Is Sanathan Textiles IPO Good or Bad - Detailed Review

00:00 / 00:00

Sanathan Textiles Limited IPO is kicking off its initial public offering which will be open from December 19, 2024, to December 23, 2024. While considering applying for this IPO, certain questions may arise in your mind, some of which include whether theSanathan Textile IPO is good or bad, whether it is worth investing in this IPO, and so on.

This article offers a comprehensive Sanathan Textiles IPO review, covering its business operations and fundamental analysis to help you make an informed investment choice.

Sanathan Textiles IPO Review

The Sanathan Textiles IPO offers both opportunities and risks for investors. On the positive side, the company has a diverse product portfolio, in-house product innovation capabilities, and a skilled development team, which positions it well to serve a wide range of industries. However, it faces notable challenges, such as a decline in revenue, lower returns on net worth compared to its peers, and potential supply chain and operational vulnerabilities. Therefore, interested investors should do thorough due diligence and carefully weigh the company's strengths and risks before considering investing in the IPO.

Note: This review is backed by the overview mentioned below. Read it to know more.

Sanathan Textiles IPO - Company Overview

Sanathan Textiles, incorporated in 2005 is a polyester yarn manufacturer and a global supplier of Cotton Yarn. Their business is divided into three separate yarn businesses consisting of polyester yarn products, cotton yarn products, and yarns for technical textiles and industrial uses.

Sanathan Textiles is one of the few companies in India that operates across the polyester, cotton, and technical textile sectors. These textiles are used in various industries such as automotive, healthcare, construction, sports, and protective clothing. As of Fiscal 2024, the company held a market share of 1.7% in the Indian textile yarn industry.

As of September 30, 2024, the company offers over 3,200 active yarn products. The company manages more than 45,000 stock-keeping units (SKUs) and has the capability to produce a diverse range of over 14,000 yarn product varieties and more than 190,000 SKUs. These products are used in various applications across different industries.

As of June 30, 2024, the company exported its products to 14 countries. In the previous fiscal years, the company exported to 27 countries in 2024 and 29 countries in 2023. Additionally, by June 30, 2024, the company had over 925 distributors across seven countries comprising India, Argentina, Singapore, Germany, Greece, Canada, and Israel. The company also installed rooftop solar projects at its Silvassa facility, with a total capacity of 2.35 MW, highlighting its commitment to sustainable energy practices.

As of June 30, 2024, Sanathan Textiles Limited served 983 customers. During Fiscal 2024 and Fiscal 2023, the company catered to 1,571 and 1,684 customers, respectively. While the majority of the company's revenue comes from domestic sales within India, a substantial part of its income is also derived from exports to various international markets.

Sanathan Textiles IPO - Industry Overview

Indian textile and apparel industry is projected to grow at a CAGR of 6-7% from Fiscal 2024 till Fiscal 2028. During this period, exports are expected to grow at a CAGR of 4.5-5.5% while the domestic industry is expected to grow at a slightly higher pace of 7-8%. The future growth in the Indian textile and apparel market will be led by various economic factors such as the increase in discretionary income, and a rising urban population.

The contribution of the textile, apparel, and leather industry in India in the overall manufacturing GVA (Gross Value Added) of the country improved to 11.2% in fiscal 2023, up from 10.9% in fiscal 2012. In absolute terms, the GVA of the textile, apparel, and leather industry at current prices grew to Rs 3,955 billion in fiscal 2023, on a base of Rs 1,532 billion in fiscal 2012, thereby registering a CAGR of 9.0%.

The investments in the textile and wearing apparel segment in India increased from Rs. 2,052 billion in fiscal 2012 to Rs. 3,651 billion in fiscal 2023, growing at a CAGR of 5.4%. The increase in investments had led to the total number of textile and apparel factories reaching the figure of 30,672 in fiscal 2023, increased from 27,958 in fiscal 2012.

Source: RHP of the company

Sanathan Textiles IPO - Financial Overview

As per the RHP, the company's revenue from operations has seen significant fluctuation over the years. In the financial year ended March 31, 2024, revenue was reported at Rs.2,957.50 crores which is a drastic drop from Rs.3,329.21 crores in March 2023 and Rs.3,185.32 crores in March 2022. The main reason for the decline in the company’s revenue was the decline in the average selling price of polyester yarn and cotton yarn which have declined from Rs 120/kg to Rs.112/kg and Rs.322/kg to Rs.266/kg, respectively from FY23 to FY24.

As a result of the decline in the revenue, the EBITDA for March 31, 2024, was reported at Rs.226.58 crores, which represents a decline from Rs.259.53 crores in Fiscal 2023 and Rs.537.61 crores in Fiscal 2022. The EBITDA margin also stood at 7.66% compared to 7.80% in Fiscal 2023 and 16.88% in Fiscal 2022.

The profit after tax (PAT) for March 31, 2024, stood at Rs.133.84 crores, showing a decline from Rs.152.74 crores in Fiscal 2023. The PAT margin also reduced to 4.53% from 4.59% in Fiscal 2023 and 11.16% in Fiscal 2022.

The Return on equity (ROE) dropped to 11.09% in March 2024 from 14.36% in Fiscal 2023 and 43.95% in Fiscal 2022. Similarly, the ROCE for March 31, 2024, stood at 11.80%, down from 15.54% in Fiscal 2023 and 35.83% in Fiscal 2022. This indicates a decline in the return to shareholders and a drop in overall efficiency which is mainly a result decline in the average selling price of yarn and cotton.

Strengths of Sanathan Textiles IPO

They are one of the few companies in India that work across different textile sectors like polyester, cotton, and technical textiles. They offer a wide variety of products with over 14,000 types of yarn and 190,000 SKUs, making them stand out in the market. This diversity lets them enter new markets easily, offer more choices to their customers, and meet varied needs around the world.

Sanathan Textiles is dedicated to creating unique products tailored to specific customer needs, focusing on color, characteristics, and properties. Their in-house Product Innovation and Development team constantly works on crafting these specialized, value-added items. By utilizing their existing machinery and infrastructure, they efficiently produce customized, made-to-order products.

As of June 30, 2024, the Product Innovation and Development team consists of five members based in Silvassa. The team includes professionals with advanced degrees in science and technology fields such as Bachelor of Science (Technology), Master of Textiles (Engineering), Bachelor of Technology, Master of Technology, and Master of Philosophy. This skilled team is focused on developing products that not only follow market trends but also meet the high-quality standards customers expect.

Their yarn manufacturing plant is strategically set up with top-notch equipment from well-known suppliers worldwide. It has strong partnerships with major consumer brands like Welspun India and others. The plant also uses a vast network of suppliers both in India and abroad to keep costs low by sourcing materials from places where they are easily available.

Risk Factors of Sanathan Textiles IPO

They don't have long-term agreements for their raw material supplies, which means if they can't get the right quality and quantity at good prices, it could negatively impact their business and financial health. They depend on a few key suppliers for most of their raw materials, so if any of these suppliers stop operating, it could make it difficult for them to find raw materials at competitive prices.

They rely on third-party logistics and support services for delivering raw materials and finished products. Any disruptions in their services, including transportation, or a decline in service quality, could negatively affect their business, financial stability, and operational results.

The company requires significant working capital to operate effectively. If they can't secure enough working capital, their operations could suffer. They are also in the advanced stages of setting up a new manufacturing facility in Wazirabad, Punjab through their subsidiary, Sanathan Polycot Private Limited. Once this facility is operational, it will need additional funding to meet its working capital requirements.

Their business heavily relies on their production facility in Silvassa. If this facility were to experience any loss or shutdown for any reason, it could significantly impact our business operations and results.

Strategies of Sanathan Textiles IPO

They will continue to introduce new products depending on customer needs across their diversified product segments and also introduce process improvements as they are critical for the expansion of their product portfolio, which shall also increase their ability to cater to a more diverse consumer base

They have their own in-house testing facility with equipment like a wrap reel machine and weight balance for measuring fiber thickness, a yarn strength tester for checking strength and stretch, and a color viewing booth for color evaluation. They will continue to invest in advanced equipment and infrastructure to meet international industry standards.

Sanathan Textiles Vs Peers

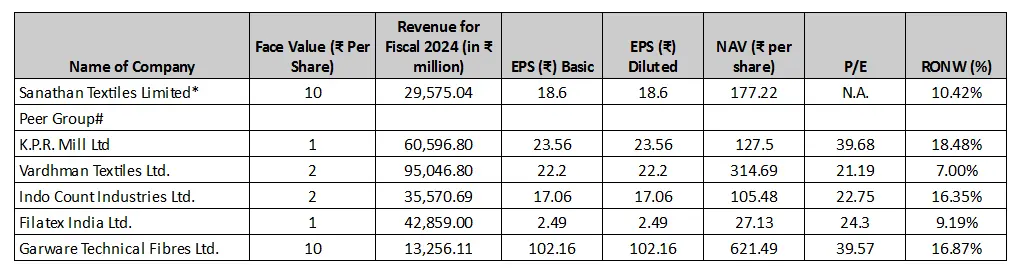

Sanathan Textiles, with a moderate revenue of Rs. 2,957.50 crores, ranks among the bottom two companies in the industry. Additionally, Sanathan Textiles has a Return on Net Worth (RoNW) of 10.42%, which is lower than that of Garware Technical Fibres Ltd, a smaller company on the list, which has a RoNW of 16.87%. This indicates the company’s need to focus more on improving its efficiency and shareholders' returns.

Objectives of Sanathan Textiles IPO

The company intends to allocate the net proceeds from its fundraising efforts to three primary objectives.

First, it plans to repay, either partially or fully, some of its existing borrowings. Second, it aims to invest in its subsidiary, Sanathan Polycot Private Limited, specifically to assist with the repayment and prepayment of its borrowings. Finally, a portion of the funds will be used for general corporate purposes to support the broader operational and strategic needs of the business.

Sanathan Textiles IPO Details

IPO Date

Sanathan Textiles IPO is open to subscription from December 19, 2024, to December 23, 2024. The shares will be allocated to investors on December 24, 2024, and the company will be listed in the NSE and BSE on December 27, 2024.

IPO Issue Price

Sanathan Textiles IPO is offering its shares in the price band of Rs.305 to Rs.321 per share. This means you would require an investment of Rs.14,766 per lot (46 shares) if you are bidding for the IPO at the upper price band.

IPO Size

The Sanathan Textiles IPO is offering a total of 1,71,33,958 shares, amounting to Rs. 550 Crores. This includes an offer for sale of 46,72,898 shares, totaling Rs. 150.00 crores, and a fresh issue of 1,24,61,060 shares, totaling Rs. 400 Crores.

IPO GMP

Many investors consider the Grey Market Premium (GMP) before applying for the Mamata Machinery IPO. The GMP indicates market sentiment and can offer insights into the potential listing price.

Track the Sanathan Textiles IPO Today

Note: GMP does not reflect the financial strength or fundamentals of the company

IPO Allotment Status

The shares from the Sanathan Textiles IPO will be allotted to its investors on December 24, 2024. One can check the allotment status for the IPO from its registrar Kfin Technologies Limited, the BSE website, or your broking platform where you have applied for the IPO.

IPO Application Link

Open a demat account with Rupeezy today and enjoy a seamless experience when applying for the IPO. With an easy-to-use platform, Rupeezy makes the IPO application process quick and hassle-free. Click on the apply link below to get started.

The content on this blog is for educational purposes only and should not be considered investment advice. While we strive for accuracy, some information may contain errors or delays in updates.

Mentions of stocks or investment products are solely for informational purposes and do not constitute recommendations. Investors should conduct their own research before making any decisions.

Investing in financial markets are subject to market risks, and past performance does not guarantee future results. It is advisable to consult a qualified financial professional, review official documents, and verify information independently before making investment decisions.

All Category