Is JSW Cement IPO Good or Bad – Detailed Review

00:00 / 00:00

JSW Cement Limited’s IPO is kicking off its initial public offering, which will be open from August 07, 2025, to August 11, 2025. While considering applying for this IPO, certain questions may arise in your mind, including whether the JSW Cement IPO is good or bad, whether it is worth investing in this IPO, and so on.

This article offers a comprehensive JSW Cement IPO review, covering its business operations and fundamental analysis to help you make an informed investment choice.

JSW Cement IPO Review

JSW Cement Limited, established in 2006, is a cement manufacturer and a part of the JSW Group. The company's core focus is on "green cementitious products," including blended cement and ground granulated blast-furnace slag (GGBS), alongside ordinary portland cement (OPC), clinker, ready-mix concrete (RMC), and other related products. The company's business model is based on a "circular economy approach," which involves using industrial by-products as raw materials, giving it the lowest carbon dioxide emission intensity among its peers.

They have been one of the fastest-growing player in the Indian cement industry, with their installed grinding capacity and sales volume growing at a CAGR of 12.42% and 15.05%, respectively, from fiscal 2023 to 2025. As of March 31, 2025, the company's total installed grinding capacity was 20.60 Million Metric Tonnes Per Annum (MMTPA), with operations spread across India and the UAE. It has a robust distribution network of over 4,600 dealers and more than 6,500 direct customers.

The company's financial performance has been mixed. Revenue from operations showed fluctuations, with a slight decrease to Rs 5,813.07 crore in Fiscal 2025. This was accompanied by a significant drop in profitability, with the company reporting a net loss of Rs -163.77 crore in Fiscal 2025, a stark contrast to the profits in the previous two fiscal years. The EBITDA and PAT margins also declined, and the Debt to Equity Ratio increased to 2.62 in Fiscal 2025, indicating a higher reliance on debt.

Key strengths of JSW Cement include its strong brand lineage from the JSW Group, a focus on sustainable and eco-friendly products, strategically located plants, and a history of strong execution capabilities. However, the company faces risks such as a negative cash flow in the latest fiscal year, a high reliance on borrowings and related parties for raw materials, and project execution and geographical concentration risks associated with its ambitious expansion plans.

JSW Cement is launching its IPO with a total issue size of Rs 3,600 crore, consisting of a fresh issue of Rs 1,600 crore and an Offer for Sale (OFS) of Rs 2,000 crore. The price band for the IPO is set between Rs 139 to Rs 147 per share, with a lot size of 102 shares. The IPO will be open for subscription from August 7 to August 11, 2025, and the shares are expected to be listed on the NSE and BSE on August 14, 2025. The company plans to use the fresh issue proceeds to partially finance a new integrated cement unit in Nagaur, Rajasthan, and to repay certain outstanding borrowings.

Company Overview of JSW Cement Limited

JSW Cement Limited, incorporated in 2006, is a cement manufacturer focused on "green cementitious products," which include blended cement and ground granulated blast-furnace slag (GGBS). They also produce ordinary portland cement (OPC), clinker, and other allied products such as ready-mix concrete (RMC), screened slag, construction chemicals, and waterproofing compounds.

The company is among the top three fastest-growing cement manufacturers in India in terms of installed grinding capacity and sales volume from fiscal 2015 to fiscal 2025. During the fiscal years of 2023 to 2025, the company's installed grinding capacity grew at a CAGR of 12.42%, and its sales volume grew by 15.05%, which is higher than the industry average.

The company's operations are spread across India with 5 grinding units and 2 integrated plants, and another plant in the UAE with one clinker unit operated by its joint venture, JSW Cement FZC. As of March 31, 2025, the company's total installed grinding capacity was 20.60 Million Metric Tonnes Per Annum (MMTPA), and its overall installed clinker capacity was 6.44 MMTPA. They have a network of 4,653 dealers, 8,844 sub-dealers, and 158 warehouses. Through non-channel routes, they have 6,559 direct customers, comprising builders and institutional customers.

JSW Cement has a Cement to Clinker ratio for fiscal 2025 at 50.13% and fiscal 2024 at 46.60%, which is lower compared to the industry average of 66.43% in fiscal 2024, according to the Crisil report.

Industry Overview of JSW Cement Limited

The Indian cement industry is highly competitive and fragmented, with the top four players holding approximately 58% of the market share as of Fiscal 2025. The primary end-user sectors for cement include housing, infrastructure, and industrial or commercial. Demand from these sectors is expected to grow at a CAGR of 6%-10% between fiscal 2025 and 2030, with overall cement demand projected to grow at a CAGR of 7.5%-8.5% during the same period.

The demand for GGBS, in particular, is expected to grow at a higher CAGR of 14%-15%. As per Crisil Intelligence, it expects to add 245 to 255 MTPA of grinding capacities between 2026 and 2030. The budgetary capital expenditure for core infrastructure ministries in India is Rs 10.7 lakh crore for fiscal 2026, which is an increase of 11.6% from the revised estimate for fiscal 2025.

Financial Overview of JSW Cement Limited

Particulars | March 31, 2025 | March 31, 2024 | March 31, 2023 |

Revenue from Operations (Rs in Crores) | 5,813.07 | 6,028.10 | 5,836.72 |

EBITDA (Rs in Crores) | 815.32 | 1,035.66 | 826.97 |

EBITDA Margin (%) | 13.78% | 16.94% | 13.82% |

PAT (Rs in Crores) | -163.77 | 62.01 | 104.04 |

PAT Margin (%) | -2.77% | 1.01% | 1.74% |

RoE (%) | -4.85% | 3.64% | 5.97% |

RoCE (%) | 7.05% | 11.01% | 6.46% |

Debt to Equity Ratio | 2.62 | 2.31 | 2.42 |

The financial performance of JSW Cement over the three fiscal years ending March 31, 2025, shows a mixed trend with fluctuations in both revenue and profitability.

Revenue from operations saw a slight increase of 3.28% from Rs 5,836.72 crore in Fiscal 2023 to Rs 6,028.10 crore in Fiscal 2024. However, it then experienced a decrease of 3.56% to Rs 5,813.07 crore in Fiscal 2025.

EBITDA showed a significant increase of 25.24% from Rs 826.97 crore in Fiscal 2023 to Rs 1,035.66 crore in Fiscal 2024. This positive trend reversed in Fiscal 2025, with EBITDA decreasing by 21.28% to Rs 815.32 crore. Consequently, the EBITDA Margin fluctuated, rising from 13.82% in Fiscal 2023 to 16.94% in Fiscal 2024, before falling to 13.78% in Fiscal 2025.

Profit After Tax (PAT) shows a concerning downward trend. It decreased from Rs 104.04 crore in Fiscal 2023 to Rs 62.01 crore in Fiscal 2024, a drop of 40.40%. The situation worsened significantly in Fiscal 2025, with the company reporting a loss of Rs -163.77 crore. This led to the PAT Margin declining from 1.74% in Fiscal 2023 to 1.01% in Fiscal 2024, and becoming negative at -2.77% in Fiscal 2025.

The company's Return on Equity (RoE) and Return on Capital Employed (RoCE) also reflect the profitability challenges. RoE steadily declined from 5.97% in Fiscal 2023 to 3.64% in Fiscal 2024, and further to -4.85% in Fiscal 2025, indicating a negative return for shareholders. RoCE increased from 6.46% in Fiscal 2023 to 11.01% in Fiscal 2024 but then decreased to 7.05% in Fiscal 2025.

The Debt to Equity Ratio initially improved slightly, decreasing from 2.42 in Fiscal 2023 to 2.31 in Fiscal 2024, suggesting a reduction in leverage. However, it increased to 2.62 in Fiscal 2025, indicating higher reliance on debt.

Overall, JSW Cement experienced a period of fluctuating revenue, declining profitability leading to a loss in Fiscal 2025, and increasing leverage in the latest fiscal year.

Strengths of JSW Cement Limited

Growing Market Presence and Strong Execution Capabilities: JSW Cement is among the top three fastest-growing cement manufacturing companies in India based on its installed grinding capacity and sales volume from Fiscal 2015 to Fiscal 2025. The company's installed grinding capacity grew at a CAGR of 12.42%, and sales volume grew at a CAGR of 15.05% from fiscal 2023 to 2025, outpacing the industry average.

Focus on Sustainable Products and Manufacturing: JSW Cement is India’s largest manufacturer of ground granulated blast furnace slag (GGBS), an eco-friendly product. Its carbon dioxide emission intensity is lower than that of its Indian and global peers. The company's business model is based on a "circular economy approach" that prioritises the use of industrial by-products as raw materials, helping to conserve natural resources.

Strategically Located Plants and Efficient Logistics: The company's seven plants in India are strategically located in the southern, western, and eastern regions, ensuring proximity to both raw material sources and key markets. This is supported by a robust logistics network that includes road and rail transport, as well as digital tools like a logistics control tower (LCT) for optimising supply chain efficiency.

Strong Corporate Lineage and Experienced Management: As a part of the JSW Group, the company benefits from a well-established brand name and synergies with other group entities for raw material procurement, like blast furnace slag from JSW Steel, and digital platforms like JSW One. The company is led by an experienced management team, including promoters Sajjan Jindal and Parth Jindal, who provide strong leadership and industry expertise.

Lowest Carbon Dioxide Emission Intensity: The company has the lowest carbon dioxide emission intensity among its peer cement manufacturing companies in India and is one of the top global cement companies. In Fiscal 2025, its intensity was 258 kg per tonne, which was 52% lower than the Indian peer average. This is achieved through a circular economy approach that utilises industrial by-products as raw materials and the use of green power sources like solar and waste heat recovery systems.

Risks of JSW Cement Limited

Financial Performance and Negative Cash Flow: The company reported a net loss of Rs 163.76 crore in Fiscal 2025. Some of its subsidiaries and joint ventures have also incurred losses in the past, and a continuation of this trend could require the company to provide them with financial support. The company's net cash flow from operating activities was also negative in Fiscal 2025.

Highly reliant on Borrowings: JSW Cement has a substantial amount of debt, with total borrowings of Rs 6,166.55 crore as of March 31, 2025. The company’s ability to service this debt depends on its capacity to generate sufficient cash flows and can include restrictive covenants that limit certain corporate actions without lender approval.

Dependence on Related Parties for Raw Materials: Around 93% of the company’s blast furnace slag, a key raw material for its green cement products, is sourced from JSW Steel Limited and its subsidiaries. 51.48% of raw materials are sourced from JSW Group company entities. Any loss of these suppliers can impact raw material costs.

Project Execution and Geographical Concentration Risks: The company's ambitious expansion plans in new regions like North and Central India face risks of delays, cost overruns, and challenges in obtaining timely regulatory approvals. It includes even the Bhushan Plant dispute with the Supreme Court of India. Its current operations are also concentrated in specific regions of India, making it vulnerable to adverse economic or policy changes in those areas.

Strategies of JSW Cement Limited IPO

Expand Pan-India Presence: The company plans to expand its geographic footprint by establishing new plants in North and Central India while also undertaking brownfield and greenfield expansions in its existing regions. This strategy aims to increase its grinding capacity to 41.85 MMTPA and clinker capacity to 13.04 MMTPA.

Deepen Market Penetration: JSW Cement intends to strengthen its position in existing markets by growing its distribution network of dealers and leveraging its influencer loyalty programs and digital platforms like the JSW One business-to-business platform.

Enhance Operational Efficiency: The company is committed to implementing cost-reduction measures by increasing its use of alternative raw materials and green power sources like solar and waste heat recovery systems. It also plans to utilize its digital logistics control tower to optimize its supply chain.

Commit to Sustainability: JSW Cement aims to reduce its carbon dioxide emission intensity through its "CO-CREATE" framework, which focuses on circular economy principles, climate and energy, and other ESG-related goals.

Strategic Acquisitions: The company intends to continue exploring strategic acquisitions of cement plants and other related businesses, including those undergoing insolvency proceedings, to further its growth and expansion strategy.

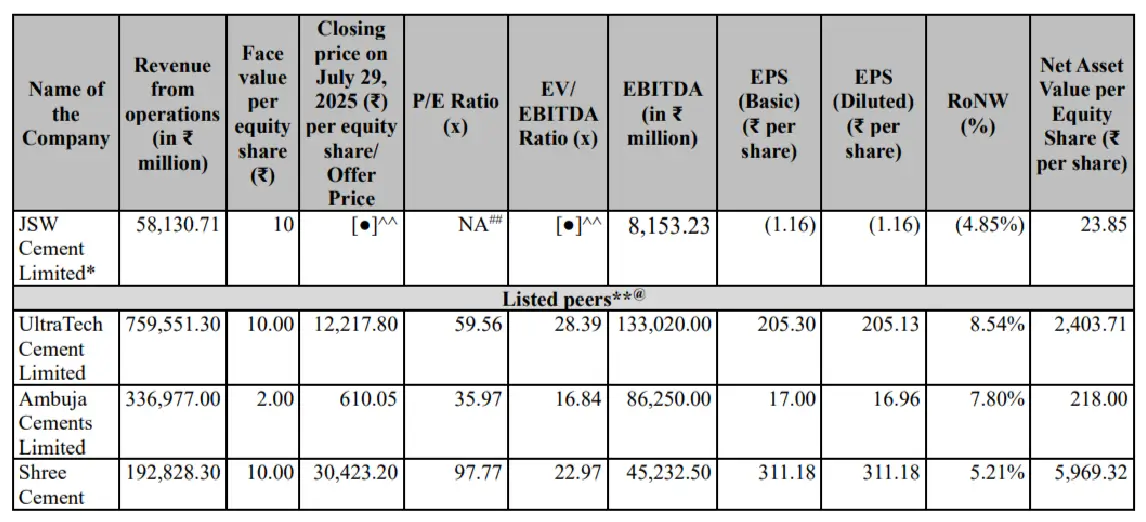

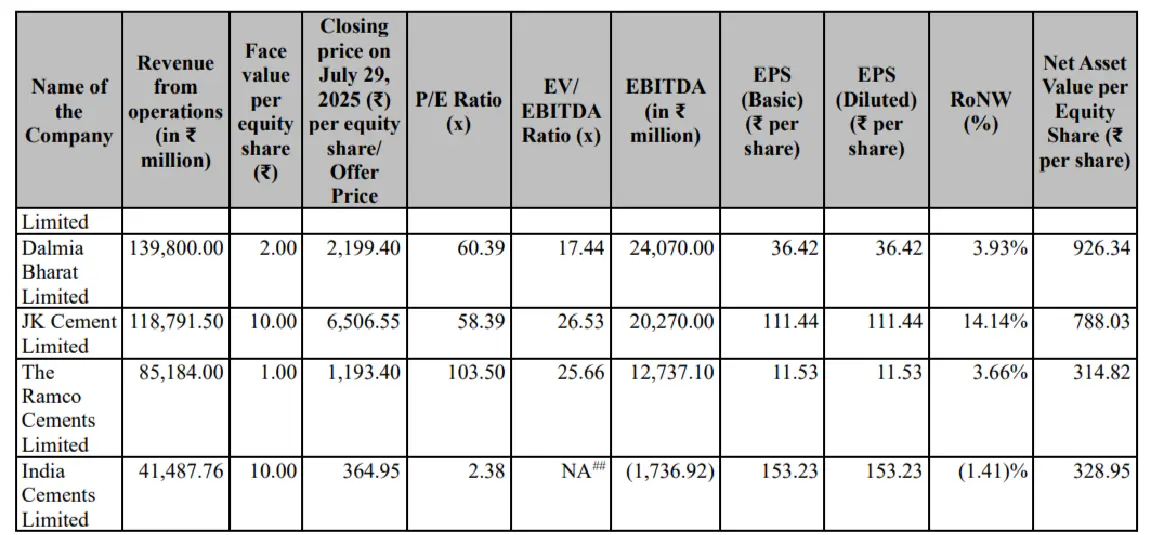

JSW Cement Limited IPO Peer Comparison

In Fiscal 2025, JSW Cement reported a revenue from operations of Rs 5,813 crores, which is lower than its assessed peers, such as UltraTech Cement Limited with Rs 75,955 crores, Ambuja Cements Limited with Rs 35,045 crores, and Shree Cement Limited with Rs 19,283 crores. The company's Profit After Tax (PAT) margin in Fiscal 2025 was (2.77%), which is lower than the peer average.

JSW Cement's Return on Equity (RoE) was (4.85%). These figures are lower than most of its peers, such as Ambuja Cements, which reported an RoE of 8.73%, and Dalmia Bharat Limited, with an RoE of 4.15%.

The company stands out for its low carbon dioxide emission intensity, which was 52% lower than the Indian peer average in fiscal 2025. The company's business model highlights the use of industrial by-products as raw materials, with its waste usage accounting for 64.36% of its total raw material consumption in fiscal 2025, the highest among its peers. The company's debt-to-equity ratio was 2.62 which is higher compared to its peers.

Objectives of JSW Cement IPO

The total issue size stands at Rs 3,600 crore, out of which Rs 2,000 crore is through offer for sale and the remaining Rs 1,600 crore is a fresh issue. The selling shareholders in the offer for sale include the AP Asia Opportunistic Holdings Pte. Limited, Synergy Metals Investments Holding Limited, and State Bank of India.

The funds raised through the fresh issue are to be utilised for,

Part financing to establish a new integrated cement unit in Nagaur, Rajasthan, amounting to Rs 800 crore.

Prepayment or repayment of certain outstanding borrowings availed by the company, totalling Rs 520 crore.

General Corporate Purposes.

JSW Cement IPO Details

IPO Dates

JSW Cement IPO will be open for subscription from August 07, 2025, to August 11, 2025. The allotment of shares to investors is expected to take place on August 12, 2025, and the company is expected to be listed on the NSE and BSE on August 14, 2025.

IPO Issue Price

JSW Cement is offering its shares in the price band of Rs 139 to Rs 147 per share. This means you would require an investment of Rs. 14,994 per lot (102 shares) if you are bidding for the IPO at the upper price band.

IPO Size

JSW Cement is raising funds by issuing a total of 24,48,97,958 shares, amounting to Rs 3,600 crore, out of which Rs 2,000 crore is an offer for sale and the remaining Rs 1,600 crore is through a fresh issue.

IPO Allotment Status

Investors who applied for the IPO can check their IPO allotment status on August 12, 2025, through the registrar's website, Kfin Technologies Limited, BSE, NSE, or through the stockbroker platform.

IPO Listing Date

The shares of JSW Cement will be listed on the NSE and BSE on August 14, 2025.

IPO Application Link

Open demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free.

Important IPO Details | |

Bidding Date | August 07, 2025 to August 11, 2025 |

Allotment Date | August 12, 2025 |

Listing Date | August 14, 2025 |

Issue Price | Rs 139 to Rs 147 per share |

Lot Size | 102 Shares |

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category