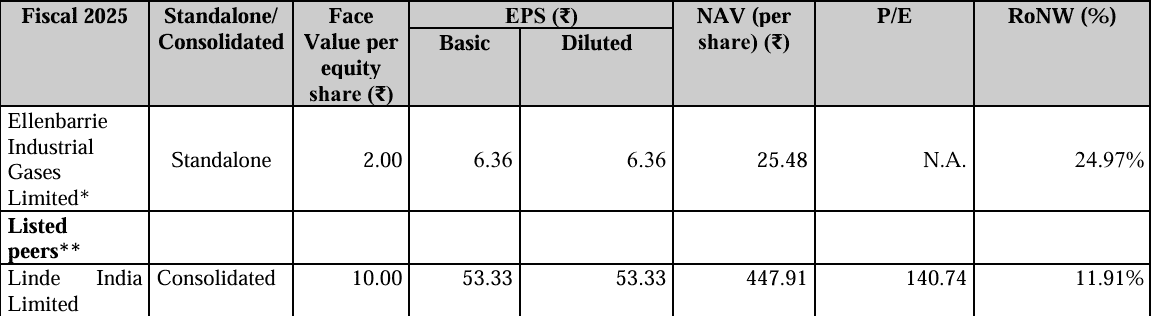

Ellenbarrie Industrial Gases IPO Vs Peers

Ellenbarrie Industrial Gases has a revenue of Rs 312.48 crore in FY25, which is smaller compared to the industry leader, Linde India, which posted Rs 2,485.38 crore. In terms of profitability, Ellenbarrie reported an EPS of Rs 6.36, much lower than Linde's Rs 53.33. However, Ellenbarrie delivers a strong Return on Net Worth (RoNW) of 24.97%, more than double compared of Linde’s 11.91%, which indicates efficient capital utilisation. Ellenbarrie also reported a superior EBITDA margin of 35.12% versus Linde’s 30.78% and a PAT margin of 23.90% compared to Linde's 17.81%. This reflects Ellenbarrie’s robust internal efficiency and profitability, despite being smaller in scale. Notably, its RoE also improved significantly year over year, showcasing consistent financial strengthening.

Objectives of Ellenbarrie Industrial Gases IPO

The issue by the IPO will be used by the company for the following purposes:

Repayment or prepayment of outstanding borrowings availed by the company worth Rs 210 crore.

Capital expenditure towards expanding capacity of 220 TPD in Uluberia - II plant for air separation unit for Rs 104.5 crore.

General corporate purposes.

Ellenbarrie Industrial Gases IPO Details

IPO Dates

Ellenbarrie Industrial Gases IPO will be open for subscription from June 24, 2025, to June 26, 2025. The allotment of shares to investors will take place on June 27, 2025, and the company is expected to be listed on the NSE and BSE on July 1, 2025.

IPO Issue Price

Ellenbarrie Industrial Gases is offering its shares in the price band of Rs 380 to Rs 400 per share. This means you would require an investment of Rs. 14,800 per lot (37 shares) if you are bidding for the IPO at the upper price band.

IPO Size

Ellenbarrie Industrial Gases is issuing a total of 2,13,13,130 shares, which are worth Rs 852.53 crores. From the total issue, a total of 1,13,13,130 shares worth Rs 452.53 crore are through offer for sale, and the remaining 1,00,00,000 shares worth Rs 400 crores are through fresh issue.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on June 27, 2025, through the registrar's website: KFin Technologies Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of Ellenbarrie Industrial Gases will be listed on the NSE and BSE on July 1, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Apply for Ellenbarrie Industrial Gases IPO

Important IPO Details | |

Bidding Date | June 24, 2025 to June 26, 2025 |

Allotment Date | June 27, 2025 |

Listing Date | July 1, 2025 |

Issue Price | Rs 380 to Rs 400 per share |

Lot Size | 37 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category